比特币突发:历史罕见

作者:秦晋

2月6日,比特币最大拥护者、迈克尔-赛勒(Michael Saylor)领导的上市公司微策略(Microstrategy)发布2023年第四季度财报。

这份财报有2个与众不同之处。值得重点关注一下。首先是,在第四季度财报中,微策略将自己定性为「全球首家比特币开发公司」,实属历史罕见。因为在比特币历史上,还未曾有过一家专属开发比特币的公司,Bitcoin Core是以DAO的形式来组织个人开发者对比特币网络进行开发维护的,还未曾出现公司开发者。既然比特币在未来的进化的道路上要不断前进,那么,就会出现或者创造很多我们常人可能难以理解的非常规的历史事迹。

现在看,微策略是一个非常规存在。微策略表示,我们是一家公开上市公司,致力于通过我们在资本市场、宣传能力与技术创新方面的活动,持续开发比特币网络。以公司公司的形式开发比特币网络,这个是历史罕见。

此外,微策略还表示,我们还开发并提供业界领先的人工智能驱动的企业商业智能软件,促进我们实现智能无处不在的愿景,并正在利用我们的智能软件开发能力开发比特币应用。我们相信,我们的运营结构、比特币战略与对技术创新的关注相结合,为创造价值提供了一个独特的机会。

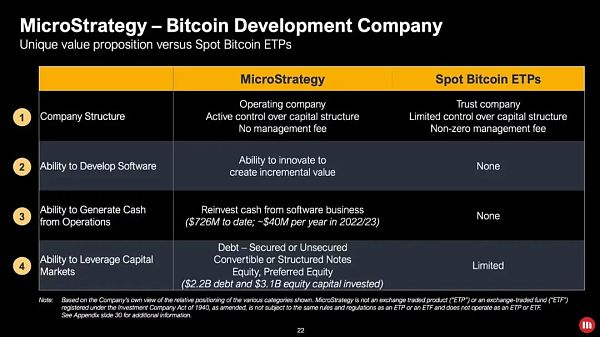

其次是,在第四季度财报中,微策略还将自己与比特币ETF作对比,以体现出自己的「独特价值主张」。要知道,比特币现货ETF是通过美国SEC批准的以合规的方式在资本市场公开交易的一种有价证券产品。而微策略拿什么与包含贝莱德在内的11只比特币现货ETF作对比呢?答案是,他们的股票MSTR。MSTR与微策略所储备BTC之间的关系,就有点类似于IBIT与贝莱德所储备BTC之间的关系。一开始,华尔街对这个故事非常着迷。这样说,不知道,你们懂不懂。

针对那些希望配置比特币的投资者是选择ETF还是MSTR的问题,微策略才第四季财报中也试图证明自己是更优的选择。

微策略给出了三个配置MSTR的好处。首先是,购买MSTR的投资者可以积极的控制资本结构。其次是,该公司有能力进行价值创新,而ETF只是持有加密资产。三是是,管理费的差异。四是,微策略公司产生现金和利用资本市场进行有吸引力的债务交易的能力。

有分析师表示,相对于比特币现货ETF,微策略的股票MSTR继续为希望接触比特币的投资者提供了许多重要的好处。

我们知道,微策略是全球首家开始在资本市场以合规的方式储备比特币的上市公司。至今已有4年时间,要在华尔街机构购买比特币的历史上论资排辈,微策略可能会排在贝莱德、富达前边。这个决策的背后所体现出的就是公司创始人的胆识和战略眼光。从他们今年的第四季季度财报中能够看出,这种胆识和战略还将继续执行下去。

比如,微策略在财报中表示,作为一家上市企业,我们能够利用现金流以及股权和债务融资的收益来积累比特币,比特币是我们的主要财务储备资产。自第三季度末以来,该公司以12.5亿美元购买31755枚比特币,即每枚比特币39411美元。2月6日,微策略创始人兼董事长迈克尔-赛勒发文表示,2024年1月以3720万美元的价格购买了850枚比特币。

