解读Uniswap V4:引领去中心化交易所的新未来

作为DeFi领域的重要参与者,Uniswap可谓是一骑绝尘,不仅稳定占据Dex(去中心化交易所)市场TOP1的席位,同时也在推动行业进步和完善方面发挥了至关重要的作用。2023年6月13日,Uniswap V4代码草案发布。据业内人士透露,近期Uniswap V4即将上线新版本,在此之前我们深入了解下V4版本的创新之处。

Hooks:V4交易更自由

Hooks是Uniswap V4中的一种智能合约,可以理解为V4上面的插件,允许开发者在流动性池生命周期(如添加、调整、删除、交换等)的特定点位调用外部合约执行指定的操作,从而实现动态费用、链上限价单、时间加权平均做市商(TWAMM)分散大订单等功能。

也就是说,Uniswap V4成了一个可定制化的流动性池平台,开发者可以在此基础上开发出更加合适自有项目发展的各种新功能,推动项目的流动性的同时,更是繁荣生态内项目的发展和创造。

具体而言,例如ETH-USDT这样的资金池都有包括创建池子、添加流动性、移除流动性、swap交易前/后等环节在内的完整生命周期,在以往版本中,每个操作之间具有耦合性,必须严格按顺序执行,但是在V4中,用户在一个生活周期内的操作空间更大,可以自定义组合出更多功能。例如,用户可以通过Hooks创建出根据市场行情变动的动态费用的资金池,而不是预先设置和静态的交换费用。

同时,交易者通过Hooks还可以实现更加丰富的订单形成。去中心化交易所(DEX)都是兑换自动完成交易,并不支持链上限价单功能,但是UniswapV4,交易者可以根据自己对市场的判断设定一个理想价位进行买卖,交易者可以更低价格购买加密货币,或者设定更高价格卖出加密货币。并且,通过Hooks实现了TWAMM(加权平均做市商)功能,能帮助交易者更高效地执行大额订单。TWAMM逐渐分散大额订单,最大限度地减少价格影响。

这种无限制的自定义操作,有利于闲置流动性存入借贷协议,亦或推动跨链流动性。总之,开发者可以基于Uniswap V4的核心功能,创建出更加复杂和定制化的交易策略和应用。

单例模式:V4交易更高效

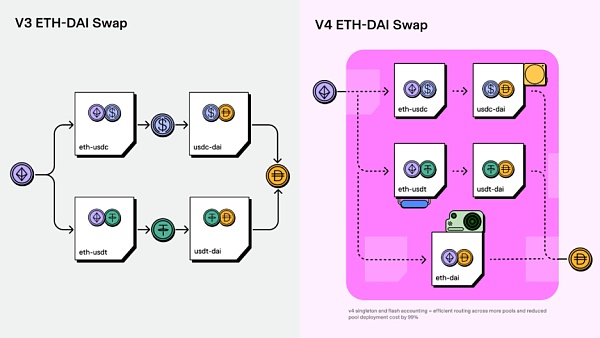

在Uniswap V3中,每个流动性资金池都部署新的合约,例如,USDT-ETH池的资产放在合约A中、USDT-UN放在合约B,如果想要用ETH兑换UNI,则需要在A合约完成一次兑换,然后再在B合约做一次兑换,多步交易需要经过多个合约,需要消耗多次gas。

在Uniswap V4的设计中引用了Singleton模式,实现了所有资金池都在一个合约中,因此在不同资产池兑换交易时,只需要收取一次gas费用,此举节省了大量的燃料成本。据Uniswap估计,Uniswap V4可以将创建资金池的燃料成本降低99%。

与此同时,通过单例模式,Uniswap V4能够更有效地管理其内部的资源和状态,提高了系统的整体性能和稳定性。

闪电记账系统:V4交易更节能

Uniswap V4引入了flash accounting(闪电记账系统),这一系统通过链下预处理和链上确认的方式,可以理解成为交易者提供了临时内存空间。例如,在V3版本中,如果一个交易需要3步操作,那么每一步都需要消耗一定数量gas费用,不仅造成了链上交易拥堵,也极大增加了交易者的额外费用。但是在V4版本中,中间操作可以借助闪电记账系统暂时存储,不需要消耗gas费用。

由此可见,闪电记账系统降低了交易延迟和成本,使得交易能够更快地完成链上确认。这一优化为用户提供了更流畅的交易体验,降低了交易成本,提高了交易效率,增强了用户的交易体验。

DEX生态的扩展

众所周知,为了方便交易,Uniswap V2/V3版本中,移除原生ETH交易对,绝大多数的交易需要在交易前将ETH封装为WETH,并支付额外的gas费用。Uniswap V4恢复了原生ETH交换功能,这一举措对于去中心化交易所生态的发展具有重要意义。除了显而易见地降低交易成本之外,重点是促进了ETH与其他代币之间的流动性。

