Coin Metrics:2024 年加密市场第一季度总结

作者: Tanay Ved & Matías Andrade 来源:Coin Metrics 翻译:善欧巴,比特币买卖交易网

简介

在本期特别版的“网络概况”中,我们将运用数据驱动的方式,回顾 2024 年第一季度影响数字资产行业的重大事件。

来源:Coin Metrics 参考汇率

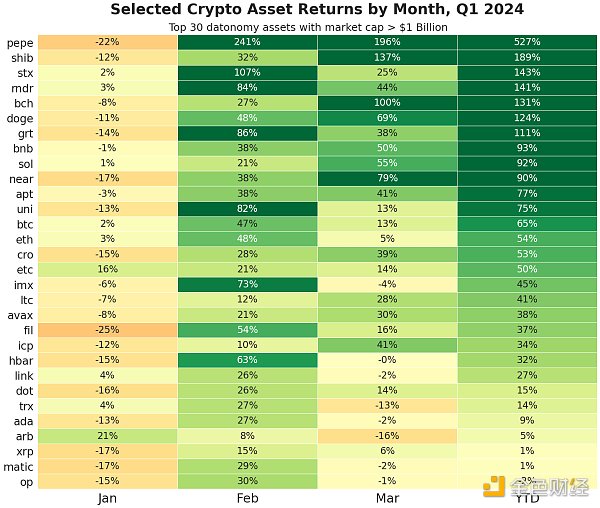

得益于美国终于批准了现货比特币交易所交易产品的十年期努力,2024 年第一季度,数字资产市场显着增长。与过去几个季度加密资产市场充斥的不确定性形成鲜明对比,第一季度标志着该行业的一个转折点。在此期间,我们看到数字资产总市值再次攀升至 2 万亿美元以上,比特币 (BTC) 创下历史新高 7.3 万美元,年内涨幅达到 66%。

这种强劲势头也体现在其他各种加密资产和领域,例如 Solana (SOL +92%) 和 Near (NEAR +90%) 等 Layer 1 区块链、Pepe (PEPE +527%) 等迷因币,以及 Render Network (RNDR +141%) 等结合人工智能和计算应用的项目。此外,我们还看到各种形式的工具、基础设施和应用程序陆续落地,为整个区块链生态系统注入了创新的动力和乐观情绪。以下我们将重点介绍 2024 年第一季度塑造数字资产格局的主要发展趋势。

比特币创历史新高

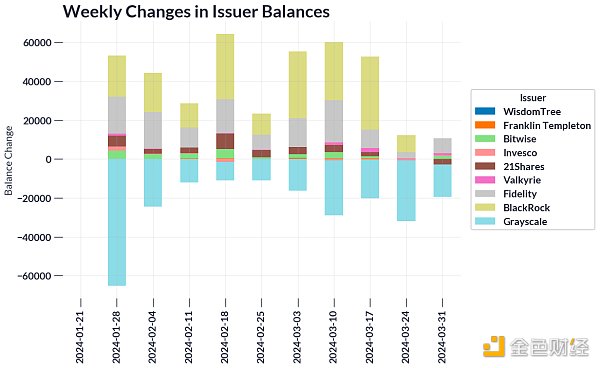

本季度,现货比特币 ETF 的推出成为数字资产市场的重要催化剂,这是一场备受期待的盛事,扩大了比特币的投资渠道。这一发展吸引了散户投资者和传统投资者,为他们提供了一种熟悉的投资工具,具有竞争力的成本和费用结构,让他们可以接触到最大的数字资产。包括 BlackRock 和 Fidelity 等巨头在内的 11 家发行商加入了竞争,此次推出标志着数字资产被更广泛地接受。

来源:Coin Metrics ATLAS Coin Metrics ATLAS

比特币交易所交易产品需求强劲,资金流入史无前例,令许多人吃惊,使其成为历史上增长最快的 ETF。自推出以来,仅用了一个季度的时间,就有大约 120 亿美金流入这些工具,持有约占比特币当前供应量的 4%。在 11 家发行商中,BlackRock 的 IBIT 是当之无愧的赢家,自成立以来累积了接近 25 万枚比特币(约 170 亿美金),其他几家发行商也在获得市场份额。相反,Grayscale 的 GBTC 则因费用较高以及 Genesis 和 FTX 破产事件的影响而出现大量资金流出。

