盘点13份现货比特币 ETF 提案最新进展

行业人士信心满满,静候美国证券交易委员会(SEC)下个月对现货比特币ETF做出批准决定。Swan Bitcoin首席执行官Cory Klippsten在接受彭博社采访时预测,批准的时间窗口可能已经缩小到2024年1月8日、9日或10日。

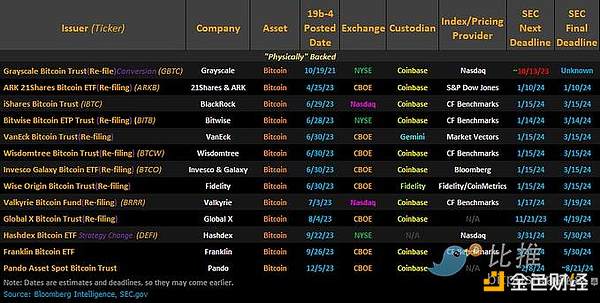

彭博资讯 (Bloomberg Intelligence) 分析师 James Seyffart 编制的一份清单显示,目前有 13 只拟议的现货比特币 ETF提交至 SEC。

本文将总结这13份现货比特币 ETF 提案的最新进展。

灰度

据行业观察人士称,灰度投资公司 (Grayscale Investments) 8 月份在法庭上战胜了美国证券交易委员会 (SEC),这一事件促使人们对现货比特币 ETF 获得批准更加乐观。

当时法官裁定,监管机构拒绝将灰度比特币信托基金 (GBTC) 转换为 ETF,但允许推出基于比特币期货的 ETF,是“任意且反复无常的”。SEC选择不对这一裁决提出质疑。

Grayscale表示, GBTC 已准备好在监管部门批准后作为 ETF 运营,并指出它将“与 SEC 迅速合作”。

Grayscale 在 12 月 1 日的博客文章中指出,虽然现货比特币 ETF 批准的时间表“本质上是不确定的” ,但该公司认为这“只是时间问题,而不是是否问题”。

首席法务官 Craig Salm 在帖子中表示,如果 Grayscale 获得 SEC 的批准,该公司计划立即将 GBTC 从 OTCQX 市场转移到 NYSE Arca。

该公司表示,由于转换为 ETF,同时进行的增发和赎回将基本上消除该股票历史上持有的任何折扣或溢价,并使信托能够更密切地跟踪 BTC 的价值。

Ark Invest/21Shares

关注比特币 ETF 竞赛的人们应该很熟悉他们的名字了,Ark Invest、21Shares于 2021 年首次合作提出了现货比特币基金提案。

该申请于2022 年 3 月被据,2023年2月,第二次被拒,最新的重新申请是在四月份,先于资产管理巨头贝莱德和其他公司。

预计 SEC 将于 1 月 10 日对最新提交的文件作出裁决,一些行业观察人士认为,该日监管机构还将决定其他发行方类似提案的命运。

Ark 首席执行官 Cathie Wood 表示:“我们确实认为,虽然我们排在第一位,但许多公司将同时获得批准,根据他们提交申请的具体方式,可能会有超过六项申请一次性获得批准。”

双方于 11 月 20 日第三次更新了比特币 ETF 申请,指出保荐费为信托持有的比特币的 0.80%。该基金的股票将在 Cboe BZK 交易所交易,股票代码为 ARKB。

贝莱德

贝莱德是管理着约 9 万亿美元资产的金融巨头。该公司在 6 月份加入了现货比特币 ETF 竞赛,促使许多其他公司重新提高了对此类产品的出价。

贝莱德提议的 iShares 比特币信托将采用 IBTC 股票代码并在纳斯达克交易。

上个月,该公司多次会见了美国证券交易委员会交易和市场部门的官员。其 11 月 20 日的会议公告概述了实物和现金赎回模式之间的差异。

不同 ETF 的授权参与者使用两种主要方法参与股票的创建和赎回:实物或现金交易。

通过实物交易,AP 将 ETF 份额交换为反映 ETF 持有量的相应一篮子证券。 对于现金交易,AP 创建或赎回股票以换取现金而不是证券。

11 月 28 日(另一次会议召开的当天)的一份文件指出,“美国证券交易委员会对实物模型存在某些未解决的问题。”

