律师如何看待币安43亿美元和解案?

2023年11月21日,据彭博社报道,美国司法部正寻求从币安获得超40亿美元罚款,以解决对这家全球最大加密货币交易所的长期调查。随后,币安与美国政府的大和解出炉,据认罪协议,CZ 承认违反《银行保密法》和其他相关法律的行为,并同意支付 5000 万美元的罚款、辞去币安首席执行官一职,三年内不参与币安运营,币安将在判决后 15 个月内支付约 18.05 亿美元的罚款和25.11 亿美元的判决。

谈感情伤钱,币安与美国监管机构发生情感纠葛已久。2023年6月5日,美国证券交易委员会(SEC)对币安及其CEO赵长鹏(CZ)提起诉讼,指控其不当处理客户资金、误导投资者和监管机构。币安通过向美国投资者非法销售BNB和BUSD等代币进行融资,并通过出售其他未注册证券获利数亿美元,总收入达116亿美元。

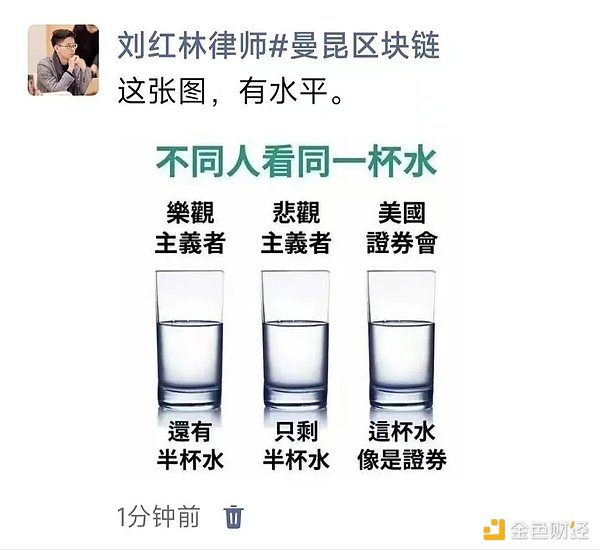

美国证券交易委员会(SEC)是美国最重要的金融监管机构之一,它的职责是保护投资者、维护公平、有序和高效的市场,以及促进资本形成。如何看待以美国SEC为首的“起诉+罚款”了事的组合拳行为?这篇文章红林律师和大家聊一聊。

01、什么是SEC认为的证券?

SEC对于区块链项目是否属于证券的判断标准是基于1946年美国最高法院在Howey案中制定的所谓的“Howey测试”。根据这个测试,如果一个投资合约满足以下四个条件,那么它就是一种证券:

投资者投入了金钱或其他有价值的东西

投资者期待从投资中获得利润

投资者将利润寄托于第三方(如企业或项目团队)的努力

投资者之间存在共同的企业或共同利益

SEC认为,很多区块链项目通过发行代币或加密货币来筹集资金,这些代币或加密货币就是一种证券,因此必须遵守美国证券法规。如果没有事先向SEC注册或申请豁免,那么这些项目就可能被SEC起诉,要求他们停止违法行为,并支付罚款和赔偿。

02、SEC过往创收战绩

自2017年以来,有幸被SEC盯上的区块链项目并不少,其中一些比较知名的战绩如下:

2017年12月,SEC对Munchee公司提起了行政诉讼,指控其未经注册就向公众发行了MUN代币。Munchee公司是一个基于区块链的餐饮评价平台,它计划通过发行MUN代币来奖励用户和商家。SEC认为MUN代币是一种证券,因为Munchee公司在其白皮书和社交媒体上承诺了MUN代币未来会升值,并且会在各大交易所上市。Munchee公司最终同意停止发行MUN代币,并退还给投资者120万美元。

2018年9月,SEC对Block.one公司提起了民事诉讼,指控其未经注册就向公众发行了EOS代币。Block.one公司是一个基于区块链的智能合约平台,它通过发行EOS代币来筹集了40亿美元的资金。SEC认为EOS代币是一种证券,因为Block.one公司在其网站和社交媒体上宣传了EOS代币未来会有多种用途,并且会在各大交易所上市。Block.one公司最终同意支付2400万美元的罚款,以了结此案。

2019年10月,SEC对Telegram Group Inc.和TON Issuer Inc.提起了紧急诉讼,要求其停止发行GRAM代币。Telegram Group Inc.是一个基于区块链的通讯平台,它通过发行GRAM代币来筹集了17亿美元的资金。SEC认为GRAM代币是一种证券,因为Telegram Group Inc.在其白皮书和私募协议中承诺了GRAM代币未来会有多种用途,并且会在各大交易所上市。Telegram Group Inc.最终同意退还给投资者12.2亿美元,并支付1800万美元的罚款,以了结此案。

