十年磨一剑 写在美国比特币现货ETF获批后

两天前,我们提出,对于比特币现货ETF市场美国不会轻易放手。十年磨一剑,今天,这一里程碑终于到来。美国证监会(SEC)批准了11只比特币现货ETF,将会在芝加哥期权交易所(CBOE)、纽约证券交易所(NYSE)和纳斯达克交易所(NASDAQ)上市,意味着比特币将正式与全球金融体系相连通。

这一路走来十分不易。直至今天,无论对于“批准通过”这一决议本身还是对已经通过的比特币ETF未来所面临的挑战还存在诸多疑虑。

避免“马戏氛围”,先“正常”看待比特币

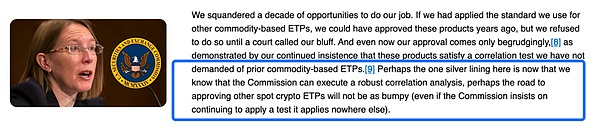

随着SEC的批准文件的发布,SEC委员也发出了不同立场的声明,有来自SEC委员Hester Pierce,Crypto长期倡导者的支持,并阐述了这长达十年“拒绝”的思虑和她个人对SEC的看法,称“由于在考虑现货比特币 ETP 时未能遵循我们的正常标准和流程,我们在它们周围制造了一种人为的狂热。如果这些产品以其他同类产品通常的方式进入市场,我们就可以避免现在所处的马戏氛围。”

图 “SEC制造了一种人为的狂热”

最想保持“市场中立”的SEC,也被融入了市场的巨大狂欢之中。

比特币具有时代开创性,如同几千年前从矿场中挖出的黄金。只不过,现在人们身处数字时代,挖矿的工具变了,挖出的贵金属也变成了数字品。像黄金ETF一样,比特币现货ETF的通过可以使投资者能够通过购买ETF股票来获得比特币的投资回报,而无需直接持有和管理比特币。

若以“正常”眼光去看待比特币,可能市场无需等待十年。

拖住了SEC的脚步的两大因素

此前十年,最被质疑的两个方面主要有「比特币的托管安全性问题」和「比特币ETF可能被操纵问题」,在批准文件中也得到了再次强调。

就如同刚刚提到的类似黄金ETF,比特币现货ETF的出现,就是为了给投资者提供便捷性和低门槛的投资途径。那这里的“投资者”到底是指谁呢?

ETF是为无法持有基础资产的基金、机构投资者和散户准备的。也就是说由托管机构进行统一集中托管是在帮助那些无法直接持有基础资产的投资者。从技术上来说,对于比特币的托管安全性问题,Web3行业中在做钱包业务的领军者都是可以被参考学习或者直接与之合作的。

图 SEC批准文件截图

而对于比特币ETF可能被操纵的顾虑,在来自SEC委员Caroline A. Crenshaw的声明中也做了详细的说明。她认为比特币ETP背后的全球现货市场因欺诈和操纵、集中和缺乏充分监督而陷入困境。

图 “相关性并不能保护投资者”

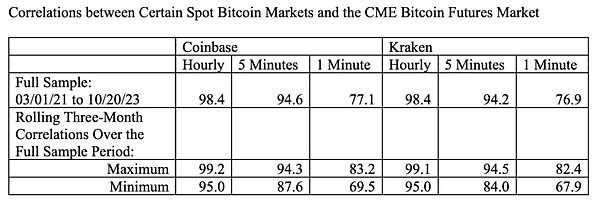

尽管在批准文件中已经测算了自2021年开始,Coinbase 和 Kraken 两家加密交易所的BTC价格(现货)与CME期货价格的相关性,按照小时来测算的话,其相关性高达95%至99%。因此,若市场出现操纵,SEC可以通过期货市场监测到。

图 SEC批准文件截图

但通过监控期货市场来预测现货市场可以被作为一个投资者使用的投资数据指标,而并不能完全被监管机构所利用用于进行全面监控市场操纵的一个指标。期货与现货市场是截然不同的。期货市场是在未来某个时间点履行合约的交易场所,而现货市场是即时交易实际资产的市场。

