互联网巨头创始人出手拿下这一牌照

作者:中国基金报

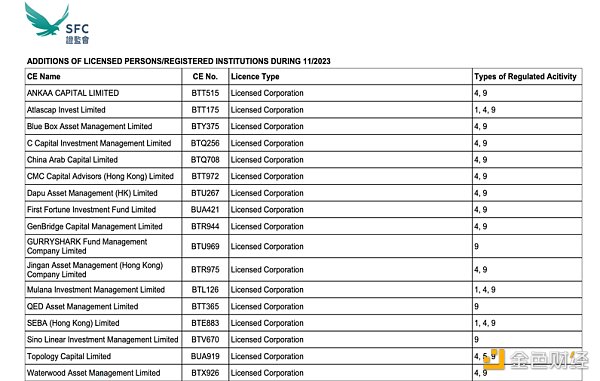

日前,香港证监会于官网发布11月牌照申请情况。来自香港证监会的信息显示,包括互联网巨头创始人家族办公室、香港知名基金、全球虚拟资产投资机构等均在11月拿下香港证监会牌照,进军香港金融市场。

例如,香港投资机构C Capital Investment Management Limited 于11月获得香港证监会的4号、9号牌。相关资料显示,4号牌为就证券提供咨询意见的牌照,9号牌为资产管理牌照。

C Capital Investment Management 成立于2017年,迄今为止团队超过20人。它由新世界发展CEO 郑志刚等联合创立。基金聚焦消费、科技、区块链。来自香港证监会的资料显示,C Capital Investment Management的地址为新世界大厦。C Capital 最开始专注于风险投资,后拓展至其它策略包括信贷基金和对冲基金。近年来,郑志刚在区块链、Web3等活动上时常露面。

来源:C Capital 官网

来源:香港证监会官网

C Capital 之外,香港机构GURRYSHARK Fund Management Company Limited 11月也获得了香港9号牌。记者从业内了解到,这家机构为单一家族信托,其投资范围包括私募股权、风险投资和对冲基金。该机构由一家头部互联网机构创始人所有,基于所有者的背景,该机构的投资中也较为青睐技术相关领域。

其它获批牌照的机构还包括,Dapu Asset Management (HK)——国内知名私募基金大朴资产管理的香港子公司,于11月23日获得4号牌和9号牌。由麦加投资(Makkah Investment)与中民新能(CMIG New Energy)共同出资创办的中天投资管理 China Arab Capital Limited 于11月获得4号和9号牌等。

虚拟资产从业者纷纷申请牌照

在香港特区政府的大力推动下,香港吸引了全球虚拟资产从业者的目光。

例如,11月新获批牌照的机构中,壹财投资基金(First Fortune Investment Fund Limited)相关人士在接受采访曾表示对区块链、虚拟资产感兴趣。例如,壹财投资基金创始人杨振骏曾对媒体介绍,中国香港有完善的监管制度,香港基金的可信度和安全性同样相对较其它虚拟资产中心来说较高。中国香港紧随新加坡之后推出了OFC基金架构,也发布了一系列优惠政策(OFC基金补贴、基金税务全套豁免)。“香港的法币托管与银行系统是最为完善的。从2022年11月的‘数字货币宣言’开始,中国香港推出了目前为止我们认为全球最为积极和宽紧适度的监管规则,并且正紧锣密鼓地不断推出越发完善的后续政策,是最为友好的有明确数字货币监管规则可以遵循的管辖地”。他亦补充解释道,香港证监会明确规定若要发行合规的全额投资于数字货币的基金,不仅仅需要(传统)的9号牌,还需要9号牌下的两名持牌负责人(RO)具有相应的从业经验。

再如,官网资料显示,瑞士数字银行SEBA Bank AG(SEBA Bank)是一家获得完全许可的瑞士加密银行,为数字时代提供全面的金融解决方案,涵盖在瑞士的权益投资、借贷、托管、投资、交易、银行业务和存款等领域。SEBA Bank 全资子公司SEBA(香港)有限公司(SEBA Hong Kong)11月获得香港证券及期货事务监察委员会(SFC)颁发的牌照。该牌照允许SEBA Hong Kong在香港进行受监管的活动。

