ABCDE:我们为什么要投资DLC.Link

作者:ABCDE 来源:medium 翻译:善欧巴,比特币买卖交易网

DLC.Link利用了由闪电网络的联合创始人在MIT发明的Discreet LogContracts技术,以在以太坊上提供无需信任的与DeFi互通的桥梁,解锁了众多比特币生态的应用场景。

一. BTC生态的最佳打开方式

今年随着Ordinal的火爆,BTC生态随之崛起,既有铭文,BRC20所代表的链上数据流派,也有闪电网络,Stacks等代表的链下数据流派。不少团队开始探索如何把Defi,NFT等基础设施在BTC上复现。然而我们认为,因为缺乏智能合约的支持,BTC天然不适合在链上做复杂应用,其中短期最强叙事依旧是作为投资品的“数字黄金”。同时,比特币的POW网络具有更高的安全性和持久性,使其成为一种有价值的资产类别,我们相信它将继续保持增长。

因此关于BTC+Defi,最好的路径有两条:

找到一个相对安全和效率兼顾的方式,把BTC带入有智能合约的公链(比如以太坊),直接利用其已经完善的Defi基础设施;

通过链下客户端验证与链上UTXO安全挂钩的方式,发行链下资产,比如RGB与Taro。

我们投资的DLC.Link属于上述第一条路径

二. 天下苦WBTC久矣

FTX去年底的暴雷对与整个区块链行业造成了重重一击,这种打击不单单体现在资金与信心上,且对部分业内关键性基础设施有着直接的关联,比如Ren Protocol就因为受到 Alameda“拖累”,缺乏运营资金,直接关停了Ren1.0网络,原本计划的2.0进入了“无限期等待”

renBTC曾经是链上最常用的封装BTC之一,仅排在WBTC之后,而Ren与Multichain(发行了multiBTC)的先后关停,市场再度陷入了中心化WBTC一家独大的局面,去中心化封装BTC只有Threshhold,Badger等苦苦支撑,且市场份额与当年renBTC差距甚远。封装BTC再次陷入一个当年17–18年Dex的尴尬 — 明明是鼓吹去中心化的区块链,交易却99%发生在Cex上。20年Defi Summer Uni与Curve的崛起消除了这个问题,然而Defi里重要的一环,封装BTC却依旧停留在中心化WBTC霸占市场的局面,天下“苦”WBTC久矣。

三. 新的技术 — Discreet Log Contracts

Taproot升级给BTC带来了诸多新的技术扩展可能性,上述提到的Brc20,Inscription,RGB等都是又了Taproot技术做基础才能实现的东西,然而还有一个新的技术没有得到太多关注,却有着非常大的应用潜力,那就是DLC — Discreet Log Contracts。

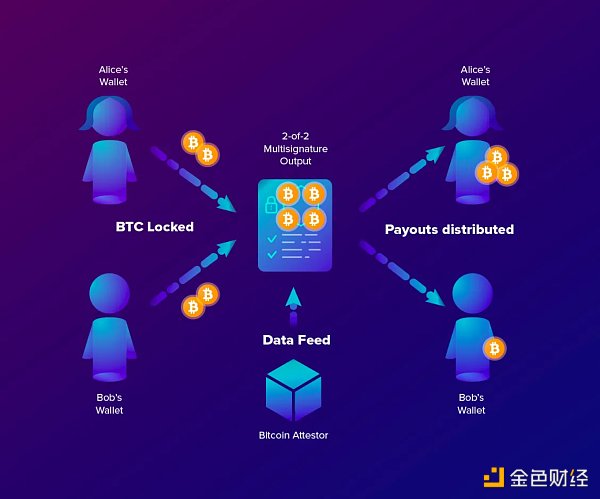

简单来说,你可以把DLC看成一个类似多签的机制。通过配合Taproot升级支持的Point Time Locked Contracts (哈希时间锁HTLC的升级版) 与Schnorr签名技术,DLC可以看做一种低层次的原语,最初目的是帮助在比特币上实现智能合约,然而,它也许更适合被视为比特币上的if-then语句(比特币本身并不是图灵完备的),其中的条件由另一条链上的智能合约的链外数据决定。这解锁了点对点借贷,衍生品合约、体育博彩、预测市场和保险等各种应用。

