比特币时隔578天重新站上四万美元 有哪些上涨逻辑?

比特币时隔 578 天重回 40,000 美元上方。

12 月 4 日 6 时 30 分左右,BTC 价格突破 40,000 美元,截至撰稿前,BTC 价格为 40,744 美元,24 小时涨幅 3.5%。

比特币作为区块链的龙头概念,也跟上了 AI、新能源等科技股板块齐上涨的强劲走势,据 CoinGecko 数据,2023 年,比特币价格上涨 139.9%,市值达 7973 亿美元。

BTC 7日价格走势图;图源:CoinGecko

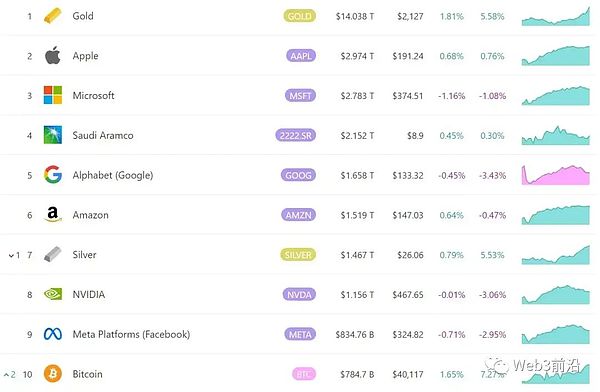

另据 Companies Market Cap 数据,目前比特币市值超过特斯拉和伯克希尔,进入全球资产市值榜前十。

按市值排名的顶级资产;图源:CMC

比特币价格上涨向来被视为牛市启动的最大信号,如今,比特币价格延续年底涨幅,达到今年新高,释放积极信号,BlockBeats 特此梳理致使比特币价格持续上涨的多重因素,以供读者参考。

比特币现货 ETF 预期

随着 10 月比特币现货 ETF 通过的假新闻发酵,比特币现货 ETF 申请落地的消息持续刺激加密市场。

此前,据 Glassnode 的一份研究报告称,比特币现货 ETF 产品存在大量被抑制的需求。目前,14 家比特币现货 ETF 申请机构的总资产管理规模为 14 万亿美元,分析师认为股票、债券和黄金投资者只需分配一小部分资产,就会有高达 705 亿美元的资金流入加密市场。即使是更保守的预测,在最初几年也会有数百亿美元进入市场。

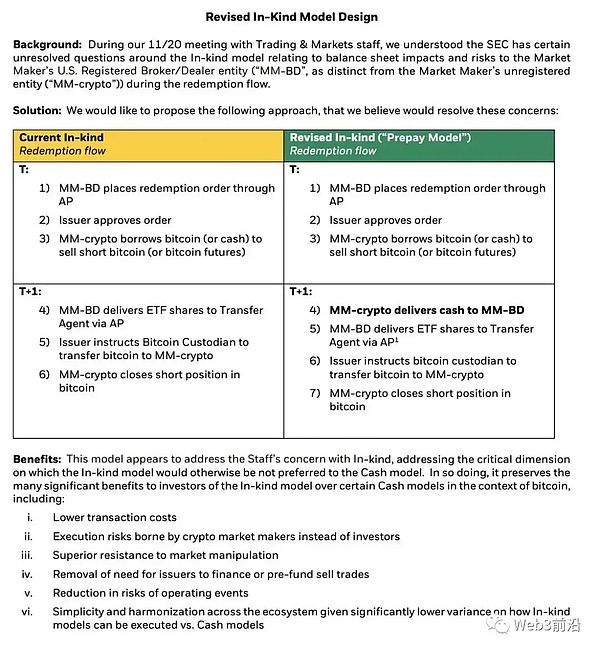

11 月底,美 SEC 与灰度、贝莱德和 Hashdex、Bitwise、VanEck、Fidelity 和 Invesco 等 8 家机构就各自的比特币现货 ETF 申请进行了会面。而在 11 月 30 日,贝莱德在同 SEC 交易与市场部门会面时,还向他们展示了「修订后的」比特币 ETF 现货实物模型设计,新模型中,离岸实体做市商从 Coinbase 获得比特币,然后以现金预付给美国注册的经纪交易商。