尽管投资流偶尔会出现波动,有些日子会出现异常高的活动,但毫无疑问,现货比特币 ETF 的推出是整个数字资产市场更广泛上涨的基础。第一季度让我们看到了市场对这些产品的强劲需求,然而,参与者将渴望看到衍生品类 ETF 加入后的持久吸引力和影响力。

以太坊 Dencun 升级上线

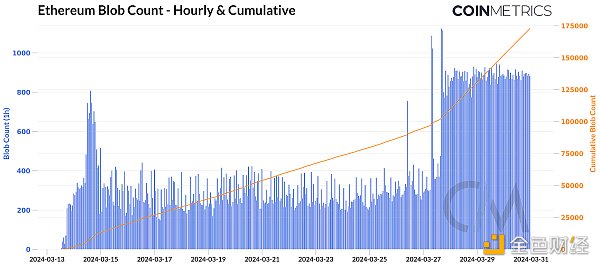

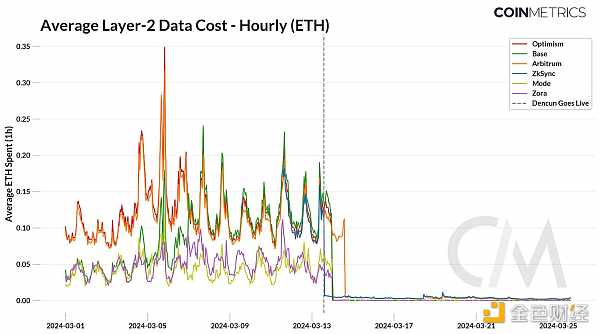

随着 3 月 13 日 Dencun 硬分叉的成功完成,以太坊实现了路线图上的另一个重要里程碑,完成了重大基础设施升级以提高区块链的可扩展性。此次升级不仅受到以太坊用户的期待,他们曾在网络拥塞期间面临高昂的交易费用,同时也受到 Layer 2 (L2) 解决方案的期待,后者一直面临与存储或结算已处理的链下数据相关的成本上升问题,这些数据最终会返回以太坊的 Layer 1。然而,通过 EIP-4844 引入的“blob”缓解了这些瓶颈,为改善网络对所有利益相关者的经济可行性奠定了基础。

Blobs 登陆以太坊主网

来源:Coin Metrics 网络数据专业版,Dencun Metrics

EIP-4844 通过创建数据“blob”空间来解决以太坊的可扩展性问题。与 calldata 相比,blob 是一种更有效的数据存储形式,Layer 2 可以利用 blob 空间将交易结算到以太坊的 Layer 1,后者充当数据可用性和结算层。自升级以来,截至 3 月 31 日,网络已处理了超过 20.9 万个 blob。这通过“blob 交易”得以实现,这是一种新的交易类型,涉及使用 blob,这些 blob 大约可保存 18 天 - 这与永久存储的 calldata 不同。blob 的临时性使它们能够以更低的成本定价,从而显着降低了 L2 的数据可用性成本 (DA) 成本。

Blob 采用带来的影响

包括 Arbitrum、Optimism 和 ZkSync 在内的几个 rollup 在升级后不久就开始采用 blob,数据成本急剧下降。平均成本(即相应 L2 顺序器(负责排序和处理 L2 上的交易并将它们提交到 L1 进行结算)花费的 ETH)从 0.15 ETH 大幅下降到约 0.0005 ETH,这意味着用户交易费用降低了 60% 到 90%。随着成本降低和交易量的增加(例如通过去中心化交易所 (DEX) 等应用程序),L2 可能从更高的利润率中受益。

