Agilely深度解析 首个流动性再质押衍生品(LRT)协议

虽然如今市场在资金集中于BTC和Solana生态,ETH生态显得默默无名。但是当eigenlayer正式上线后抬升ETH生态基准利率,资金还是会重新流动回DeFi生态,正所谓买在无人问津时,在此时通过agilely埋伏未来的Restaking生态是一个赔率很高的选择。

前言

以太坊转入POS后,Lido,Rocket Pool等质押底层协议所发行的warpped ETH给以太坊生态带来了源于POS的4%无风险利率,而EigenLayer将以太坊质押节点的安全性与网络解耦,通过restake提供给多个POS网络。虽然还未正式上线,但可以预见的是restake能够将以太坊生态中的基准利率进一步提升至6%-8%。在这个基准利率之上加杠杆,我们可以预计用户可以获得大约10%的长期无风险收益。而Agilely就是在众多LSDFi协议中第一个拥抱Restaking Token的协议。

关于Agilely

简而言之,agilely是一个稳定币$USDA发行协议。USDA是一个基于Liquity模型的全链生息稳定币,通过多重创新机制在保证用户持有就能获取利息的同时保证USDA始终锚定于$1,保证收益和流通属性共存。

今年LSD赛道兴起后,兼具流动性、稳定性和收益性的生息稳定币迅速得到了DeFi玩家的青睐。在今年五月由Lybra打响第一枪,随后Gravita, Raft, Prisma紧随其后,总TVL达到$400m,成长为一股不可忽视的力量。Agilely博采众家之长,不仅在产品设计上保有最多的创新点,同时在代币设计上保证代币能够捕获到协议的真实收入,这是同赛道协议所不具备的优点。

基于CDP(Collateral Debt Position,债务抵押头寸)的稳定币模型最早由MakerDAO提出,用户在协议中超额抵押资产,以此作为保证,从而借出协议发行的稳定币。但是高达250%的抵押率造成了底下的资本效率。

DAI的Collateral Ratio(Source:https://daistats.com/#/overview)

之后Liquity提出了最为经典的CDP稳定币模型,即通过硬软双重锚定以及三层清算模型来实现低达110%的MCR,实现优秀的资本效率。Liquity发行的稳定币LUSD历经市场两年牛熊波动价格始终锚定于$1,足可见其机制设计完美性。agilely采用Liquity的价格稳定机制,来保证USDA在价格上的稳定性。

Liquity稳定机制回顾

在我们介绍USDA之前,首先对Liquity的稳定机制进行回顾,借此让读者更好的理解。Liquity的CDP稳定币LUSD设计主要包括以下几个方面,Soft/Hard Peg带来LUSD价格锚定,稳定池-债务再分配-恢复模式保证协议安全,通过铸造费率和赎回费率变化对供需进行控制。这些模块共同作用,为LUSD的稳定提供了保障,也让其成为了基于CDP的稳定币最佳模型。

Liquity的价格稳定机制

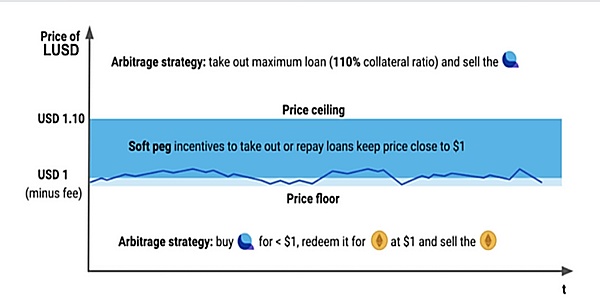

LUSD作为锚定美元的稳定币,最重要、最核心的属性便是稳定性。其价格稳定机制分为两部分,Hard Peg和Soft Peg。Hard Peg部分通过确定最低110%的抵押率来塑造价格上限为$1.1,如果LUSD价格超过$1.1那么用户可以通过抵押以太坊(110%抵押率)来铸造LUSD并在市场上卖出来获得无风险套利;通过提供硬性赎回/偿还通道来约束价格下限为1,如果LUSD市场价低于1那么任何人都可以在市场上购买LUSD来从Liquity协议中兑换ETH/赎回抵押品来进行无风险套利。通过提供开放套利通道,来将LUSD的价格稳定在 $[1-赎回费率, 1.1]之间。