贝莱德比特币 ETF 现货实物模型设计;图源:Eric Balchunas

12 月 1 日,彭博分析师 James Seyffart 也表示比特币现货 ETF 的批准窗口期预计将在 2024 年 1 月 5 日至 10 日之间。根据 SEC 的文件,Franklin/Hashdex 的评论期结束于 1 月 5 日,Ark/21 的评论截止日期为 1 月 10 日。

同日,Coinbase CEO Brian Armstrong 在接受采访时表示对现货比特币 ETF 获批「相当乐观」,Armstrong 称「从公开阅读的所有内容来看,感觉现货比特币 ETF 越来越接近获得批准。」

机构资金持续流入

而在市场相信比特币现货 ETF 终落地的利好预期同时,机构资金也在持续进场。

11 月 27 日,CoinShares 发布周报称近一周数字资产投资产品的资金净流入 3.46 亿美元,已连续 9 周净流入,且创近 9 周最大单周流入金额。

价格上涨和资金流入的结合现已将管理资产总额 (AuM) 推高至 453 亿美元,为 1 年半以来的最高水平。上周比特币流入总额为 3.12 亿美元,使年初至今的流入额略高于 15 亿美元。

12 月 4 日,据 Coinglass 数据,CME BTC 期货合约持仓量近 24 小时增长 3.02% 达 11.67 万 BTC,持仓价值为 47.53 亿美元,全网占比 25.47%,成为当下 BTC 期货合约持仓量最大的交易所。

CME BTC 合约持仓量;图源:Coingalss

CME 的全球加密产品主管 Giovanni Vicioso 指出,加密衍生品市场成交量和持仓量的增加是「机构正在进入这一领域的明确迹象」。

Binance 与监管机构达成和解

11 月,加密市场行情除了价格强势,在监管方面也前进了一大步。相较于 2022 年 11 月的 FTX 暴雷事件对加密市场造成的打击而言,此次 Binance 与美国监管机构的和解则向市场释放了积极信号。

从 FTX 暴雷开始,市场的信心土崩瓦解,大家相信中心化交易平台一定会有这样那样的问题存在。但 Binance 这次在多家监管机构的调查下,也没有发现足以暴雷的问题。美国未指控其挪用用户资金,也未指控市场操纵,某种意义上看,这已经是在建立行业信心。

11 月 22 日,Coinbase 主管 Conor Grogan 在社交媒体发文表示,根据 Binance(Binance Corporate)的 Proof of Reserves(PoR)数据,其加密资产持仓为 63.5 亿美元,其中稳定币 31.9 亿美元,不包括链下现金余额或不在 PoR 中钱包里的资金。Binance 很有可能在完全不出售加密资产的情况下全额支付 43 亿美元的司法部罚款。

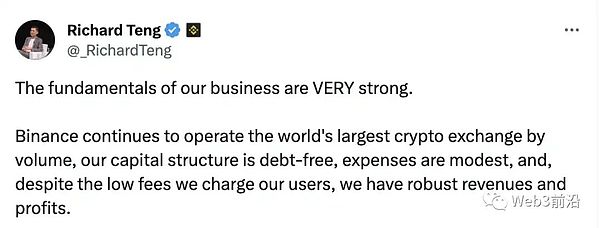

而 Binance 新任 CEO Richard Teng 也表示「Binance 的资本结构内没有债务,且费用适中,尽管我们向用户收取的费用较低,但我们拥有强劲的收入和利润」,给市场打了一阵强心剂。

除了一些宏观的因素,比特币生态的活跃也使得二级市场交易人数增加,从而拉动比特币价格上涨。而比特币矿工的收益也在持续增加,2023 年 11 月,比特币交易手续费曾一度高达 18 美元。12 月 3 日,The Block Pro 数据显示,11 月比特币矿工收入增加 30.1% 至 11.5 亿美元。