贝莱德周一提交的最新提案修正案指出,该信托基金仅接受已实施合规计划的授权参与者和做市商的实物创设和赎回请求。

更新后的文件中还添加了有关该公司为该基金筹集 10 万美元种子资金的内容。

Bitwise

Bitwise 最新的 S-1修正案与贝莱德的同一天发布。Bitwise 比特币 ETF(之前拟命名为 Bitwise 比特币 ETP 信托基金)将在 NYSE Arca 交易,股票代码为 BITB。

彭博分析师称:“美国证券交易委员会和这些发行人都在努力解决问题,这些文件可能是双方多次对话和大量工时的结果。”

Bitwise 首席投资官 Matt Hougan 指出,发行人与 SEC 之间的对话是“这次确实感觉与几个月前不同”的原因之一。

与其他公司一样,Bitwise多年来一直希望推出现货比特币 ETF。

该公司于2021年10月提交了一份长达100多页的白皮书。这表明CME比特币期货市场领先于现货市场和不受监管的比特币期货市场。它发表的额外研究表明,新的比特币 ETP 不太可能对 CME 比特币期货市场价格产生主要影响。

Bitwise 在 9 月份提交的文件中解决了 SEC 对该公司先前申请中包含的研究提出的八项分歧。

VanEck

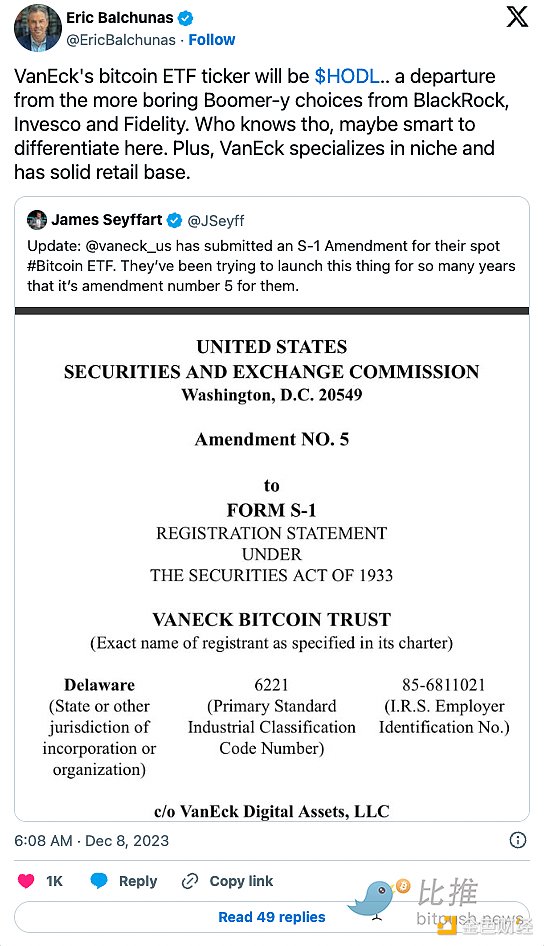

VanEck 周五更新了 VanEck 比特币信托的 S-1表格,标志着其第五次修订。披露指出,该基金的股票代码为 HODL。

HODL 将在Cboe 进行交易。最新披露的信息并未披露拟议产品的费用。

VanEck 聘请 Gemini Trust Company 作为 ETF 的比特币托管商——这与大多数选择 Coinbase 作为托管合作伙伴的公司不同。

VanEck 数字资产研究主管 Matthew Sigel 在 6 月份表示,SEC 应立即批准所有现货比特币 ETF。

Sigel 和 VanEck 投资分析师 Patrick Bush周四写道,他们预计此类产品将在第一季度获得批准。他们估计,头几天流入现货比特币 ETF 的资金将约为 10 亿美元,第一季度将达到 24 亿美元。

