比特币减半的历史、影响和 2024 年预测

作者:Matthew Sigel、Denis Zinoviev 来源:VanEck 翻译:善欧巴,比特币买卖交易网

2024 年 4 月 20 日的减半为比特币社区带来机遇和不确定性。这一事件内置于比特币的基础代码中,改变了矿工的奖励,并可能显着影响比特币在更广泛的生态系统中的价值和作用。

比特币减半周期解释

比特币减半是比特币世界中的一个重大事件,影响着投资者和其他相关人员。大约每四年,挖掘新比特币区块的奖励就会减少一半。这样做是为了控制比特币的供应,使其更像黄金等稀缺资源。减半有助于通过降低新比特币的创建速度来保持比特币的价值随着时间的推移保持稳定。

比特币减半是由其创造者中本聪提出的,旨在控制通货膨胀并确保数字货币仍然是通货紧缩资产。最初,矿工收到 50 个比特币作为处理交易和支持区块链网络的奖励。2012年第一次减半后,奖励被削减至25个比特币,随后定期减半,每次奖励进一步减少。

比特币减半的历史

比特币的减半历史很有趣,显示了它从 2009 年开始的增长。此后,比特币经历了几次减半事件,每一次都在其发展中发挥了重要作用。

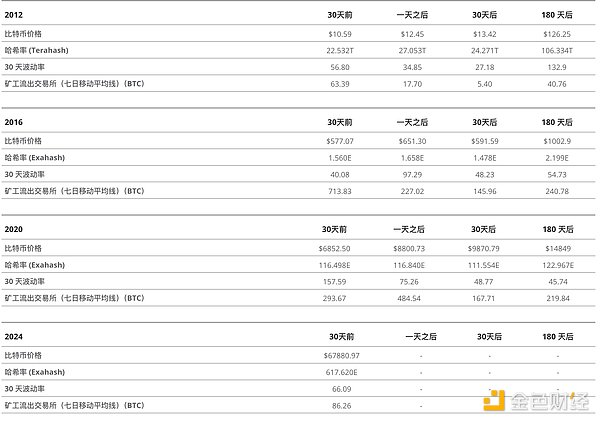

第一次减半(2012 年 11 月):当网络达到 210,000 个区块时,比特币首次减半。挖矿奖励从每个区块 50 比特币减少到 25 比特币。这一事件标志着对中本聪控制货币供应和通货紧缩经济学理论的首次检验。尽管最初存在不确定性,但比特币网络保持稳定,比特币价格在 180 天内从 10.59 美元飙升至 126.24 美元,增强了其基本经济原则的可行性。

第二次减半(2016 年 7 月):随着比特币在公众意识中的牢固确立,第二次减半将区块奖励减少至 12.5 个比特币。这一时期,加密货币作为一种合法的投资类别崛起,散户和机构投资者的参与度不断增加。减半后,比特币经历了大幅上涨,最高达到 1002.92 美元以上,为 2017 年的牛市奠定了基础。

第三次减半(2020 年 5 月):最后一次减半将奖励减少至每块 6.25 比特币。由于 COVID-19 大流行,全球经济存在不确定性,此次减半受到了全球投资者的密切关注。它在比特币从 2020 年到 2021 年的出色表现中发挥了至关重要的作用,这种加密货币在 180 天内达到了 14,849.09 美元的历史新高,并成为围绕数字货币在未来金融中的作用讨论的焦点。

资料来源: Glassnode 截至 2024 年 4 月 10 日。过去的表现并不是未来业绩的保证。无意作为购买或出售本文提及的任何证券的建议。Terahash 代表每秒 1 万亿次哈希。Exahash 代表每秒 1 千万亿次哈希。过去的表现并不是未来业绩的保证。

