cmDeFi:由 Ethena 发起的稳定币市场纵深渗透作战

作者:陈默 cmDeFi;来源:作者推特@cmdefi

Author Chen Mo Source Author Twitter 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

Author: Chen Mo, cmDeFi; Source: Author's Twitter @cmdefi

核心观点:一种加密原生的合成美元稳定币,介于中心化与去中心化之间的结构化被动收益产品,在链上保管资产并通过Delta中性保持稳定性同时赚取收益。

Core Point: A crypto-native synthetic USD stablecoin, a structured passive income product that sits between centralization and decentralization, custody assets on-chain, maintains stability through Delta neutral and earns a return.

1.诞生背景是以中心化稳定币为代表的 USDT&USDC 统治稳定币市场,去中心化稳定币DAI的抵押品逐渐趋于中心化,算法稳定币 LUNA&UST 在巨量增长至稳定币市值前五名后崩盘。Ethena的诞生在DeFi和CeFi市场之间做了折中和平衡。

The background of its birth is the dominance of centralized stablecoins represented by USDT & USDC in the stablecoin market, the collateral of the decentralized stablecoin DAI is gradually tending towards centralization, and the algorithmic stablecoin LUNA & UST collapsed after a huge growth to the top five of the stablecoin market value. The birth of Ethena has made a compromise and balance between the DeFi and CeFi markets.

2.由机构提供的OES服务在链上托管资产,并将金额映射至中心化交易所来提供保证金,保留DeFi的特性将链上资金与交易所隔离,以降低交易所挪用资金、资不抵债等风险。另外一面保留CeFi的特性得到充足的流动性。

2. The OES service provided by institutions custody assets on-chain and maps the amount to centralized exchanges to provide margin, retaining the characteristics of DeFi to isolate on-chain funds from exchanges to reduce the risk of exchanges misappropriating funds and insolvency. On the other hand, the characteristics of CeFi are preserved to obtain sufficient liquidity.

3.底层收益由以太坊流动性衍生品的Staking收益以及在交易所开立对冲头寸获取的资金费率收益构成。也被称为一种结构化的全民资金费率套利的收益产品。

3. The underlying returns are composed of staking returns from Ethereum liquidity derivatives and funding rate returns obtained from opening hedge positions on exchanges. It is also known as a structured universal funding rate arbitrage income product.

4.正在通过积分系统激励流动性。

4. Liquidity is being incentivized through a point system.

其生态资产包括:

Its ecosystem assets include:

USDe - 稳定币,通过存入stETH铸造 (未来可能增加更多的资产和衍生品)。

USDe - Stablecoin, minted by depositing stETH (more assets and derivatives may be added in the future).

sUSDe - 质押USDe后获得的凭证代币。

sUSDe - Certificate tokens obtained by pledging USDe.

ENA - 协议代币/治理代币,目前通过每期积分兑换后流入市场,锁定ENA可以获得更大的积分加速。

ENA - Protocol tokens/governance tokens, currently entering the market through point redemption at each period, locking ENA can obtain greater point acceleration.

研究报告

Research Report

1.USDe稳定币如何铸造和赎回

1. How USDe stablecoin is minted and redeemed

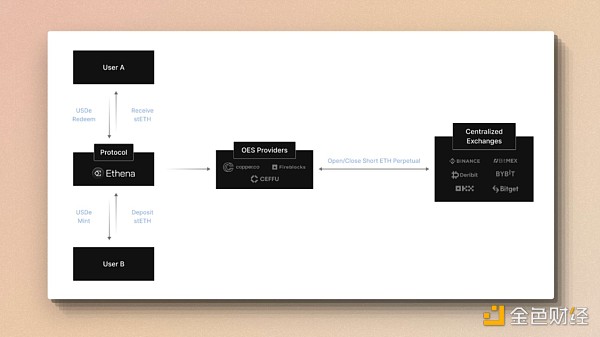

将 stETH 存入 Ethena 协议,即可以 1:1 美元的比例铸造 USDe。存入的 stETH 被发送给第三方托管方,通过 "Off-exchange Settlement" 的方式映射余额至交易所,Ethena 随后在 CEX 上开设空头 ETH 永续头寸,确保抵押品价值保持 Delta 中性或以美元计价不变。

By depositing stETH into the Ethena protocol, USDe can be minted at a 1:1 ratio to the US dollar. The deposited stETH is sent to a third-party custodian, and the balance is mapped to the exchange through "Off-exchange Settlement". Ethena then opens a short position on ETH perpetual contracts on the CEX to ensure that the collateral value remains Delta neutral or unchanged when denominated in US dollars.