你也许会疑惑,这跟ETH生态常见的2/3多签有什么区别?最重要的区别便是 — Bitcoin Attestor,也就是预言机这个角色,不知道使用自己数据的具体合约,所以也就无法决定具体的合约的结果,从根本上杜绝了一方与预言机串谋的可能性,提供了几乎等同于BTC自身的安全性。此外,DLC.link 的开创性创新在于将最初 DLC白皮书中提到的 “oracle “进一步拆分为三个部分:oracle层(如Chainlink或Pyth),在区块链上运行的智能合约(如在以太坊上运行的 Defi合约),以及 DLC.link 提供的名为 “Attestor “的组件,它可以从智能合约中获取数据,并将其转化为结算 DLC 的指令。

要知道renBTC当时作为去中心化封装BTC的龙头,主要是依靠Ren网络的MPC节点生成。换句话说,renBTC或者说绝大多数的封装型BTC,其安全性与BTC原链没有任何关系。renBTC的安全与Ren网络挂钩,WBTC更是依赖中心化机构背书,这也是为什么封装BTC一直不愠不火的原因,试想如果你是你有手里有100个BTC的大户,你会放心的为了5,6个点的收益,把手里的BTC都发送到一个不属于你的地址,然后选择“相信”那个地址背后的机构,或是网络么?

Not your keys, not your coins — 绝大多数Bitcoin Holder的“执念”。

而DLC这种类多签+预言机的方式,无论是理性技术层面,还是感性认知层面,都更能取得Bitcoin Holder的好感。

四. DLC.Link解锁的应用场景

整体上,DLC.Link的路线会分为三个大的Milestone,每一步都会在上一步经过市场验证之后,继续向前推进。稳扎稳打,避免急功近利带来的各种安全或是其他方面的隐患。

第一步:原生比特币为抵押品的POC (Proof of Collateral) 稳定币。

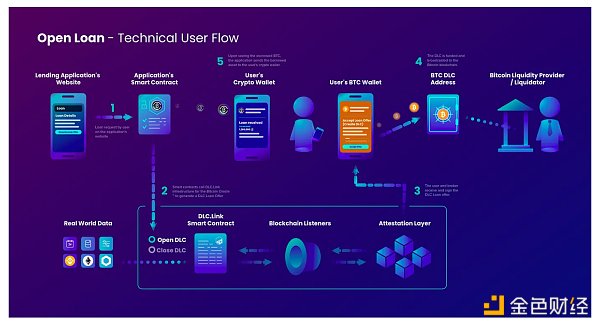

第一步可被视为使用 BTC 铸造稳定币的 “半去中心化 ”的方法。在这种情况下,DLC双方的交易对手都是知名的CeFi机构或Defi 组织(以MakerDAO 为例)和比特币大户持币者。Maker和BTC Holder通过 DLC 签订合同,设定清算标准等参数。BTC在签署后被锁定,Maker在ETH端向持币者铸造DAI。当持币者在指定参数内烧掉 DAI 时,比特币自动解锁并返回持币者的地址。清算时,比特币自动解锁并返回Maker的比特币地址。

DLC.Link前段时间刚刚取得了一个技术上的突破,使得DLC.Link官方可以以管理员的身份作为BTC Holder的Counterpart(对手盘)去sign DLC contract,但清算发生时BTC直接流向清算方(比如Maker)的BTC地址。这样既简化了机构参与整个借贷的过程,又保证了BTC只会流向Holder自己或是贷款机构方,资金在任何情况下都完全不与DLC.Link官方做接触