香港证监会9号牌的持牌机构是否可以在香港不受限制地从事虚拟资产投资?针对这个问题,北京大成律师事务所肖飒团队骨干成员袁承鹏对中国基金报记者表示,若持有9号牌的机构,并且其投资组合中虚拟资产占比不超过组合净资产比例的10%,则可在原有的牌照下,管理这一组合。若持有9号牌的机构,其投资组合中虚拟资产占比超过组合净资产的10%或以上,则需要再向香港证监会提出申请,对牌照进行升级,获批准之后才能管理这一组合。

三季度,香港证监会收到2017宗牌照申请

数据显示,包括虚拟资产相关牌照在内的香港金融牌照具吸引力。

今年6月1日香港证监会推行新的虚拟资产交易平台发牌制度以来,截至12月11日,共有两家机构获批香港的虚拟资产交易平台牌照,分别为OSL数字证券有限公司和Hash Blockchain Limited。

来源:香港证监会官网

截至目前,有9家机构向香港证监会提交了虚拟资产交易平台申请,分别为Hong Kong BGE Limited;香港数字资产交易集团有限公司;香港虚拟资产交易所有限公司;胜利数码科技有限公司;Meex Digital Securities Limited;猎豹交易(香港)有限公司;OKX Hong Kong FinTech Company Limited;Hong Kong VAEXC Limited;云账户大湾区科技(香港)有限公司。

来源:香港证监会官网

香港证监会于官网表示,之所以公布虚拟资产交易平台申请名单是为了使公众能够确定虚拟资产交易平台是否对其在香港证监会的牌照申请状态进行了虚假或误导性的陈述。申请名单上的虚拟资产交易平台运营商其许可申请尚未获得香港证监会批准,并且可能未符合相关要求。投资者应参考香港证监会的“已获批的虚拟资产交易平台名单”,了解已获正式许可的虚拟资产交易平台运营商的名称。香港证监会还提醒投资者要注意在未受监管的虚拟资产交易平台上交易虚拟资产的风险(包括此名单中列出的任何VATP申请人)。

香港证监会日前发布的三季度报告显示,三季度,香港证监会收到2017宗牌照申请(包括1972名人士及 45家机构),较上季增加13%,及较去年同期增加6%。 截至9月30日,持牌机构及人士和注册机构的总数为 48362,其中包括3236家持牌机构及112家注册机构。 三季度,新持牌机构及人士和注册机构的总数为3094, 其中包括3061位个人,以及33家持牌机构和注册机构。 在三季度发出的33个公司牌照中,第9类(提供资产管理)受规管活动及第4类(就证券提供咨询意见)分别占44%及36%。