普通用户可以在无需许可的外部流动性池中获取USDe。

普通用户可以在无需许可的外部流动性池中获取USDe。

经过KYC/KYB筛选并被白名单列出的认可机构方可以直接通过Ethena合约随时铸造和赎回USDe。

Institutions approved through KYC/KYB screening and whitelisted can mint and redeem USDe directly through the Ethena contract at any time.

资产始终保留在透明的链上托管地址,因此不依赖传统银行基础设施,不会受到交易所挪用资金、破产等影响。

Assets are always held in transparent on-chain custody addresses, so they do not rely on traditional banking infrastructure and are not affected by exchange misappropriation of funds or bankruptcy.

2.OES - ceDeFi的资金托管方式

2. OES - Fund custody method for ceDeFi

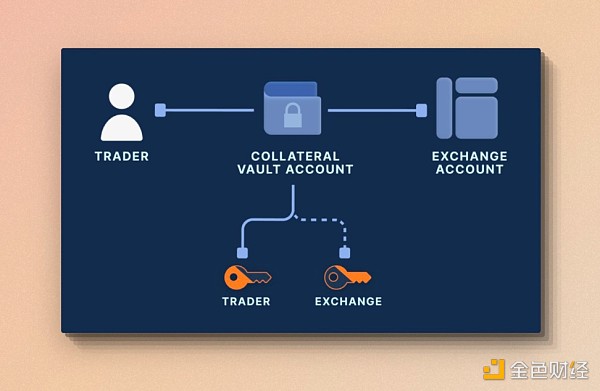

OES(Off-exchange Settlement)是一种资金场外托管的结算方式,它同时兼顾了链上透明可追溯性,和中心化交易所的资金使用。

OES (Off-exchange Settlement) is a settlement method for off-exchange fund custody that simultaneously takes into account transparent traceability on-chain and the use of funds on centralized exchanges.

利用MPC技术构建托管地址,将用户的资产在链上保存,以保持透明度和去中心化,并由用户和托管机构共同管理地址,消除了交易所交易对手方风险,大大减轻了潜在的安全问题和资金滥用问题。这能够最大限度保证资产掌握在用户自己手中。

The use of MPC technology to build custody addresses, to preserve user assets on-chain for transparency and decentralization, and to be jointly managed by users and custody institutions eliminates counterparty risks of exchanges, greatly reduces potential security issues, and fund abuses. This ensures that assets are maximally controlled by the users themselves.

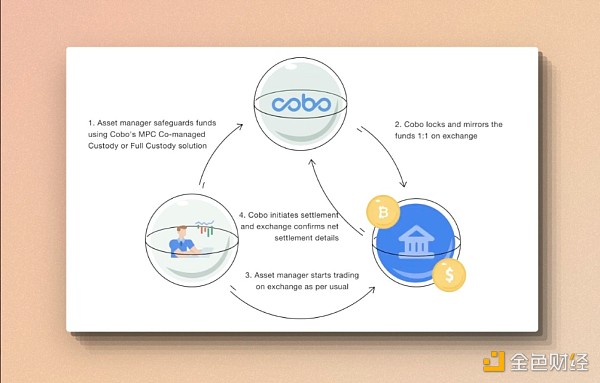

OES提供方通常与交易所合作,使交易者能够从他们共同控制的钱包中将资产余额映射到交易所,以完成相关的交易、金融服务。比如这可以实现Ethena在交易所外托管资金,但仍然可以在交易所中使用这些资金来为 Delta 对冲衍生品头寸提供抵押。

OES providers typically cooperate with exchanges, enabling traders to map asset balances from their jointly controlled wallets to exchanges to complete related trades and financial services. For example, this allows Ethena to custody funds off-exchange, but still use these funds in exchanges to collateralize Delta hedging derivative positions.

MPC钱包目前被视为是联合集团控制单个加密资产池的完美选择。 MPC模型将单个密钥以单独的单元分发给各自的钱包用户,共同管理托管地址。

The MPC wallet is currently considered the perfect choice for a consortium to control a single crypto asset pool. The MPC model distributes single keys as separate units to respective wallet users, jointly managing custody addresses.

fireblocks off-exchange settlement

cobo SuperLoop

3.盈利方式

3. Profit mode

ETH流动性衍生品带来的以太坊质押收益。

Ethereum staking income from ETH liquidity derivatives.

在交易所开立空头头寸获取的资金费率收益,基差交易(Basis Spread)收益。

Funding rate income obtained from opening short positions on exchanges, Basis Spread income.