同时,Uniswap V4引入了捐赠功能,允许流动性提供者在提供流动性的同时,为特定的项目或社区进行捐赠,这一创新功能增强了社区参与度和项目支持度,推动了去中心化项目的筹款和发展。

据悉,随着Uniswap不断迭代以及稳定于DEX生态领军行列,V4增加了治理民主性与透明度的机制。新的投票机制和社区参与度的提高使得Uniswap的治理更加符合社区的利益和期望,这一改进有助于提高去中心化交易所生态的稳定性和可持续性。

总之,UniswapV4通过引入Hook等更多系统,延展出加权平均做市商、动态手续费、链上限价、范围外借贷协议等具有可组合性和扩展性的新功能,从而改善用户体验、降低交易费用、提高成本效率以及改善平台流动性,这无异于大幅提高Uniswap竞争力的同时,推动整个DEX以及DeFi市场的发展,并且逐步拥有与CEX中心化交易所一较高下的技术资本和生态资本。

V4生态圈的利与弊

基于UniswapV4的升级,开发者能够在Uniswap的流动性和安全性基础上进行创新,自定义更丰富的特色流动性池子。如此便有行业人士认为V4主要是对项目方更有利,他们能够更自由地开发出各类项目和玩法。但实则不然,多元生态的构建和竞争,无异于对项目方开发项目提出更高的要求,项目方需要更加注重项目的质量和创新性,以吸引用户的关注和投资。

DeFi是加密货币流动性的基石,Uniswap V4即将为DeFi赛道提供前所未有的开放性,实现自由撮合的去中心化交易流程,对于当前低迷市场来说,意味着更多机会与可能。

盘活市场,投资才有意义。Uniswap V4市场效率的提高和交易成本的降低为投资者提供了更多的投资机会和利润空间,在提升存量用户积极性的同时,吸引更多增量用户才是市场持续发展的王牌。Uniswap V4功能体验更趋近于CEX,并拥有去中心化的正统性,为交易者提供成本更低以及体验更优化的服务,从而有望获得CEX的部分市场份额。

然而,不可否认的是包括Uniswap V4在内的DEX在速度和效率方面仍存在不足,对于绝大多数交易者而言,是否为了享有去中心化的自由度而承担一定合约安全性等问题。

行业人士表示:目前,Uniswap V4版本尚无法有效解决这些问题,只有真正解决效率与用户体验两大问题,DEX才有可能替代中心化交易所。

结语

Uniswap自2018年诞生以来,不断升级迭代,从V1证明了自动做市商(AMM)的可能性,V2实现支持人物ERC-20 Token之间的交易,V3引入聚合流动性概念,极大地提高了资本效率。V4采用Hooks与Singleton模式,以解决V3分叉许可和管理集中化流动性头寸的挑战,成为可组合性的协议,让LP更好地享受去中心化金融时代更大的红利。

目前来看Uniswap V4提高了交易的效率和安全性,降低了交易成本,提高了交易的自由度和效率,它的上线必将缩短DEX和CEX交易平台之间的差距,吸引更多CEX用户进入DEX平台,这对去中心化交易所生态和加密货币市场产生了深远的影响。同时,Uniswap V4为开发者提供了更大的可操作性和灵活性,推动着去中心化交易所技术的创新和生态的扩展,更能在DeFi迫切需要创新的时刻激发创意的浪潮,创造出更符合行业发展和用户需求的DeFi项目。

