CoinShares 挖矿报告:我们对 2024 年减半的见解

作者:James Butterfill,研究主管、Max Shannon、Alex Schmidt 来源:medium 翻译:善欧巴,比特币买卖交易网

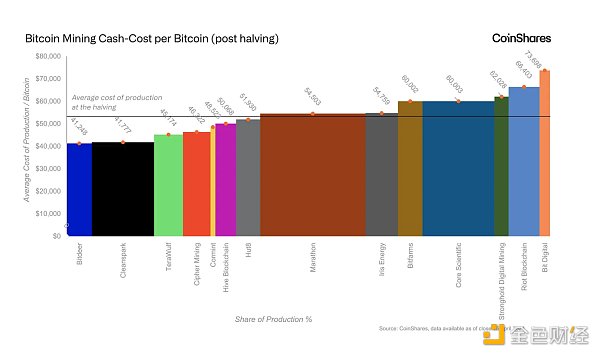

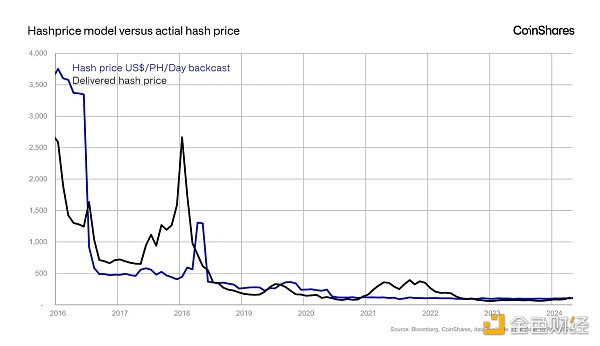

这篇研究文章的发布恰逢 2024 年比特币减半,旨在更新并向投资者通报比特币挖矿行业面临的风险和机遇。最近,我们主要根据 2023 年第四季度的报告数据更新了数据。我们发现,上市矿业公司每枚比特币的平均生产成本目前约为 53,000 美元。

在本报告中,我们更详细地探讨了采矿业及其挑战。我们现在采用了哈希成本方法(更容易计算托管活动的账户)和每比特币成本方法,以更好地了解行业的盈利能力。

摘要

我们预计,由于人工智能带来更高收入的潜力,能源安全地区将转向人工智能,BitDigital、Hive 和 Hut 8 等公司已经从人工智能中获得收入。这一趋势表明,比特币开采可能会越来越多地转移到搁浅的能源地点,而人工智能的投资则在更稳定的地点增长。TeraWulf、BitDigital 和 Core Scientific 目前都有人工智能业务或人工智能增长计划。

