借鉴以太坊 BTC生态炒作的可能路径

作者:NP Hard 来源:X,@xingpt

在加密货币行业,对于技术类型的项目,我们常常需要区分短期叙事和长期价值,来辨别什么样类型的项目是属于炒作类的泡沫资产,什么样的项目是技术上有长期价值的,当然好的项目也可以兼具热门叙事与长期价值,而炒作类的泡沫资产并不是毫无价值。

这篇文章主要论述未来比特币生态的炒作逻辑,但在此之前,我们先来借鉴在炒作之路上走的最成功的以太坊是如何发展其叙事的。

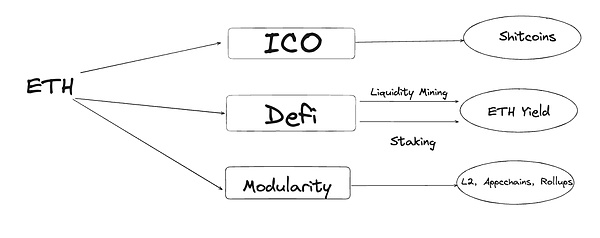

一、借鉴以太坊炒作之路的叙事

1、ICO - 制造公平但无用的资产

以太坊在初出茅庐之时,需要找到一个独立于比特币和衍生币种的独立定位,即可以支持智能合约来让运行各种应用,第一个类型的应用便是ICO,强调公平的代币发射,即募集ETH,给用户项目的以太坊格式erc20代币,由于新币的低市值造成价格早期暴涨,而因此爆发以太坊第一个资产炒作狂热——ICO热潮。

尽管从当今回顾,99%的ICO项目已没有任何价值,但ICO类资产的炒作让以太坊坐实了应用发射平台的产品定位,后来也被包装为听起来更炫酷的“世界计算机”。

2、DeFi 和 NFT

以太坊在18,19年经历沉沦后,上一轮20-22年的牛市主要经历了两轮主流的炒作:一是DeFi类的资产,其底层产品逻辑是使用以太坊本币ETH来做“铲子”,在各类借贷,DEX,衍生品等协议中提供ETH流动性,来换取项目代币。不同于ICO,ETH不再作为投资本金,而是作为抵押物,给用户的体验是:我可以免费获得新的代币,利用用户的“白嫖”心里来快速抢占用户。

但类似ICO一样售卖无用资产的模式仍然借由NFT的炒作延续了下来,NFT符合几大特征:“无用” - 有更大的炒作空间,”低流通低市值“ - 前期参与者能够获得巨大收益,”公平“ - 除白名单用户,每个人均有参与机会。(注:这里不去讨论NFT和ICO在文化传播属性上的区别,仅探讨资产炒作上的相似之处。)

3、Meme

尽管Shib和动物园行情开启了meme的玩法,但直到Pepe系列的出现,Meme才成为一个单独的赛道,但meme当前问题是很难容纳多个大市值项目,只有1-2个龙头能够到1B以上的市值,因此要带动以太坊本身市值的上涨动力还不够。

我们从同样的角度,也可以观察到这轮ETH表现不及预期的原因,缺乏类似NFT可以售卖的低流动性资产,也没有作为“铲子”的功能,Arb/OP/Stark等等不会给你存ETH挖Layer2本币的机会,只有Manta,Blast这种个例,restaking挖出来的币上限又达不到公链Layer2的市值,因此ETH本轮走弱。

对于ETH,表现抢眼的比如Celestia,就通过模块化的叙事将“铲子”属性发挥到了极致。而在“垃圾”资产这方面,Solana也捧出了诸如Bonk,Wif等涨幅巨大的Meme,同时Sol生态诸多类似Pyth,Jupiter,Jito的空投,也让SOL有了些许“铲子”属性。

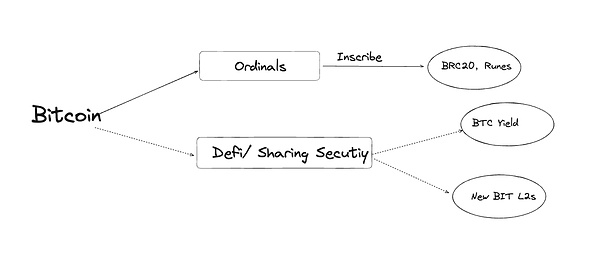

二、比特币生态炒作方向的猜想

对于比特币生态,本轮市场周期中最大的变化铭文,也是比特币上首次直接发行“垃圾”资产,并且兼具低流通、公平分发、低市值的属性。问题是,后铭文时代的比特币还能怎么玩?