来源:Coin Metrics ATLAS

在这一背景下,网络需求对 blob 费用定价动态的影响将是至关重要的监测指标。EIP-4844 创建了一个新的 blob gas 市场,其运作方式类似于 EIP-1559,费用会根据供需关系而变化。目前,网络的目标是每个区块 3 个 blob,最大为 6 个 blob。因此,当一个区块中的 blob 数量超过这个目标时,blob 的基础费用就会增加。我们已经看到这种情况发生了几次,证明了它对于网络在 blob 空间利用率高的情况下进行压力测试的重要性。例如,随着席卷 Solana 的迷因币热潮也蔓延到 Base,Coinbase 的 L2 Base 经历了交易费用激增。

此外,在 3 月 27 日,大量 blob 数据铭文(“blobscriptions”)的涌入导致每小时平均 blob 费用飙升,从之前几乎没有成本一下子涨到超过 60 美元。这种增加的 blob 活动也导致了以太坊网络的区块数量下降。因此,随着 rollup 采用率及其 blob 容量的增加,监测费用动态和网络健康状况将变得至关重要。尽管出现了一些早期问题,但很明显,Dencun 升级为用户、rollup 和应用程序带来了更高的可访问性。

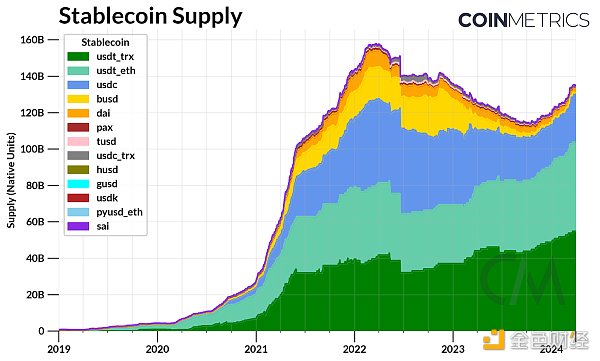

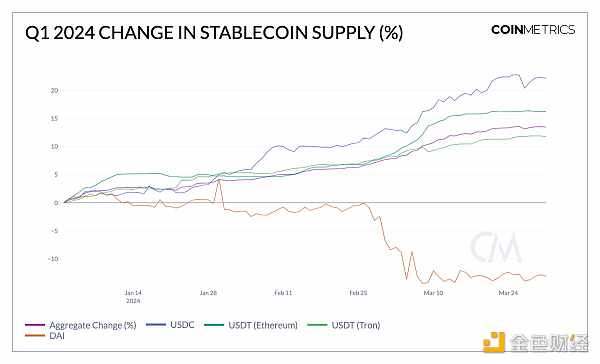

稳定币的增长与格局

随着数字资产市场估值的增长,稳定币在第一季度也恢复了扩张。挂钩美国美元的稳定币供应量突破 1350 亿美元,整个季度累计增长 13.5%。稳定币巨头 Tether (USDT) 的流通量突破 1000 亿美元,其中以太坊网络上的流通量增长了 16%,而 Tron 网络上的流通量增长了 11%。Circle 的 USDC 在第一季度开局强劲,供应量增长 22% 至 270 亿美元,接近去年区域性银行危机期间的水平。虽然 USDT 一直主导着中心化交易所的交易量,但随着流动性改善,USDC 交易对在现货市场上也获得了越来越大的份额。除此外,Paxos 发行的 BUSD 停用以及对数字资产的整体需求增加,也部分解释了这两大领先稳定币市场份额的增长。

来源:Coin Metrics 网络数据

与此同时,MakerDAO 的代币供应量在第一季度下降了 13%,降至 32 亿枚。由于美国接近峰值的利率,对加密货币抵押借贷收益的需求超过了美国国库券提供的收益率吸引力,而美国国库券占支持 Dai 的抵押品大部分。来自高收益新加入者的竞争,例如 Ethena 的 USDe(由质押的 ETH 和衍生品市场的永续期货仓位抵押),也促使整个生态系统的利率发生变化。为了防止 Dai 出现需求冲击并改善其储备流动性,Maker 将 Dai 储蓄利率从 5% 提高到 15%,激励采用 Dai。受这些因素的影响,整个去中心化金融市场的稳定币利率飙升至接近 15%,并提高了整个生态系统借贷和杠杆的成本。