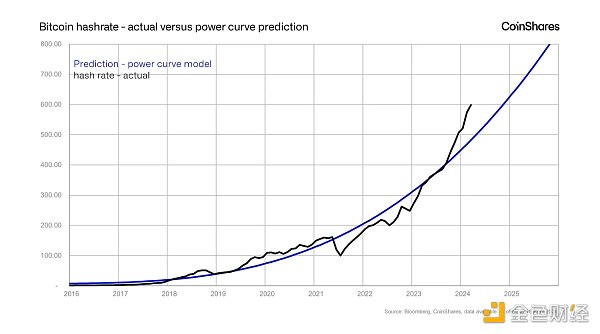

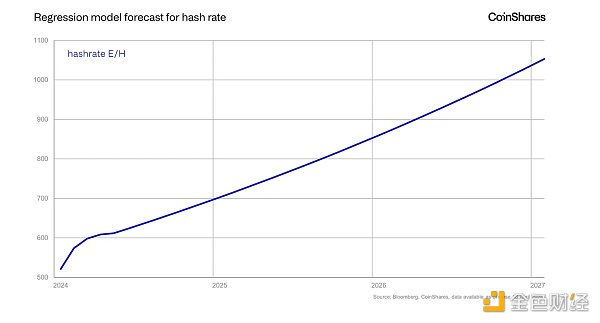

我们的模型预测,到 2025 年,算力将升至 700 Exahash,尽管减半后,随着矿工关闭不盈利的 ASIC,算力可能会下降 10%。

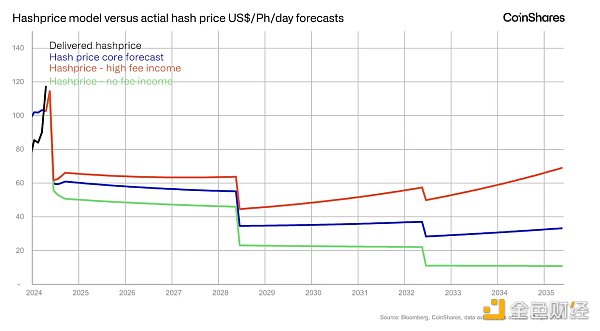

预计哈希价格将在 2024 年减半后下降至 53 美元/Ph/天。

由于减半,预计成本将大幅增加,电力和总体生产成本几乎翻倍。主要缓解策略包括优化能源成本、提高采矿效率以及确保有利的硬件采购条件。

矿商正在积极管理金融负债,其中一些矿商使用多余的现金来大幅减少债务。

新兴趋势:人工智能计算对比特币挖矿构成威胁吗?

它确实可能对某些数据中心构成威胁。人工智能计算和比特币挖矿对能源和互联网正常运行时间的需求差异很大。AI 需要极高的正常运行时间(通常为 99% 或更高)以及复杂的冗余系统。人工智能的停机通常会导致巨���合同处罚,并且可能会长时间延迟先前处理活动的恢复,从而限制其适用性。相反,比特币挖矿则不会面临这些问题。ASIC 是用于比特币挖矿的硬件,可以在几分钟内打开和关闭电源,并立即恢复散列。这种灵活性使它们成为能源不太可靠的地点的理想选择,例如使用可再生能源或滞留气体燃烧的地点,这些地点的正常运行时间要求很灵活。

我们最近的矿业公司管理层讨论揭示了一个显着的转变,一些矿工越来越多地在其能源安全站点转向人工智能。尽管这一趋势相对较新,但 Hve 和 Hut 8 等公司的人工智能收入分别占其收入的 3.6% 和 2.9%,其他公司也在开发人工智能项目。我们看到,在这些能源安全的地区,人们对人工智能的偏好超过了比特币挖矿。展望未来,可以想象,比特币挖矿可能会主要基于能源不安全的搁浅能源站点,特别是在它可以为此类能源项目提供经济补贴的地方。相反,寻求收入多元化和潜在更高利润的矿商可能会投资人工智能,从而加剧这种差异。

人工智能带来了一些挑战,特别是需要独特且成本更高的基础设施,这为规模较小、资本较少的实体设置了进入壁垒。此外,随着公司雇用更多人工智能技术人才,员工需要不同的技能,这会导致成本增加。TeraWulf 和 Bitdeer 等公司正在积极扩大产能。例如,Core Scientific 根据一份多年期合同托管 Coreweave。与此同时,BitDigital 计划将其容量增加一倍,目标是达到预计年运行额约 1 亿美元。

哈希率建模

对整体网络哈希率进行建模可以简单地完成,人们可以认为它遵循摩尔定律的某种形式,或者更好的是其增长的功率曲线。这可以决定未来将采取什么路径。

不过,这种方法存在几个问题。未来的情况可能会发生变化,特别是随着行业的成熟,由于能源资源有限,更有可能采用 Verhulst S 曲线,而不是功率曲线。它还没有考虑费用如何演变。到目前为止,费用是零星的,但随着网络使用量的增加,费用可能会随着时间的推移而增加。

我们的目标是计算哈希价格(矿工盈利能力),从而更容易确定矿工盈利能力,特别是因为在计算托管时使用每个比特币的方法很困难。算力价格的组成部分包括发行量、矿工费、算力和价格。