微策略成立于1989年,至今已有35年历史。2020年之前一直从事软件咨询业务。2020年7月,开始探索购买比特币等另类资产,截至2024年2月6日,该公司已经持有19万枚比特币,价值超过80亿美元。

2023年,比特币价格暴涨,受益于公司股票与公司储备比特币的紧密关系的影响。该公司股票MSTR暴涨337%。成为美国估值50亿美元或以上公司中涨幅最大公司之一,当时,超过英伟达的234%涨幅以及Meta飙升的194%。

在美国SEC审批未通过比特币现货ETF之前,某种程度上,微策略公司的股票MSTR是另一种合规的比特币的映射有价证券产品。但在美国SEC审批通过11只比特币现货ETF之后,该公司的股票价格受到一些此影响,即使在比特币价格基本持平的情况下,2024年至今已经下跌 22%。比特币今年上涨4%。这个也是微策略2023年第四季度财报表现低于预期的一个重要原因。

根据微策略2023年第四季度财报,该公司在2023年第四季度总营收为1.245亿美元,与2022年第四季度相比下降了6.1%,按非美国通用会计准则不变汇率计算下降7.8%。2023年第四季度的毛利润为 9630万美元,毛利率为77.3%,而2022年第四季度的毛利润为1.058 亿美元,毛利率为79.8%。

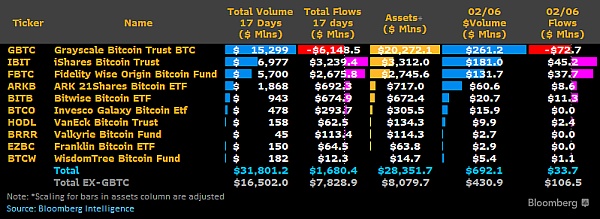

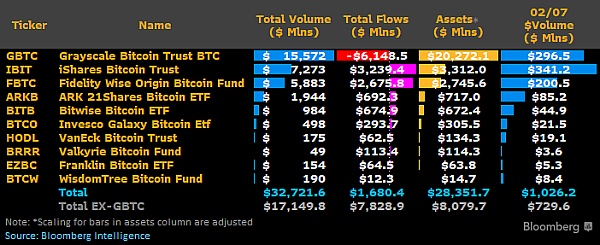

财报表现低于市场预期,通常是公司存在一些问题的具体体现。我想,比特币现货ETF通过之后的各种惊艳投资者的表现是其中一个重要原因。根据彭博社分析师提供的最新数据显示,自比特币ETF推出的17个交易日内,其成交量已经达到318亿美元。今日比特币现货ETF成交量已经突破10亿美元。

那么微策略比特币战略在比特币ETF的影响之下,能否继续帮助公司公司股票MTSR继续创造新故事呢?

不过,微策略在证明自己的股票MTSR相比比特币ETF更具备优势的同时,他们也在开始执行新的战略举措。那就是,将公司转型为一家比特币开发公司。这个举措将使公司定位与比特币ETF区别开来,而且创造现金流,并允许微策略更积极地开发和投资比特币产品和公司。

