币圈开仓是什么意思?币圈合约操作入门教程

随着区块链和加密货币成为家喻户晓的术语,在过去几个月里,投资加密货币的兴趣显着增加。加密货币领域比其他任何领域都更像是一个全球社区。基于区块链技术的去中心化金融系统的想法意味着很难确定全球重心,而去中心化数字资产的匿名性使得数据很难收集。其实很多投资加密货币的投资者还是新手,对于币圈中的很多概念都不是很了解,就像今天要为大家介绍的币圈开仓,很多投资者还不知道这个币圈开仓是什么意思?下面就让小编为大家简单科普一下。

The idea of decentralized financial systems based on block-chain technology means that it is difficult to determine the global focus, and the anonymity of decentralized digital assets makes it difficult to collect data. Indeed, many investors who invest in encrypted money are new to them, and many of the concepts in the currency circles are not very well known, just as they are about to open up for you today.

其实在在合约交易中,交易类型分为两类,开仓和平仓。开仓简单来说就是建立订单,下单。平仓简单来说是关闭订单,接受浮亏浮赢,盈亏计入账户。

In the case of contractual transactions, there are two types of transactions.

1、开仓也叫建仓,有两个交易方向:如果投资者看涨行情,买入开多(做多)一定数量的标准合约,持有多仓(多头);如果看跌行情,卖出开空(做空)一定数量的标准合约,持有空仓(空头)。

1. The opening of a warehouse is also known as the construction of a warehouse, and there are two trade directions: if an investor looks at the upturn, buys up a certain amount of a standard contract, and holds a certain amount of a standard contract, and if it looks down, sells a certain amount of a standard contract, and holds an empty one.

2、平仓是指投资者清空或减少仓位,停止持有合约,它也有两个交易方向:

2. Silos mean that investors emptied or reduced their positions and ceased to hold contracts, and that they also had two trade directions:

如果投资者持多仓,看跌行情,可以卖出平多,减少其所持有的合约仓位;如若持空仓,看涨行情,可以买入平空,减少所持有合约仓位。总而言之,用户通过开仓,获得仓位,开始持有合约;合约到期前,通过平仓,清空(全平)或减少(不全平)仓位,停止持有合约。

If an investor has more than enough room and looks down, it can sell more and reduce its holdings; if it is empty, it can buy more and reduce its holdings. In any case, the user starts holding the contracts by opening the warehouses and obtaining the seats; before the contract expires, it stops holding the contracts by clearing them, clearing them or reducing them (incompletely).

今天小编就以在火必交易所进行合约交易为例,为广大投资者介绍币圈合约怎么玩?教程如下:

Today, the editor-in-chief uses the following as an example of a contract transaction at the Firebee Exchange to inform investors about how to play the currency-circle contract:

1. 点击此处打开火必合约官网:登录火必账号,点击币本位合约,然后选择合约类型和品种,进入到对应的合约交易页面。若您还未开通合约交易,请先开通。

1. & nbsp; click here //strang> to open the mandatory fire network: log in the fire account number, click on the currency-based contract, then select the type and variety of the contract to enter into the corresponding contract transaction page.

2. 进行资金划转。

2. Transfer of funds.

币本位永续合约是以标的品种作为担保资产,用户需转入对应标的品种方可参与该品种合约的交易,且当前仅支持从币币账户转入。比如BTC/USD币本位永续合约,用户需要转入BTC充当担保资产。

A currency-based sustainable contract is a standard type of encumbered asset that the user needs to transfer to the corresponding type in order to participate in the transaction, and currently only supports transfers from a currency account. For example, a BTC/USD-based sustainable contract requires the user to transfer to BTC to serve as an encumbered asset.

2.1点击划转按钮

2.1 Click the spin button

划转入口一:点击交易页面的【划转】按钮

Row to XI: Click on transaction page [Transfer] button

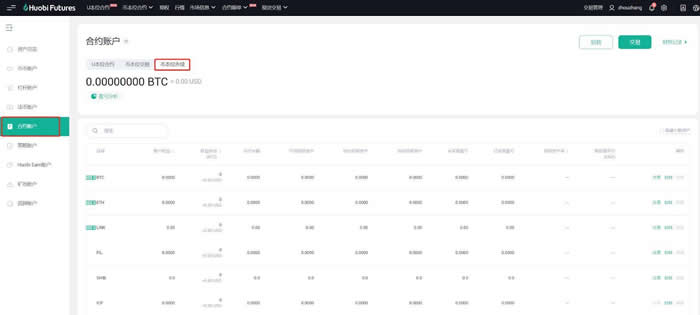

划转入口二:在合约资产页面点击对应品种的【划转】按钮

Row to XII: Click the [Transfer] button on the asset page of the contract

2.2 选择转入/转出账户以及标的品种

2.2 Selection of transfer/transfer accounts and target varieties

进行币本位永续合约,需要将对应标的品种从币币账户划转到币本位永续合约账户

A currency-based permanent contract requires the transfer of the variety of the corresponding bid from the currency account to the currency-based permanent contract account.