发行量是可预测的,并且哈希率可以建模。这使得预测者可以调整他们对价格和费用的假设来确定哈希价格。

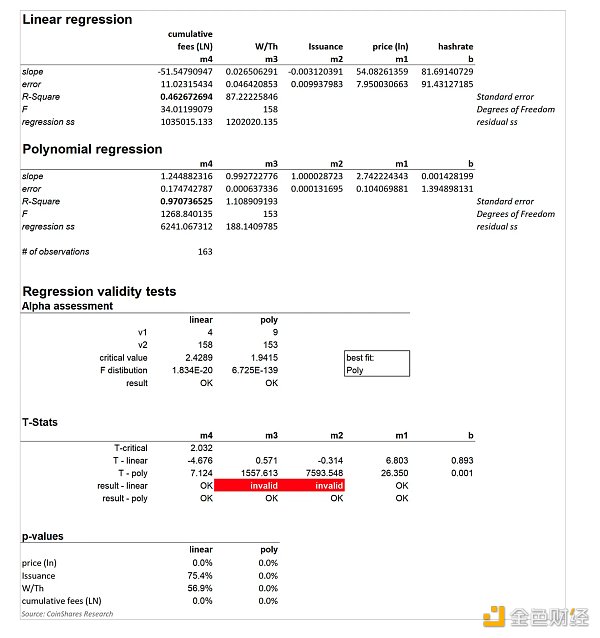

如果我们要使用回归分析,那么对哈希率进行建模以帮助计算哈希价格是迄今为止最大的挑战。在我们的方法中,我们坚持敏感性原则,仅识别模型中那些有意义的潜在输入,而不是因为它们偶然与哈希率有联系。全球利率与哈希率密切相关。尽管如此,从敏感性的角度来看,我们并不认为它们与算力有足够密切的联系,因为较低/较高的利率向矿工收购的传导存在滞后效应。我们确定了四个因素来预测哈希率:费用、矿工效率、发行和价格。

结果令人鼓舞,并表明,使用 2011 年以来的月度数据,多项式回归是最好的方法,特别是在评估 alpha 评估(错误地得出存在关系的概率)和 T 统计数据(每个斜率系数是否有用)��估计哈希率)。而 p 值仅适用于多项式回归。

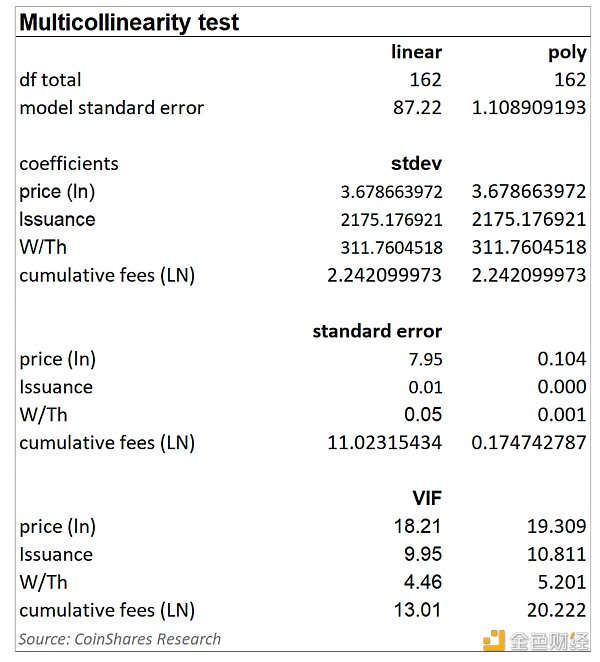

我们还测试了多重共线性,通常称为自相关。当模型中的多个变量高度相关时,就会出现多重共线性,这意味着它们提供了重叠的信息。

多重共线性可能会掩盖哪些因素真正具有影响力,从而损害模型结论的可靠性和精确度。结果应该通过观察方差膨胀因子(VIF)来解释,VIF 为 1 是理想的,上限为 10;我们在模型中发现,线性和多项式都有一些 VIF 高于 10 的因子。

尽管我们不认为我们应该因此而完全放弃该模型。在许多方面,可以预期各种因素之间存在关系,价格影响哈希率,因为它影响矿工的资本支出决策。值得注意的是,多重共线性有时在回归分析中是有害的,但它取决于模型的背景和目标。由于我们的主要目标是模型预测,多重共线性的存在并不是一个重大问题。即使自变量高度相关,该模型仍然可以做出准确的预测。