Soft Peg部分中,分为几个部分,首先是协议主导的长期市场心理强化,Liquity系统强化人们1LUSD的价值就是1USD,用户在长期博弈中也会达到1LUSD=1USD的谢林点(博弈论中人们在没有沟通的情况下的选择倾向),并且只要市场用户心中对于LUSD的价格区间养成[1-赎回费率,1.1]的心理预期,那么用户就不会在高价买入LUSD(在$1.09买入LUSD最高损失达到9%,最大盈利1%),不会在价卖出LUSD(可以在Liquity协议中无风险套利),那么LUSD的价格就不会靠近价格上限和下限;除此之外还有算法确定的一次性发行费用作为额外的稳定机制,相较于加息,增加发行费率能够比较直接的影响新增的LUSD铸造数量,具体见下方的”供需控制机制“一节,通过发行费率和赎回费率共同的作用来控制基础货币的发行数量,从而调控LUSD的市场价格。

综合来看,LUSD的价格稳定机制可以如下图所描述。

LUSD的价格稳定机制

事实证明这套稳定机制行之有效的。

Liquity的清算机制

正如前文中提到,Liquity的清算机制由稳定池-仓位再分配-恢复模式作为协议安全防线。在正常操作中,清算用户(即那些抵押率下降至110%以下的用户)通常由稳定池作为清算对手。然而,如果稳定池中的LUSD资源不足以支持清算仓位,系统将启动仓位再分配机制。最后,在全体系统的抵押率降至150%以下时,系统将切换至恢复模式。

在这个清算流程中,稳定池作为第一防线,也是最常用的防护手段。而债务再分配和恢复模式主要是在极端情况下的协议安全保护机制。

稳定池:作为协议层面清算用户的对手方存在。LUSD持有者将LUSD存入稳定池,当有头寸需要清算时,外部清算人调用稳定池进行清算。清算人获得0.5%的抵押品以及50LUSD的gas补贴。剩余99.5%的ETH归为稳定池存款人所有。理论上稳定池存款人最大可以获得10%的ETH收益(在刚跌破110%的清算线就进行清算,获得相对于销毁LUSD的1.09945倍的ETH),但需要注意的是,该动作实际是在ETH下跌区间内买入ETH,如果ETH价格持续下跌而没有及时提取收益兑换的话可能承担损失。

仓位再分配:当稳定池内LUSD消耗完毕,系统将待清算的ETH和待偿还的LUSD按照比例重新分配给所有的现存仓位。抵押率越高收到的债务和抵押品就越多,借此来保证系统不会出现连环清算。截至目前即使在数次市场大跌时,系统也没有启动仓位再分配。

恢复模式:当系统的总抵押比率低于150%,系统就会进入恢复模式,将系统总体抵押率快速拉回150%之上。在恢复模式下,清算行为比较复杂,本文中不再赘述。总体来看抵押率低于150%的仓位都有可能被清算,但协议为用户的最大损失设置了10%的上限。在5.19大跌中Liquity就进入了恢复模式,细节见事后Liquity官方总结 How Liquity Handled its First Big Stress Test 。

Liquity的供需控制机制

作为稳定币,LUSD也像传统货币类似,通过货币市场操作来控制货币供应。具体就是通过调整铸造和赎回的利率来控制LUSD的供需,铸造费率和赎回费率会依据赎回的时间和周期进行调整,更具体一点就是在无人赎回时,系统的铸造和赎回费率都会降低,当赎回行为增加,赎回费率也随之增加。相较于传统的货币市场操作,该机制防守性更强,重点在通过增加赎回费率来防止大规模的赎回出现。

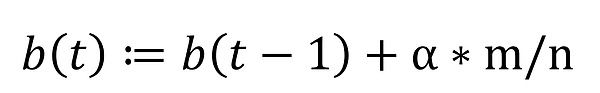

在Liquity中只收取一次性的铸币和赎回费用,他们根据协议中的全局变量BaseRate计算。铸造费用数值上等于BaseRate*铸造量,赎回费用在数值上等于(BaseRate+0.5%)*赎回ETH的价值。

当没有赎回行为发生时,BaseRate会随着时间衰减为0,半衰期为12h。当有赎回行为发生时,BaseRate按照如下公式计算,其中b(t)是时间t的BaseRate,m是赎回的LUSD数量,n是LUSD的当前供应量,?是常数参数。

通过调整赎回产生的费用,? 对硬锚定中的价格下限产生影响。在Liquity白皮书的推算中,基于货币定量理论,将 ? 设置为 0.5,利润最大化套利者将赎回与恢复的挂钩所需的 LUSD。具体推导过程见 Derivation。

