DeFi 将要纳税?美国国税局召开听证会

作者:Matthew Lee

北京时间 11月15日,美国国税局(IRS)召开了一场备受瞩目的听证会,讨论扩大加密货币资产的征税范围。此次听证会囊括了诸多关键议题,包括用户隐私、必须报告交易信息的加密实体的范围、稳定币的纳入,将拟议法规应用于参与去中心化金融的参与者以及钱包地址的报告等。

DeFi 的快速发展使其成为监管者关注的焦点,据巴克莱银行研究,加密货币税收缺口至少有 500 亿美元。该举措针对 DeFi 项目定义模糊,无课税历史,无经验针对链上交易,以及其他实体冒充 DeFi 实体都导致监管难度上升,所以 IRS 试图通过将其纳入监管框架中来确保税收透明度和完整性。

听证会最主要的内容是围绕“经纪商”(Broker)的定义展开。根据 8 月份制定的拟议法规,经纪商的定义有可能会被扩大到“直接或者间接影响数字资产销售的数字中间商”,而扩充后的定义会直接把 DeFi 和非托管钱包以及钱包开发者也纳入经济商的范围。要求经纪商对以下几点负责:

纳税人的姓名、地址和纳税人识别号;

出售数字资产的名称、类型、数量、日期和时间;

卖方从卖出中收到的总收益(包括交易所收益与链上收益);

向经纪商支付交易费用的总收益;

知晓出售方转移数字资产的钱包地址;

发生在链上的出售或转入账户的交易,与出售相关的交易标识或哈希。

简单来说,IRS 需要类似 Uniswap,Sushi,Metamask 等依赖代码运营的去中心项目需要对所有用户进行 KYC,包括统计交易所以及链上发生的的交易,链上的地址,并且需要对用户的链上交易动向,交易收益了如指掌。

虽然这次听证会被公众批评,但是基于现在的市场上存在一些问题:1. 去中心化交易所大幅增长的交易量趋势;2. 非托管钱包的资金转账无法追踪;3. 私人钱包(缺少第三方报告)导致非法活动增加;使得市场多位专家认为扩大税收范围将成为必然,预计正式法案推出时间为 2025 年。

扩大税收范围会带来什么影响?

用户

除了减少一定的收入外,还会面临繁杂的数据处理和文书工作。美国在 2021 年的《基础设施投资和就业法案》中的条款就曾指示 IRS 对加密货币经纪人实施新规则。如果扩大税收范围,数字经纪人必须汇报纳税 Cost Basis,而 Cost Basis 的复杂性会给经纪商,纳税人和 IRS 带来更多问题。纳税人在计算 Cost Basis 有两种选择:

First in, First out(FIFO,默认):如果你购买了比特币分别在价格为 1000 美元、2000 美元时,然后在 4000 美元时卖出,FIFO 会假定你卖出了 1000 美元那部分的比特币;

特定识别:特定标识方法允许纳税人自行选择出售哪些数字资产,允许选择性地最小化税务负担,但是要求纳税人对每笔交易进行清晰的标识和跟踪。

基于特定识别的部分,纳税人需要深入挖掘不仅是交易所甚至是几年前能追溯到的链上交易记录,并在他们打算出售的库存中标记特定的比特币,即使委托给经纪人也必须在链上或者交易所历史中识别出想要出售的特定资产。

简单的 FIFO 可能会带来额外的课税,因为美国适用税率有长期和短期两种,短期税率持有不足一年,会直接按照现有方法征收累进税率,长期税率指持有超过一年,即使属于最高纳税级别的长期税率也只用缴纳 20%,而短期需要 37%。

IRS 也承认收取加密税会给他们本身带来海量的文书工作,海量的链上数据可能会将 1300 万至 1600 万纳税人的 1099-DA 表格增加 80 亿份。目前经纪商并没有能力支持识别特定交易,用户目前只能依赖于系统性的学习基础税务知识和使用链上数据工具追踪和记录数字资产的交易、转账以及持有情况,针对性的报税。