2020年12月,SEC对Ripple Labs Inc.和其两名高管提起了民事诉讼,指控其未经注册就向公众发行了XRP代币。Ripple Labs Inc.是一个基于区块链的跨境支付平台,它通过发行XRP代币来实现价值转移。SEC认为XRP代币是一种证券,因为Ripple Labs Inc.和其高管在其网站和社交媒体上宣传了XRP代币未来会有多种用途,并且会在各大交易所上市。SEC要求Ripple停止发行XRP,并退还非法所得和利息,并支付民事罚款。这一诉讼导致XRP代币价格大幅下跌,并被多个交易所下架。Ripple Labs Inc.和其高管否认了SEC的指控,并声称XRP代币是一种货币而非证券。

2021年6月,SEC对美国最大的加密货币交易所Coinbase提起诉讼,指控其作为未经注册的证券交易所、经纪交易商和清算机构运营其加密资产交易平台。SEC还指控Coinbase未经注册提供和出售与质押服务计划相关的证券。SEC要求Coinbase停止违法行为,并交出非法所得和利息,并支付民事罚款。

这些案例只是SEC对区块链公司进行监管执法的冰山一角,相信未来还会有更多优秀的创业者被盯上。

03、如何评价这一现象?

打人不打脸,怼人不谈动机。话都说到这个份上了,我们不妨从动机的角度,理解下他对区块链公司发起诉讼的初心:

保护投资者免受欺诈和误导。SEC认为区块链是一种有潜力的创新技术,但也需要在合法、合规、合理的框架下进行发展。通过起诉这些项目,SEC可以促使区块链行业自律、自净、自强,在SEC看来,很多区块链项目通过虚假或夸张的宣传来吸引投资者,而实际上这些项目并没有真正的技术或商业模式,存在诈骗或洗钱的嫌疑。通过起诉这些项目,SEC可以迫使它们退还给投资者资金或支付罚款,从而维护投资者的合法权益。

维护证券市场的秩序和规范。SEC认为很多区块链项目通过发行代币或加密货币来规避美国证券法规,而这些法规是为了保障市场的公开、公平和透明而制定的。通过起诉这些项目,SEC可以强制它们遵守证券法规,从而维护市场的秩序和规范。

理想很丰满,现实很骨感,在SEC对区块链项目的起诉过程中,确实也存在如下被人诟病的问题:

首先,SEC对于区块链项目是否属于证券的判断标准过于模糊和主观,没有提供足够的指导和解释。这种不确定性可能会让区块链创业者难以判断自己的项目是否符合法规,从而陷入法律风险。所以SEC对区块链项目的起诉行为很容易引发法律和伦理上的争议。有人认为SEC的做法是在保护投资者和市场的合法权益,也有人认为SEC的做法是在滥用权力,这种做法可能会损害投资者的利益,加密资产是一种新型的投资方式,其具有高风险和高收益的特点,SEC的诉讼通常会引发市场恐慌,导致加密资产价格大幅波动,给投资者带来巨大损失。

其次,监管层忽视行业的特点,过度依赖惩罚和威胁的手段。任何一个新兴的领域,都需要时间和空间来探索和实验,区块链行业需要一个开放、包容、灵活的法律和监管环境,以鼓励创新和试错,而不是一个僵化、保守、严苛的法律和监管环境,以打压创新和惩罚错误。SEC的频繁起诉可能会让区块链公司感到不安和困惑,害怕任何创新尝试都可能遭到监管打击。这种恐惧和不确定性可能会阻碍区块链技术的发展和应用。

04、如何评价这一现象?

SEC对区块链项目的起诉行为是一种双刃剑,既有保护投资者和市场的正面作用,也有抑制创新和发展的负面影响。作为区块链的合规的提倡者,我们自然希望以SEC为典型代表的监管部门,能够改变其对待区块链技术和加密资产的态度和方法,从执法和诉讼转向沟通和协商,从打压和惩罚转向支持和鼓励,从僵化和保守转向开放和包容,以促进区块链技术的健康发展,真正保护投资者的合法权益。