比特币现货市场就如同第一块黄金在公元前4000年左右的古代美索不达米亚和埃及地区被挖出和后续被古希腊等国家和地区被逐渐定价一样,逐渐形成的全球市场,是呈现分散和多中心化的。

依赖于一家监管机构或者说透过期货市场来监管这已然蓬勃发展的现货市场是无法进行投资者保护的。所以,用技术解决技术所带来的问题才是正解。通过链上数据的分析、大额异动等才能从第一时间了解到这个市场有可能被操纵的证据。

未来的3点看法

Web3行业中提供技术解决方案的公司会迎来其风口。

在此次SEC批准文件中,我们看到了大众对于技术安全、托管安全以及监控缺失等问题的担忧。市场的担忧也是市场的巨大需求。因此,随着加密资产市场和金融市场不断扩大连通,这方面的需求也将不断扩大。

像Chainalysis、OKLink、Ellipitics等数据分析工具公司以及有冷、热钱包的成熟安全技术的公司将会迎来其风口。对于比特币的托管安全性问题,Web3行业中在做钱包业务的领军者都是可以被参考学习或者直接与之合作的。

ETF和去中心化并不冲突。

随着发展,在ETF加入之前,比特币现货市场已经初具规模。不然,也不会存在各家机构以降低费率来吸引投资者进入。除了希望吸引投资者进入外,费率还存在“规模效应”。当ETF的规模增大时,管理费用和运营成本可以在更多的资产基础上分摊,从而降低每份ETF的费率。因此,也能反向说明金融机构的信心十足。

无论是VanEck创始人Jan van Eck在今早发布声明提到5%的收益将直接贡献给比特币开发者社区,还是已经克服交易成本的比特币持有者,比特币和区块链技术是公共产品这一理念已深入人心。

比特币现货ETF为其他非证券加密ETP提供了一个开创性的先例。

Hester Pierce在其声明称“现在我们知道委员会可以执行稳健的相关性分析,也许批准其他现货加密 ETP的道路就不会那么崎岖不平了。”

图 “其他现货加密ETP道路不那么崎岖不平了”

不过,我们要值得注意的是此次批准的是基于非证券Crypto现货ETF。SEC主席声明提到,今天委员会的行动局限于持有一种非证券商品比特币的ETP。”因此,后续的“其他”加密资产,是需要先厘清是否属于证券。

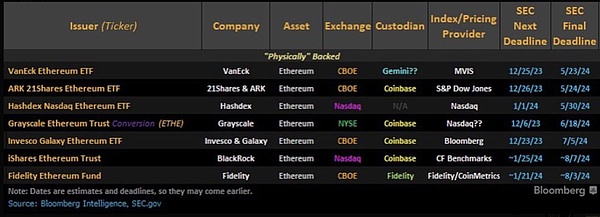

而对于以太坊,则处于模糊地带。不过各家金融巨头早已布局,通过下表,SEC对于第一家VanEck申请的最终回复期限是在24年5月23日。

无论有多少“担忧”,这份加速批准文件还是发布了,最不想变成市场狂热氛围助推者的SEC也被这包容的市场所包容,倒成了这一“马戏氛围”的一员。随着合规、低门槛的投资渠道的逐步扩充以及配套工具、技术的不断成熟,这个市场也会逐渐成熟,才能从根本上脱离“马戏氛围”。