行业

税收需要有完整的交易记录,这样才可以计算 Cost Basis,资本利得,公允市场价值等,但是追踪交易所,钱包,去中心化协议的资产变动是非常复杂的任务,IRS 很难直接生产税务报告,据相关机构统计,有超过数百万加密投资者的税务报告不准确。

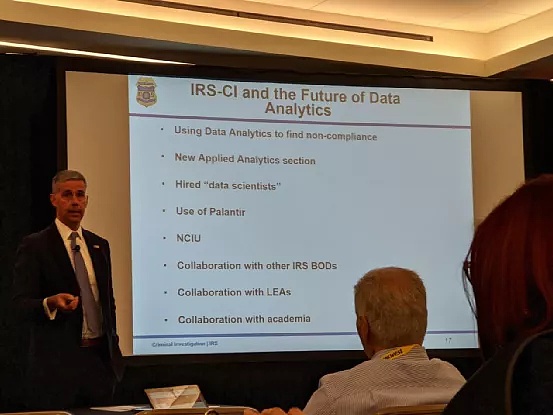

IRS 披露加密货币税收调查方法;Source: Cointracker

未来,商业机构或者税务机关会依赖于链上数据和中心化数据的基础上建立更智能的类似于 Turbo,H&R Block 等自动化报税系统,整合链上包括买入,卖出,空投,分叉,铸币,互换,馈赠等记录,而这种系统报税机制会导致使得大量的公众信息公开,动摇行业的“去中心化”的理想。

民众反对声浪

对于该听证会,数万人提出了反对意见。大部分人认为这种过度的监管将侵犯个人隐私权,损害个体自由。这种担忧也表达了公众对于政府过度干预的担忧,认为监管应该在保障社会秩序的同时,也要保护公民的基本权利。国会已经尝试过类似对中间人的定义包括“任何去中心化交易所或点对点市场”,但最终遭到了否决。而现在 IRS 又利用与中间人的概念相似的语言重新解读回“经纪人”的定义中,超出了法定定义,所以被公众质疑该行为潜在违反行政法。

笔者看来,DeFi 的征税不现实,市场上 95% 以上的项目都没有产生正向现金流,处于非常早期与脆弱阶段,征税会对 DeFi 项目造额外负担。扩大征税范围(到非托管钱包)也将对市场造成巨大压力,21 年拜登增加富人资本利得税后,比特币就曾上演高台跳水。如果实行新的税收制度,范围扩大到链上资产,会有更多的用户进行税损交易,在正式交税前获利卖出,以减免税收。

课税还需要一段路要走,要涉及到多个政府机构,并且现在有很多的模糊不清的地方:比如稳定币交易是否需要汇报,如何确认非金融资产。Coinbase 税务副总裁在听证会上表示,“在没有收益或损失(包括稳定币)的情况下进行税务报告,将导致大量但低价值的报告”。区块链协会高级顾问也表示:该提案过于宽泛,使得去中心化的项目面临两个选择,1. 放弃去中心化的技术;2. 远离美国。