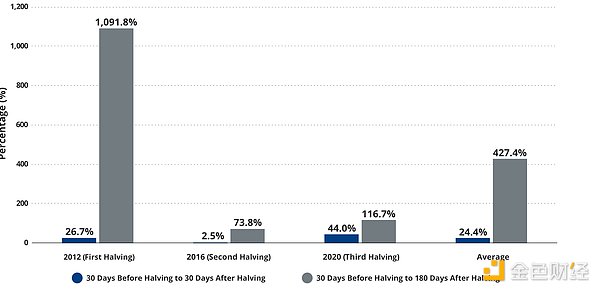

比特币最具爆炸性的涨幅通常是在减半后

资料来源: Glassnode 截至 2024 年 4 月 10 日。过去的表现并不是未来业绩的保证。无意作为购买或出售本文提及的任何证券的建议。Terahash 代表每秒 1 万亿次哈希。Exahash 代表每秒 1 千万亿次哈希。过去的表现并不是未来业绩的保证。

2024 年比特币减半:展望

减半有望成为一个分水岭事件,奖励将减少至每个区块 3.125 比特币。这一时刻预计将深刻影响采矿业格局,有可能重塑盈利指标并加速采矿效率的技术进步。历史先例表明,随着矿工应对激励措施的减少,需要一段调整期,这对网络的哈希率和整体安全性可能产生影响。

从历史上看,哈希率(专用于挖掘和处理交易的总计算能力)在减半后会因无利可图的矿工断开连接而下降,但往往会在几周内恢复。这是因为减半加剧了比特币的稀缺性,可能会推高价格并增加那些能够继续挖矿的人的利润。如果价格上涨超过奖励减少,就像之前每次减半后一年的情况一样,即使每个区块的代币数量减少,挖矿也可以保持盈利。这是因为当其他人退出时,幸存者获得了网络的市场份额。此外,减半会激励矿工投资更高效的设备以保持竞争力。因此,哈希率往往会经历暂时的下降,但从长远来看,效率和整体哈希率会上升。

这就是为什么我们在2024 年预测文章中建议投资者在减半前的六个月内减持比特币矿商,因为市场普遍低估了成本上升的一阶效应。在这个棘手的时期,矿工经常发行大量资金。减半后,一些矿工可能被迫关闭,导致网络哈希率(专用于挖矿的综合计算能力)可能出现短期下降。

比特币减半对矿工和市场的影响

也就是说,对比特币矿工的影响会有所不同。与运行能源密集型采矿设备相关的电力成本是矿工最大的支出,通常占矿工总现金运营支出的 75-85%。当前所列范围的电力成本平均约为 0.04 美元/千瓦时。按此成本计算,我们估计减半后排名前 10 名的上市矿商的全部现金成本约为 4.5 万美元/比特币。每枚币成本较低的大型矿商将看到利润缩水,但可能仍保持盈利,尤其是在比特币价格上涨的情况下。我们认为,减半可能会导致采矿业内部整合,小型矿商被挤出,大型矿商扩大市场份额。然而,这种趋势已经存在,因为公开交易的矿商现在控制着创纪录的算力百分比。

比特币减半后的未来

随着挖矿奖励的减少,交易费用对于矿工的盈利能力可能变得更加重要。减半强调了比特币的稀缺性,吸引了投资和投机。它重申了比特币作为一种去中心化、有限且安全的资产的原则,塑造了其在不断发展的金融格局中的作用。

