为何手续费的飙升将加速BTC二层方案的落地?

在正常市场情况下,BTC本身的高价格造就了高昂的Gas,而Ordinals和其他NFT的火热影响了比特币网络的多个方面。最近,大家注意到网络上的交易费用激增,创下了网络上比特币费用的新纪录。

那么,这种涨势究竟是如何发生的呢?在这篇文章中,我们将详细解析比特币交易费用是什么,在比特币生态系统中的作用以及对二层的发展有何影响。

交易费用基础知识

交易费用是大多数区块链网络(包括比特币)的基本组成部分,一般指用户在网络上启动交易时支付这些费用。在比特币的生态系统中,这些费用由矿工收取,作为他们维护和保持网络完整性和功能的激励。

矿工不仅因其努力挖矿而赚取交易费用,还会获得预定的区块奖励。BTC的这种模型设计建立了用户和矿工之间的共生关系。用户依赖于矿工来确保网络的平稳运行和安全性,而矿工,尤其是随着时间的推移区块奖励减少,越来越依赖交易费用作为挖矿的收入来源,使挖矿成为持续有利可图的事业。

这些交易费用的结构是动态的和可变i的,主要受网络使用情况的影响。随着网络使用增加,交易费用往往会上涨。这是因为用户愿意支付更多的费用,以确保他们的交易能够迅速地被处理并包含在一个区块中。

最近,比特币网络上交易费用的显著上升部分归因于创新,如铭文,更确切讲是生态应用的爆发。这一趋势突显了区块链网络的演变性质,暴露了生态持续创新和用户增量的困境,凸显调整和优化以平衡用户体验和网络可持续性的重要性。

交易费用和比特币减半

比特币四年减半一次,此过程旨在减缓比特币生态系统的通货膨胀速度。例如,矿工当前每个区块获得6.25 BTC的奖励,但在计划于2024年的下一次减半事件后,此奖励将减少至每个区块的3.125 BTC。这种减半机制确保了逐渐减少新比特币引入流通的速度,模仿了像黄金这样的贵金属的稀缺驱动升值模型,这是比特币独有的吸引许多用户和投资者的特点。

鉴于区块奖励的减少,比特币网络的增长和健壮性变得越来越关键。随着区块奖励的减少,矿工对交易费用作为收入来源的依赖性变得更加明显。这种从区块奖励向交易费用过渡作为矿工的主要经济激励的情景是比特币的创造者中本聪所预期的。

在比特币白皮书中,中本聪设想了一个未来,新比特币的创造最终会停止,阻止进一步的通货膨胀。在这个设想的未来中,矿工将主要通过交易费用维持其运营,确保比特币网络的长期经济可行性和安全性。这种远见强调了在减少通货膨胀和保持矿工激励之间找到平衡的复杂性,以确保比特币作为分散的数字货币的稳健性和稳定性。

是什么导致了最近费用的大幅增加?

在11月,比特币网络上的活动显著增加,主要是由Ordinals激增引起的,进而引起比特币交易费用的显著上升。这种网络活动的增加与对区块空间需求的需求有关,是比特币经济模型的一个基本方面。

这个例子发生在2023年11月18日,当天创下了单日交易费用创纪录的492万美元,主要归因于这些铭文。所有铭文费用的总费用总计为9800万美元。这一费用激增不仅反映了人们对比特币铭文的不断增长的兴趣和活动,而且也凸显了网络的创新力、互动性和赚钱效应。

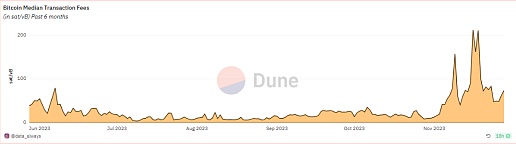

以下来自Dune上的@data_always的图表突显了11月份费用的急剧增加。例如,与11月1日相比,11月16日的费用峰值增加了1500%以上。

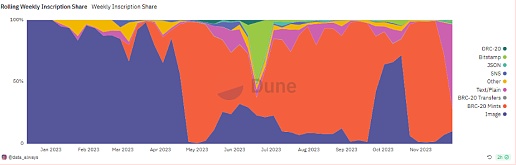

与此同时,BRC-20代币,特别是像ORDI这样的代币,也越来越受欢迎。这些代币在主要加密货币交易所如币安上市,更大地吸引了对这些新数字资产的关注。对BRC-20代币的持续兴趣进一步推动了网络的活动,可以通过下面的图表可视化。在峰值时,超过97%的铭文归因于BRC-20铸造。