The author held a high-profile hearing on expanding the taxation scope of cryptocurrency assets on June, Beijing time. The hearing covered many key topics, including user privacy, the scope of cryptoentities that must report transaction information, the inclusion of stable currency, the application of proposed regulations to participants involved in decentralized finance and the report of wallet addresses, which made it the focus of regulators' attention. According to Barclays Bank, the tax gap of cryptocurrency is at least 100 million US dollars. The move is aimed at the vague definition of the project, no tax history, inexperience, online transactions and other entities posing as entities, which leads to the difficulty of supervision. Therefore, it is tried to ensure the transparency and integrity of tax revenue by bringing it into the regulatory framework. The main content of the hearing is to focus on the definition of brokers, and the proposed regulations formulated according to the month may be extended to digital intermediaries that directly or indirectly affect the sales of digital assets, and the expanded definition will directly trust and blame. Wallet management and wallet developers are also included in the scope of brokers. Brokers are required to be responsible for the following points: the name and address of taxpayers and the taxpayer identification number; the name, type, quantity, date and time of selling digital assets; the total income received by sellers from selling includes exchange income and chain income; the total income of paying transaction fees to brokers is known; the wallet address of sellers transferring digital assets is sold on the chain or transferred to accounts; the transaction identification or hash related to selling is simply put. Decentralized projects that require similar code-dependent operations need to count all users, including the addresses of the exchanges and transactions that occur on the chain, and they need to know the trading trends and trading income of users well. Although this hearing has been criticized by the public, based on some problems in the current market, decentralized exchanges have greatly increased the trading volume trend, and the fund transfer of unmanaged wallets cannot be tracked. The lack of third-party reports from private wallets has led to an increase in illegal activities, which has led to the market. Many experts in the field believe that it will be inevitable to expand the tax scope. It is expected that the formal bill will be introduced in 2008. What impact will it bring? In addition to reducing certain income, users will also face complicated data processing and paperwork. The provisions of the Infrastructure Investment and Employment Act of 2008 in the United States have instructed to implement new rules for cryptocurrency brokers. If the tax scope is expanded, digital brokers must report tax payment, and the complexity will bring more problems to brokers, taxpayers and taxpayers. There are two options for calculation. By default, if you buy bitcoin when the price is US dollars and then sell it in US dollars, it will be assumed that you have sold the part of bitcoin in US dollars. The specific identification method allows taxpayers to choose which digital assets to sell, and allows them to selectively minimize the tax burden. However, taxpayers are required to clearly identify and track each transaction. Based on specific identification, some taxpayers need to dig deep into the chain that can be traced back to not only the exchange but even a few years ago. Record the transactions and mark the specific bitcoin in the inventory they intend to sell. Even if entrusted to brokers, they must identify the specific assets they want to sell in the chain or in the history of the exchange. Simple tax rates may bring additional taxes, because there are long-term and short-term tax rates applicable in the United States. If they are held for less than one year, they will be directly taxed at progressive rates according to the existing methods. Long-term tax rates mean that even if they are held for more than one year, they will only have to pay and bear short-term needs. It is believed that charging encrypted tax will bring them a huge amount of paperwork, and a huge amount of data on the chain may increase the form of taxpayers by 100 million copies. At present, brokers are unable to support the identification of specific transaction users. At present, they can only rely on systematic learning of basic tax knowledge and the use of online data tools to track and record the transaction transfer and holdings of digital assets. Targeted tax returns require complete transaction records in order to calculate the fair market value of capital gains. However, it is a very complicated task to track the asset changes of the exchange wallet decentralization agreement, and it is difficult to directly produce tax reports. According to the statistics of relevant institutions, the tax reports of more than millions of cryptocurrency investors do not accurately disclose the tax investigation methods of cryptocurrency. In the future, commercial organizations or tax authorities will rely on the data on the chain and centralized data to establish a more intelligent automatic tax return system, which integrates records such as buying, selling, airdropping, forking, coin exchange and gifts, and this system The tax filing mechanism will cause a large number of public information disclosure to shake the ideal of decentralization of the industry. Tens of thousands of people have raised objections to the hearing. Most people think that this excessive supervision will infringe on individual privacy and damage individual freedom. This concern also expresses the public's concern about excessive government intervention. It is believed that supervision should protect the basic rights of citizens while safeguarding social order. Congress has tried a similar definition of middleman, including any decentralization. The exchange or peer-to-peer market was eventually rejected, but now it is reinterpreted in terms similar to the concept of middleman. The definition of broker is beyond the statutory definition, so it is questioned by the public that this behavior is potentially in violation of administrative law. In my opinion, taxation is unrealistic. None of the above projects in the market have generated positive cash flow. Taxation will create an additional burden on the project and expand the scope of taxation to unmanaged wallets, which will also put great pressure on the market. After the capital gains tax, Bitcoin has staged a high platform diving. If the scope of the new tax system is extended to the assets in the chain, more users will conduct tax loss transactions, and it will take some time to sell them at a profit before the official tax payment to reduce the tax. There are many ambiguous places, such as whether the stable currency transaction needs to be reported, and how to confirm the non-financial assets. At the hearing, the vice president of taxation said that it will enter without any gains or losses, including stable currency. The tax report will lead to a large number of low-value reports, and the senior consultant of the blockchain association also said that the proposal is too broad, which makes the decentralized project face two choices: abandon decentralized technology and stay away from the United States. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。