从香港SFC最新文件看链上交易合规必备之选

作者:Hedy Bi

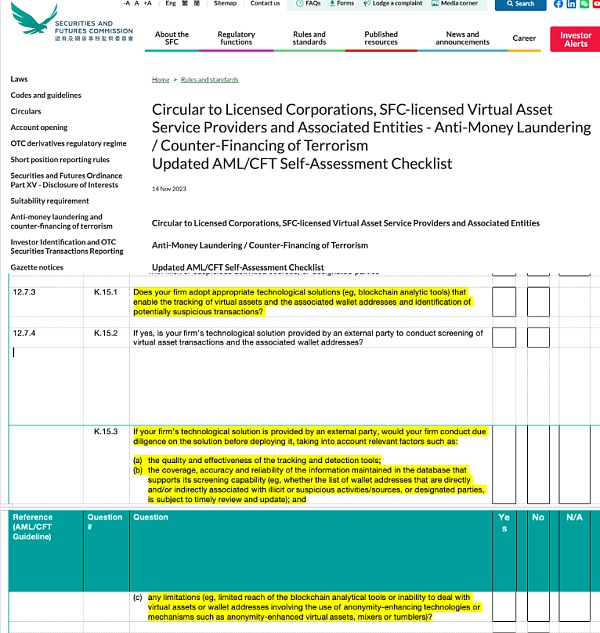

近日,香港证监会在其官网发布“致持牌法团、获证监会发牌的虚拟资产服务提供者及有联系实体的通函 - 打击洗钱/恐怖分子资金筹集经更新的《打击洗钱/恐怖分子资金筹集的自我评估查检表》”,其中在更新的《打击洗钱/恐怖分子资金筹集的自我评估查检表》中再提区块链分析工具。具体而言,证监会在“与虚拟资交易及活动有关的持续监察”部分强调区块链分析工具的重要性。

证监会发布此函旨在“建立一个系统全面的框架,用于自我评估遵守反洗钱和打击资助恐怖主义行为主要要求的情况”。与2022年所用的版本相比,新增了K)虚拟资产章节。

来源:https://apps.sfc.hk/edistributionWeb/gateway/EN/circular/aml/doc?refNo=23EC56

区块链分析工具“考编成功”

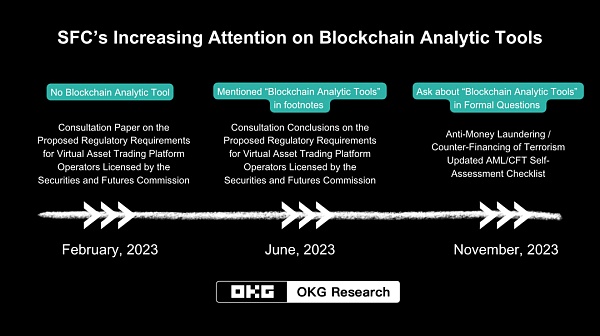

这并非香港证监会首次提出有关区块链分析工具的科技方案。

区块链分析工具在国际上一直是虚拟资产服务提供商的必备合规工具。香港监管当局也逐渐意识到其重要性:从今年年初,香港证监会《有关适用于获证券及期货实务监察委员会发牌的虚拟资产交易平台运营者的建议监管规定的咨询》对公众进行问询,该版本是没有提到区块链分析工具。欧科云链研究院在建言中以欧科云链Onchain AML科技解决方案为例深入剖析链上转账和交互等在内的链上世界,并提出“金融机构应采用适当的科技方案(如区块链分析工具),以便追踪虚拟资产及相关钱包地址,并识别潜在可疑交易”的建议。

今年6月,香港证监会更新的《有关适用于获证券及期货实务监察委员会发牌的虚拟资产交易平台运营者的建议监管规定的咨询总结》新增附录B - 虚拟资产的第12章,区块链数据分析工具在第12.7.3新增的134条脚注中得到了特别强调。再到11月14日证监会更新的《打击洗钱/恐怖分子资金筹集的自我评估查检表》内容,可以看出证监会更希望虚拟资产服务提供方自己采用区块链数据分析工具等科技解决方案,提前规避洗钱风险。

链上交易,香港SFC的关注重点

虚拟资产和链上交易具有创新性和高度复杂性,其技术特性与传统金融产品有着显著差异。这使得传统监管方式难以直接适用于链上交易的监管,因此香港证监会在今年6月提出一个全面的监管架构,并且对于与传统金融产品不同的「链上交易」给出特别的关注。为何香港证监会关注链上交易?