According to Bloomberg News, the U.S. Department of Justice is seeking to obtain a fine of over 100 million U.S. dollars from Currency Security to solve the long-term investigation of the world's largest cryptocurrency exchange. Subsequently, a grand settlement was made between Currency Security and the U.S. government. According to a plea agreement, it admitted that it violated the bank secrecy law and other related laws and agreed to pay a fine of 10,000 dollars to resign as CEO of Currency Security. Currency Security will not participate in the operation of Currency Security within three years. Currency Security will pay a fine of about 100 million dollars and a judgment of 100 million dollars to talk about emotional injury. Qian An has been involved in emotional disputes with American regulators for a long time. On April, the US Securities and Exchange Commission filed a lawsuit against Qian An and Zhao Changpeng, accusing them of improper handling of client funds, misleading investors and regulators. Qian An raised money by illegally selling and waiting for tokens to American investors, and earned hundreds of millions of dollars by selling other unregistered securities. The US Securities and Exchange Commission is one of the most important financial regulators in the United States. Its duty is to protect investors and maintain fairness, order and stability. Efficient market and promoting capital formation: How to treat the combination boxing behavior led by the United States to sue for fines? This article, Lawyer Hong Lin talks with you about what is considered securities. The criterion for judging whether the blockchain project belongs to securities is based on the so-called test formulated by the Supreme Court of the United States in. According to this test, if an investment contract meets the following four conditions, then it is a securities investor who has invested money or other valuable things. Investors who make profits from capital pin their profits on the efforts of third parties, such as enterprises or project teams. There are common enterprises or common interests among investors. Many blockchain projects raise funds by issuing tokens or cryptocurrencies. These tokens or cryptocurrencies are a kind of securities, so they must abide by the US securities laws and regulations. If they do not register or apply for exemption in advance, these projects may be sued for stopping illegal activities and paying fines and compensation. What do lawyers think of the currency? In the past, there were many blockchain projects that were lucky enough to be targeted since, and some of them were well-known records. In the following month, they filed an administrative lawsuit against the company, accusing it of issuing tokens to the public without registration. The company is a catering evaluation platform based on blockchain. It plans to reward users and businesses by issuing tokens, because the company promised in its white paper and social media that tokens will appreciate in the future and will be listed on major exchanges. In the end, it agreed to stop issuing tokens and return them to investors. In October, it filed a civil lawsuit against the company, accusing it of issuing tokens to the public without registration. The company is an intelligent contract platform based on blockchain. It raised hundreds of millions of dollars by issuing tokens. It believes that tokens are a kind of securities because the company publicized on its website and social media that tokens will have multiple uses in the future and will be listed on major exchanges. The company finally agreed to pay a fine of $10,000 to settle the case. And filed an urgent lawsuit to stop issuing tokens, which is a communication platform based on blockchain. It raised billions of dollars by issuing tokens, and thought that tokens were a kind of securities, because in its white paper and private placement agreement, it promised that tokens would have multiple uses in the future and would be listed on major exchanges, and finally agreed to return them to investors for billions of dollars and pay a fine of tens of thousands of dollars to settle the case. In June, it filed a civil lawsuit against two of its executives, accusing them of issuing them to the public without registration. Coin is a cross-border payment platform based on blockchain, which realizes the value transfer by issuing tokens. It thinks that tokens are a kind of securities because it and its executives publicized on their websites and social media that tokens will have multiple uses in the future and will be listed on major exchanges, demanding to stop issuing, refund illegal income and interest, and pay civil fines. This lawsuit led to a sharp drop in the price of tokens, which was denied by many exchanges and its executives, and claimed that tokens were a currency rather than a securities. The lawsuit against the largest cryptocurrency exchange in the United States accused it of operating its cryptoasset trading platform as an unregistered stock exchange broker and clearing institution, and also accused it of providing and selling securities related to the pledge service plan without registration, demanding to stop illegal activities, hand over illegal income and interest, and pay civil fines. These cases are just the tip of the iceberg for the supervision and enforcement of blockchain companies. I believe that more outstanding entrepreneurs will be targeted in the future. How to evaluate this phenomenon? We may as well understand his initial intention to file a lawsuit against blockchain companies from the perspective of motivation, and think that blockchain is a potential innovative technology, but it also needs to be developed within a legal, legal and reasonable framework. By suing these projects, the blockchain industry can be self-disciplined, self-purified and self-reliant. It seems that many blockchain projects attract investors through false or exaggerated propaganda, but in fact, these projects. There is no real technology or business model that is suspected of fraud or money laundering. By suing these projects, they can be forced to return funds to investors or pay fines, thus safeguarding the legitimate rights and interests of investors and maintaining the order and norms of the securities market. It is believed that many blockchain projects evade the US securities laws and regulations by issuing tokens or cryptocurrencies, and these laws and regulations are formulated to ensure the openness, fairness and transparency of the market. By suing these projects, they can be forced to abide by the securities laws and regulations. The market order and norms are ideal, and the reality is very skinny. In the process of prosecuting blockchain projects, there are indeed the following problems that have been criticized. First of all, the criteria for judging whether blockchain projects belong to securities are too vague and subjective, and they have not provided enough guidance and explanation. This uncertainty may make it difficult for blockchain entrepreneurs to judge whether their projects comply with laws and regulations and thus fall into legal risks. Therefore, the prosecution of blockchain projects is likely to lead to legal and ethical disputes. Some people think that the practice is to protect the legitimate rights and interests of investors and the market, while others think that it is an abuse of power. This practice may harm the interests of investors. Encrypted assets are a new investment method. Litigation with the characteristics of high risk and high return usually leads to market panic, which leads to large fluctuations in the price of encrypted assets and brings huge losses to investors. Secondly, the regulatory authorities ignore the characteristics of the industry and rely too much on punishment and threats. Any emerging field needs time and space to explore and experiment. Blockchain industry needs an open, inclusive and flexible legal and regulatory environment to encourage innovation and experimentation. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。