WisdomTree

在贝莱德提交申请后,WisdomTree于 6 月重新申请了现货比特币 ETF 。

该公司管理着约 980 亿美元的资产,在披露中表示:“比特币市场已经成熟,其运营效率和规模在实质性方面与成熟的全球股票、固定收益和大宗商品市场相似。 ”

WisdomTree于 11 月 16 日修改了其比特币 ETF 申请。该基金的股票将在 Cboe BZK 交易所交易,股票代码为 BTCW。

WisdomTree 数字资产主管 Will Peck 在该公司 10 月份的财报电话会议上表示:“似乎确实出现了一些令人兴奋的势头,[并且]我们仍然非常关注现货比特币 ETF。” “我们认为这是美国传统渠道中该资产类别的最佳执行方式,我们期待继续与监管机构就此进行合作。”

Invesco

景顺 (Invesco) 也追随贝莱德 (BlackRock) 的脚步,于 6 月重新申请了现货比特币 ETF。拟议的 ETF 将在 Cboe BZX 交易所上市。该申请是与 Galaxy Digital 合作提交的,反映了两人提交的 2021 年比特币 ETF 申请。

该公司于今年秋天早些时候对其申请进行了修改,表明在监管机构继续考虑决定时,该公司将继续与监管机构进行对话。

根据存款信托和清算公司的清单,股票代码为 BTCO。

富达

富达作为重新申报者加入了当前的比特币 ETF 现货竞赛,类似于 Invesco 和 Ark。拟议的比特币 ETF 脱颖而出的原因之一是它的托管商:Fidelity Digital Assets Services。与一些竞争对手不同,它不使用 Coinbase。

Fidelity Digital Assets 自 2018 年以来一直提供托管和交易执行服务,使其成为该公司内部托管的不二选择。

该提案于六月下旬首次提交,这意味着它也紧随贝莱德之后。早在 2021 年,富达就申请了现货比特币 ETF,但去年 1 月被 SEC 阻止。

根据 DTCC 的清单,该基金将以 FBTC 代码进行交易。与景顺一样,它将在芝加哥期权交易所上市。

Valkyrie

Valkyrie紧随贝莱德之后于 6 月底申请了现货比特币 ETF(早于富达几天)。

该公司还对其提案进行了多项修改。与其他一些申请人不同,Valkyrie 似乎对它提议的股票代码 BRRR 很感兴趣–指代“印钞机”。

该 ETF 将与贝莱德拟议的 ETF 一起在纳斯达克上市。这两只基金是唯一在纳斯达克交易所上市的基金。不出所料,Coinbase 被列为该基金的拟议托管人。

SEC上次推迟 Valkyrie 申请是在 9 月底,下一个截止日期是在 Seyffart 提出的黄金窗口之后。

Valkyrie 首席投资官 Steven McClurg 在接受 Schwab Network采访时表示,他相信比特币的价格(无论是减半还是潜在的现货比特币 ETF 推出)明年可能会高达 10 万美元。

Global X

另一个“回归者”,Global X 在 2021 年最初申请一只现货比特币 ETF 后,于 8 月申请了一只现货比特币 ETF。

与其他公司一样,它计划在 Cboe 交易所上市,并由 Coinbase 作为托管人。最初向 SEC 提交的申请将 Coinbase 列为监控共享合作伙伴,此举被视为安抚监管机构。

该申请早在 11 月份就被推迟了,SEC 表示需要更多时间来考虑该申请,这一点并不令人意外。

在推迟之前,彭博资讯分析师 Eric Balchunas 在 X 上发帖称,SEC 与可能的现货比特币 ETF 发行人之间就在拟议的 ETF 19b-4 申请中添加现金创造进行了讨论,分析师表示,这些讨论是一个“好兆头”。

