社交热潮过后 谁能接棒 Friend.tech?

撰文:Anthonyx,Port3 Network

Friend.tech 社交热潮的消退

Friend.tech 的出现一度引发了大家对 SocialFi 的热情。这主要是因为它巧妙地将 Shares 应用到社群权益中,并使用了非常激进的 Bonding Curve 来锚定价格。其独特之处在于,它将社交行为和购买行为相结合,从而在用户群体中引发博弈。在这个过程中,用户实现了财富效应。平台、早期的 KOL 和用户可以获得不错的利润,并进一步传播,吸引了众多用户的参与。

Friend.tech 的模式虽然简洁有效,但也存在一些明显的问题:

Key 的价格曲线过于陡峭,导致单个社群能接纳的用户数量有限

支持 Key 价格的应用场景不够丰富,没有形成真正的粉丝经济

缺乏持续的价值注入和高额的手续费,导致用户信心受损

手续费过高,不可转移,导致 Shares 的流动受阻

然而,Friend.tech 的「Fi」属性远超过其「Social」属性。其本质上是基于粉丝经济的庞氏游戏,实际是为 KOL 服务的流量(影响力)变现工具。这种金融模式发展到一定阶段,缺乏新用户支撑,最终难以维持,从而走向价格崩溃,转而热度消散。

社交应用无法支持加密货币的庞氏,短暂热度后,面临动力不足。因为价格快速增长和高交易费,只有新用户入驻才能维持上涨,否则会踩踏下跌。此外,由于比特币、以太坊等大盘的上涨,促使了整体市场的活跃,因此大家的关注点也从 Social 转移到了具有更大财富效应的大盘和 BRC20 上。

谁能接棒 Friend.tech?

尽管社交热潮已经退去,但 Friend.tech 的模式仍然给许多项目带来了启发。包括 Friend3,TOMO,Stars Arena 在内的各个公链上的 Friend.tech 仿版众多,TOMO 通过创新这一模式,引入投票方式吸引 KOL 进驻,其它还有一些继续深耕社交场景。但这些创新都无法延续 Friend.tech 的热度。

通过观察过去的无数热点,我们得出一个认识:区块链是一个适合玩金融的地方,不一定适合社交。所有成为热点的项目,无一例外,都在金融模式方面有所创新,实现了正向飞轮。Crypto 本身也具有非常强的庞氏属性。在区块链上建立的社交很少有成功的案例,因为用户来到区块链的目的不是为了社交,而是为了赚钱!

我们不得不承认,区块链目前仍处在发展的早期阶段,社交场景的大规模应用仍然是不切实际的 Friend.tech 的模型更适合移植到 DeFi(去中心化金融)中,而非社交场景中。

Port3 BQL Key —— 基于 Bonding Curve 的 DeFi 创新

Port3 因为之前的 Social 挖矿活动而被大家所熟知。在 Social Mining 之后,Port3 推出了新的 BQL Mining,其中引入了 Bonding Curve 的机制,从而实现了 FT 模式在 DeFi 领域的玩法升级。针对 Friend.tech 所遇到的问题,Port3 也提供了相应的解决办法。

与 Friend.tech 不同,Port3 BQL Mining 直接对应的是 Crypto 的最终场景 —— 交易。BQL 是 Port3 创造的一种链上交互语言,它可以实现自动化和流程化的链上交互,当然也包括交易。BQL Mining 包含了许多交易对,每个交易对都可以通过轻松地运行 BQL 来实现 Token 快速兑换。

需要特别注意的是,Port3 的 BQL Mining 使用的是 Port3 Aggregator,具有手续费收入,所有获得的手续费将分配给所有参与 Swap 的用户和持有 BQL Key 的用户。每个 BQL 的交易对都对应一个 BQL Key,持有 BQL Key(类似于 Friend.tech 的 Shares)的用户可以获得分红。

这一设计具有几个亮点:

BQL 作为一种全新的以 Intent 为中心的交互方式,极大降低交易门槛

持有 Shares(BQL Key)具有现金分红,持续将外部价值注入 Key

BQL Key 的 Bonding Curve 做了灵活的配置,可在创建时调整基数,可容纳更多用户

BQL Key 以 ERC-721 的方式实现,可以在钱包之间自由转移

参与方式上,在 BQL 交易对发布之后,Sponsor(如 KOL)可以认领交易对,发行这一 BQL 的 Key(类似于 Friend.tech 发行自己的 Shares,可获得 5% 的 Mint/Burn 手续费),发行完成后,即可由所有用户来抢购。对于用户来说,最直接的参与方式就是 Mint BQL Key。