这一次,市场赢了!今晚,美国加密市场新时代即将拉开帷幕。

Two days ago, we proposed that the United States would not easily let go of the bitcoin spot market for ten years. Today, this milestone has finally arrived. The US Securities Regulatory Commission has approved that only bitcoin spot will be listed on the Chicago Board Options Exchange, the new york Stock Exchange and the Nasdaq Stock Exchange, which means that bitcoin will be formally connected with the global financial system. It has been a very difficult journey. Today, there are still challenges to the approval of this resolution and the future of bitcoin that has been passed. With the release of the approval documents, the Committee members also issued statements of different positions, supported by long-term advocates of the Committee members, and expounded the thoughts of rejection for ten years and her personal views, saying that because we failed to follow our normal standards and procedures when considering spot bitcoin, we created an artificial fanaticism around them. If these products enter the market in the usual way as other similar products, we can avoid being in the present situation. The circus atmosphere created a kind of artificial fanaticism, and the one who wanted to keep the market neutral was also integrated into the huge carnival of the market. Bitcoin was groundbreaking, just like the gold dug out of the mine thousands of years ago, but now people are in the digital age, and the dug precious metals have become digital products, like gold. The adoption of bitcoin spot can enable investors to obtain the return on investment of bitcoin by buying stocks without directly holding and managing bitcoin. Looking at bitcoin from a long-term perspective, there are two major factors that the market may not have to wait for ten years. The two most questioned aspects in the previous decade mainly include the security of bitcoin custody and the possibility that bitcoin may be manipulated, which has also been re-emphasized in the approval documents. Just like the emergence of similar gold bitcoin spot just mentioned, it is to provide investors with convenience and low-threshold investment channels. So who are the investors here? Who are the fund machines that cannot hold the basic assets? Structured investors and retail investors prepared, that is to say, the unified centralized custody by the custodian is to help those investors who can't directly hold the basic assets. Technically speaking, the leaders in the industry who are doing wallet business can be referenced or directly cooperated with them, and the concerns about the possible manipulation of Bitcoin are also explained in detail in the statement from the members. She believes that the global spot market behind Bitcoin is due to The concentration of fraud and manipulation and the lack of adequate supervision can't protect investors. Although the correlation between spot and futures prices has been calculated in the approval documents since, the correlation is as high as if it is measured by hours. Therefore, if the market is manipulated, you can monitor the screenshot of the approval document through the futures market, but by monitoring the futures market, you can predict that the spot market can be used as an investment data indicator for investors, but it is not. An indicator that can be fully used by regulatory agencies to comprehensively monitor market manipulation, futures and spot markets are completely different. Futures market is a trading place to perform contracts at a certain point in the future, while spot market is a market to trade real assets in real time. Bitcoin spot market is just like the first piece of gold was dug up in ancient Mesopotamia and Egypt around BC and then gradually priced by ancient Greece and other countries and regions. The gradually formed global market is presented. It is impossible to protect investors by relying on a regulatory agency or the futures market in a decentralized and multi-centered way. Therefore, it is the right solution to solve the problems brought by technology with technology. Only through the analysis of large-scale transactions in the chain data can we know the evidence that this market may be manipulated at the first time. In the future, companies that provide technical solutions in the industry will welcome their enthusiasm. In this approval document, we have seen the public's concern. Concerns about technical security, custody security and lack of monitoring are also huge demands in the market. Therefore, with the continuous expansion of the encryption asset market and the financial market, the demand in this area will also continue to expand, and companies with mature security technologies such as data analysis tools and hot and cold wallets will welcome their enthusiasm. For the custody security of Bitcoin, the leaders in the wallet business in the industry can be referenced or directly cooperated and decentralized. There is no conflict. With the development, the bitcoin spot market has begun to take shape before joining. Otherwise, there will be no institutions to reduce the rate to attract investors. In addition to attracting investors, the rate also has a scale effect. When the scale increases, management expenses and operating costs can be shared on the basis of more assets, thus reducing the rate per share. Therefore, it can also be reversed that financial institutions are full of confidence, and the income mentioned in the statement issued by the founder this morning will directly contribute to Bits. The community of coin developers is still a bitcoin holder who has overcome the transaction cost. The idea that bitcoin and blockchain technology are public goods has been deeply rooted. Bitcoin spot provides a groundbreaking precedent for other non-securities encryption. In its statement, it is said that now we know that the Committee can perform a robust correlation analysis, and perhaps the road to approving other spot encryption will not be so bumpy. The chairman's statement mentioned that the Committee's action today is limited to holding a non-securities commodity bitcoin, so other subsequent encrypted assets need to be clarified whether they belong to securities or not, but they are in a vague area for Ethereum. However, the financial giants have already laid out the following table, and the deadline for the final reply to the first application is on, no matter how worried they are about this accelerated approval document or the release of it, those who least want to become market fanaticism are also tolerated. The market has become a member of this circus atmosphere. With the gradual expansion of investment channels with low compliance threshold and the continuous maturity of supporting tools and technologies, this market will gradually mature before it can fundamentally break away from the circus atmosphere. This time, the market has won tonight, and a new era of American encryption market is about to begin. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。