一夜暴涨超50% RWA信贷的春天要来了?

昨天追了一下币安的行业热点,今天继续回到我更擅长的RWA行业观察。这段时间真有意思,前几天提到的defi巨头Goldfinch也暴涨了~正好我也在准备相关内容,准备和大家介绍一下RWA在私募信贷的进展。毕竟,也不是所有的加密项目都是空气,也有个别干事的。

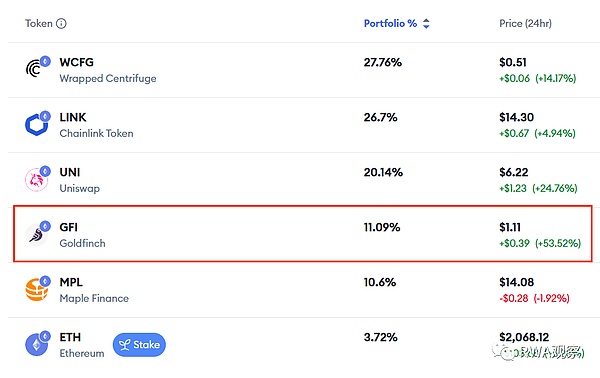

前几天有提到我的RWA行业持仓:当你们忙着打铭文的时候,RWA代币早就悄悄起飞了。当时我还吐槽,大部分代币表现很不错,就是$Uni和$GFI表现不行。

结果今天早上一起来,$Uni和$GFI就起飞了。

尤其是$GFI暴涨53%~

正好最近也在准备向大家介绍RWA赛道中私募信贷的发展,就趁这个机会和大家一起说了吧。

私募信贷是个成熟的行业

中国有句老话:“科技的尽头是放贷”

目前在美帝的私募圈,也有句类似的话:“私募的尽头是放贷”

黑石/高盛/高瓴等一众巨头,都在搞私募信贷业务:

按照定义,私募信贷(Private Debt)是非银行贷款定义的一种资产,其中债券不在公开市场上发行或交易。

在中国,可能有一个更广为人知的名字:“民间借贷”

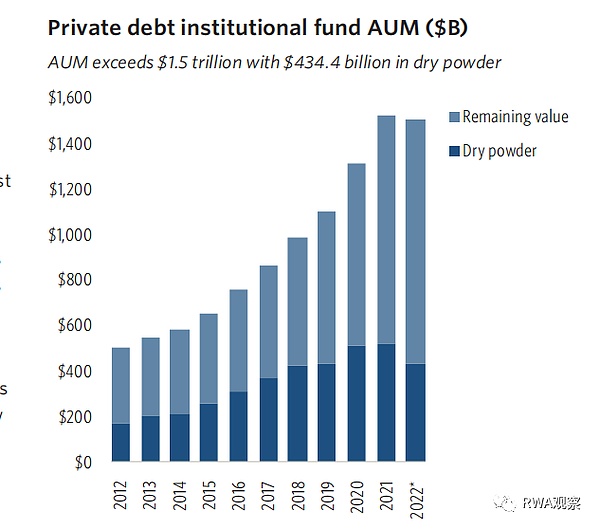

全球私募信贷规模大概1.5万亿美元,和币圈规模差不多大。

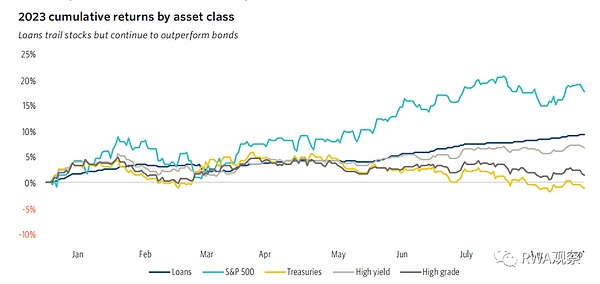

说到回报率嘛,贷款其实一直仅次于股票,算是回报比较高的。

只不过和银行还有公开发行的债券不一样。

在金融领域,私募信贷算是另类资产。

在美帝,只有合格投资者才能参与。

私募信贷:RWA早期核心切入点

根据我在本号开篇关于RWA的6点不靠谱观察提出的观点,RWA可能要从长尾开始做起。

在这里的长尾分为两个维度:

