DePIN:从默默无闻到资本宠儿的跨越

回顾过去一年的加密市场,很多参与者是感到意外的。2022年底市场在FTX暴雷过后陷入绝望,随着杠杆和恐慌情绪的释放,开始触底反弹。彼时大家都以为只是深熊中的反弹,没想到比特币短短一年时间能突破5万大关,很多山寨币更是从底部反弹十几倍甚至几十倍。

恐怕虔诚的加密信徒也不会想象到市场的反弹会来得如此猛烈。

在这个过程中,市场也诞生了很多热点话题和赛道,热点的爆发为市场的提供了上涨的动力,如铭文、RWA、比特币ETF、Meme、模块化等等。尤其是从去年底开始接棒铭文成为当下最受关注的DePIN,如果说铭文是亚洲散户的狂欢,那么DePIN则是欧美资本的“宠儿”。

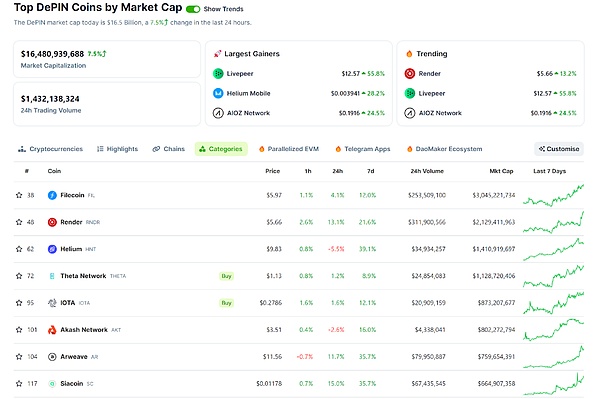

据Coingecko的数据,截至2024年2月,DePIN板块有流动性的资产规模已经超过160亿美元,而Messari Report预测DePIN的市场规模有望在 2028 年达到 3.5 万亿美元规模。

信息来源于Coingecko,数据截至2024.2

DePIN是去中心化物理基础设施网络 (Decentralized Physical Infrastructure Networks) 的简称。简单来说,DePIN是基于区块链,利用Token激励的手段,让用户参与到网络的建设和硬件大规模地部署中来,从而形成基础设施网络。

很多人看到这里内心会有疑问,这些概念不是很早以前就有项目在做?如Filecoin、Helium、Arweave、Theta等,难道这次又是包装概念炒冷饭?甚至有人拿几年前的IMO(首次矿机发行)概念和Pi等带有CX性质的项目与现在的DePIN比较,质疑DePIN就是所谓包装概念卖矿机。

DePIN赛道的契机

相较于铭文赛道是自下而上由散户的共识推动,基础设施网络的建设则通常是自上而下的,硬件的生产和参与意味着DePIN项目需要充分的前期资本支持,以确保硬件能铺的更广泛,从而建立强大的网络覆盖,这都需要大量的资金和长时间的投入。

与传统的基础设施提供商相比,原生Web3公司通常没这么多资金进行持续建设。早期团队只能通过“发币”、“卖矿机”吸引用户参与炒作,获得资金,然后拿资金收入拉币价。

如果是在牛市周期,这种方式能够正向循环,矿机和币价继续上涨,参与者有更高的回报,吸引更多人参与。但加密市场牛熊更迭很快,上一轮牛市很多项目方还没卖出多少就遇到熊市,面对手里留一堆筹码和矿机,没有流动性无法出货的窘境。

很多参与者同样也面对手里的设备每天挖,费电不说只能产出一堆没用的“积分”。因此在上一轮牛市以前参与这类项目的用户大多没有得到很好的回报,甚至参与较晚的更是血本无归。这也导致很多“过来人”对DePIN嗤之以鼻,下了庞氏骗局的定义。

有句老话叫“领先一步是先驱,领先三步是先烈”。毫无疑问,没有资本加持,也没有造血能力,基础设施几乎等于零,仅靠代币炒作来维持项目又遭遇熊市,这些项目方和参与者就成了“先烈”。