这一步主要是BTC大户与Cefi机构的参与,属于一种去中心化借贷+中心化清算的风格

第二步:以dlcBTC(erc20)代币的形式参与Defi生态

第一步里的POC扮演的更多是一个用与还款或是中心化清算的“凭证”,这个凭证不可转移。

第二步将会进一步拓展DLC的使用场景,把第一步里的POC变成类似WBTC这种更加通用的,可转移的Erc20

在这种模式下,DLC官方充当了所有前来“存币”的Bitcoin Holder的“对手盘”,同时也是dlcBTC的发行方。与renBTC类似,dlcBTC并不怎么担心脱铆问题,因为一旦发生,购买低价的dlcBTC赎回原价的BTC就变成了一个套利行为。不同的在于,与renBTC任意人可以任意赎回的方式相比,dlcBTC只能由当初存币进来的这些bitcoin Holder去赎回成原链BTC。团队后期有打算设计加入Merchant这个角色(由合作的多家信誉机构与做市商担任),通过只允许 “合格零售商 “和大型机构铸造和烧毁dlcBTC来拓展dlcBTC的“可赎回性”

届时dlcBTC可以像WBTC一样直接参与像是Uniswap,AAVE,Curve等Defi生态,同时依旧保持着近似BTC原链的安全性,这是市面上任何其他解决方案都无法提供的

第三步:完全去中心化的,多种形态的dlcBTC

第三步会是第二步的延伸与进一步去中心化

在延伸层面,当ERC20版本的dlcBTC得到验证后,dlcBTC会继续往Cosmos,Solana,Move等生态拓展,目前已有一些生态前来咨询合作事宜

在去中心化层面,第二步的dlcBTC使用的是偏中心化的Attestor,第三步将会把Attestor完全去中心化。当然,这并不意味这第二步里用户的资金会有风险,与Layer2 Sequencer所面临的的情景类似,中心化更多是为了冷启动时的安全与效率,中心化Sequencer与Attestor的作恶能力都十分有限(主要体现在可以“拒绝”合法交易),且完全没有动机这样做,但长远来看,去中心化依旧是个符合Web3内核与精神的方式

除了上述三步的“主线任务”之外,由于近期Brc20的火爆,基于Ordinal原生的借贷需求,以及目前许多团队正在探索的“BTC Layer2”,DLC.Link也都可以在其中扮演BTC Layer1 点对点借贷+将BRC20带入”BTC Layer2"跨链桥的关键基础设施

DLC.Link已经取得了ChainLink与Stacks的Grant,且正与多家Cefi机构与多条智能合约共链积极讨论如何将原生BTC带入其业务/生态圈。DLC.Link是我们目前市面上看到的,可以把BTC带入其他公链生态圈的技术最优解。我们有理由相信,在下一轮牛市,DLC.Link会成为BTC生态重要的基础设置之一,更多的BTC会通过DLC.Link进入各个生态,为Holder创造更高的价值,解锁更多的可能性。