模型输出

有趣的是,调整模型凸显出哈希率上升会压低哈希价格,这是有道理的,因为更多的矿工/哈希算力相当于每个矿工的收入更少。虽然比特币价格上涨确实会在短期内对哈希价格产生重大影响,但从长远来看,比特币价格上涨往往会鼓励更多人进行挖矿。因此,正如模型所反映的那样,对哈希价格的净影响往往是中性的。

该模型预计到 2025 年初,算力将升至创纪录的 700 Exahash。

目前矿工费用相对来说是一个谜,我们认为这是由于费用市场相对不成熟造成的。到目前为止,费用是跟随价格变化的;当牛市出现时,费用往往会随着活动的增加而增加。尽管最近,序号产生的费用远比许多人预期的更有弹性,并且对矿工来说是一个福音,而且每天的费用有时会高于挖矿收入。随着比特币的成熟,预计费用将在矿工收入中占据越来越大的市场份额。该模型目前强调,费用上涨往往对哈希价格产生最积极的影响。

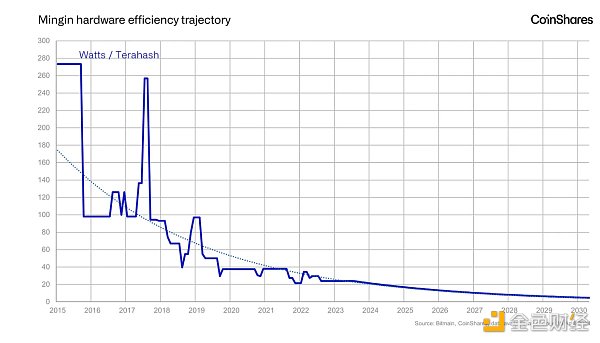

预测哈希价格需要对 4 个输入变量做出假设。发行量具有高度可预测性,而挖矿硬件的效率(W/Th)很可能遵循相当简单的指数下降趋势,到 2028 年挖矿硬件的效率将达到 10W/Th。

采用每月 1.2% 的价格增长和 1% 的费用增长的适度假设,可以看出哈希价格在 2024 年减半后可能为 60 美元/Ph/天,并在 2028 年减半后降至 35 美元/Ph/天。

这些增长假设将相当于到 2025 年底比特币月平均价格为 8.6 万美元,费用相对于历史水平为第 80 个百分点。我们还纳入了一些异常情况��其中一种情况是费用收入降至零;这将对哈希价格产生直接影响,到 2025 年底,该价格