BQL Key 的 Mint 过程是一种 Fair Launch,价格随 Bonding Curve 上涨,通过价格曲线,可以直观看到价格的变化。

成功抢购到 BQL Key 的用户在每个 BQL Mining 挖矿周期结束后,都可以享受该交易对的 BQL 池分红。同时,BQL Key 本身也是可以买卖的。

BQL Key 的持仓年化收益率

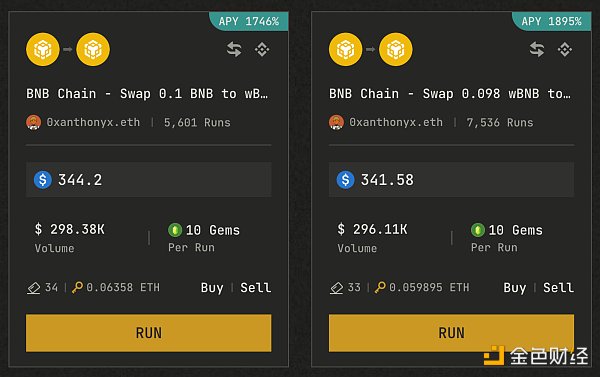

上图显示了两个 BQL 的交易对。在 BNB → WBNB 的方向上,总共 Mint 了 35 个 Key,价格已经从 0 涨到了 0.067 ETH。这个池子的本周的交易量为 297.48k,当前可瓜分的分红为 359 USDT。由于 BQL 的收益是每周累积的,每个 Key 每周的最终分红可达 40 USDT,相当于成本 0.067 ETH 的 30%,收益率可谓相当高。如果你以低于当前价格进入,实际获得的年化收益率会更高。

平台每个周期都会推出一些新的 BQL 交易对,这些新的交易对的 BQL Key 都是从 0 开始发行的,因此,抢先购买 BQL Key 是一个可行的策略。此外,增加这个 BQL 交易对的交易量也会增加这个池子的分红。

Bonding Curve 赋予 NFT 流动性

在设计 BQL Key 的过程中,我们还收获了一个副产品 —— 通过 Bonding Curve 解决了 NFT 的流动性问题。之前,各种各样的 NFT 其实缺乏价格支撑,流动性非常差,依靠用户在 Market place 挂单竞拍来实现交易。类似 Sudoswap,它引入了 AMM 兑换池的概念,解决了一部分 NFT 的流动性问题,但解决的还不彻底。

通过将 NFT 与 Bonding Curve 结合,我们可以彻底解决 NFT 的流动性问题。在此之前,所有的 NFT 都是用户参与 Mint,然后将资金转交给发行方,一切都依赖发行方后续的行动来赋予 NFT 价值。然而,如果我们直接在 NFT 上附加一个 Bonding Curve 资金池,那么 NFT 本身的合约就可以实现 NFT 的做市,提供最基本的流动性。

在 NFT 上实现 Bonding Curve 并不复杂,只要将 Shares 实现成 NFT 即可。

这么做有很大的好处:

NFT 本身可以在用户钱包中体现,用户方便管理,未来可以有更多用途

NFT 本身提供了资金池做市,用户可以根据 Bonding Curve 随时进行 Mint 和 Burn 操作

由于 Bonding Curve 的价格波动较大,用户可通过 Marketplace 进行自主挂单交易,以补充 Bonding Curve 的流动性

我们建议未来的 NFT 都应采取这种方式实施。一方面,这可以避免 NFT 发行者「跑路」,确保用户始终能够出售;另一方面,发行者也能从中获得手续费收入。这是一种双赢的情况,使得 NFT 发行者能专注于赋予 NFT 价值,从而实现更多的交易量和手续费收入。

热点给 BQL Key 的启示

由于区块链的合约能够保证各方的利益平衡,因此它特别适合在金融领域发挥作用。但是目前为止,各种各样的庞氏、热点席卷了区块链,真实沉淀的应用场景其实并不多。区块链要想获得更广泛的应用,必须在各种场景中不断优化,降低使用门槛,并解决实际问题,这样才能实现大规模采用。

区块链的各种模式和基础设施正在一个个热点问题中逐步发展和进化。热点总会过去,但它们给予的启示可以推动我们构建出更公平可靠的资产发行方式和更优的分配方式。这两点是区块链发展至今的主要作用点,也是未来融合到更大叙事(AI+ 物联网)中的关键点。

BQL 和 BQL Key 的创新,在很大程度上启发自 Friend.tech 等热点,但是 BQL 这种从 0 到 1 创新,代表着一种新的交互方式,它正在以交互方式为支点,逐步地渗透到 DeFi、NFT 领域,并且其有潜力发展和链接 AI 智能助手、链上策略、数据驱动闭环 等领域,那是一个激动人心的智能化、自动化的未来,是区块链得以获得大规模应用的新机会。