大额转账偏爱链上交易

大额交易通常涉及更高的风险包括洗钱、欺诈和操控市场等风险 ,不仅在传统金融还是虚拟资产市场都是监管重点。大部分大额转账交易实际上并不在中心化交易平台上进行,而是在钱包之间完成,链上的转账和交易往往有匿名性和抗审查性,这会给监管带来难度。

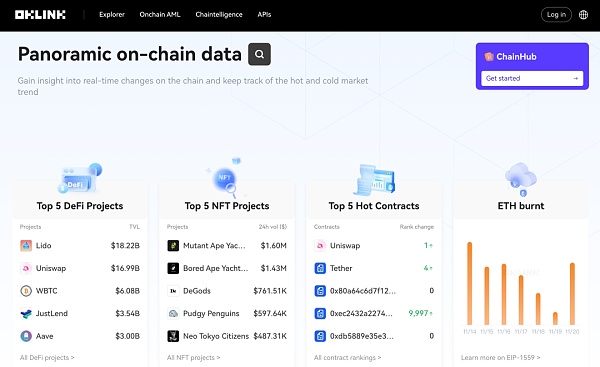

根据欧科云链链上浏览器上的数据分析显示,除了交易所账户的资金流转和做市商(Market Maker Service) 与交易所间的资金流转,个人账户的大额交易多通过链上而非中心化交易所进行。

洗钱犯罪在不断升级演变

相对于传统洗钱犯罪,利用加密资产进行洗钱犯罪更具隐蔽性和难以追踪。且由于其技术特性可以在洗钱犯罪三个阶段———置入、培植和 融合中,发挥不同作用。此外,还存在不法分子盗取合法用户的账户并利用此进行洗钱。

FATF在“Money Laundering Using New Payment Methods”报告中所提到,网络支付方式常被用于清洗基于身份盗窃的诈骗犯罪非法收益,或通过计算机黑客、钓鱼等方式盗窃银行账户、信用卡或借记卡中资金犯罪之非法收益; 并利用加密数字货币的匿名性把这些非法所得资金转移到无法追踪的地方。这是由于大多数加密数字货币交易不需要面对面接触,这为行为人提供了滥用其合法账户进行洗钱的机会。

链上匿名性vs链上透明性

链上匿名不等于难监管。区块链技术虽然带来了匿名性等特性,但同时,区块链技术的不可篡改性和公开透明性让每一笔链上的交易都可以在区块链上进行验证和追溯。交易记录被永久性地记录在分布式的区块链网络中,难以篡改或删除。这使得监管机构能够更加准确地追踪资金流动,查找可疑交易和洗钱行为。

因此,区块链分析工具就成为了行业内想要高效解读链上数据的不二选择。通过分析交易模式、地址关联和资金流动,这些工具可以发现异常模式和风险指标,为监管机构和虚拟资产服务提供方提供线索和决策支持。

香港证监会行政总裁梁凤仪在聊到香港证监会对虚拟资产进行规管是出于投资者保护,并就工具提到,“使用新的技术,一定有新的风险,所以要尽量让风险减到最低,要具备能够应对新风险的新工具,才能够享受新技术给金融服务带来的好处。”

随着监管机构和虚拟资产服务提供方对区块链分析工具的认可和需求增加,这一领域将会是拥有更多的投资与创新。对于其他赛道的企业、创业者甚至是包括散户在内的投资者来说,随着业内更加积极探索和应用区块链数据分析工具,也可以更好地理解和管理虚拟资产交易的风险。像欧科云链OKLink就可以提供多种工具让投资者通过简单操作了解交易数据和链上活动,这样,散户投资者可以更好地评估项目的可靠性和风险水平,从而更加谨慎地进行投资。