我认为这次DePIN的火热主要归功于两点,基本面的改善和资本的关注。归根结底,现在时机对了。

DePIN已经逐渐从“炒概念卖矿机”开始落地有实际应用,价值逐步被市场所认可。最具有代表性的项目Helium转型成功,深度绑定Solana,另起炉灶搞的Helium Mobile近期在美推出的20美元无限通话流量的套餐备受好评。去中心化GPU渲染网络RNDR也与苹果、微软、谷歌、英伟达和迪士尼等巨头建立合作。基本面的改善意味着这个赛道不再只是空中楼阁。

任何新技术的炒作都离不开资本的推动。2022年以前,对于整个DePIN赛道没有一个整体的定义,对于项目的分类也都是去中心化物联网、去中心化存储、去中心化计算等等。直到2022年底,Messari 通过投票的方式正式提出DePIN这个概念,随后在2023年初判断DePIN会是未来十年加密领域最值得关注的赛道之一。资本的入局使得DePIN快速发展,目前有统计的就有超过600个DePIN项目。而市场的转暖,风投们又开始活跃起来,DePIN领域的新增投融资更是不计其数。

不说区块链,即使是目前已经大规模使用的物联网平台、大数据、云计算、AI、VR、AR等技术,其实也都经历过热炒和泡沫破灭的反复循环。因此我们普通投资者不要因为过往而对一个事物抱有太大偏见。

如何选择和参与DePIN项目?

即使现在整个板块都出现了较大涨幅,DePIN整个赛道依旧属于早期,并且DePIN的发展是自上而下的,需要项目方持续深耕,也几乎不会像Meme那样动辄百倍不敢上车,更不会莫名奇妙冒出来一个“万倍涨幅”的神话。

具体落实到投资上来,有两种方式。一种是短线投机,借着目前整个大盘情绪火热,有趋势的护航,买一些DePIN项目代币。例如FIL、HNT、RNDR、AR、AKT等上了大所,流动性较好的板块龙头。这种方式不必要买设备,不需要考虑回本周期,止盈止损都较为灵活,缺点是容易踏空。

另一种如果你看好DePIN赛道的潜力,认为这个赛道可能会是像DeFi、公链一样的大叙事,那就深度参与一些基本面好的潜力新项目,并持续投入建设,无视短期的波动,博一个成长收益。

这种缺点是耗费时间精力久,且如果选择不当,项目死掉最后颗粒无收。因此如何在几百个项目当中做出选择是非常重要的能力。

我们大可以奉行拿来主义,让机构帮我们先筛选一道。很多机构和评级媒体都会发布一些清单,方便投资者参考。这些清单会筛选汇总同赛道的一些优质或者知名的项目。我们只要分析列表里的几个项目即可,最后每一个板块选择最优质的1-2个项目进行参与,就避免了自己去大海捞针。

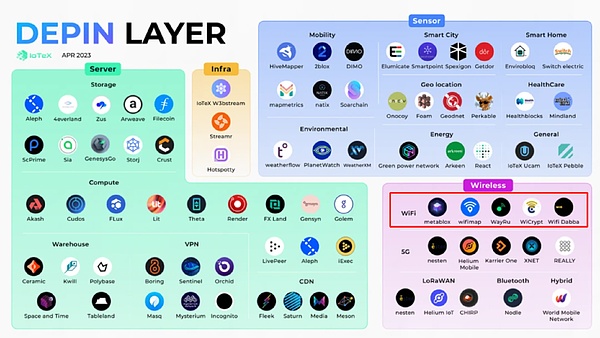

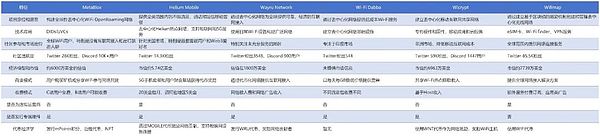

以Wireless为例,WiFi板块一共列举了5个项目,分别是Metablox、Wifimap、Wayru、Wicrypt、Wifi Dabba。(数据基于2023/12)