一是从资产类别上,大型企业债/股票等核心资产算头部资产,但算力债/艺术品等边缘资产类型算长尾资产。

二就是发达国家的金融市场算头部资产,亚非拉等各个发展中国家的市场算是长尾市场。

在资产类别上,私募信贷与公募债券不一样,属于长尾资产。

如果能在亚非拉发展中国家做,那还属于长尾市场。

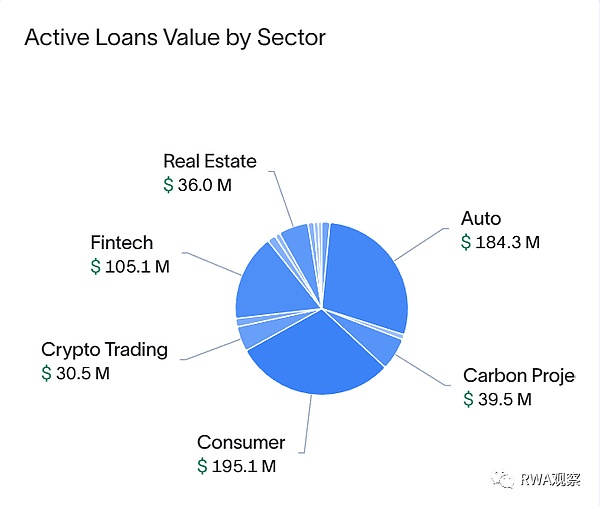

根据RWA行业知名分析网站rwa.xyz的数据,当前全球的代币化私募信贷5.7亿美金,资产类别上仅次于美国国债的7.8亿。

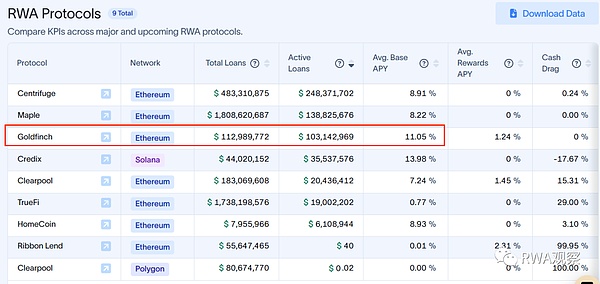

从资产规模上看,今天重点介绍的Goldfinch要排名第三。

Goldfinch是细分赛道样板龙头

Goldfinch 的定位为去中心化的借贷协议。2021 年来,Goldfinch 曾完成过总额高达 3700 万美元的三轮融资(100 万美元、1100 万美元、2500 万美元),其中后两轮均由 a16z 领投,可谓出身名门。