The author's research director translated Shanouba Bitcoin Trading Network. This research article was released at a time when bitcoin was halved in 2000. It aims to update and inform investors about the risks and opportunities faced by the bitcoin mining industry. Recently, we mainly updated the data according to the report data in the fourth quarter of 2000. We found that the average production cost of each bitcoin of listed mining companies is currently about US dollars. In this report, we discussed the mining industry and its challenges in more detail. We now adopt the hash cost method to be more tolerant. It is easy to calculate the account of custody activities and the cost per bitcoin method to better understand the profitability of the industry. We expect that due to the potential of higher income brought by artificial intelligence, energy security areas will turn to artificial intelligence and other companies have already obtained income from artificial intelligence. This trend shows that bitcoin mining may be transferred to stranded energy sites more and more, while artificial intelligence investment will grow in more stable locations, and there are artificial intelligence business or artificial intelligence growth plans for us at present. The model predicts that the annual computing power will rise to, although after halving, the unprofitable computing power may decline with the closure of miners. It is expected that the hash price will drop to USD days after halving. Due to halving, it is expected that the cost will greatly increase electricity and the overall production cost will almost double. The main mitigation strategies include optimizing energy costs, improving mining efficiency and ensuring favorable hardware procurement conditions. Some miners are actively managing financial liabilities, and some of them use excess cash to greatly reduce the emerging trend of debt. Artificial intelligence. Does computing pose a threat to bitcoin mining? It may indeed pose a threat to some data centers. The demand for energy and Internet uptime between artificial intelligence computing and bitcoin mining is very different. It requires extremely high uptime, usually higher or higher, and complex redundant systems. The shutdown of artificial intelligence usually leads to huge contract penalties and may delay the recovery of previous processing activities for a long time, thus limiting its applicability. On the contrary, bitcoin mining will not face these problems. The hardware of special currency mining can turn on and off the power supply in a few minutes and immediately restore the hash. This flexibility makes them an ideal choice for places with less reliable energy sources, such as places where renewable energy is used or trapped gas is burned. The normal operation time requirements of these places are very flexible. Our recent management discussion of mining companies revealed a significant change. Some miners are increasingly turning to artificial intelligence at their energy safety sites, although this trend is relatively new, they are in harmony with people from other companies. Other companies, whose income from industrial intelligence accounts for their income respectively, are also developing artificial intelligence projects. We see that in these energy-safe areas, people's preference for artificial intelligence exceeds that of bitcoin mining. Looking forward to the future, it is conceivable that bitcoin mining may be mainly based on energy-unsafe stranded energy sites, especially where it can provide economic subsidies for such energy projects. On the contrary, miners seeking income diversification and potential higher profits may invest in artificial intelligence, thus aggravating this difference. Artificial intelligence has brought some challenges, especially the need for unique and higher-cost infrastructure, which has set up entry barriers for smaller entities with less capital. In addition, as companies hire more artificial intelligence technicians, employees need different skills, which will lead to increased costs and other companies are actively expanding production capacity. For example, according to a multi-year contract custody, at the same time, it plans to double its capacity, with the goal of achieving the expected annual operation of about 100 million US dollars. Hash rate modeling of the overall network. Modeling can be done simply. People can think that it follows some form of Moore's Law or, better yet, the power curve of its growth, which can determine what path it will take in the future. However, there are several problems with this method, and the future situation may change, especially with the maturity of the industry, because of the limited energy resources, it is more likely to adopt a curve than a power curve. It has not considered how the cost has evolved so far, but it may be sporadic with the increase of network usage. With the passage of time, our goal is to calculate the hash price, miners' profitability, so that it is easier to determine the miners' profitability, especially because it is difficult to use each bitcoin method in calculating custody. The components of the price, including circulation, miners' fees and price circulation, are predictable, and the hash rate can be modeled, which allows forecasters to adjust their assumptions about price and cost to determine the hash price. If we want to use regression analysis, we will carry out the hash rate. Modeling to help calculate hash price is the biggest challenge so far. In our method, we adhere to the sensitivity principle and only identify those meaningful potential inputs in the model, not because they are accidentally related to hash rate. However, from the sensitivity point of view, we don't think they are closely related to computing power because there is a lag effect in the transmission of lower and higher interest rates to miners. We have identified four factors to predict hash rate. The efficiency distribution and price results of cost miners are encouraging, and it shows that polynomial regression of monthly data since the use of years is the best method, especially in the evaluation of the probability and statistics that there is a relationship incorrectly. Whether each slope coefficient is useful or not, and the value is only suitable for polynomial regression, we also test multicollinearity, which is usually called autocorrelation. When multiple variables in the model are highly correlated, multicollinearity will appear, which means that they provide overlapping information. Sex may cover up which factors are really influential, thus damaging the reliability and accuracy of the model conclusion. The result should be interpreted as the ideal upper limit by observing the variance expansion factor, because we find that both linear and polynomial have some higher factors in the model, although we don't think we should give up the model completely because of this. In many aspects, we can expect the relationship between various factors, and the price affects the hash rate because it affects the miners' capital expenditure decision. Linearity is sometimes harmful in regression analysis, but it depends on the background and goal of the model. Because our main goal is to predict the existence of multicollinearity in the model, it is not a major problem. Even if the independent variables are highly correlated, the model can still make accurate predictions. Interestingly, adjusting the model highlights that the increase in hash rate will depress the hash price, which makes sense, because more miners' hash computing power is equivalent to less income for each miner. Although the increase in bitcoin price will indeed have a major impact on the hash price in the short term, in the long run, the increase in bitcoin price will often encourage more people to dig. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。