顺着上述将比特币作为“铲子”的逻辑,这里提出几个猜想。

1、质押比特币生息

比特币生态龙头之一的项目Babylon提供BTC Staking,想通过在比特币网络实现Slashing将比特币permissionless地staking保障发行的cosmos公链安全性。将比特币作为底层生息资产和用比特币网络保障公链安全,这两个叙事都足够吸引人,因此Babylon在一级市场大杀四方受到各大VC追捧,但是实际上要让比特币发挥铲子作用,还需要两个条件:

一是用Babylon协议挖出的Po S币价值足够高,数量足够多;

二是通过Babylon协议质押的比特币也满足一定体量,TVL太低的话,比特币网络保障安全的叙事就不成立。

两个条件都需要顶级的BD资源去推动,而且是需要同时在比特币生态和Cosmos生态两头发力,难度不小。 想效仿Babylon的项目需要考虑清楚,自己有没有融资过亿美金的能力。

2、质押比特币挖矿

质押比特币挖矿是很多新兴比特币Layer2采用的冷启动方式,如BSquare,MerlinChain等等;但对于比特币holder来说,存在两个显著的问题,一是安全性,比特币通过跨链桥存入二层网络中,需要信任二层网络合约与节点的安全性,相对比特币网络安全性有明显降级;二是操作不便,与Celestia这种本身就是Cosmos based链不同,用户质押一次TIA可以获得多个项目空投,而比特币二层的挖矿需要用户在不同的协议间闪转腾挪,对用户来说体验不友好,也多了很多操作风险。

而另一个挑战也是收益的问题,作为铲子挖出来的链本身价值几何也很值得考量,如果没有年化10%甚至20%以上的收益,很难吸引比特币大户冒着风险去挖新链的代币。

因此,这种模式的项目方一来需要先发制人,尽可能早地抢占有限的比特币大户中的高风险偏好者(which is not a high percentage), 又需要尽可能地提升本币的价值,包括上所,拉生态项目等等,都更利好有币圈创业经验或者资产运作经验的项目。

3、用比特币做融资发行“垃圾”资产

“垃圾”资产之所以看似“无用”却有人买单,是因为其非常创新的叙事方法,铭文的叙事讲的是比特币的复兴,NFT玩的是文化出圈。

目前来看符文(Runes)的铺垫最为充分,创始人是Ordinals的Casey,并且各种类似RSIC的社区玩法不断出现。Merlin的项目方RCSV曾发行的BRC420蓝盒子可以说是从发行新资产出发,以炒作资产为核心,最后再回归更大的基础设施故事的典型。

其他各类新出的比特币二层公链和类似Babylon的跨生态公链,可能不仅仅要思考如何做一个更去中心化更安全的二层公链(作为正统项目的叙事基础),在发链之前也应该规划如何创造新的资产类别,如何更创新的公平分发资产,而不仅仅是吸纳用户手中的比特币来airdrop这么简单。

那么如何“包装”一个完美的比特币生态基础设施项目?

首先,我们希望能让比特币用户无需信任地质押在我们的协议中,无需动用冷钱包资金转账,使用类似比特币原生底层验证逻辑,类似Bitcoin Convenant,DLC等;

其次,我们希望质押获得的利息或者新的资产,能够要么以某种方式换回比特币,在比特币本位看来产生一个相当具有吸引力的年化收益;

对于degen们,新发行的资产有相对公平的参与方式,能够相对限制大户的资金优势,奖励早期的社区小群体核心用户,这个话题我在上一篇文章(https://www.noweb3.ai/p/dapp)也有相关的阐述。