“资金费率” 是基于现货价格与永续合约市场之间的差异,定期支付给持有多头或空头的交易者的款项。因此,交易者将根据持有多头或空头的需求支付或获得资金。当资金费率为正时,多头支付给空头;当资金费率为负时,空头支付给多头。这种机制确保了两个市场的价格不会长期偏离。

“基差” 是指由于现货和期货是分开交易的,它们的价格并不总是保持一致。它们价格出现的偏差被称之为基差(Basis Spread),而随着期货合约临近到期,期货合约价格通常会趋向于相应的现货价格。在到期时,持有多头合约的交易者需要按照合约预定的价格购买基础资产。因此,随着期货到期日的临近,基差应该会趋向于0。

“Funding rate” is the differential between the spot price and the perpetual contract market, regularly paid to traders holding long or short positions. Therefore, traders will pay or receive funds based on the demand for long or short positions. When the funding rate is positive, longs pay shorts; when the funding rate is negative, shorts pay longs. This mechanism ensures that the prices of the two markets do not deviate significantly for extended periods of time.

“Basis” refers to the fact that because spot and futures are traded separately, their prices do not always remain consistent. The deviation in prices is referred to as the basis spread, and as futures contracts approach expiration, the prices usually tend towards the corresponding spot prices. At expiration, traders holding long contracts need to buy the underlying asset at the contract's predetermined price. Therefore, as the futures expiration date approaches, the basis spread should tend towards 0.

Ethena通过使用映射到交易所的资金余额,制定不同的策略进行套利,这为链上USEe的持有者提供了多元化的收益。

Ethena uses the mapped funds balance on exchanges to develop different strategies for arbitrage, providing diversified income for holders of on-chain USEe.

4.收益率和持续性

4. Yield and sustainability

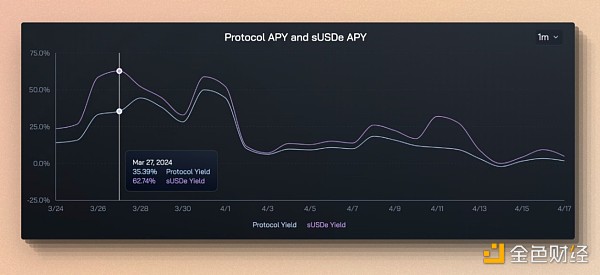

从收益率上来说,近一个月协议赚取的年化收益最高达到35%,分配到sUSDe的收益率达62%。这里的差值是由于USDe并没有全部通过质押转换为sUSDe,事实上也基本不可能达到100%质押率,如果只有50%的USDe质押转换为sUSDe,则这部分sUSDe等于用50%的质押量就捕捉了100%的全部收益。因为USDe的应用场景会进入Curve、Pendle等DeFi协议中,这样既满足了不同应用场景的需求,也潜在提升了sUSDe的收益率。

In terms of yield, the protocol's annualized yield earned over the past month has reached as high as 35%, and the yield allocated to sUSDe has reached 62%. The difference here is due to USDe not being fully converted to sUSDe through collateralization, and in fact, reaching a 100% collateralization rate is basically impossible. If only 50% of USDe is collateralized and converted to sUSDe, then this portion of sUSDe captures 100% of the total yield with only 50% of the collateral. As USDe's use cases enter DeFi protocols such as Curve and Pendle, this meets the needs of different application scenarios and potentially enhances the yield of sUSDe.

但是随着市场降温,交易所中的多头资金变少,则资金费率收入也会随之下降,所以在进入4月以后,综合收益都有一个明显的下降趋势,目前Protocol Yield降低至2%,sUSDe Yield降至4%。

However, as the market cools down and long funds in exchanges decrease, the funding rate income will also decline, so after entering April, there is a significant downward trend in comprehensive yields, with the Protocol Yield currently dropping to 2% and the sUSDe Yield dropping to 4%.

所以在收益率方面,USDe比较依赖于中心化交易所中期货合约市场的情况,也将受制于期货市场的规模,因为当USDe的发行量超过相应的期货市场容量时,就不再满足USDe继续扩张的条件。

Therefore, in terms of yield, USDe is relatively dependent on the situation in the futures contract market within centralized exchanges, and will also be constrained by the size of the futures market, as when the issuance of USDe exceeds the corresponding futures market capacity, it no longer meets the conditions for the continued expansion of USDe.

5.扩展性

5. Scalability

稳定币的扩展性是至关重要的,它是指增加稳定币供应的条件和可能性。

The scalability of stablecoins is crucial, as it refers to the conditions and possibilities for increasing stablecoin supply

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。