Hashdex

Hashdex 于 8 月底申请在其比特币期货 ETF 中持有现货比特币。该申请将名称更新为 Hashdex 比特币 ETF,“以反映该基金更新的投资策略”。

它是少数不依赖 Coinbase 作为监控共享合作伙伴的公司之一。相反,它选择使用芝商所的实物市场交易所“获取和结算”比特币。它还将持有现货比特币、比特币期货合约以及现金和现金等价物。如果该基金被转换,它将与灰度一起在纽约证券交易所上市。

更新后的基金将以其期货代码 DEFI 进行交易。

富兰克林邓普顿

金融服务巨头富兰克林邓普顿 (Franklin Templeton) 也在9 月份加入了现货比特币 ETF 竞赛。它寻求在 Cboe BZX 交易所上市其基金。与大多数其他申请人一样,该公司选择 Coinbase 作为其托管商。

拟议的比特币 ETF 的征求意见期于 11 月底开始,这让一些人认为 SEC 提前开始征求意见的举动增加了比特币 ETF 在 1 月初获得批准的可能性。

富兰克林邓普顿在其最初提案中写道,该 ETF 将成为富兰克林邓普顿数字控股信托基金内的一个“系列”。

Pando Asset Management

作为现货比特币 ETF 竞赛的最新参与者,Pando 于 11 月 29 日提交了提案。如果获得 SEC 批准,该 ETF 将在 Cboe 上市– 13 家申请公司中的 8 家选择该交易所。

该公司于本周早些时候正式提交了19b-4,正式将其纳入 ETF 的竞争之中。

这家瑞士资产管理公司在瑞士六大交易所拥有多种加密产品交易,但这将是其首次在美国发行加密ETF。

Coinbase 将担任该基金的托管商,Pando 任命纽约梅隆银行为信托管理人。由于申请时间较晚,目前还不清楚如果 Pando 获批,能否与贝莱德或 Ark 同时推出 ETF。