Shanouba Bitcoin Trading Network uses the technology invented by the co-founder of Lightning Network to provide a bridge of no trust and intercommunication in the Ethereum, which unlocks many application scenarios of Bitcoin ecology-the best way to open the ecology. This year, with the booming ecology, there are both online data schools represented by inscriptions and offline data schools represented by Lightning Network. Many teams have begun to explore how to reproduce the infrastructure on the Internet. However, we think that due to Because of the lack of the support of smart contracts, it is naturally not suitable for complex applications on the chain. Among them, the strongest short-term narrative is still digital gold as an investment. At the same time, the network of Bitcoin has higher security and durability, making it a valuable asset class. We believe that it will continue to grow, so there are two ways to find a relatively safe and efficient way to bring it into the public chain with smart contracts, such as Ethereum, and directly use its perfect infrastructure to pass through the chain. Issuing the assets under the chain by linking the authentication of the lower client with the security of the chain, for example, the assets invested by us belong to the above-mentioned first path. The thunderstorm at the end of last year caused a heavy blow to the whole blockchain industry. This blow is not only in terms of funds and confidence, but also directly related to some key infrastructures in the industry. For example, because of the lack of operating funds, the network was directly shut down and the original plan entered an indefinite waiting period, which used to be one of the most commonly used packages in the chain. After that, the market was shut down one after another, and the centralized packaging was once again in a monopoly situation. The decentralized packaging had to be supported hard and the market share was far from that of that year. The packaging was once again in an embarrassment of that year. Obviously, the blockchain transaction that advocated decentralization took place last year and the rise of it eliminated this problem. However, the important part of packaging remained in the situation of centralized occupation of the market, and the world suffered for a long time. Three new technological upgrades brought many new technologies. The possibility of expansion, etc. mentioned above are all things that can only be realized by technology. However, there is a new technology that has not received much attention but has great application potential. In short, you can regard it as a mechanism similar to multi-signing. By cooperating with the upgraded version of hash time lock and signature technology supported by upgrade, it can be regarded as a low-level primitive. The original purpose is to help realize smart contracts on Bitcoin. However, it may be more suitable to be regarded as sentence bits on Bitcoin. The currency itself is not Turing complete, and the conditions are determined by the off-chain data of the smart contract on another chain, which unlocks various applications such as peer-to-peer lending derivatives contracts, sports betting forecasting markets and insurance. You may wonder what is the difference between this and the ecological common multi-signing. The most important difference is that the role of the Oracle does not know the specific contract using its own data, so it is impossible to determine the outcome of the specific contract, which fundamentally eliminates the possibility of collusion between one party and the Oracle. It provides almost the same security as itself. In addition, the pioneering innovation lies in further dividing the original white paper into three parts, such as the smart contract running on the blockchain, such as the contract running on the Ethereum, and the provided component named, which can obtain data from the smart contract and turn it into a settlement instruction. You know, at that time, as the leader of decentralized packaging, it mainly relied on the node generation of the network, in other words, most of the packaging types were safe. The security link with the network that has nothing to do with the original chain relies on the endorsement of centralized institutions, which is why the packaging has never been successful. Imagine that if you are a big family with a hand, you will feel at ease to send everything in your hand to an address that does not belong to you for the benefit of a point, and then choose to trust the institutions or networks behind that address. This kind of multi-signing Oracle machine is more accessible in both rational technology and perceptual cognition. The overall route of the unlocked application scenario will be divided into three major steps, and each step will continue to move forward after the previous step has been verified by the market, so as to avoid various security or other hidden dangers brought about by quick success and instant benefit. The first step is to stabilize the currency with the original bitcoin as collateral. The first step can be regarded as a semi-decentralized method of casting stable currency. In this case, the counterparties of both parties are well-known institutions or organizations, and they think that the case is a large bitcoin holder and signed. After the signing of the contract, the parameters such as the settlement standard are locked in the end and cast to the holder. When the holder burns within the specified parameters, the bitcoin automatically unlocks and returns to the holder's address. When clearing, the bitcoin address automatically unlocked and returned has just made a technical breakthrough some time ago, so that the official can act as an administrator, but when clearing occurs, it directly flows to the liquidator's address, which not only simplifies the process of institutions participating in the whole lending, but also ensures that only. Under any circumstances, the funds that will flow to themselves or the lending institutions will not be in contact with the government at all. This step is mainly about the participation of large households and institutions, which belongs to a style of decentralized lending and centralized liquidation. The second step is to participate in the ecology in the form of tokens. In the first step, it plays more of a voucher for repayment or centralized liquidation. This voucher is not transferable. The second step will further expand the use scenario and turn the first step into a more general and transferable one. The lower authorities acted as the counterparties for all who came to deposit money, and they were also the issuers and similar ones. They were not worried about the problem of peeling off, because once the original price was redeemed by buying low prices, it became an arbitrage behavior. The difference is that compared with the way that anyone can redeem it at will, the original chain can only be redeemed by those who deposited money at the beginning. The team later planned to design and join this role, which was played by a number of cooperative credit institutions and market makers. Only qualified retailers and large institutions were allowed to cast and cast. The redeemability of burning to expand can be directly involved in the ecological environment as usual, while still maintaining the security similar to the original chain. This is the third step that no other solution in the market can provide. The third step of complete decentralization will be the extension and further decentralization of the second step. At the extension level, when the version is verified, it will continue to expand to the ecological environment. At present, some ecological issues have come to consult and cooperate. At the decentralization level, the second step uses decentralization, and the third step will completely decentralize. Of course, this does not mean that users will be completely decentralized in this second step. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。