Author China Fund News Recently, the Hong Kong Securities Regulatory Commission issued a monthly license application in official website. The information from the Hong Kong Securities Regulatory Commission shows that including the Internet giant's founder's family office, Hong Kong's well-known funds, global virtual asset investment institutions, etc., won the Hong Kong Securities Regulatory Commission's license plate in June and entered the Hong Kong financial market. For example, Hong Kong investment institutions obtained the number plate of the Hong Kong Securities Regulatory Commission in June. Relevant information shows that the number plate is the license plate for providing advice on securities, and the number plate is the asset management license. The team was established so far in. More than people, it was co-founded by New World Development Zheng Zhigang and other funds to focus on consumer technology blockchain. The information from the Hong Kong Securities Regulatory Commission showed that the address was New World Building, which initially focused on venture capital and then expanded to other strategies, including credit funds and hedge funds. In recent years, Zheng Zhigang has often appeared in blockchain and other activities. Sources: official website, Hong Kong Securities Regulatory Commission, official website, and other Hong Kong institutions also obtained Hong Kong number plates last month. Journalists in the industry learned that this institution is a single family trust, and its investment scope includes Private equity venture capital and hedge fund, which is owned by the founder of a head internet organization, is based on the owner's background. Other institutions that have been licensed in technology-related fields also include the Hong Kong subsidiary of Dapu Asset Management, a well-known domestic private equity fund, which obtained the number plate and the number plate on January. Zhongtian Investment Management, which was jointly funded by Mecca Investment and Zhongmin Xinneng, obtained the number plate and other virtual assets practitioners in the Hong Kong SAR government in succession. Hong Kong has attracted the attention of virtual assets practitioners around the world. For example, in an interview, the relevant person of Yicai Investment Fund, a newly licensed institution, expressed interest in blockchain virtual assets. For example, Yang Zhenjun, the founder of Yicai Investment Fund, once introduced to the media that China and Hong Kong have a sound supervision system, and the credibility and security of Hong Kong funds are also relatively higher than those of other virtual asset centers. China and Hong Kong have launched a fund structure and released a series of excellent ones after Singapore. Hui policy fund subsidy fund tax exemption Hong Kong's legal tender custody and banking system is the most perfect. Since the digital currency Declaration in June, China and Hong Kong have introduced the most active, lenient and moderate regulatory rules in the world so far, and we are constantly introducing more and more perfect follow-up policies. It is the most friendly to have a clear jurisdiction that digital currency's regulatory rules can follow. He also added that the Hong Kong Securities and Futures Commission has clearly stipulated that if it wants to issue compliant full investment in the number. The fund in Chinese currency not only needs the traditional number plate, but also needs two licensed principals with corresponding working experience. For example, official website data shows that Swiss Digital Bank is a fully licensed Swiss cryptobank, providing comprehensive financial solutions for the digital age, covering equity investment, lending, custody, investment transaction, banking business and deposits in Switzerland. Hong Kong Limited, a wholly-owned subsidiary, obtained a license issued by the Hong Kong Securities and Futures Commission last month, which allowed. Can the licensed institution of the Hong Kong Securities Regulatory Commission's license plate engage in virtual assets investment in Hong Kong without restrictions? In view of this problem, Yuan Chengpeng, a key member of Xiao Sa's team of Beijing Dacheng Law Firm, told the China Fund News reporter that if the institution holding the license plate and the proportion of virtual assets in its portfolio does not exceed the proportion of net assets of the portfolio, it can manage this portfolio under the original license. If the institution holding the license plate accounts for more virtual assets than the portfolio. If the net assets are above or above, you need to apply to the Hong Kong Securities Regulatory Commission to upgrade the license before you can manage this portfolio. In the third quarter, the Hong Kong Securities Regulatory Commission received a number of license applications, and the data showed that Hong Kong financial licenses, including virtual assets related licenses, were attractive. Since the Hong Kong Securities Regulatory Commission implemented the new licensing system for virtual assets trading platforms on April this year, as of June, two institutions have been approved for virtual assets trading platforms in Hong Kong, namely Digital Securities Co., Ltd. and Hong Kong origin. Official website, China Securities Regulatory Commission (CSRC) Up to now, one institution has submitted an application for a virtual asset trading platform to the Hong Kong Securities Regulatory Commission, namely, Hong Kong Digital Asset Trading Group Co., Ltd., Hong Kong Virtual Asset Exchange Co., Ltd., Shengli Digital Technology Co., Ltd., Cheetah Trading Hong Kong Co., Ltd., cloud account, Greater Bay Area Technology Hong Kong Co., Ltd. from the Hong Kong Securities Regulatory Commission, official website, and the Hong Kong Securities Regulatory Commission said in official website that the list of applications for a virtual asset trading platform was published to enable the public to determine that the virtual asset trading platform is. Did you make a false or misleading statement about the license application status in the Hong Kong Securities Regulatory Commission? The license application of the virtual asset trading platform operators on the application list has not been approved by the Hong Kong Securities Regulatory Commission and may not meet the relevant requirements. Investors should refer to the list of approved virtual asset trading platforms of the Hong Kong Securities Regulatory Commission to know the names of the officially licensed virtual asset trading platform operators. The Hong Kong Securities Regulatory Commission also reminded investors to pay attention to handing in the unregulated virtual asset trading platform. The risk of virtual assets includes any applicant listed in this list. The third quarter report released by the Hong Kong Securities Regulatory Commission recently showed that the number of license applications received by the Hong Kong Securities Regulatory Commission in the third quarter increased compared with the previous quarter and compared with the same period of last year. The total number of licensed institutions, individuals and registered institutions as of March included, and the total number of new licensed institutions, individuals and registered institutions in the third quarter included, among which, the number of companies' licenses issued by the two companies in the third quarter provided asset management, regulated activities and securities advice accounted for, respectively. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。