People in the industry are full of confidence and waiting for the US Securities and Exchange Commission to make a decision on the approval of spot bitcoin next month. In an interview with Bloomberg, the CEO predicted that the time window for approval may have been narrowed to the day of the month or the day of the month. A list compiled by Bloomberg analysts shows that there is only a proposed spot bitcoin submitted to this article, and the latest progress of this spot bitcoin proposal will be summarized. According to industry observers, the gray investment company defeated the US securities exchange in court in January. The Committee's incident prompted people to be more optimistic about the approval of spot bitcoin. At that time, the judge ruled that it was an arbitrary and capricious choice for the regulator to refuse to convert the gray bitcoin trust fund into but allow the introduction of bitcoin-based futures. He said that he was ready to operate after the approval of the regulatory authorities and pointed out that it would cooperate quickly. In a blog post on May, he pointed out that although the timetable for the approval of spot bitcoin was essentially uncertain, the company thought it was. It's only a matter of time, not whether it's a problem. chief law officer said in his post that if approved, the company plans to transfer from the market to the company immediately. He said that the conversion to simultaneous issuance and redemption will basically eliminate any discount or premium held by the stock in history and enable the trust to track the value more closely. People who pay attention to the bitcoin competition should be familiar with their names. In 2006, the company jointly proposed the spot bitcoin fund proposal for the first time. The application was filed in June. The latest reapplication was rejected for the second time in April, ahead of BlackRock, an asset management giant, and other companies. It is expected that the latest submission will be decided on May. Some industry observers believe that the regulator will also decide the fate of similar proposals from other issuers on that day. The CEO said that we really believe that although we are in the first place, many companies will be approved at the same time. According to the specific way they submit their applications, more than six applications may be approved at one time. The application for bitcoin was updated for the third time, pointing out that the sponsorship fee is bitcoin held by the trust, and the shares of the fund will be traded on the exchange. The stock code is BlackRock, a financial giant that manages about one trillion dollars of assets. The company joined the spot bitcoin competition in May, prompting many other companies to raise their bids for such products again. BlackRock's proposed bitcoin trust will adopt the stock code and be traded on Nasdaq. Last month, the company met with the US Securities and Exchange Commission several times. The announcement of the meeting of the officials of Yihe Market Department outlined the differences between the physical and cash redemption models. Different authorized participants used two main methods to participate in the creation and redemption of stocks. Through physical transactions, the shares were exchanged into a corresponding basket of securities reflecting their holdings. For cash transactions, stocks were created or redeemed in exchange for cash instead of securities. A document on the day of another meeting on January pointed out that the US Securities and Exchange Commission had a certain physical model. Some unresolved issues BlackRock's latest proposal amendment submitted on Monday pointed out that the trust fund only accepts the physical creation and redemption requests of authorized participants and market makers who have implemented the compliance plan. The updated document also added the content that the company raised $10,000 in seed money for the fund. The latest amendment was proposed to be named Bitcoin before BlackRock released Bitcoin on the same day. The trust fund will be traded under the stock code Bloomberg analysts called the US Securities and Exchange Commission and these companies. Pedestrians are trying to solve the problem. These documents may be the result of many conversations between the two parties and a lot of working hours. The chief investment officer pointed out that the dialogue between the issuer and the is one of the reasons why it really feels different from a few months ago. Like other companies, it has been hoping to launch spot bitcoin for many years. The company submitted a multi-page white paper in June, which shows that the bitcoin futures market is ahead of the spot market and the unregulated bitcoin futures market. Additional research published by it shows that the new bitcoin. It is unlikely to have a major impact on the market price of bitcoin futures. In the document submitted in June, eight differences on the research contained in the company's previous application were resolved. On Friday, the form of Bitcoin Trust was updated, marking its fifth revision. The disclosure pointed out that the stock code of the fund was a screenshot, and the latest information disclosed in the afternoon would be used for trading, but the cost of the proposed product was not disclosed. This is different from the digital assets of most companies that choose to be custody partners. The research director said in January that all spot bitcoins should be approved immediately, and investment analysts wrote on Thursday that they expected such products to be approved in the first quarter. They estimated that the capital flowing into spot bitcoins in the first few days would be about $ billion, and it would reach $ billion in the first quarter. After BlackRock submitted its application, it re-applied for spot bitcoins in February. The company managed assets of about $ billion. In the disclosure, it said that the bitcoin market has matured, and its operational efficiency and scale are substantially the same as mature global ones. The fixed income of stocks and the commodity market are similar to that of September. The stocks applying for the fund will be traded on the exchange. The stock code is digital assets. The director said in the earnings conference call of the company in January that there seems to be some exciting momentum indeed, and we are still very concerned about the spot bitcoin. We think this is the best way to implement this asset category in the traditional channels of the United States. We look forward to continuing to cooperate with regulators on this issue, and Jing Shun also follows BlackRock's footsteps. Re-applied for spot bitcoin in June, and the proposed listing on the exchange was submitted in cooperation with the company, reflecting the annual bitcoin application submitted by the two people. The company revised its application earlier this fall, indicating that it will continue to have a dialogue with the regulatory authorities while the regulatory authorities continue to consider the decision. According to the stock code of the deposit trust and clearing company, Fidelity has joined the current bitcoin spot competition as a re-applicant, which is similar to the proposed bitcoin. One of the reasons is that its custodian, unlike some competitors, does not use the custody and transaction execution services that it has been providing since 2000, making it the best choice for the company's internal custody. This proposal was first submitted in late June, which means that it followed BlackRock and Fidelity applied for spot bitcoin as early as 2000, but it was prevented from trading according to the list last month. Like Jing Shun, it will be listed on the Chicago Board Options Exchange, followed by BlackRock and applied for spot bitcoin at the end of the month, a few days earlier than Fidelity. The company also made several amendments to its proposal, which is different from other applicants. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。