至于这个战略举措是否奏效,我们交给时间来回答吧。

The author Qin Jin, the biggest supporter of Bitcoin, Michael Sailor, led the listed company Micro Strategy to release the fourth quarter financial report of the year. This financial report has a distinctive feature that deserves special attention. First, in the fourth quarter financial report, Micro Strategy characterized itself as the first bitcoin development company in the world, which is rare in history, because in the history of Bitcoin, there has never been a company that exclusively develops Bitcoin to organize individual developers to develop and maintain the bitcoin network in a new form. Now, since the developers of the company will continue to advance in the future evolution of bitcoin, they will appear or create many unconventional historical deeds that we ordinary people may find difficult to understand. Now, micro-strategy is an unconventional existence micro-strategy, which means that we are a publicly listed company and are committed to continuously developing bitcoin networks in the form of companies through our activities in capital market propaganda and technological innovation. This is rare in history. In addition, micro-strategy is also rare. It shows that we have also developed and provided the industry-leading enterprise business intelligence software driven by artificial intelligence, which promotes us to realize the vision of intelligence everywhere, and we are using our intelligent software development ability to develop bitcoin applications. We believe that the combination of our operating structure, bitcoin strategy and attention to technological innovation provides a unique opportunity to create value. Secondly, in the fourth quarter financial report, Microstrategy also compares itself with Bitcoin to reflect its unique value proposition. Bitcoin spot is a securities product approved by the United States and publicly traded in the capital market in a compliant manner. What does Microstrategy compare with Bitcoin spot including BlackRock? The answer is that the relationship between their stocks and the reserves of Microstrategy is a bit similar to that with BlackRock. At first, Wall Street was very fascinated by this story. I wonder if you understand whether to choose or not to allocate Bitcoin to investors. In the fourth quarter financial report, Strategy only tries to prove that it is a better choice. Micro-strategy gives three advantages: firstly, the investors who buy it can actively control the capital structure; secondly, the company has the ability to carry out value innovation and only hold encrypted assets; thirdly, the difference in management fees; fourthly, the ability of micro-strategy companies to generate cash and use the capital market to conduct attractive debt transactions. Some analysts said that compared with bitcoin spot micro-strategy stocks, they continue to want to contact Bitcoin. Investors have provided many important benefits. We know that Microstrategy is the first listed company in the world to start to reserve bitcoin in a compliant way in the capital market. It has been years since it was decided that Microstrategy may rank ahead of BlackRock Fidelity in the history of buying bitcoin from Wall Street institutions. What is reflected behind this decision is the courage and strategic vision of the company's founders. From their quarterly financial reports in the fourth quarter of this year, we can see that this courage and strategy will continue to be implemented. For example, Microstrategy said in the financial report that as a listed company, we can use cash flow and the proceeds from equity and debt financing to accumulate bitcoin, which is our main financial reserve asset. Since the end of the third quarter, the company has bought 100 million bitcoins, that is, each bitcoin. Michael Sailer, founder and chairman of Microstrategy, issued a document saying that Microstrategy bought 10,000 bitcoins at the price of 10,000 dollars in October, and has been engaged in software consulting since it was established in. The business began to explore the purchase of alternative assets such as bitcoin in June, and as of June, the company had held 10,000 bitcoins worth more than US$ 100 million. The soaring price of bitcoin benefited from the close relationship between the company's stock and the company's reserve bitcoin. The company's stock soared and became one of the companies with the largest gains in the United States with a valuation of US$ 100 million or more. At that time, it surpassed NVIDIA's gains and soared. Before the US approval failed to pass the bitcoin spot, the stock of Microstrategy Company was another combination. However, the stock price of the company was somewhat affected after the US approved only the spot bitcoin. Even though the price of bitcoin was basically the same, the bitcoin has fallen so far this year, which is also an important reason why the financial performance in the fourth quarter of micro-strategy year was lower than expected. According to the financial report in the fourth quarter of micro-strategy year, the total revenue of the company in the fourth quarter of 2008 was $100 million, which was lower than that in the fourth quarter of 2008 according to non-US GAAP. The gross profit in the fourth quarter of 2008 was USD 10,000, while the gross profit in the fourth quarter of 2008 was USD 100 million. The performance of the financial report was lower than the market expectation, which is usually a concrete manifestation of the company's problems. I think the performance of various amazing investors after Bitcoin passed the spot is one of the important reasons. According to the latest data provided by Bloomberg analysts, its trading volume has reached USD 100 million in the first trading day since its launch. Can micro-strategy bitcoin strategy continue to help companies continue to create new stories under the influence of bitcoin? However, while micro-strategy proves that their stocks have advantages over bitcoin, they are also beginning to implement new strategic measures, that is, transforming the company into a bitcoin development company, which will distinguish the company's positioning from bitcoin, create cash flow and allow micro-strategy to actively develop and invest in bitcoin products and companies. As for whether this strategic measure works, we will leave it to time to answer. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。