总体来看,Liquity通过优秀的机制设计来保障整体系统的正常运行,事实也证明了这套系统的可行性,上线以来Liquity一直保持着良好的运行,LUSD在稳定性和资本效率上达到了极致。

基于Liquity的Agilely机制创新

抵押品

在抵押品层面,agilely中用户使用ETH, 主流wrapped ETH以及GLP等生息资产作为抵押物来铸造USDA,之后还会接入Restaking Token,将其本身所带有的利率继承到USDA中,提升USDA利率。

利率模型

本节主要讨论协议内的费率,包括铸币、赎回和借款费用。铸币和赎回费用是一次性费用,借款费用是未偿还债务随时间累积产生的费用。

铸币费:指用户在协议中铸造稳定币时需要支付的一次性费用。Agilely选择使用Liquity的BaseRate模型并在其上进行修改。(关于BaseRate的讨论详见本文“Liquity机制回顾”的“供需控制机制”一节),在BaseRate随时间衰减的部分中增加了衰减因子,并对于每个实例都确定不同的衰减因子,将其公式化描述如下:

赎回费:指用户在偿还贷款从协议中拿回自己抵押品所需要的费用,通常高于铸币费。Agilely的铸币费为BaseRate+0.5%;

借款费:指用户为未偿债务随着时间的推移而累积的费用,部分协议为了激励用户长期借款选择不收取这部分费用,agilely在这里创新设计了ADI(Agilely Dynamic Interest)来对货币总量进行调控。

稳定机制

本节主要讨论agilely作为稳定币的稳定机制,主要分为Hard Peg和Soft Peg两部分。

Hard Peg:提供ETH抵押品上110%的MCR来保证价格上限,并提供赎回通道来保证价格下限

Soft Peg:除了依靠协议主导带来的长期市场心理博弈来达到1USDA=1USD的谢林点,Agielly内部还内嵌ADI(Agilely Dynamic Interest)来通过调控USDA的市场投放来在宏观上对价格进行调控(详见上节“利率模型”)。