Coin Metrics 公式生成器

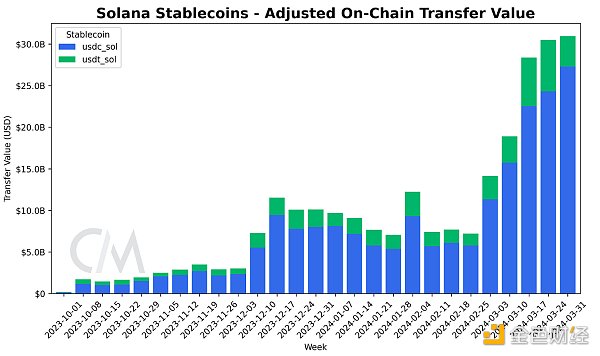

随着流动性的增加,稳定币的格局也变得更加多样化。例如,PayPal 的 PYUSD 在今年年初面临挑战,供应量自 1 月以来下降了 28%;法国兴业银行发行的欧元支持的 EURCV;以及协议原生稳定币,例如 Aave 的 GHO。最近,我们还看到了“BlackRock USD 机构级数字流动性基金”(BUIDL)的推出,该基金是基于以太坊的代币化货币市场基金。这些产品不仅在抵押品支持和风险方面各不相同,而且发行者也多种多样,包括金融机构和 DeFi 协议。此外,稳定币发行和转移量也扩展到 Solana 等 Layer 1 网络,以及 Tron 和以太坊的 Layer 2 网络,展示了它们在整个生态系统中的使用情况。

结论

随着第一季度的收官,数字资产领域经历了深刻的增长和关键的发展,标志着市场日趋成熟和多样化。尽管市场充斥着投机和亢奋情绪,但仍取得了诸多方面的进展,从现货比特币 ETF 的推出到基础设施升级以及 Layer 1 和 Layer 2 生态系统的采用,都为更广泛的可访问性和创新用例铺平了道路。

随着SBF被判刑,第一季度也标志着市场情绪的重大转变,我们正摆脱笼罩该行业的阴影。展望未来,还有各种发展可能会影响数字资产行业。 Coinbase 案与美国证券交易委员会 (SEC) 案的重启,以太坊 ETF 的潜在推出以及比特币即将到来的第四次减半无疑将让参与者保持关注。

