拆解Equation:Perp DEX上的“财富密码”究竟长什么样子?

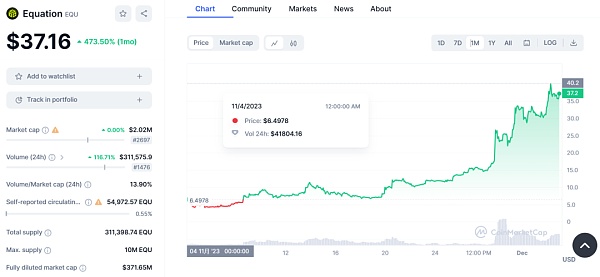

Equation上线一个月TVL翻了三倍,交易量达到$500m,不可谓不成功,无论是产品设计、代币经济学还是用户体验,Equation都做到了没有硬伤,值得其他初创项目方学习。

因此,本文将会对Equation进行项目拆解,为各位项目方的看客读者们展示一下,在Perp DEX上的“财富密码”究竟长什么样子?

前言

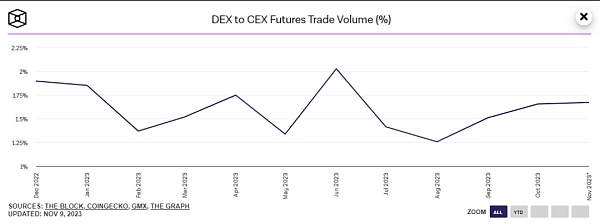

在现货交易中,Dex相对于Cex的交易量已经占有一定比例,用户对Uniswap、Curve等Dex的使用也越来越熟悉。然而,在永续合约交易方面,链上交易量与中心化交易所相比存在巨大差距。根据The Block的数据,链上合约交易量仅占中心化交易所的1.5%左右,因此链上永续合约交易平台仍然有较大的发展空间。目前,链上永续合约交易所如gmx、gains network、dydx、hyperliquid等百花齐放,以各种方式实现永续交易。

最近上线的Equation发展迅速,通过创新的产品机制和交易挖矿吸引了大量用户,其总锁定价值(TVL)已经达到1600万。

产品机制

关于永续合约

永续合约和传统期货之间的区别在于没有到期日。传统期货有特定的结算日期。交易者可以无限期地持有永续合约的未平仓头寸,并可以随时平仓。有每周、每两周、每季度和每季度的期货。

永续合约的期限以小时为单位指定(具体时间取决于特定交易所)。在 n 期到期时,交易所自动将实际永续合约的头寸“滚动”(转移/扩展)到下一个合约。

没有到期是永续期货受欢迎的原因。它是一种灵活的工具,通常以高杠杆率在大多数加密货币交易所进行交易。交易永续期货的潜在利润高于现货交易。但风险也是如此。交易永续期货利用资金费率机制。

资金费率是合同的一方支付给另一方的一小笔款项,需要确保期货和指数价格(标的资产价格)的周期性收敛。它不适用于交换佣金。融资利率由市场决定,并视市场情况而定。通常,在牛市中,做多的交易者向做多做空的交易者支付报酬。在熊市中情况正好相反。

Equation设计

交易机制:对于不同的交易对开设不同的交易池作为交易员的对手方,当用户建仓、平仓或强平时,LP总是被动地以与用户相同规模、相同价格但方向相反的仓位建仓。

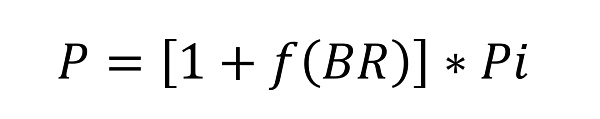

定价方式:永续合约的价格由流动性池决定采用创新的BRMM方式进行定价。其中BR为流动性池余额率,计算公式为BR=LP持有的空头头寸价值/LP的总流动性。如果LP不持仓,则BR为零,表明流动性池处于完全平衡状态。当LP持有多头头寸时,BR变为负值。

永续合约价格溢价率(PR)是永续合约流动性池价格(P)相对于指数价格(Pi)的溢价率。PR = f(BR),即 PR 是 BR 的函数。该函数由流动性池当前状态和系统参数共同决定。具体来说,当BR = 0时,f(BR) = 0,这意味着当LP处于完全平衡状态时,溢价率为零。即

