金色观察 | 年内涨超14倍 Injective的叙事到头了吗

作者:Climber,比特币买卖交易网

回望2023年,有多少人会因错过Injective而拍断大腿?

11月30日,OKX宣布上线Injective (INJ) ,成为继Binance、HTX、Bitget之后又一接纳该项目的主流CEX。而在今年内,Injective 币价从1.25美元上涨至近期高点19.20美元,涨幅高达1436%。相较于其它Layer1来说可谓遥遥领先。

加密市场不乏百倍、千倍公链项目,而在熊市之下还能取得超过14倍涨幅的Injective确实值得关注。但是就涨幅力度来说现阶段已成高位,INJ价格也在11月11日之后再未有所突破。此外,头部CEX OKX宣布上线的利好也并未刺激到INJ币价。

那么这些现象是否意味着Injective的市值空间已经触达边际?还是说眼下只是瓶颈期,冲破后即是星辰大海?

狂飙的Injective

2023年加密市场依旧在熊市行情中挣扎,大多数主流公链项目依然在TVL山脚仰望旧时顶峰。而Injective却在今年接连走出年内新高,币价一度到达19.20美元。距离2021年5月牛市高点的25.30美元仅差一步之遥。

据CoinMarketCap数据显示,Injective币价在今年初约为1.25美元。此后一路上涨至今,最终在11月11日取得年内新高的19.20美元。截止目前INJ涨幅已达1436%,远超竞争对手的个位倍数涨幅。

并且Injective的市值也以15.16亿美元上升至该平台代币排行榜的第41位,领先OP、AAVE和MKR.

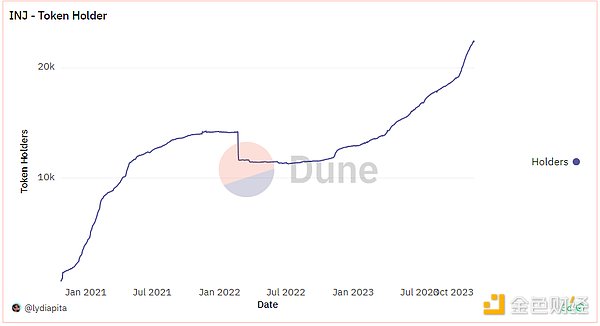

另根据Dune用户@lydiapita给出的Injective项目代币持有数据及分布可以看出,自2021年1月起至今总体呈现持有人数增长态势,并且在2023年初开始出现爆发式增长,人数约从12K上涨至24K。

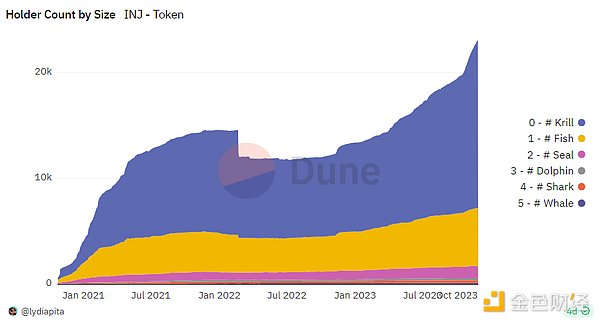

而在INJ的持仓主体分布上,巨鲸占据半数,这说明该币有大户托底。而散户数量约占三分之一,说明INJ不乏散户投资者的关注和市场热度。

此外,加密研究人员Miracle Abel表示,截至 2023 年 10 月,Injective已处理超过 3 亿笔交易,巩固了其在 DeFi 领域的领导者地位。

不过,在DeFiLlama上Injective的TVL排名颇为靠后,仅以1515万美元排名62位。这表明该公链在用户群体数量上依然有待拓展,需要多开发繁荣生态应用才能拥有更多链上存储资产。

暴涨14倍,Injective凭什么?