Although the market is now unknown in terms of capital concentration and ecological ecology, when it is officially launched, it will raise the ecological benchmark interest rate, and the funds will still flow back to the ecology. It is said that it is a very high chance to ambush the future ecology at this time when no one cares. Foreword: The underlying agreement issued by Ethereum has brought the risk-free interest rate to Taifang Ecology, but it will decouple the security of Taifang pledge node from the network and provide it to multiple networks, although it is not yet correct. The formula is online, but it is foreseeable that the benchmark interest rate in Taifang Ecology can be further raised to leverage above this benchmark interest rate. We can predict that users can get about long-term risk-free income, which is the first agreement embraced among many agreements. In short, it is a stable currency issuance agreement, which is a model-based full-chain interest-bearing stable currency. Through multiple innovative mechanisms, it is guaranteed that users can get interest while always anchoring in guaranteed income and circulation. Sexual Coexistence After the rise of this year's track, the interest-bearing stable coins with liquidity, stability and profitability quickly gained the favor of players. In May this year, the first shot was fired, followed by it, and it always grew into a force that cannot be ignored. It not only kept the most innovations in product design, but also ensured that tokens could capture the real income of the agreement in token design, which was an advantage that the agreement on the same track did not have. The stable coin model based on debt mortgage position was first proposed by users. In the agreement, the excessive mortgage of assets was used as a guarantee to lend the stable currency issued by the agreement, but the high mortgage rate caused the underlying capital efficiency. After that, the most classic stable currency model was put forward, that is, the low capital efficiency was achieved through hard and soft double anchoring and three-layer liquidation model. After two years of market fluctuation, the price of the stable currency was always anchored to the perfection of its mechanism design, and the price stabilization mechanism was adopted to ensure the price stability. System review Before we introduce it, we first review the stability mechanism, so that readers can better understand the stable currency design, which mainly includes the following aspects: price anchoring, debt redistribution recovery mode, ensuring the security of the agreement, controlling the supply and demand through the change of casting rate and redemption rate, and these modules work together to provide guarantee for the stability, which also makes it the most important and core attribute of the stable currency based on the best model of stable currency. It is stability, and its price stability mechanism is divided into two parts and parts. By determining the lowest mortgage rate, the upper price limit is shaped. If the price exceeds, users can cast it by mortgaging the Ethereum mortgage rate and sell it in the market to obtain risk-free arbitrage. By providing a hard redemption repayment channel, price floor can be restrained. If the market price is lower than that, anyone can buy it in the market to redeem the mortgage from the agreement for risk-free arbitrage. By providing an open arbitrage channel, it will The price stability between redemption rates is divided into several parts. First, the long-term market psychological strengthening system led by the agreement strengthens people's value, which is what users will achieve in the long-term game. In Schelling's point game theory, people tend to choose without communication, and as long as market users develop the psychological expectation of redemption rates in their hearts, users will not buy at high prices, lose the most when buying, sell at high prices and have no wind in the agreement. Risk arbitrage, then the price will not be close to the upper and lower price limits. In addition, there is a one-time issue fee determined by the algorithm as an additional stability mechanism, which can directly affect the newly added casting quantity compared with raising interest rates. See the section below on supply and demand control mechanism for details. The price stability mechanism that controls the market price through the joint action of issue rate and redemption rate can be described in the following figure. Facts have proved that this stable mechanism is effective. As mentioned above, the liquidation mechanism uses the stable pool position redistribution recovery mode as the protocol security line. In normal operation, users who liquidate, that is, those whose mortgage rate drops below, usually use the stable pool as the liquidation opponent. However, if the resources in the stable pool are insufficient to support the liquidation position system, the position redistribution mechanism will be started. Finally, when the mortgage rate of the whole system drops below, the system will switch to the recovery mode. In the calculation process, the stable pool is also the most commonly used protection means, and the debt redistribution and recovery mode is mainly the agreement security protection mechanism in extreme cases. As the counterparty of the clearing user at the agreement level, the holder will deposit it in the stable pool. When there is a position to be liquidated, the external liquidator will call the stable pool to carry out the collateral and subsidies obtained by the liquidator, and the rest will be classified as the stable pool depositors. In theory, the maximum income that can be obtained by the stable pool depositors has just fallen. The broken clearing line will be liquidated to get twice as much as that destroyed, but it should be noted that this action is actually to buy in the falling range. If the price continues to fall and the income is not withdrawn in time, it may bear the loss of position redistribution. When the stable pool is exhausted, the system will redistribute the to-be-liquidated and to-be-repaid positions to all existing positions in proportion, and the higher the mortgage rate, the more debts and collateral will be received to ensure that the system will not have serial liquidation. Up to now, even in several times. When the market plunged, the system did not start the position redistribution recovery mode. When the total mortgage ratio of the system is lower than the system, it will enter the recovery mode, and the overall mortgage ratio of the system will be quickly pulled back to the top. In the recovery mode, the liquidation behavior is more complicated. In general, the positions with mortgage ratio lower than that may be liquidated, but the upper limit set by the agreement for the maximum loss of users will enter the recovery mode. See the official summary of the supply and demand control mechanism as a stable currency, just like traditional goods. Coin is similar to controlling money supply through money market operation, that is, the supply and demand casting rate and redemption rate controlled by adjusting the interest rate of casting and redemption will be adjusted according to the time and cycle of redemption. More specifically, when there is no redemption, the casting rate and redemption rate of the system will decrease, and the redemption rate will also increase. Compared with the traditional money market operation, this mechanism is more defensive. The key point is to prevent large-scale redemption by increasing the redemption rate, and only one-time casting fee and redemption fee will be charged. They calculate the casting fee according to the global variables in the agreement, which is numerically equal to. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

清算机制

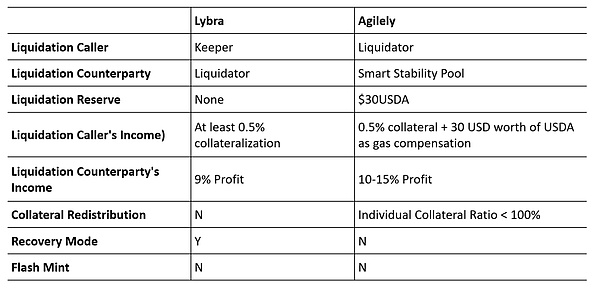

在对于清算机制的讨论中,我们以Liquity的三层清算机制(稳定池-仓位再分配-恢复模式)为基准,总结agilely在其之上的修改。

Agilely在保证系统安全性的同时,更加公平,清算界面放在前端降低门槛,让更多人参与,不像Lybra需要运行专业的bot才能参与清算,并且Agilely更进一步将常规的Stability Pool优化为了Smart Stability Pool,用户投入的USDA将会被放在最有可能发生清算、潜在清算资金缺口最大抵押品的Stability Pool。

PSM

除了以太坊的质押收益,Agilely还致力于捕获RWA收益,以多样化协议收入,通过设置PSM模块调高利率,来实现对DAI的虹吸,将收集到的DAI来结合MakerDAO,从而使协议能够捕获到MakerDAO的国债收益。