3. 切换交易单位/倍数。

3. Switching of transaction units/multipliers.

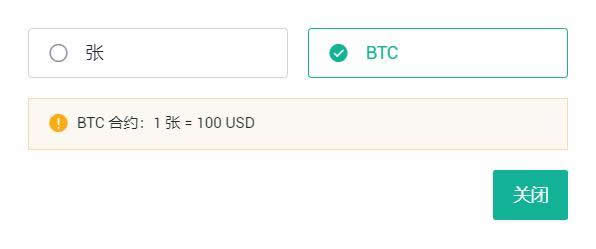

单位:可以选择张、对应品种作为单位

Unit: Jang, corresponding varieties can be selected as units

倍数:在开仓前或者有持仓无任何挂单的情况下,可以切换倍数。

Multipliers: Multipliers can be changed before a warehouse is opened or when there is no register in the warehouse.

4. 进行交易。用户可以分别选择限价委托、计划委托、跟踪委托、跟单吃单进行开仓。

4. Dealing. Users may choose to open their own purchase orders, plan orders, follow-up orders, and billboards.

● 限价委托。确认价格(可以输入或者选择档位)和数量(可以输入或者滑动百分比)进行下单。开仓和平仓都可以使用限价委托,开仓时可以同时设置止盈止损【>>>止盈止损操作说明 】。限价委托可选择三种生效机制,“只做Maker(Post only)”、“全部成交或立即取消(FillOrKill)”、“立即成交并取消剩余(ImmediateOrCancel)”;若不选择生效机制则限价委托默认是“一直有效”。 >>>限价委托操作说明

• Price limit commission. Confirm price (may enter or select slots) and quantity (may enter or slide a percentage). Price limit commission can be used for the opening of a warehouse, which can also set up a stop-over loss [> > > & stop-loss instructions]. Price limit commissioning can choose three effective mechanisms, “ only Maker (Post only)” & & “ full or immediate cancellation (FillOrkill)” & & & & & &dquo; immediate hand-off and cancellation of surplus (ImmediteOrCancel & & rdquo; default of price limit assignment if not effective mechanism is selected & & & > > > > & & & gt; commissioning operation instructions.

● 计划委托:设置触发价格、委托价格和数量。当市场最新成交价格达到触发条件时,系统将按提前设置好的委托价格和数量进行下限价单。>>>计划委托操作指引

• Plan commissioning: Sets the trigger price, commission price, and quantity. When the market's latest offer meets the trigger conditions, the system will base the price on the pre-set commission price and quantity. > > & gt; & plan commissioning guidelines

● 跟踪委托:设置激活价格、回调比例、委托价格和数量。当合约市场价格满足用户设定的激活条件和回调比例后,则会触发该策略,以用户设定的委托价格和数量下限价单。>>>跟踪委托操作指引

• Follow-up commission: Sets the active price, the return ratio, the commission price and the quantity. When the contract market price meets the activation conditions and the return rate set by the user, the policy is triggered by the client's fixed commission price and the lower price limit. > > > tracking the commission operation guidelines

● 跟单吃单:跟单吃单指的是按照用户所选档位的盘口价格、可用/可平资产比例的数量(盘口数量或者设定数量)下达限价委托买单或卖单的订单;跟单功能可以选择“只做Maker”生效机制,若不选择生效机制则为普通限价委托;吃单功能可以选择“IOC”或“FOK” 两种生效机制,若不选择生效机制时则限价委托默认是“一直有效”。>>>跟单吃单操作指引

• Stakesheets: Stakesheets refer to orders for which price-limits are issued for purchase or sale according to the price of a plate selected by the user, the number of assets available/alterable in proportion to the amount of assets (count or set quantity); Slips function can choose “ only Maker” effective mechanisms are effective, or ordinary price-limits if the effective mechanism is not selected; single functions can choose & ldquo; IOC&rdquao; or & & & & & & & & quo; FOK& & & quo; two effective mechanisms, defaults for price-limiting if the effective mechanism is not selected are & & & & & & & & & & & ; & gt; and single-eating guidelines.