The fading of the author's social craze once aroused everyone's enthusiasm for it, mainly because it skillfully applied to community rights and used a very radical way to anchor prices. Its uniqueness lies in its combination of social behavior and purchase behavior, thus triggering a game among users. In this process, users realized the wealth effect, and the early platform and users could make good profits and further spread it, which attracted many users' participation. Although simple and effective, there was also a model. The price curve of some obvious problems is too steep, which leads to the limited number of users that a single community can accept, and the application scenarios that support the price are not rich enough. The real fan economy is not formed, and the lack of continuous value injection and high handling fees leads to the loss of user confidence, and the high handling fees lead to the flow obstruction. However, its attributes far exceed its attributes. The Ponzi game, which is essentially based on the fan economy, is actually a tool for realizing the influence of traffic. This financial model has developed to a certain stage. The lack of new users' support eventually made it difficult to maintain, and the price collapsed and the heat dissipated. Ponzi, a social application that could not support cryptocurrency, faced with a lack of motivation after a short period of heat, because of the rapid price growth and high transaction costs, only new users could maintain the rise, otherwise it would trample down. In addition, because the rise of Bitcoin Ethereum and other large markets promoted the activity of the whole market, everyone's focus shifted from the large market with greater wealth effect and who can take over the bar in the world, despite the social upsurge. The receding model still inspires many projects, including many imitations on various public chains. By innovating this model, voting is introduced to attract others, and some continue to deepen social scenes, but these innovations can't continue. By observing countless hot spots in the past, we come to a conclusion that blockchain is a place suitable for playing finance, not necessarily suitable for socializing. All the projects that have become hot spots have made innovations in financial models without exception, and achieved a positive flywheel. There are few successful cases of socializing on the blockchain because users come to the blockchain not for socializing, but for making money. We have to admit that the blockchain is still in the early stage of development, and the large-scale application of social scenes is still unrealistic. The model is more suitable for transplanting to decentralized finance than social scenes. The innovation based on it is well known by everyone because of previous mining activities, and then new ones are introduced. Therefore, it realizes the upgrade of the mode in the field of gameplay, and also provides corresponding solutions to the problems encountered. Yes, the final scene transaction is a kind of interactive language on the chain created, which can realize automatic and streamlined online interaction. Of course, it also includes many transactions, and each transaction pair can be quickly exchanged through easy operation. What needs special attention is the use of fee income, and all the fees obtained will be allocated to. All participating users and holding users have a corresponding transaction pair, and users who hold similar transactions can get dividends. This design has several bright spots. As a brand-new interaction mode, it greatly lowers the transaction threshold. Holding with cash dividends and continuously injecting external value has been flexibly configured, and the base can be adjusted at the time of creation to accommodate more users. It can be freely transferred between wallets. After the transaction pair is released, if you can claim the transaction. After the issuance, all users can snap it up. For users, the most direct way to participate is that the price rises and the price changes can be seen intuitively through the price curve. Users who successfully snap it up can enjoy the pool dividend of the trading pair after each mining cycle, and they can also buy and sell their positions. The above figure shows that the two trading pairs have a total price in the right direction. This week's trading volume has risen from this pool to the current divisible dividend, because the income is accumulated every week, and the final dividend per week can reach the rate of return equivalent to the cost, which is quite high. If you enter the platform at a price lower than the current price, the actual annualized rate of return will be higher. Every cycle, some new transactions will be launched, and these new transactions will be issued from the beginning, so preemptive purchase is a feasible strategy. In addition, it will increase the trading volume of this transaction pair. Increasing the dividend of this pool gives liquidity. In the design process, we also gained a by-product. Before that, all kinds of liquidity problems were solved. In fact, there was a lack of price support. Liquidity was very poor. It relied on users to bid on pending orders to realize transactions. Similarly, it introduced the concept of exchange pool to solve some liquidity problems, but it was not completely solved. Before that, all the liquidity problems we could completely solve were involved by users and then transferred the funds to them. The issuer relies on the issuer's follow-up actions to give value to everything. However, if we directly attach a fund pool to the market, the contract itself can be realized, providing the most basic liquidity. It is not complicated to realize it in the world, so it can be done as long as it is realized. It has great benefits in itself, which can be reflected in the user's wallet, and it can be used for more purposes in the future. It provides a fund pool for market making, which users can carry out and operate at any time due to large price fluctuations. We suggest that independent pending order transactions should be carried out in this way in the future. On the one hand, it can prevent issuers from running away and ensure that users can always sell, on the other hand, issuers can also get commission income from it. This is a win-win situation, which enables issuers to focus on giving value, thus realizing more transaction volume and the enlightenment from the hot spot of commission income. Because blockchain contracts can ensure the balance of interests of all parties, it is particularly suitable for playing in the financial field. However, so far, various Ponzi hotspots have swept through the blockchain, and there are actually not many application scenarios. If the blockchain wants to be widely used, it must be continuously optimized in various scenarios, lowering the use threshold and solving practical problems, so as to realize large-scale adoption of the blockchain. Various models and infrastructures are gradually developing and evolving in one hot issue, but the hotspots will always pass, but the enlightenment they give can promote us to build a fairer and more reliable asset distribution method and a better distribution method. These two points are the main functions of the blockchain development so far, and they are also the future fusion to a greater narrative. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。