Wayru 、Wicrypt 、Wifi Dabba主要做发展中地区(如拉丁美洲、印度)的无线网络,社区规模较小,基础设施建设较为迟缓。

WiFi Map用户数最多,但功能类似360万能钥匙的海外版,无硬件设备支持,主要盈利方式为订阅和广告,团队Web3运营经验较弱。

这里面最有潜力的当属Metablox,其致力建立一个全球性的WiFi开放漫游网络,通过赋予用户去中心化标识(DIDs)和相应的可验证凭证(VCs)在公共WiFi网络中无缝切换的能力,向公众提供企业级WiFi漫游。

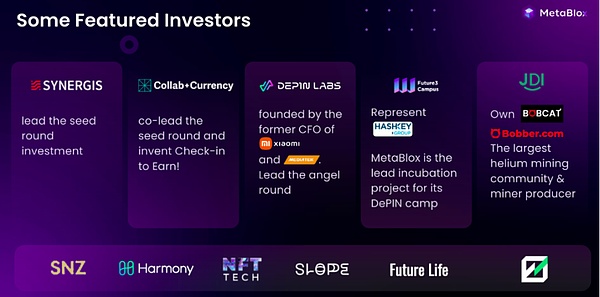

团队主要成员位于加拿大,种子轮由北美知名机构Synergis领投,Depinlabs,Collab等多家机构参投。

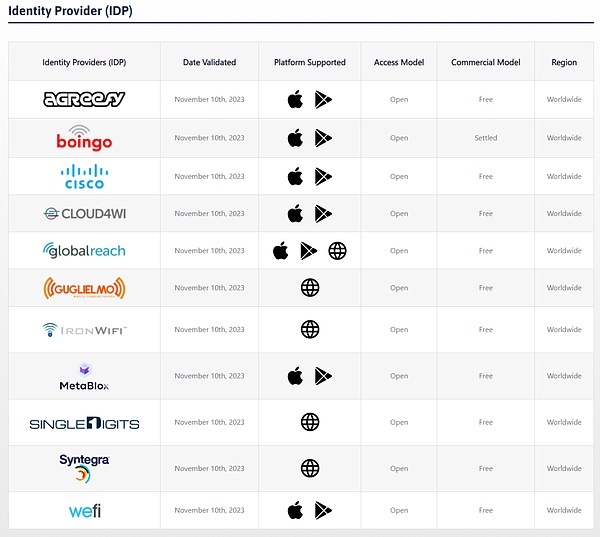

Metablox是无线宽带联盟(WBA)OpenRoaming的Identity Provider (IDP)的11家公司提供商之一,也是里面唯一一家Web3企业。

信息来源于WBA OpenRoaming官网

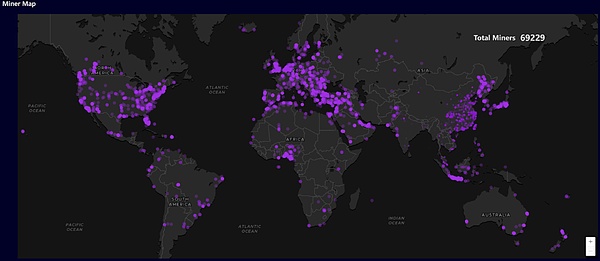

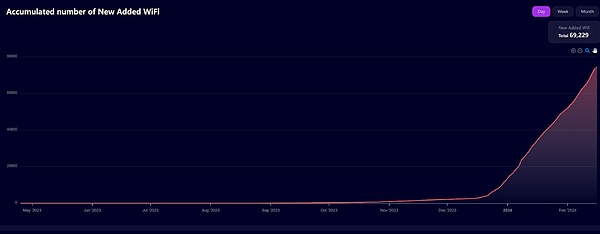

得益于Web3的创新模式,Metablox在短短两年时间内,在全世界100+个国家,通过用户参与部署了7万+自建WiFi网络节点,根据DePINscan官网数据,节点数排DePIN赛道全球第二。