最后,尽可能地参与开源社区建设,贡献比特币的基础开发工具和文档,给开源社区奖励等等,回馈社区是获得正统性的重要非技术手段,甚至比技术手段本身更重要。

The author comes from the cryptocurrency industry. For technical projects, we often need to distinguish between short-term narrative and long-term value to distinguish what kind of projects belong to speculative bubble assets and what kind of projects have long-term value in technology. Of course, good projects can also have both hot narrative and long-term value, and speculative bubble assets are not worthless. This article mainly discusses the speculation logic of bitcoin ecology in the future, but before that, let's learn from the most popular on the road of speculation. How successful Ethereum develops its narrative is a reference to the narrative of Ethereum's hype road to create fair but useless assets. When Ethereum is young, it needs to find an independent positioning independent of bitcoin and derivative currencies, that is, it can support smart contracts to run various applications. The first type of application is the Ethereum format token that emphasizes fair token launch, that is, raising items for users. Because of the low market value of new coins, the first asset of Ethereum broke out. Although the projects reviewed today have no value, the hype of class assets has enabled Ethereum to firmly position the products of the application launch platform, and later it has been packaged as a world computer and Ethereum that sounds more cool. After the fall of 2000, the last round of bull market in 2000 mainly experienced two rounds of mainstream hype. First, the underlying product logic of class assets is to use Ethereum's local currency as a shovel to provide liquidity in various loan derivatives and other agreements in exchange for project tokens, which is different from no longer. As the investment principal, but as collateral, the experience for users is that I can get new tokens for free and use the user's Bai Piao heart to quickly seize the user. However, the mode of selling useless assets in a similar way still continues, which conforms to several major characteristics. There is more room for speculation, low circulation and low market value. Participants in the early stage can get huge benefits, and everyone except the white list users has the opportunity to participate. Note that we will not discuss here and only discuss the differences in cultural communication attributes. Similarities in the world, despite the opening of the game with the zoo market, it didn't become a separate track until the appearance of the series, but the current problem is that it is difficult to accommodate multiple large-value projects, and only one faucet can reach more than the market value, so it is not enough to drive the upward momentum of the market value of Ethereum itself. From the same perspective, we can also observe the reasons why this round of performance is not as expected, and the lack of similar low-liquidity assets that can be sold and the function of shovel will not give you the opportunity to deposit and dig local currency. Only in this case can the upper limit of coins dug up not reach the market value of the public chain, so this round of weakening has brought the shovel attribute to the extreme for eye-catching performance, for example, through modular narrative, while in the aspect of garbage assets, it has also brought about a huge increase, and many similar airdrops in ecology have also given some shovel attributes. The guess of the direction of bitcoin ecological speculation is that the biggest change inscription in the current market cycle of bitcoin ecology is also the first time that bitcoin directly issues garbage assets, and The problem of low circulation, fair distribution and low market value is how to play bitcoin in the post-inscription era. Following the logic of using bitcoin as a shovel mentioned above, this paper puts forward several conjectures to pledge one of the ecological leaders of bitcoin, and provide projects that want to ensure the public chain security of bitcoin through the realization of bitcoin network. The two narratives of using bitcoin as the underlying interest-bearing asset and using bitcoin network to ensure the public chain security are attractive enough, so they have been killed in the primary market. But in fact, there are two conditions for Bitcoin to play a shovel role. First, the value of coins dug up by agreement is high enough and the quantity is sufficient. Second, the bitcoin pledged by agreement also meets a certain volume. If the bitcoin network is too low, the narrative of ensuring security will not be established. Both conditions need top resources to promote, and it is not difficult to exert efforts at both ends of bitcoin ecology and ecology. The project that wants to emulate needs to consider whether it has raised more than 100 million US dollars. Bet bitcoin mining pledge bitcoin mining is a cold start method adopted by many emerging bitcoins, such as and so on, but there are two obvious problems for bitcoin. First, the security of bitcoin stored in the second-tier network through the cross-chain bridge needs to be trusted, and the security of the second-tier network contracts and nodes is obviously degraded compared with the security of bitcoin network. Second, it is inconvenient to operate, because different users pledge the chain and can get multiple airdrops at one time, while the mining of the second-tier bitcoin requires users to cooperate in different ways. Flickering between meetings is unfriendly to users, and it also brings a lot of operational risks. Another challenge is also the problem of income. The value geometry of the chain itself dug by shovel is also worth considering. If there is no annualized or even more income, it is difficult to attract large bitcoin households to take risks to dig new chain tokens. Therefore, the project party of this model needs to preemptively seize the high-risk preferences among the limited large bitcoin households as soon as possible, and also need to improve the value of the local currency as much as possible, including the above. Pulling ecological projects and so on are all more beneficial to projects with entrepreneurial experience or asset operation experience in the currency circle. Bitcoin is used as financing to issue garbage assets. The reason why garbage assets seem useless is that some people pay the bill because of its very innovative narrative method. The narrative of the inscription is about the revival of Bitcoin and the cultural outing. At present, the founder is the most fully paved, and various similar community games are constantly emerging. The blue box that the project party once issued can be said to be based on the release of new assets for speculation. Assets are the core and then return to the larger infrastructure story. Other new types of bitcoin two-tier public chains and similar cross-ecological public chains may not only think about how to make a more decentralized and safer two-tier public chain as the narrative basis of orthodox projects, but also plan how to create new asset categories, how to distribute assets fairly in more innovative, and how to package a perfect bitcoin ecological base. First of all, we hope that bitcoin users can pledge without trust in our agreement, and there is no need to use cold wallets to transfer funds. The original underlying verification logic of bitcoin is similar, etc. Secondly, we hope that the interest gained from pledge or new assets can be exchanged for bitcoin in some way, which will generate a quite attractive annualized income from the bitcoin standard, and have a relatively fair way to participate in our newly issued assets, which can relatively limit the financial advantages of large households and reward the core users of small communities in the early days. I also elaborated on this topic as much as possible in the last article. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。