Injective 是基于Cosmos-SDK 构建的Layer1网络,利用 Ignite(前身为 Tendermint)权益证明共识机制来实现即时确定性的安全交易,支持 DeFi 类应用在其链上搭建。

Injective 提供即插即用模块,包括订单簿和衍生品交易模块,使任何开发人员都可以启动金融应用。外加智能合约功能,能使开发人员轻松地使用领先的协议构建复杂的应用程序。

简言之,Injective 可在多个区块链网络上实现安全、快速和互操作的交易。凭借为金融构建的快速的区块链和即插即用的 Web3 模块,Injective 的生态正在塑造具有高度互操作性、可扩展性和真正去中心化的应用金融系统。

能够在熊市中平稳涨超14倍,Injective的年内辉煌成绩背后有着多重因素。

首先,Injective获得了大量应用、众多知名做市商和基金的支持,如 Cumberland、QCP Capital、CMS 和 Bitlink等都是该项目的早期支持者,并为协议本身的初始设计和开发提供了建议。

而其投资背景也十分强大,资方包括Binance Labs、Pantera Capital、NBA达拉斯独行侠(原小牛)老板Mark Cuban、Jump Crypto等。并且分别在2020年7月种子轮融得260万美元、2021年4月战略轮获资1000万美元以及2022年8月融资4000万美元。总融资高达5260万美元。

其次,2023年Injective的爆发离不开此前一年项目方的积极布局。

自从2021年Q4 Injective主网上线以来。在2022年的Q1 Injective 发布了跨链桥 V2版本,测试网上启动了CosmWasm 智能合约层;Q2 Binance宣布支持Injective(INJ)网络升级及硬分叉;Q3 CosmWasm 智能合约层正式上线、二元期权模块上线、跨链账户启用;Q4 Wormhole 跨链桥集成至Injective、Injective集成法币入口。

由此可见,Injective正是通过与Binance深度绑定,才能在其资源的大力扶持下一步步完善发展,最终规模化、体系化、成品化。

而在今年,Injective依然没有停止快速发展的步伐。

本月初,Injective 宣布与 Kava 完成集成,扩大对USDT等稳定币资产的访问,即USDT 可从 Kava 直接桥接到 Injective 的 IBC。

10月,Injective与谷歌云达成合作,将Web3 财务数据集成到Google Cloud BigQuery。Injective的核心链数据将可以通过Google Cloud的独家数据共享平台Analytics Hub在 BigQuery 中访问。

8月,Injective宣布升级代币经济学,大幅增加了每周销毁INJ的数量,从而减少了整体代币供应量,主动减缓了代币通货膨胀问题。

今年初, Injective推出 1.5 亿美元生态系统基金,以加速互操作性基础设施和 DeFi 的采用。而这笔笔基金得到了Pantera和 Jump等前投资者以及 Kraken Ventures、Kucoin Ventures、Delphi Labs、Flow Traders、Gate Labs和 IDG Capital 的支持。

近期,Injective 也和 Google Cloud 联手推出了 Injective Illuminate黑客松活动。奖金池为 10万美元,以鼓励开发者在 DeFi、NFT Fi、SocialFi、GameFi、工具等领域构建项目。

此外,Injective在项目定位上为DeFi 和衍生品的 L1 解决方案。而在加密熊市开启后,各大CEX的现货交易量急剧下滑,同时头部交易所顾全名誉和业绩只能通过上线或拔高代币杠杆的方式增加交易量。

代表性事件为Binance近期多上线一些知名项目如BLUR、ETHW、BIGTIME等,而专注于跟单交易业务的Bigtime也因衍生品交易而保持了整体业绩的增长,同时OKX也在扩大原有的代币交易范围。

由此可见,DeFi的玩法已经渐有升级趋势,这既是加密行业发展的大势,也是投资者现时的需要。因此,Injective的产品内容刚好满足了市场的需求,填补了原有产品协议不够丰富、完善的缺陷。

还有上涨空间吗?