5. 下单成功后,已成交仓位显示在“当前持仓”栏,可以进行平仓、止盈止损等操作;未成交部分显示在“当前委托”栏,在成交前可以撤销委托。

After the entry has been successful, the silo is shown in “ the warehouse is currently held & & rdquo; the column is capable of silencing, dissipating, etc.; the unsold section is shown in “ the current commission & rdquo; the column is capable of withdrawing the commission until the transaction is completed.

6. 平仓时可以在交易页面根据情况选择限价委托、计划委托或者跟踪委托进行平仓,也可以在当前持仓页面进行平仓,平多点击“卖出平多”,平空仓点击“买入平空”。其中限价委托可以使用“闪电平仓”功能,用户发出的平仓订单能够迅速以对手盘第30档的价格进行委托,提高订单的成交率。

In the case of silos, you can select price-limiting, plan commission or follow-up on the transaction page, depending on the circumstances, or you can stow on the current silo page and click more & & & & & ; sell more & & & & ; sell empty silos & & & & & & ; buy empty & & rdquo; use & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & ; & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & ; & & & & & & & & & & & & & & & & & & & ; & & & & & & & & & & & & & & & & & & ; & & & & & & & & & & & & & & & & & & & &.

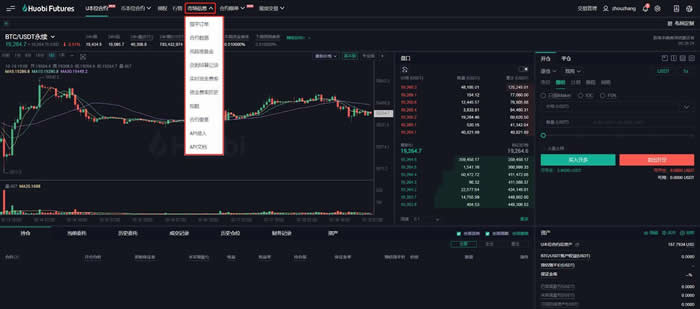

7. 在合约交易页面上方的“市场信息”中可以查询强平订单、合约数据、风险准备金等信息。

& ldquao above the contract transaction page; market information & rdquao; information on strong flat orders, contract data, risk reserves, etc. can be consulted.

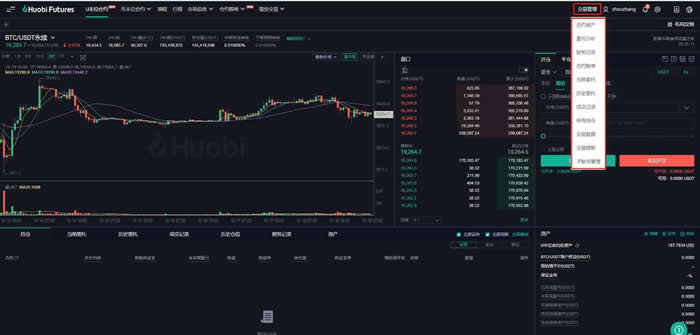

8. 在合约交易页面右上方的“交易管理”中可以查询合约资产、盈亏分析、财务记录等数据。

& ldquao on the top right of the contract transaction page; transaction management & rdquao; data on contract assets, profit/loss analysis, financial records, etc. can be consulted.

并非每一种可交易的硬币,甚至不是每一种主要硬币都具有超出纯粹投机价值的任何价值。不要因为硬币最近运行良好就跳上一波浪潮。排名前30的山寨币中有很多与它们分叉出来的山寨币之间的技术差异很小,并且几乎没有现有的开发人员支持和生态系统,在投资之前大家一定要彻底研究一枚硬币。一般要了解它的底层协议的目的是什么、区别是什么、项目背后的团队是谁、加密社区对该项目有何看法、过去和最近的价格走势如何等。

Not every tradable coin, not every major coin, has any value beyond purely speculative value. Do not jump into a wave because the coins have recently worked well.

以上就是币圈开仓是什么意思?币圈合约操作入门教程的详细内容,更多关于币圈开仓和合约玩法的资料请关注脚本之家其它相关文章!

What does that mean? The details of the introductory course on currency contract operations, more information about currency locking and contract play, please follow other relevant articles from the Script House!

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。