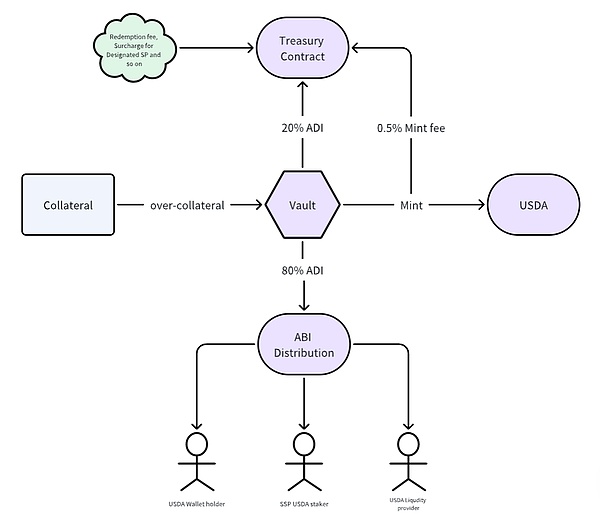

协议内价值流向

在Agilely协议内存在多项业务收入,包括铸造/赎回和借贷费用,PSM的交易费用,稳定池的附加费用,抵押品的收益以及PSM中RWA收益,这些收益将会通过以下三种方式流出

ABI(Agilelly Benchmark Interest)流向USDA持有者、LP(uniswap上USDA-ETH pool以及Curve USDA-3Pool)和稳定池的USDA质押者;

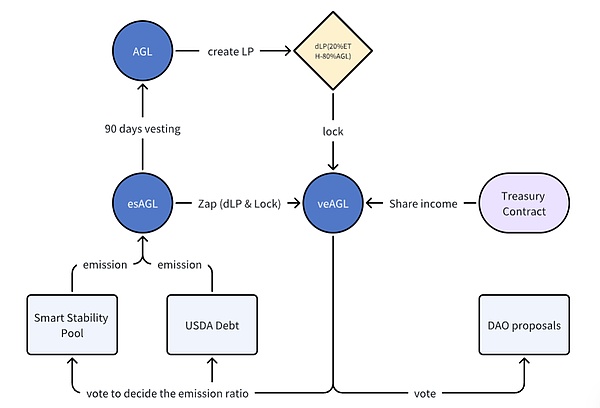

veAGL:质押dLP获取veAGL的用户除了治理权益外还能够捕获到协议真实收益;

稳定池收益:剩余业务收入被分配至稳定池作为质押收益;

代币设计

在本节中,我们将对协议代币层面的设计进行梳理、比较。主要关注协议代币的分发方式以及代币的实际效用,代币相关设计通常关系到协议用户的切身利益,因此我们可以从这些角度来对agilely的可持续性进行分析。

代币效用

代币作为协议的重要组成部分,其设计能否对协议内产生真实价值进行捕获直接决定这个代币的价格,并影响项目后续发展。在DeFi中,代币的价值支撑通常来自两个大方面,治理和收益。其中收益就是代币持有者能够可持续的分享到协议带来的收入,这是一切的基础;治理则是项目的长期主义者参与为主,但其更多还是以收益为基础,接下来就从这两角度来对agilely的代币AGL进行梳理。

治理

用户锁定 Balancer AGL/ETH 80:20 Pool的LP在协议中可以转换为veAGL获取投票权,投票权与锁定dLP数量时间成正比,锁定期满后可以反向转换为AGL。在治理层面,veAGL能够决定在不同抵押品头寸上AGL的激励分配。

收益

与现在市场上的LSD CDP项目不同的是,AGL在设计上致力于捕获真实收益,而并非本质上挖二池的庞氏逻辑。AGL主要作为各个抵押池的激励以esAGL形式分发,esAGL存在90天的解锁期限。并且veAGL持有人可以捕获到协议业务产生的收入,包括铸造/赎回,借贷费用,PSM赎回费用以及质押在稳定池的附加费用。

总结

虽然如今市场在资金集中于BTC和Solana生态,ETH生态显得默默无名,并且Balst对整个DeFi进行吸血鬼攻击导致DeFi赛道在币价上并不显眼。但是当eigenlayer正式上线后抬升ETH生态基准利率,资金还是会重新流动回DeFi生态,届时agilely凭借其优秀的产品和代币设计必将成为DeFi用户上杠杆的首选。正所谓买在无人问津时,在此时通过agilely埋伏未来的Restaking生态是一个赔率很高的选择。

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。