用户还能共享使用OpenRoaming联盟里Boingo、Cisco、Global Reach等企业在陆地、船舶、飞机上部署的超过300万个WiFi节点,可以在全球各地进行方便、安全的WiFi连接,实现网络漫游自由。

信息来源于Metablox,数据截至2024.2

整个Wireless赛道,其他的竞争者要么是偏居一隅只开拓部分区域,要么是“半路出家”希望蹭点DePIN的热度,Metablox算是血统纯正的Web3项目。并且通过自身过硬的实力和强大的合作伙伴,迅速扩张完成基础设施的部署,让产品真正能用。

Metablox代币经济学

在DePIN领域乃至整个加密市场,最棘手的挑战就是代币价格波动所带来的影响。不同于传统企业大多是在发展到一定的规模并有良好的盈利前景后才被允许上市,DePIN项目往往在初期就借助发行代币作为激励,鼓励参与的用户及运营商投入资金部署相关硬件。

这种做法能够为参与者提供初期的经济补偿和小额的投资回报,激励他们在网络还未能通过用户费用自我维持之前继续运行。随着网络的发展和规模的扩大,项目有望达到规模经济效益。

然而,代币本身的价格波动可能会成为阻碍用户参与DePIN项目的一个因素。用户参与的主要动力是盈利:尽管DePIN项目提出了清晰的价值主张,但其原生代币的市场表现仍然是吸引和保留用户的关键因素。

由于参与者获得项目的原生代币作为奖励,价格的不稳定性可能会直接影响到他们的盈利。代币价格的上升往往能够更容易吸引对市场上涨趋势感兴趣的用户。相反,在市场低迷期,代币价值和盈利能力的下滑可能会促使一部分参与者离开。对于那些市值较低、流动性较差的代币来说,这种情况尤为严峻,可能会触发一系列死亡螺旋,这在之前的很多DeFi(也包括GameFi、DePIN)项目中都出现了。

代币作为支付网络服务费的媒介,其价格波动同样会对使用方产生影响。如果代币价格急剧上升,而服务费用未做相应调整,也就是门槛太高,可能会导致潜在用户不敢参与。因此,有一个稳健的代币经济体系和运营模式对于缓解价格波动的影响至关重要。

MetaBlox的代币经济模型包含以下三个元素:

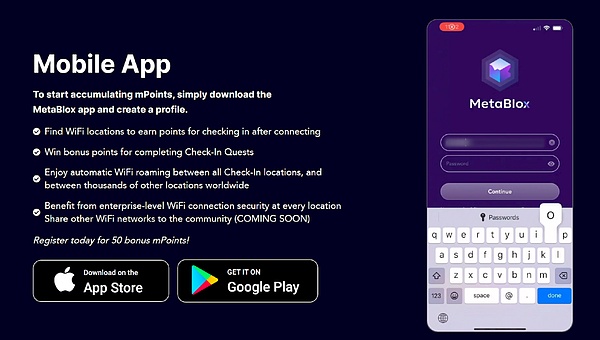

mPoints积分:在MetaBlox的代币体系中,mPoints扮演了核心角色,用户可通过参与网络建设、Check-in-to-earn:打卡赚积分等方式获得,或者直接购买以及从与MetaBlox合作商那里兑换。后续mPoints还可通过staking质押、销毁等形式换取治理代币。

治理代币:用户可以通过多种途径获取治理代币,如通过质押、参与活动或接收空投等。这些代币主要用于验证网络服务、参与社群治理、以及获得操作权限等。

MetaBlox NFT:由MetaBlox基金会发行的NFT,可绑定到具体的挖矿设备上。持有NFT的用户可以通过质押NFT来获得mPoints,同时NFT也为其持有者提供了社区内的特殊身份。

这些代币之间存在着复杂多层次的互换机制:mPoints可通过质押销毁来兑换治理代币,而MetaBlox NFT可通过质押获得mPoints奖励。这种设计构成了一个既复杂又紧密相连的代币生态。