用新工具应对新风险,区块链分析工具已经成为必备之选。用香港速度和事前风险管理的思路,才能切实做到投资者保护,推动Web3良性发展。

Recently, the Hong Kong Securities Regulatory Commission (SFC) issued a circular letter to the virtual asset service providers and related entities licensed by the SFC in official website to combat money laundering terrorist fund-raising. The updated self-assessment checklist for combating money laundering terrorist fund-raising mentioned blockchain analysis tools in the updated self-assessment checklist. Specifically, the CSRC emphasized blockchain analysts in the continuous monitoring part related to virtual capital transactions and activities. It is of great importance that the CSRC issued this letter to establish a systematic and comprehensive framework for self-assessment of compliance with the main requirements of anti-money laundering and combating the financing of terrorism. Compared with the version used in, a chapter on virtual assets has been added. The source of blockchain analysis tools has been successfully compiled. This is not the first time that the Hong Kong Securities Regulatory Commission has put forward a scientific and technological plan on blockchain analysis tools. Blockchain analysis tools have always been a necessary compliance tool for virtual asset service providers in the world, and Hong Kong regulatory authorities are gradually interested. Recognizing its importance, at the beginning of this year, the Hong Kong Securities Regulatory Commission consulted the public on the proposed regulatory provisions applicable to the operators of virtual asset trading platforms licensed by the Securities and Futures Practice Supervision Committee. This version did not mention the blockchain analysis tool. In the proposal, Ou Ke Yunlian Research Institute took Ou Ke Yunlian technology solution as an example to deeply analyze the online world including online transfer and interaction, and proposed that financial institutions should adopt appropriate technology solutions such as blockchain analysis tools to catch up. Suggestions on Tracing Virtual Assets and Related Wallet Addresses and Identifying Potential Suspicious Transactions; Consultation summary on the proposed regulatory provisions applicable to the operators of virtual assets trading platforms licensed by the Securities and Futures Commission updated by the Hong Kong Securities Regulatory Commission in May this year; The new appendix, Chapter of Virtual Assets, Blockchain Data Analysis Tool, was particularly emphasized in the new footnote; as can be seen from the contents of the self-assessment checklist for combating money laundering terrorist fund-raising updated by the CSRC on May, The CSRC hopes that the virtual asset service providers can avoid the money laundering risk in advance by adopting scientific and technological solutions such as blockchain data analysis tools. The focus of Hong Kong's attention is that virtual assets and online transactions are innovative and highly complex, and their technical characteristics are significantly different from those of traditional financial products, which makes it difficult for the traditional supervision methods to be directly applied to the supervision of online transactions. Therefore, the Hong Kong Securities Regulatory Commission proposed a comprehensive supervision framework in this month. Chain transactions pay special attention to why the Hong Kong Securities Regulatory Commission pays attention to chain transactions, and favors large-scale transfers. Large-scale transactions usually involve higher risks, including money laundering fraud and market manipulation, which are the focus of supervision not only in traditional finance but also in virtual asset markets. Most large-scale transfer transactions are not actually carried out on centralized trading platforms, but are completed between wallets. The transfer and transactions on the chain are often anonymous and anti-censorship, which will bring difficulties to supervision. The data analysis on the Internet browser shows that besides the capital flow in the exchange account and the capital flow between the market maker and the exchange, the money laundering crime is escalating and evolving, which is more hidden and difficult to track than the traditional money laundering crime using encrypted assets, and it can play different roles in the three stages of money laundering crime because of its technical characteristics. In addition, there are criminals stealing legal use. The online payment method mentioned in the report is often used to clean the illegal income of identity theft-based fraud crimes or to steal the illegal income of bank account credit card or debit card crimes by computer hacking, and use the anonymity of encrypted digital currency to transfer these illegal income funds to untraceable places. This is because most encrypted digital currency transactions do not need face-to-face contact, which provides the perpetrator with the abuse of their legal accounts. Anonymity on the opportunity chain and transparency on the chain of money laundering do not mean that it is difficult to supervise. Although blockchain technology has brought anonymity and other characteristics, at the same time, the tamper-proof and open transparency of blockchain technology allow every transaction on the chain to be verified and traced back. Transaction records are permanently recorded in the distributed blockchain network, which makes it difficult to tamper with or delete, which enables regulators to track the flow of funds more accurately and find suspicious transactions and money laundering behaviors. Blockchain analysis tools have become the best choice for the industry to efficiently interpret the data on the chain. By analyzing the transaction patterns, address associations and capital flows, these tools can find abnormal patterns and risk indicators, and provide clues and decision support for regulators and virtual asset service providers. Liang Fengyi, chief executive of the Hong Kong Securities Regulatory Commission, talked about the fact that the Hong Kong Securities Regulatory Commission regulates virtual assets for the protection of investors and mentioned that using new technologies must have new risks, so we should try our best to reduce the risks. At the minimum, we must have new tools that can cope with new risks before we can enjoy the benefits brought by new technologies to financial services. With the recognition and increasing demand of blockchain analysis tools by regulators and virtual asset service providers, there will be more investment and innovation in this field. For entrepreneurs and even investors including retail investors on other tracks, with the more active exploration and application of blockchain data analysis tools in the industry, we can better understand and manage virtual asset transactions. Risks, such as Ouke Cloud Chain, can provide investors with a variety of tools to understand the transaction data and activities on the chain through simple operations, so that retail investors can better evaluate the reliability and risk level of the project and make investments more cautiously, and it has become necessary to use new tools to deal with new risks. Blockchain analysis tools have become a must, and the idea of Hong Kong speed and ex ante risk management can be used to effectively protect investors and promote sound development. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。