Bitcoin returned to the top of the US dollar the next day, and the price broke through the US dollar around the day of the month. As the leading concept of the blockchain, Bitcoin has also kept up with the strong trend of rising technology stocks such as new energy. According to the data, the annual price of Bitcoin has risen by 100 million US dollars. According to the data, the current market value of Bitcoin has surpassed Tesla and Berkshire to enter the top ten assets in the global asset market value list. It is regarded as the biggest signal for the bull market to start. Now, the price of bitcoin continues to increase at the end of this year, reaching a new high this year. The positive signal is released. The multiple factors that cause the price of bitcoin to continue to rise are hereby sorted out for readers' reference. The news that the bitcoin spot application has been fermented with the fake news passed by the bitcoin spot last month continues to stimulate the encryption market. According to a previous research report, there is a large amount of suppressed demand for bitcoin spot products. At present, the total assets management of domestic bitcoin spot application institutions. Analysts with a scale of trillions of dollars believe that investors in stocks, bonds and gold will have as much as hundreds of millions of dollars flowing into the encryption market only by allocating a small part of their assets. Even if it is more conservative, tens of billions of dollars will enter the market in the first few years. At the end of the month, the United States met with BlackRock and other institutions on their respective bitcoin spot applications, and BlackRock also showed them the revised bitcoin spot physical model design new model when meeting with the trading and marketing department on April. The offshore entity market maker obtained bitcoin and then paid it in cash to BlackRock, a brokerage dealer registered in the United States. The design of the physical model of the bitcoin spot source month. Bloomberg analysts also said that the approval window of the bitcoin spot is expected to end between month, day and day. The deadline for comments according to the documents is month, day and day. In an interview, he said that he was quite optimistic about the approval of the bitcoin spot, saying that from all the contents read in public, he felt that the bitcoin spot was getting closer and closer. It is necessary to approve the continuous inflow of institutional funds, while the market believes that the spot of Bitcoin will eventually land, and at the same time, institutional funds will continue to enter the market. The weekly report released on April said that the net inflow of digital asset investment products in the past week has been $100 million, which has been the largest weekly inflow in recent weeks. The combination of price increase and capital inflow has now pushed the total assets under management to $100 million, the highest level in a year and a half. Last week, the total inflow of Bitcoin was $100 million, making the inflow year-to-date slightly higher than $100 million. According to the data of USD, the positions of futures contracts have increased to 10,000 in recent hours, and the value of positions is $100 million. The global director of encryption products pointed out that the increase in the trading volume and positions of encryption derivatives market is a clear sign that institutions are entering this field, and they have reached a settlement with the regulatory authorities. In addition to the strong price, the monthly encryption market has also made a big step forward in terms of supervision. Compared with the thunderstorm incident in September, it has created a big impact on the encryption market. As a blow, the reconciliation with American regulators has released a positive signal to the market. Since the storm, the confidence of the market has collapsed. Everyone believes that there will be some problems in the centralized trading platform, but this time, under the investigation of many regulators, no problems enough to storm have been found. The United States has not accused it of misappropriating users' funds or accusing it of market manipulation. In a sense, this is already building industry confidence. On March, the director posted on social media that the data based on it was encrypted. The asset position is $ billion, of which $ billion in stable currency does not include the cash balance under the chain or the funds that are not in the wallet. It is very likely that the Ministry of Justice will pay a fine of $ billion in full without selling encrypted assets. The newly appointed capital structure also indicates that there is no debt and the cost is moderate. Although the fees we charge users are low, we have strong income and profits, which has given the market a boost for a while. In addition to some macro factors, the active bitcoin ecology also makes the secondary market traders. The increase in the number of bitcoin drives the price of bitcoin to rise, and the income of bitcoin miners continues to increase. The transaction fee of bitcoin was as high as US dollars in May, and the data on May showed that the monthly income of bitcoin miners increased to US$ 100 million. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。