明牌空投&参与方法

目前MetaBlox尚未发币,属于早期。并且官方明牌宣布空投,可以免费参与。

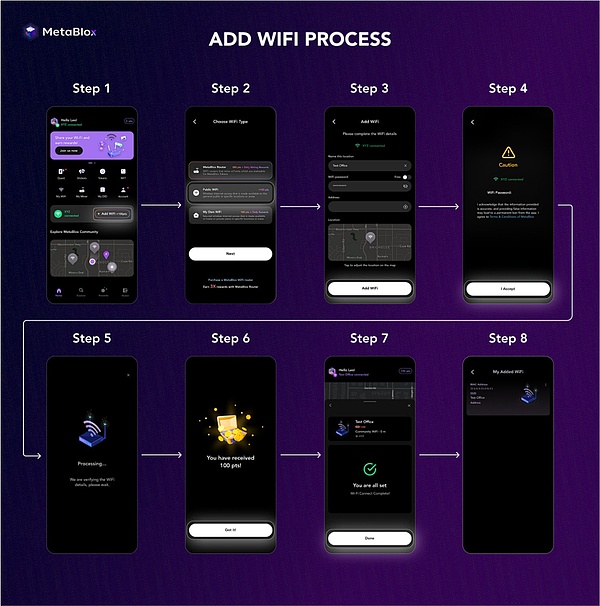

前往应用市场获取Metablox。苹果需要海外ID,安卓需要谷歌商店。

按照流程添加WiFi即可获得mPoints奖励,每天签到都可以获得mPoints。

DePIN利用分布式透明系统提高基础设施的扩展性和运作效率符合加密货币行业的原则。此类项目应用代币经济学,汇集存储容量和算力等众包资源,无需投资大量初始资本。其于各行各业拥有潜在应用场景,预示着巨大的潜在市场 。

其普及过程中仍存在着产品体验、护城河建立、法规合规以及人才短缺等诸多挑战。DePIN无法在短期内完全取代中心化网络,因此很可能将与传统基础设施提供商共存。长期来看,无论是从门槛降低、创新还是利用闲置资源和金钱流动的角度,DePIN的出现将对市场带来深远的影响。