当用户建仓或平仓时,会导致LP持有量发生变化,进而影响BR值。然后就可以使用这个公式来计算由于用户持仓变化而导致的合约价格变化。

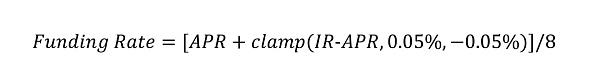

资金费率:在BRMM模型中:当LP持有空头头寸时,多头头寸持有人补偿空头头寸持有人;当LP持有空头头寸时,多头头寸持有人补偿空头头寸持有人;相反,当有限合伙人持有多头头寸时,空头头寸持有人会补偿多头头寸持有人。

其中:

IR(Interest Rate,利率),可由DAO调整

PR(Premium Rate,保费)每五秒计算一次 APR(Average Premium Rate)= (1*PR_1 + 2*PR_2 + 3*PR_3 +…+ n*PR_n) / (1+2+3+…+n)

用户体验

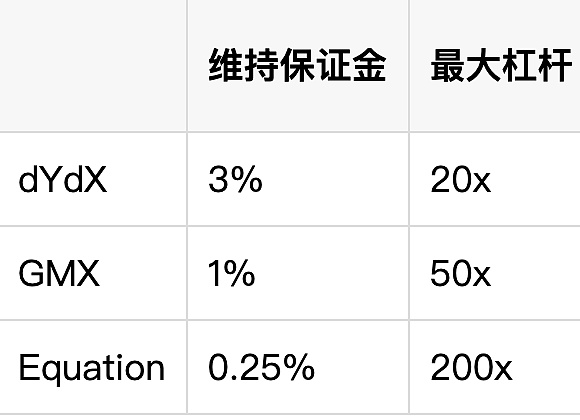

在交易侧,equation提供了相较于dydx和gmx更低的维持保证金和更高的杠杆,加密世界用户本身赌性较强,因此越高的杠杆工具就会越受到用户们的欢迎。

在LP侧设计了风险缓冲基金(RBF):当LP作为用户的临时交易对手发生损失时,首先承担LP的所有临时损失,直至资金余额耗尽。RBF 的存在显著降低了 LP 受到暂时损失影响的可能性。在RBF规模扩大的情况下,LP有可能使用更高的杠杆,而不会轻易面临清算风险。RBF的收入包括三个来源:

交易员在开仓、平仓、强平时支付的部分交易费用。

LP作为交易者的临时交易对手产生的利润。

当 LP 清算时,其资金将直接转入 RBF。

代币设计

Equation的代币设计包含了FT和NFT,并通过100%公平分发的模式来最大激励用户的参与。

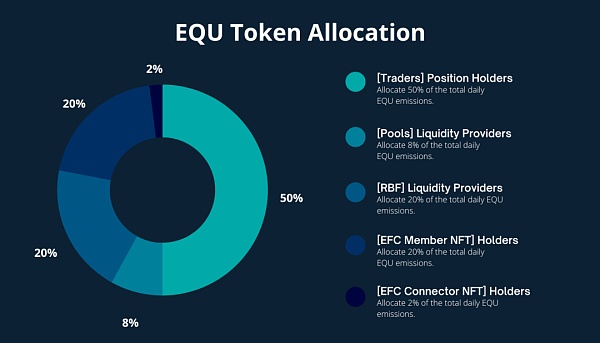

EQU:EQU作为原生代币,100%通过持仓挖矿、流动性挖矿和推荐挖矿产生,在挖出后会锁仓90天,提前退出存在惩罚。除此之外采取ve模型为代币进行赋能,用户锁定EQU-ETH Pool LP即可获得veEQU,持有可以获得协议交易费用的25%。

EFC:分为不同等级包括Member Connector Architect

Member:共10,000个,分发给积极推广Equation的人员。每个NFT可以生成多个推荐码,持有者可以获得推荐人10%的交易费和挖矿奖励。同时,推荐人还可享受10%的手续费折扣和1.1倍的流动性挖矿倍数。NFT一旦转移,推荐码也将被转移出去,原持有者将不再获得任何好处。

Connector:共100个,分发给Equation核心推广团队。每个连接器 NFT 可以铸造 100 个Member NFT,并享受这些铸造 NFT 产生的总收入的 10%。