V4不是Uniswap的终点,整个DEX生态刚好在加速带上,用力挣扎,仰望远方,这必将是Uniswap不变的未来。

As an important participant in the field, it can be said that it not only stably occupies the seat in the decentralized exchange market, but also plays a vital role in promoting the progress and perfection of the industry. According to industry sources, the draft code was released in the near future, and a new version will be launched soon. Before that, we have a deep understanding of the innovation of the next version, which is a kind of intelligent contract. It can be understood that the above plug-in allows developers to add, adjust, delete and exchange in the life cycle of the liquidity pool. Call the external contract at a specific point to perform the specified operation, so as to realize the functions of limit orders, time-weighted average market makers and large orders in the dynamic cost chain, which means that it has become a customizable liquidity pool platform. On this basis, developers can develop various new functions that are more suitable for the development of their own projects, promote the liquidity of projects, and at the same time, prosper the development and creation of projects within the ecosystem. Specifically, such a pool of funds includes creating pools, adding liquidity and removing liquidity. In the previous version, the complete life cycle, including the links before and after sex trading, is coupled between each operation, which must be executed in strict order. However, in China, users have more room for operation in a life cycle, and they can customize and combine more functions. For example, users can create a fund pool of dynamic fees that changes according to market conditions instead of pre-setting and static exchange fees, and traders can also form more abundant orders. Decentralized transactions are all exchanges. Automatic completion of transactions does not support the function of chain limit orders, but traders can set an ideal price to buy and sell according to their own judgment on the market. Traders can buy cryptocurrency at a lower price or set a higher price to sell cryptocurrency, and through the realization of the weighted average market maker function, traders can execute large orders more efficiently and gradually disperse large orders, minimizing the price impact. This unrestricted custom operation is conducive to idle liquidity to deposit in loan agreements. Or promote cross-chain liquidity. In short, developers can create more complex and customized trading strategies and applications based on the core functions of. singleton pattern trading is more efficient. In China, each liquidity fund pool deploys new contracts, such as the assets of the pool, and puts them in the contract. If you want to use the exchange, you need to complete the exchange once in the contract and then make an exchange once in the contract. Multi-step trading needs to go through multiple contracts and consume many times. In the design, the model is cited to realize that all the fund pools exist. Therefore, in a contract, you only need to charge once when exchanging transactions in different asset pools, which saves a lot of fuel costs. It is estimated that the fuel cost of creating a fund pool can be reduced. At the same time, singleton pattern can manage its internal resources and status more effectively, improving the overall performance and stability of the system. The lightning bookkeeping system is more energy-efficient in transactions, and the lightning bookkeeping system is introduced. This system can be understood as providing temporary services for traders through offline pretreatment and online confirmation. Memory space, for example, in the version, if a transaction needs to be operated step by step, then each step needs to consume a certain amount of expenses, which not only causes the transaction congestion on the chain, but also greatly increases the extra expenses of the trader. However, in the version, the intermediate operation can be temporarily stored with the help of the lightning bookkeeping system without consuming expenses, which shows that the lightning bookkeeping system reduces the transaction delay and cost, and enables the transaction to be confirmed on the chain faster. This optimization provides users with a smoother transaction experience and reduces the transaction. As we all know, in order to facilitate the removal of the original transaction in the transaction version, it is necessary to package and pay extra fees before the transaction to restore the original exchange function. This measure is of great significance to the development of the decentralized exchange ecology, in addition to obviously reducing the transaction cost, the key point is to promote the liquidity with other tokens, and at the same time introduce the donation function to allow liquidity providers. The innovative function of donating to a specific project or community while providing liquidity has enhanced community participation and project support, and promoted the fundraising and development of decentralized projects. It is reported that with the continuous iteration and stability in the ranks of ecological leaders, the mechanism of governance democracy and transparency has been increased, and the new voting mechanism and the improvement of community participation have made the governance more in line with the interests and expectations of the community. This improvement will help improve the stability and sustainability of decentralized exchanges. By introducing more systems such as weighted average market maker's dynamic handling fee chain, new functions with combinability and expansibility are extended, such as lending agreement outside the price limit range, so as to improve the user experience, reduce transaction costs, improve cost efficiency and improve platform liquidity. This is tantamount to greatly improving competitiveness, promoting the development of the whole market and gradually having the advantages and disadvantages of the technical capital and ecological capital ecosystem that are comparable to the centralized exchange. Innovating on the basis of liquidity and safety, customizing a richer characteristic liquidity pool, so that some people in the industry think that it is mainly beneficial to the project side, and they can develop all kinds of projects and games more freely, but in fact, the construction and competition of multiple ecology is tantamount to putting forward higher requirements for the project side to develop projects. The project side needs to pay more attention to the quality and innovation of projects to attract users' attention and investment, which is the cornerstone of cryptocurrency liquidity, and will soon provide an unprecedented track. The decentralized trading process that is open and free to match means more opportunities and possibilities for the current depressed market. It is meaningful to revitalize market investment. The improvement of market efficiency and the reduction of transaction costs provide investors with more investment opportunities and profit margins. It is the trump card for the sustainable development of the market to attract more incremental users while enhancing the enthusiasm of existing users. The functional experience is closer to and has the legitimacy of decentralization, providing traders with lower costs and more optimized experience. However, it is undeniable that there are still some shortcomings in terms of speed and efficiency. For most traders, whether to undertake certain contract security in order to enjoy the freedom of decentralization, industry insiders say that the current version can not effectively solve these problems. Only by truly solving the two major problems of efficiency and user experience can it replace the centralized exchange conclusion. Since its birth in, it has been continuously upgraded and iterated, which has proved the possibility of automatic market makers to support transactions between people and introduced the concept of aggregate liquidity, which greatly improved the adoption of capital efficiency. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。