前文提到,Injective币价在11月11日到达高点的19.20美元后即再未能突破新高,截止撰文INJ在16美元附近徘徊已有20天。而昨日上线OKX的消息从币价走势来看显然影响不大,这究竟是OKX 交易所本身的上币效应偏弱还是Injective上涨空间已尽?市场上给出了不同的看法。

网友@miyoga进击的鸭鸭的认为,OKX上线INJ意味着OKX已经入局Injective生态项目,OKX钱包也会支持Injective Dapps,而Injective 上的NFT项目也会陆续上架到OKX钱包上来。总的来说是看好INJ的未来。

而对于Injective的未来,早在10月初就有市场分析人士@苏白Vediez mieast指出,Injective诞生于牛市顶峰,但是成长期却遇到了熊市,很多生态项目没有扩战开来,但依然有着不错的基础设施。未来随着DeFi和NFT的发展,至少也会有10倍的回报。

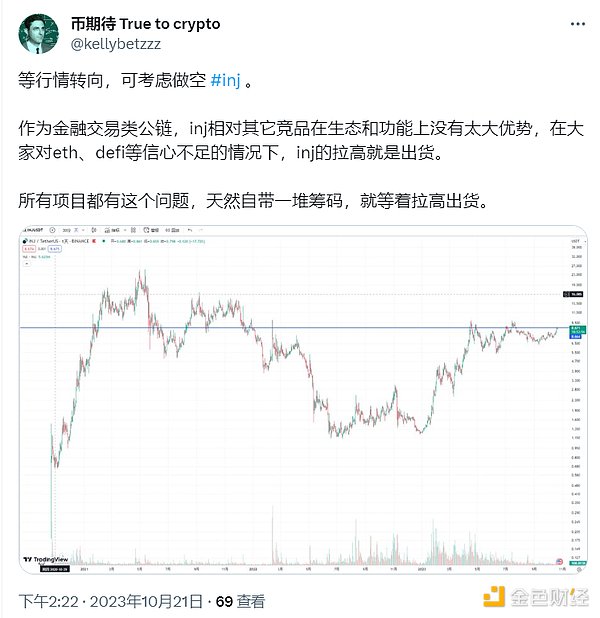

不过,也有网友表示当前INJ价格已经太高,OKX上币也并未带飞,所以势必要回调一波,不妨继续等待观察。而@币期待 True to crypto此前则尖锐指出,作为金融交易类公链,Injective相对其它竞品在生态和功能上没有太大优势,在大家对ETH、DeFi等信心不足的情况下,INJ的拉高就是出货。

小结

相较于以太坊、Solana、Polygon或者Arbitrum、Optimism、Starknet等明星项目公链,Injective的市场讨论度和出场度显然并没有那么高。不过随着INJ市值的水涨船高,项目的知名度也在一点点扩散。《福布斯》“Under 30 Finance 2024”榜单上已经纳入了Injective Labs 创始人的名字。