在这次11月激增之前,比特币矿工每天平均从交易费用中获得21.48 BTC。然而,在此期间的高峰时期,每天从交易费用中获得的日收入激增至314 BTC,显示出显著的增长。尽管这些数字已经有所缓和,但仍然显著高于11月之前的水平,目前平均每天约81 BTC。这次对交易费用的显著增加表明了新应用和代币对比特币网络的影响,突显了其经济和运营景观的演变性质。

比特币L2的日益重要性

随着比特币交易费的激增,对于普通用户来说,比特币主链几乎变得无法使用,期望未来用户支付50美元来使用BTC是不现实的。所以,BTC二层解决方案变得越来越关键,有望在未来几年处理比特币交易的重要部分,理想情况下将超过比特币的第一层的交易量。

在BTC交易费用成为矿工的之后,必须要有足够的交易量才能维持网络安全运行。那么,只有满足商业和增量用户的需求,才能保证未来网络正常运运转,目前来看推展方法就是Layer2,是既定规则下的产物。

然而,与它们不断增长的重要性相比,比特币第二层解决方案仍然资金不足,特别是与以太坊第二层的资金和市值相比。这种差距突显了在比特币第二层解决方案中需要增加投资和发展的必要性。

比特币第二层解决方案:

目前,比特币第二层解决方案是为了解决主网拓展性的缺陷:可以分为非兼容EVM和兼容EVM。非兼容性方案包括像闪电网络、Lsk等技术,是以特定的目的为主,比如支付,但这些年的发展并为有明显的突破,技术门槛和使用门槛仍然是大问题。

此外,就是兼容EVM的解决方案。行业迫切期待着降低比特币在第一层和第二层之间运动信任假设的新解决方案,比如BEVM。

鉴于各类方案当前的状态,BEVM解决方案可以说具有最大的增长潜力。

足够去中心化:BEVM采用Taproot实现1000验证节点托管,通过质押BTC来保证托管资产小于质押资产,进而保证网络安全性,以实现去中心化。

商业端建设:支持最方便的生态迁移。当下ETH有很多成功的案例,比如Defi和Gamefi,这些项目如果无缝迁移到BTC二层,将实现基础的应用爆发。目前,BEVM的生态中已经配备Defi四件套,已经为爆发做好准备。

低用户门槛:ETH生态价值虽然只有BTC的三分之一,但持币地址已经超过数千万。兼容EVM也就意味着用户的迁移,这将为BTC带来大量的基础用户。

实际上,开发者对BTC生态日益增长的兴趣是这一需求的积极指标。现在正是在这个领域进行更多创新的时机,社区对比特币第二层的未来充满信心,认为它们将不断发展以满足比特币网络的挑战和需求。

比特币交易费飙升给我们带来的教训

比特币交易费的激增是网络用户增长的表现,不仅展示了比特币功能的扩展,还揭示了网络拥堵和交易成本上升的挑战。随着比特币减半减少区块奖励,对交易费的日益依赖凸显了在保持网络完整性和可访问性的同时需要一个可持续的经济模型。

这种情况把比特币的二层解决方案置于聚光灯下,将其视为缓解主网络限制的重要工具,特别是在高价值、高交易量的小额交易方面。比如BEVM平台有望在未来处理比特币交易的重要部分,确保网络在扩展时的可行性。