对于我们普通投资者,最好的选择是当风口来临时顺应趋势,放下成见大胆参与。在市场过热的时候保持一分理智及时抽身。

Looking back at the encryption market in the past year, many participants were surprised. At the end of the year, the market fell into despair after the thunderstorm. With the release of leverage and panic, it began to bottom out. At that time, everyone thought it was just a rebound in the deep bear. I didn't expect Bitcoin to break through the 10,000 mark in just one year, and many counterfeit coins rebounded from the bottom by ten times or even dozens of times. I am afraid that devout encryption believers would not have imagined that the market rebound would be so fierce. In this process, many hot topics were born in the market. And the outbreak of hot spots on the track have provided the rising power for the market, such as the inscription, modularization of bitcoin, etc. Especially since the end of last year, the inscription has become the most concerned at present. If the inscription is the carnival of Asian retail investors, it is the darling of European and American capital. According to the data, the scale of liquid assets in the plate has exceeded US$ 100 million by the end of March, and the predicted market scale is expected to reach US$ 1 trillion by the end of 2008. The information comes from the data, which is the abbreviation of decentralized physical infrastructure network. It is said that based on the blockchain, users are encouraged to participate in the network construction and large-scale hardware deployment, thus forming an infrastructure network. Many people will have doubts when they see this. Aren't these concepts being done a long time ago? Is this the packaging concept fried rice again? Some people even compare the concept of the first mining machine release a few years ago and other projects with nature with the present, questioning that the so-called packaging concept is the opportunity to sell the mining machine track from the bottom up compared with the inscription. Generally speaking, the construction of infrastructure network is promoted by the consensus of retail investors, but the production and participation of hardware from top to bottom usually means that the project needs sufficient upfront capital support to ensure that the hardware can be spread more widely, so as to establish a strong network coverage, which requires a lot of money and long-term investment. Compared with traditional infrastructure providers, the original company usually does not have so much money to carry out continuous construction. The early team can only attract users to participate in speculation through coin-selling machines to obtain funds and then collect them. If the price of incoming coins is in the bull market cycle, the mining machine and the price of coins can continue to rise in a positive way. Participants have higher returns and attract more people to participate. However, in the last bull market, the bulls and bears changed quickly, and many project parties encountered a bear market before selling much. Many participants also faced the dilemma that they left a pile of chips in their hands and the mining machine was not mobile and could not ship. They also faced the equipment in their hands and dug electricity every day, saying that they could only produce a bunch of useless points. Therefore, they participated in such projects before the last bull market. Most of the target users didn't get a good return, and even those who participated late lost their money, which also led many people to sneer at the definition of Ponzi scheme. There is an old saying that one step ahead is the pioneer, three steps are the martyrs, and there is no doubt that there is no capital blessing and no hematopoietic capacity. The infrastructure is almost zero. Only relying on token speculation to maintain the project and encountering a bear market, these projects and participants have become martyrs. I think this fiery time is mainly due to two fundamental improvements and capital. In the final analysis, the time is right now, which has been gradually recognized by the market for its practical application value. The most representative project has been successfully transformed and deeply bound. The package of unlimited call traffic in the US recently launched in the United States has been well received. Decentralized rendering network has also established cooperation with giants such as Apple, Microsoft, Google, NVIDIA and Disney. The improvement in fundamentals means that this track is no longer just a castle in the air, and the hype of any new technology cannot be separated from capital. Before the promotion of this year, there was no overall definition of the whole track, and the classification of projects was decentralized, networked, stored and calculated. It was not until the end of the year that the concept was formally put forward by voting, and then it was judged at the beginning of the year that it would be one of the most noteworthy tracks in the encryption field in the next decade. The entry of capital made the rapid development. At present, there are more than 10 projects in statistics, and the market is warming up, and the new investment and financing in the field are not counted. Not to mention the blockchain, even the Internet of Things platform, big data cloud computing and other technologies that have been used on a large scale at present have actually experienced repeated cycles of hot speculation and bubble bursting. Therefore, we ordinary investors should not be too biased about one thing because of the past. How to choose and participate in the project? Even though the whole plate has seen a big increase now, the whole track is still in its early stage and its development needs top-down continuous cultivation, and it is almost impossible for the project side to dare to get on the bus as it is. Not to mention, there are two ways to put the myth of a 10,000-fold increase into practice in investment. One is short-term speculation. With the escort of the current hot and trending market, you can buy some project tokens, for example, when you wait for a plate leader with good liquidity. This way, you don't need to buy equipment, and you don't need to consider going back to this cycle. Stop loss is more flexible. The disadvantage is that it is easy to step on the track. If you think that this track may be a big narrative like a public chain, then it is easy. Deeply participate in some potential new projects with good fundamentals and continue to invest in construction, regardless of short-term fluctuations and gain a growth income. This shortcoming is that it takes a long time and energy, and if the project is not selected properly, it will die and there will be no harvest. Therefore, how to choose among hundreds of projects is a very important ability. Let the institutions help us screen one first. Many institutions and rating media will publish some lists for investors' reference. These lists will screen and summarize some of the same track. High-quality or well-known projects, we only need to analyze a few projects in the list, and finally we can choose the best project in each section to participate, so as to avoid looking for a needle in a haystack. For example, the section lists a total of projects based on data, such as the wireless network community in developing regions such as Latin America and India, and the infrastructure construction is relatively slow. The overseas version with the largest number of users but similar functions has no hardware equipment support. The main profit methods are subscription and advertising teams. The operating experience is weak, among which the most potential is that it is committed to establishing a global open roaming network, providing the public with enterprise-level roaming team by giving users the ability to switch seamlessly in the public network with decentralized logo and corresponding verifiable credentials. The main members of the team are located in the Canadian seed wheel, led by well-known institutions in North America, and many other institutions participated in the investment. It is one of the 10 company providers of the wireless broadband alliance, and the only enterprise information in it comes from the innovative model benefited by official website. In just two years, 10,000 self-built network nodes have been deployed in countries around the world through users' participation, according to the official website data node. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。