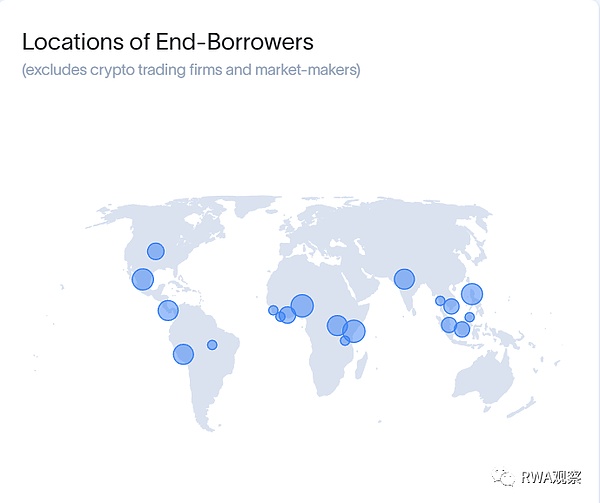

与两年前defi项目大多借款给链上加密投资者不同,Goldfinch目前专注于新兴市场的企业债,通过各种各样的方式在亚非拉找合适的借款人。

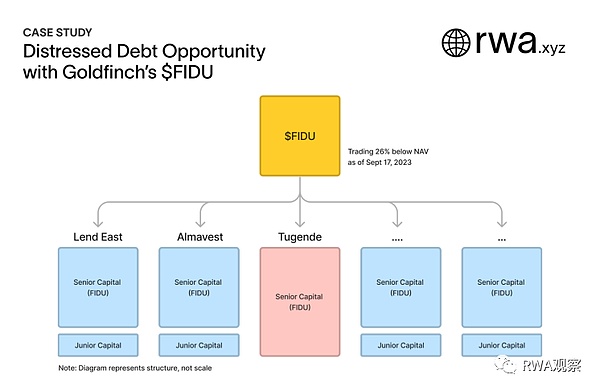

本质上Goldfinch就是一个贷款平台,出资人把钱给到Goldfinch后,会获得一种叫"FIDU”的代币,初始价格是1美金。

然后池子里的自己会借给多个项目,这样除非所有项目都违约,否则投资者不会损失所有本金。

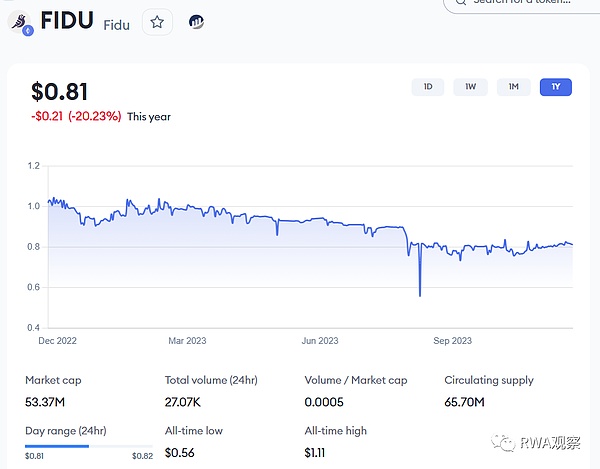

有意思的是,其实投资者不去Goldfinch投资,直接在交易所也可以买到Fidu,而且价格还便宜。

按照最近的价格0.8美金计算,相当于您在投资100元本金后,可以在二级市场上按80元的价格卖掉这笔投资。

是不是看起来很傻?

这主要就是受最近这两笔违约的影响:8月份被非洲的摩托车租赁公司Tugenden产生500万美元坏账,10月份又爆出700万美金的坏账。

持有FIDU的投资者可以选择到期拿回本金和利息,也可以选择未到期的时候提前卖出走人。

但如果你信任Goldfinch的风控能力的话,也可能意味着获取更高的收益。

链上方案尚处早期,风控是短板

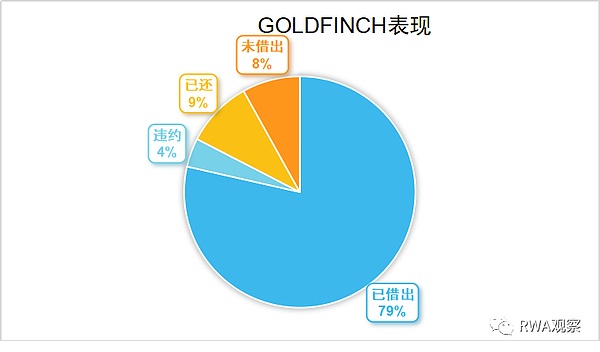

目前Goldfinch大部分资金都处于借出状态,还款金额只占9%,其中违约金额就占了还款金额的一半。

我们来从Tugende这个case详细看看Goldfinch的坏账是怎么形成的。

Tugende 为乌干达和肯尼亚的小企业提供资产支持融资,他们的核心客户群是摩托车出租车司机。当地的摩托车司机向Tugende借钱买车,然后去载客还钱。

其实Goldfinch早在今年2月份就意识到Tugende公司的财务状况有问题。Tugende 给出的理由是:“由于俄罗斯入侵乌克兰以及全球高通胀,近期燃料成本上涨,使司机更难履行其义务,导致租赁取消和由此产生的收回增加(即 Tugende借款人将摩托车归还给公司)。”

经过一系列扯皮的沟通,最后Goldfinch将所有500万美金借给Tugende的本金记录为坏账处理了。

加密支付与信贷,未来互相成就

如果经历过Fintech或者国内互联网金融的人都应该知道,做信贷生意的核心是风控,而风控的核心是数据。

以当前加密场景的覆盖程度,可产生的数据还远远不足以为链上私募信贷业务提供风控服务。

因此当前的私募信贷业务还需要依赖大量传统方式保障风控水平。

但随着加密支付的发展,可能链上会积累越来越多的数据。

这个发展路径其实和当年支付宝/微信支付放贷款的逻辑一样,只不过链上的支付数据是公开的,不会掌握在某几个巨头手中。

对于当下私募信贷的发展情况,我的判断是:

Yesterday, I chased the industry hotspots of Coin Security. Today, I continue to go back to the industry I am good at. It's really interesting to observe this period of time. The giants mentioned a few days ago have also skyrocketed. It's just that I'm also preparing relevant content to introduce the progress of private credit to you. After all, not all encryption projects are air, and some individual officers mentioned my industry positions a few days ago. When you were busy typing inscriptions, tokens had already quietly taken off. At that time, I was still complaining that most tokens performed very well, that is, peace watches. I can't do it now, but it took off together this morning, especially the skyrocketing. I was just about to introduce the development of private equity in the track recently. Let's take this opportunity to tell you about it. Private equity is a mature industry. There is an old saying in China that the end of technology is lending. At present, there is a similar saying in the private equity circle of the United States. The end of private equity is lending. Blackstone, Goldman Sachs, Gao Ling and many other giants are engaged in private equity business. According to the definition, private equity is an asset that is not a bank loan. Bonds are not issued or traded in the open market. There may be a more widely known name in China. The scale of private lending in the world is about one trillion dollars, which is about the same as the size of the currency circle. When it comes to the rate of return, loans have always been second only to stocks, which is a relatively high return, but it is different from banks and publicly issued bonds. In the financial field, private lending is an alternative asset. In the US, only qualified investors can participate in the early core of private lending. According to what I said at the beginning of this number, The viewpoint put forward by unreliable observation may start from the long tail. The long tail here is divided into two dimensions. First, the core assets such as large corporate bonds and stocks are counted as head assets, but the marginal assets such as debt and art are counted as long tail assets. Second, the financial markets of developed countries are counted as head assets. The markets of developing countries such as Asia, Africa and Latin America are counted as long tail markets. In terms of asset categories, private credit is different from public bonds. If it can be done in developing countries in Asia, Africa and Latin America, That still belongs to the long tail market. According to the data of well-known analysis websites in the industry, at present, the world's token private equity credit is billion dollars in asset category, which is second only to the billion dollars of US Treasury bonds. From the perspective of asset scale, the focus of today's introduction is to rank third. The positioning of the leading model of the subdivision track is decentralized loan agreement. Over the years, it has completed three rounds of financing totaling million dollars, of which the last two rounds were led by leading investors, and most of the projects were loaned to chain encryption investors two years ago. Different from the current corporate bonds focusing on emerging markets, finding suitable borrowers in Asia, Africa and Latin America through various ways is essentially a loan platform. After the investors give the money, they will get a token called "Dollar", and then they will lend it to multiple projects in the pool, so that investors will not lose all the principal unless all the projects default. Interestingly, in fact, investors can buy it directly on the exchange without investing, and the price is also cheap according to the recent price of USD. It is equivalent to selling the investment in the secondary market at the price of RMB yuan after you have invested the principal of RMB yuan. Does this seem silly? This is mainly due to the influence of these two recent defaults, which caused bad debts of USD 10,000 by motorcycle rental companies in Africa in the month and USD 10,000 in the month. Investors who hold bad debts can choose to get back the principal and interest when it expires, or sell it before it expires, but if you trust the risk control ability, it may also mean getting higher income above the chain. The case is still in the early stage, and the risk control is a short board. At present, most of the funds are in the state of lending, and the repayment amount only accounts for half of the repayment amount. Let's take a detailed look at how the bad debts are formed to provide asset support financing for small enterprises in Uganda and Kenya. Their core customer base is motorcycle taxi drivers, and local motorcycle drivers borrow money to buy cars and then pay back passengers. In fact, as early as this month, they realized that the company's financial situation is problematic. The reason given is that With Russia's invasion of Ukraine and high global inflation, the recent increase in fuel costs has made it more difficult for drivers to fulfill their obligations, which has led to the cancellation of the lease and the resulting increase in recovery. That is, the borrower returned the motorcycle to the company. After a series of wrangling communication, all the principal loaned by US dollars was finally recorded as bad debts, and encrypted payment and credit have achieved mutual success in the future. Anyone who has experienced or domestic internet finance should know that the core of credit business is risk control, and the core of risk control is current data. The data generated by the coverage of the encryption scene is far from enough to provide risk control services for the online private credit business. Therefore, the current private credit business still needs to rely on a large number of traditional methods to ensure the risk control level. However, with the development of encrypted payment, more and more data may be accumulated in the chain. This development path is actually the same as the logic of Alipay WeChat payment and lending in the past, except that the payment data on the chain is public and will not be in the hands of a few giants. My judgment on the current development of private credit is that 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。