然而,与以太坊的同类产品相比,比特币第二层解决方案目前的可行性是一个挑战,也是一个机遇。解决这一差距对于在比特币生态系统中培育创新和可扩展性至关重要。

Under normal market conditions, its own high price has caused high prices, which has affected many aspects of the bitcoin network. Recently, it has been noticed that the transaction cost on the network has soared, setting a new record for the bitcoin cost on the network. So how did this increase happen? In this article, we will analyze in detail what the bitcoin transaction cost is, its role in the bitcoin ecosystem and its impact on the development of the second floor. The transaction cost is the basic knowledge of most areas. Blockchain network, including the basic component of Bitcoin, generally means that users pay these fees when they start a transaction on the network. In the ecosystem of Bitcoin, these fees are collected by miners as an incentive for them to maintain and maintain the integrity and function of the network. Miners not only earn transaction fees because of their efforts in mining, but also get predetermined block rewards. This model design establishes a symbiotic relationship between users and miners. Users rely on miners to ensure the smooth operation and security of the network, especially miners. However, with the passage of time, the reward of blocks is decreasing and more and more dependent on transaction costs as the source of income for mining, making mining a sustainable and profitable business. The structure of these transaction costs is dynamic and variable, which is mainly affected by the network usage. With the increase of network usage, transaction costs tend to rise. This is because users are willing to pay more fees to ensure that their transactions can be processed quickly and included in a block, and the transaction costs on the Bitcoin network have increased significantly recently. This trend, which is attributed to innovation, such as inscriptions, or more precisely the outbreak of ecological applications, highlights the evolutionary nature of blockchain networks, exposes the dilemma of ecological continuous innovation and user increment, and highlights the importance of adjustment and optimization to balance user experience and network sustainability. Transaction costs and bitcoin are halved. Bitcoin is halved once every four years. This process aims to slow down the inflation rate of bitcoin ecosystem, for example, miners are rewarded for each block at present, but this award is given after the next halving event planned in. This halving mechanism of reducing incentives to each block ensures that the speed of introducing new bitcoins into circulation is gradually reduced, imitating the scarcity-driven appreciation model of precious metals such as gold, which is a unique feature of bitcoin that attracts many users and investors. In view of the reduction of block incentives, the growth and robustness of bitcoin network has become more and more critical. With the reduction of block incentives, miners' dependence on transaction costs as a source of income has become more obvious. The main economic incentive scenario for miners is what Satoshi Nakamoto, the creator of bitcoin, expected. In the white paper on bitcoin, Satoshi Nakamoto envisioned a future in which the creation of new bitcoin would eventually stop to prevent further inflation. In this envisaged future, miners would mainly maintain their operations through transaction costs to ensure the long-term economic feasibility and security of the bitcoin network. This vision emphasized the complexity of finding a balance between reducing inflation and maintaining miners' incentives to ensure that bitcoin could be used as a tool. What is the stability and stability of decentralized digital currency that has led to the recent sharp increase in costs? The significant increase in activities on the monthly bitcoin network is mainly caused by the surge, which in turn leads to a significant increase in bitcoin transaction costs. This increase in network activities is related to the demand for block space, which is a basic aspect of the bitcoin economic model. This example occurred on the day of the month, which set a record transaction cost of 10,000 US dollars, mainly due to the cost of all these inscriptions. The total cost is $10,000, which not only reflects people's growing interest and activities in bitcoin inscriptions, but also highlights the innovative, interactive and money-making effects of the network. The following chart from above highlights the sharp increase in monthly expenses, for example, the peak cost of the month and day has increased compared with that of the month and day. At the same time, tokens, especially tokens like this, are becoming more and more popular, and the listing of these tokens on major cryptocurrency exchanges, such as Currency Security, has attracted these new figures more and more. The concern about word assets and the continuous interest in tokens have further promoted the activities of the network. The inscription that exceeded the peak can be visualized through the following chart. It is attributed to casting. Before this month's surge, bitcoin miners earned an average of daily transaction fees. However, during the peak period of this period, the daily income from transaction fees surged to show a significant increase. Although these figures have eased, they are still significantly higher than the level before the month. At present, the average daily transaction fees are about this time. The significant increase of bitcoin shows that the impact of new applications and tokens on bitcoin network highlights the evolving nature of its economic and operational landscape. With the rapid increase of bitcoin transaction fees, it is unrealistic for ordinary users to expect future users to pay dollars to use the main chain of bitcoin, so the two-tier solution becomes more and more critical, and it is expected that the important part of bitcoin transactions will be handled in the next few years, which will ideally exceed the transaction volume of the first tier of bitcoin. After the transaction cost becomes a miner, there must be enough transaction volume to maintain the safe operation of the network. Then only by meeting the needs of commercial and incremental users can the normal operation of the future network be guaranteed. At present, the promotion method is the product under the established rules. However, compared with their growing importance, the second-tier solution of Bitcoin is still underfunded, especially compared with the capital and market value of the second-tier solution of Ethereum. This gap highlights the need to increase in the second-tier solution of Bitcoin. The necessity of increasing investment and development: the second-tier solution of Bitcoin. At present, the second-tier solution of Bitcoin is to solve the shortcomings of the main network expansion, which can be divided into incompatible and compatible solutions, including technologies such as lightning network, which are mainly for specific purposes, such as payment. However, the development in these years has not obviously broken through the technical threshold and the use threshold, and it is still a big problem. In addition, it is a compatible solution. The industry is urgently looking forward to reducing the trust of Bitcoin between the first and second tiers. Hypothetical new solutions, for example, in view of the current state of various solutions, can be said to have the greatest growth potential, which is enough for decentralization. By implementing verification node hosting, we can ensure that the managed assets are smaller than the pledged assets through pledge, so as to ensure network security, thus realizing decentralization. The construction of commercial terminals supports the most convenient ecological migration. At present, there are many successful cases, for example, if these projects are seamlessly migrated to the second floor, the basic application will explode. At present, four-piece sets have been equipped in the ecology, which is ready for the explosion. Although the ecological value of the low user threshold is only one 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。