The halving of the bitcoin trading network on June brings opportunities and uncertainties to the bitcoin community. This event, which is built into the basic code of bitcoin, has changed the reward of miners and may significantly affect the value and role of bitcoin in a wider ecosystem. The period of halving bitcoin explains that halving bitcoin is a major event in the bitcoin world, affecting investors and other related personnel, and the reward for mining new bitcoin blocks will be reduced by half every four years. This is done in order to control the supply of bitcoin and halve its scarce resources like gold, which helps to keep the value of bitcoin stable over time by slowing down the creation speed of new bitcoin. The halving of bitcoin was proposed by its creator Satoshi Nakamoto to control inflation and ensure that digital currency is still a deflationary asset. At first, miners received a bitcoin as a reward for handling transactions and supporting blockchain networks. After halving for the first time in the year, the reward was reduced to a bitcoin, and then decided. The history of halving bitcoin is very interesting, which shows its growth since 1998. Since then, bitcoin has experienced several halving events, each of which played an important role in its development. When the network reached 20 blocks in 1998, bitcoin was halved for the first time, and the reward for mining was reduced from each block to bitcoin. This event marked the first test of Satoshi Nakamoto's economic theory of controlling money supply and deflation, despite its initial existence. Uncertainty, but the bitcoin network remained stable. The price of bitcoin soared from US dollars to US dollars in a few days, which enhanced the feasibility of its basic economic principles. With the firm establishment of bitcoin in the public consciousness, the second halving reduced the block reward to a bitcoin. During this period, cryptocurrency rose as a legal investment category, and the participation of retail investors and institutional investors increased. After halving, Bitcoin experienced a sharp rise, reaching above US dollars, laying the foundation for the bull market in. On the basis of the third halving, the last halving in October reduced the reward to each bitcoin. Due to the uncertainty of the global economy due to the pandemic, this halving was closely watched by global investors, and it played a vital role in the outstanding performance of Bitcoin from to. This cryptocurrency reached a record high of US dollars in a day and became the focus of discussion on digital currency's role in future finance. The past performance as of June is not a guarantee for future performance. Suggestions for buying or selling any securities mentioned in this article represent trillions of hashes per second. Past performance is not a guarantee of future performance. The most explosive increase of Bitcoin is usually after halving. The past performance of data sources as of March is not a guarantee of future performance. It is not intended to be a suggestion for buying or selling any securities mentioned in this article. It represents trillions of hashes per second. Past performance is not a guarantee of future performance. The prospect of halving the special currency is expected to become a watershed event. The reward will be reduced to bitcoin in each block. This moment is expected to have a profound impact on the mining industry, which may reshape the profit index and accelerate the mining efficiency. Historical precedents show that with the reduction of incentives for miners, it takes an adjustment period, which may have an impact on the hash rate and overall security of the network. Historically, the total computing power of the hash rate dedicated to mining and processing transactions will be unprofitable after halving. Workers are disconnected and decline, but they often recover within a few weeks. This is because halving the price increases the scarcity of bitcoin, which may push up the price and increase the profits of those who can continue mining. If the price rises more than the reward decreases, as it did one year after halving each time before, even if the number of tokens in each block decreases, mining can remain profitable. This is because survivors gain market share of the network when others quit. In addition, halving the price will encourage miners to invest in more efficient equipment to maintain it. Competitiveness, therefore, the hash rate will often experience a temporary decline, but in the long run, the efficiency and overall hash rate will increase, which is why we suggested that investors reduce their holdings of bitcoin miners within six months before halving, because the market generally underestimated the first-order effect of rising costs. In this difficult period, miners often issue a large amount of funds, and after halving, some miners may be forced to close down, resulting in a short-term decline in the comprehensive computing capacity of the network hash rate dedicated to mining. The impact on miners and the market will be different, that is to say, the impact on bitcoin miners will be different. The power cost related to operating energy-intensive mining equipment is the biggest expense for miners, which usually accounts for the average of the current listed range of miners' total cash operating expenses. Based on this cost, we estimate that the total cash cost of the top listed miners after halving will be about 10,000 US dollars. Large miners with lower cost of bitcoin per coin will see their profits shrink but may still remain profitable. Especially when the price of bitcoin rises, we think that halving may lead to the integration of small miners in the mining industry and the crowding out of large miners to expand the market share. However, this trend already exists because publicly traded miners now control a record percentage of computing power. With the reduction of mining incentives, transaction costs may become more important for miners' profitability. Halving bitcoin emphasizes the scarcity of bitcoin and attracts investment and speculation. It reaffirms the principle that bitcoin is a decentralized, limited and safe asset and shapes its role in the ever-developing financial structure. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。