此外,加密市场上的王者大多是以出人意料的方式出现,所以不妨继续多加观察Injective的发展,以免在将来拍断另外一条腿。

Author Bitcoin Trading Network Looking back, how many people will break their thighs because they missed it in 2008? It was announced that the project was launched on March and became the mainstream after that. In this year, the currency price rose from the US dollar to the recent high point. Compared with other projects, the US dollar rose as much as 100 times as much as the public chain project in the encryption market, but it is really worthy of attention that it can still achieve more than 100 times in the bear market. However, in terms of the intensity of the increase, the price has reached a high level at this stage, and there has been no breakthrough since June. The good news that the head announced the launch did not stimulate the currency price, so does this mean that the market value space has reached the marginal point, or that the encryption market is still struggling in the bear market after the bottleneck period is broken? Most mainstream public chain projects are still looking forward to the old peak at the foot of the mountain, but they have stepped out of the new high this year and once reached the US dollar, which is only one step away from the US dollar at the high point of the bull market in February. According to the data, the currency price is about US dollars at the beginning of this year. Up to now, it has finally reached a new high of USD in the year on March. Up to now, the increase has far exceeded the single-digit increase of competitors, and its market value has also risen to the first place in the platform's token list with billions of USD. In addition, according to the data and distribution of project tokens given by users, it can be seen that the total number of holders has increased since June, and the number of holders has exploded since the beginning of the year, which shows that giant whales account for half of the positions. The fact that a large number of retail investors hold the bottom and the number of retail investors accounts for about one third shows that there is no shortage of retail investors' attention and market enthusiasm. In addition, encryption researchers say that they have handled more than 100 million transactions by the end of March, consolidating their leading position in the field, but their ranking in the world is quite low, ranking only 10,000 US dollars. This shows that the public chain still needs to be expanded in terms of the number of users, and it needs to develop more prosperous ecological applications to have more online storage assets soaring. Why is it based on the network built to use the predecessor as the right? Secure transaction support applications that benefit from proving consensus mechanism to achieve real-time certainty are built on their chains, providing plug-and-play modules, including order books and derivatives trading modules, so that any developer can start financial applications, and the smart contract function can make developers easily use leading protocols to build complex applications. In short, safe, fast and interoperable transactions can be realized on multiple blockchain networks. With the fast blockchain and plug-and-play modules built for finance, The state is shaping a highly interoperable, scalable and truly decentralized application financial system. There are multiple factors behind the brilliant achievements of the year in the bear market. First of all, it has won the support of a large number of well-known market makers and funds, such as Hehe, who were early supporters of the project and provided suggestions for the initial design and development of the agreement itself, and its investment background is also very strong. The employers include Dallas maverick, the original calf boss and so on, and they merged in the seed round in February respectively. The annual strategic round of $10,000 was funded by $10,000 and the annual financing amounted to $10,000. The outbreak of the following year could not be separated from the active layout of the project party in the previous year. Since the main online in, the cross-chain bridge version test was released in, and the smart contract layer was announced to support the network upgrade and the hard fork smart contract layer was officially launched. The binary options module went online, and the cross-chain bridge account was enabled to integrate into the integrated legal tender entrance. This shows that it is through deep binding that its resources can be large. We will support the next step to improve and develop the final large-scale systematization and finished products, but the pace of rapid development has not stopped this year. At the beginning of this month, we announced and completed the integration, expanded the access of equivalent stable currency assets, and reached a cooperation with Google Cloud from the month of direct bridge connection, and integrated the financial data into the core chain data. The exclusive data sharing platform announced the upgrade of token economics in the month of mid-visit, which greatly increased the number of tokens destroyed every week, thus reducing the overall token supply and actively slowing down the generation. Currency inflation: At the beginning of this year, an ecosystem fund of $100 million was launched to accelerate the adoption of interoperability infrastructure, which was supported by former investors such as Hehe. Recently, a bonus pool of $10,000 was jointly launched with Hehe to encourage developers to build projects in tools and other fields. In addition, in terms of project positioning, after the opening of the encrypted bear market, the spot trading volume of major companies dropped sharply, and at the same time, the head exchange could only pass the reputation and performance. On-line or raising the leverage of tokens increases the transaction volume. Representative events focus on documentary transactions for some well-known projects such as the recent launch, while maintaining the overall performance growth due to derivative transactions. At the same time, it is also expanding the original token trading scope. This shows that the gameplay has gradually upgraded, which is not only the general trend of the encryption industry development, but also the current needs of investors. Therefore, the product content just meets the market demand and fills the gap that the original product agreement is not rich and perfect Is there still room for growth? As mentioned above, the price of the currency reached a high of US dollars on January, and then it failed to break through the new high. As of the deadline, the author has been wandering around the US dollar for days, but the news of going online yesterday obviously has little impact from the trend of the currency price. Is this whether the exchange's own coin-adding effect is weak or the rising space has been exhausted? Different opinions are given in the market. The netizens think that going online means that the ecological projects that have entered the market will also be supported, and the projects that have gone up will be put on the wallet one after another. As early as the beginning of the month, Su Bai, a market analyst, pointed out that it was born at the peak of a bull market, but it encountered a bear market in its growth period. Many ecological projects have not expanded, but they still have good infrastructure. In the future, with the development of peace, there will be at least double returns, but some netizens said that the current price is too high and the currency has not taken off, so it is necessary to continue to wait and see, while the currency expectation was pointed out sharply as a public chain of financial transactions. Its competing products don't have much advantage in ecology and function. In the case of insufficient peer confidence, it is the summary of shipment. Compared with the public chain of Ethereum or other star projects, the market discussion and appearance are obviously not so high. However, with the rising market value, the popularity of the project has also spread a little. The name of the founder has been included in the Forbes list. In addition, most of the kings in the encryption market have appeared in unexpected ways, so it is advisable to continue to observe the development so as not to break another leg in the future. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。