In this special edition of the network profile, we will use a data-driven way to review the major events that affected the digital asset industry in the first quarter of 2008. Thanks to the ten-year effort of the United States to finally approve the products traded on the spot bitcoin exchange, the remarkable growth of the digital asset market in the first quarter of 2008 is in sharp contrast to the uncertainties in the encrypted asset market in the past few quarters, which marks the industry. During this period, we saw that the total market value of digital assets climbed to more than one trillion dollars again, and bitcoin reached a record high of 10,000 dollars. This strong momentum was also reflected in other encrypted assets and fields, such as memes such as blockchain and other projects that combined artificial intelligence and computing applications. In addition, we also saw that various forms of tool infrastructure and applications landed one after another, which injected innovation power and optimism into the whole blockchain ecosystem. We will focus on the main development trend of shaping the pattern of digital assets in the first quarter of 2008. Bitcoin has reached a record high. The launch of spot bitcoin in this quarter has become an important catalyst for the digital asset market. This is a highly anticipated event, which has expanded the investment channels of Bitcoin. This development has attracted retail investors and traditional investors, and provided them with a familiar investment tool, a competitive cost and expense structure, so that they can reach the largest digital assets, including giants such as Hehe. Three publishers have joined the competition. The launch marks that digital assets are more widely accepted. The demand for products traded on the Bitcoin exchange from Ethereum is strong, and the unprecedented capital inflow has surprised many people, making it the fastest growing in history. Since its launch, it took only one quarter for about 100 million US dollars to flow into the home publishers who hold these tools, accounting for about the current supply of Bitcoin. Among them, the well-deserved winners have accumulated nearly 10,000 bitcoins since its establishment, about 100 million US dollars. Several issuers are also gaining market share. On the contrary, there is a large amount of capital outflow due to high expenses and the impact of bankruptcy. Although the investment flow fluctuates occasionally, there will be unusually high activity on some days, there is no doubt that the launch of spot bitcoin is the basis for the broader rise of the entire digital asset market. In the first quarter, we saw the strong demand for these products in the market. However, participants will be eager to see the lasting attraction and influence of derivatives after they join the company. With the successful completion of the hard fork on March, Ethereum achieved another important milestone on the road map, and completed a major infrastructure upgrade to improve the scalability of the blockchain. This upgrade was not only expected by Ethereum users, who had faced high transaction costs during network congestion, but also expected by the solution, which has been faced with the problem of rising costs related to storing or settling the processed offline data, which will eventually return to Ethereum, but will be alleviated through introduction. These bottlenecks have laid the foundation for improving the economic feasibility of the network for all stakeholders. Landing on the main network of Ethereum, Ethereum source network data professional edition solves the scalability problem of Ethereum by creating data space, which is a more effective form of data storage, and can use space to settle transactions to Ethereum, which acts as the data availability and settlement layer. Since the upgrade, the network has processed more than 10,000, which has been realized through transactions. This is a new type of transaction. Type I involves the use of these about-storable days, which is different from the temporary nature of permanent storage, so that they can be priced at a lower cost, thus significantly reducing the impact of data availability cost adoption. Several companies, including and, began to adopt the data cost to drop sharply shortly after the upgrade, and the average cost, that is, the corresponding sequencer, is responsible for sorting and processing transactions and submitting them to the settlement, which means that the transaction cost of users has dropped from a large margin to about. The increase of transaction volume, for example, through decentralized exchanges and other applications, may benefit from higher profit margins. In this context, the influence of network demand on the dynamic pricing of fees will be a crucial monitoring indicator, and a new market has been created, which operates in a way similar to the fact that fees will change according to the relationship between supply and demand. At present, the goal of the network is to maximize the number of users in each block, so when the number of users in a block exceeds this goal, the basic fees will increase, as we have seen. This situation has happened several times, which proves its importance for the stress test of the network under the condition of high space utilization. For example, with the sweeping meme craze, it has experienced a sharp increase in transaction costs. In addition, the influx of a large number of data inscriptions on March has led to a sharp increase in the average hourly cost from almost no cost before to more than US dollars. This increased activity has also led to a decline in the number of blocks in the Ethereum network. Therefore, with the increase of adoption rate and its capacity, the monitoring cost dynamics and The health of the network will become very important. Although there are some early problems, it is obvious that the upgrade has brought higher accessibility to users and applications. With the growth of digital asset market valuation, the stable currency has also resumed its expansion in the first quarter, and the supply of stable currency linked to the US dollar has exceeded 100 million US dollars. The cumulative growth in the whole quarter has exceeded 100 million US dollars, of which the circulation of the stable currency giants has increased, while the circulation on the network has increased. At the beginning of the first quarter, the strong supply increased to $100 million, which is close to the level during the regional banking crisis last year. Although it has always dominated the trading volume of the centralized exchange, with the improvement of liquidity, the trading pair has also gained an increasing share in the spot market. In addition, the suspension of issuance and the overall increase in demand for digital assets partly explain the growth of the market share of these two leading stable currencies. At the same time, the supply of tokens dropped to. Due to the near-peak interest rate in the United States, the demand for cryptocurrency mortgage loan income exceeds the yield attraction provided by US Treasury bills, and most of the collateral supported by US Treasury bills comes from the competition of high-yield new entrants, such as the pledge of perpetual futures positions in the pledged and derivative markets, which also urges the interest rate of the whole ecosystem to change. In order to prevent the emergence of demand shocks and improve the liquidity of its reserves, the savings interest rate has been raised from incentive to adoption. Affected by these factors, the stable currency interest rate of the whole decentralized financial market has soared to near and improved the borrowing and leverage of the whole ecosystem. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。