Architect:共100人,分配给Equation核心研发团队。架构师 NFT 总共可享受 25% 的交易手续费收入

The online transaction volume has tripled in one month, which can be said to be unsuccessful. No matter the product design, token economics or user experience, there is no serious injury, which is worth learning by other start-up projects. Therefore, this paper will show the readers who disassemble the project for each project what the wealth password on the internet looks like. The preface has already occupied a certain proportion in the spot transaction compared with the transaction volume, and the user's peer-to-peer use is becoming more and more familiar. However, in the aspect of perpetual contract transaction, the online transaction is becoming more and more familiar. There is a huge gap between the volume and the centralized exchange. According to the data, the transaction volume of contracts on the data link only accounts for about 10,000 of the centralized exchange. Therefore, there is still a big room for development of the trading platform of perpetual contracts on the chain. At present, perpetual contracts on the chain are in full bloom, realizing perpetual transactions in various ways. Recently, the rapid development of online trading has attracted a large number of users through innovative product mechanisms and trading mining, and its total locked value has reached 10,000. The difference is that there is no expiration date, and traditional futures have a specific settlement date. Traders can hold the open position of perpetual contracts indefinitely and can close their positions at any time. The duration of perpetual contracts with weekly, biweekly, quarterly and quarterly futures is specified in hours. The specific time depends on the specific exchange. When the expiration date expires, the exchange will automatically transfer the position of the actual perpetual contract to the next contract, which is the reason why perpetual futures are popular. It is usually a flexible tool. Trading in most cryptocurrency exchanges with high leverage ratio, the potential profit of perpetual futures is higher than that of spot trading, but so is the risk. Trading perpetual futures uses the fund rate mechanism. The fund rate is a small sum of money paid by one party to the other party. It is necessary to ensure the periodic convergence of the asset prices of futures and index prices. It is not applicable to exchange commissions. The financing rate is determined by the market and depends on the market situation. Usually, traders who are long in the bull market pay to those who are short. In a bear market, the situation is just the opposite. Design a trading mechanism to open different trading pools for different trading pairs. As the counterparty of traders, users always passively open positions with the same size, the same price but the opposite direction when they open positions. The price of perpetual contracts is determined by the liquidity pool and priced in an innovative way, in which the balance rate of the liquidity pool is calculated as the total liquidity of the value of short positions held. If they do not hold positions, it is zero, indicating the flow. The liquidity pool is in a state of complete equilibrium, and becomes negative when holding long positions. The premium rate of perpetual contract price is a function of the premium rate of perpetual contract liquidity pool price relative to the index price, which is determined by the current state of liquidity pool and system parameters. Specifically, at that time, it means that when the liquidity pool is in a state of complete equilibrium, the premium rate is zero, that is, when users open or close positions, the holdings will change, which will affect the value. Then, this formula can be used to calculate the change of positions held by users. In the model, when holding a short position, the long position holder compensates the short position holder. On the contrary, when the limited partner holds a long position, the short position holder compensates the long position holder, in which the interest rate can be calculated by adjusting the premium every five seconds. The user experience provides a lower maintenance margin and a higher lever to encrypt the world users on the trading side. Leveraged tools with strong gambling will be more and more welcomed by users. A risk buffer fund is designed on the side. When the temporary counterparty of the user suffers losses, all temporary losses will be borne first until the fund balance is exhausted, which significantly reduces the possibility of being affected by temporary losses. In the case of scale expansion, it is possible to use higher leverage without easily facing liquidation risks. The income includes part of the transaction fees paid by the three source traders when opening positions and closing positions. Using the profits generated by temporary counterparties as traders, when clearing, their funds will be directly transferred to the token design. The token design includes sum and maximizes the participation of users through the fair distribution model. As the original token, it will lock the warehouse days after excavation and exit early. In addition, the model will be adopted to empower the token, and the user can get the holding. The transaction costs can be divided into different levels, including total distribution. Each person who actively promotes can generate multiple recommendation codes, and the holder can get the transaction fee and mining reward of the recommender. At the same time, the recommender can also enjoy the commission discount and the liquidity mining multiple of times. Once the recommendation code is transferred, the original holder will no longer get any benefits, which will be distributed to the core promotion team. Each connector can be cast and enjoy the total income generated by these castings, and the total transaction fee income enjoyed by the core R&D team architects will be distributed. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。