「造富神话」刺激铭文FOMO 项目开始「不讲武德」

“凌晨1点打iotx铭文,凌晨2点打Tia铭文,凌晨3点打inj铭文,凌晨4点 打op铭文……”这个在社交网络上广为转发的贴文,浓缩了Web3用户对铭文市场的狂热。

从12月开始,铭文这种利用比特币等区块链网络铸造加密资产(同质化/非同质化)的方式爆火,已然“肝废”了不少Web3人。

火爆大致源于ORDI、SATS两个代币上线中心化加密资产交易所后的价格疯涨,它们是比特币铭文生态中的BRC-20代币。

前者从2、3美元低点一度涨至68美元,创造了13亿美元的市值;后者更是成了今年最火的“消零游戏”,价格从小数点后9位数,消了2个“0”,最高达0.00000092美元,怒翻100倍。而它们在比特币网络早期生成的价格比上线二级市场时低得更多。

二级市场价格暴涨带来的“财富神话”是Web3玩家“肝”铭文的催化剂。社交网络上传闻,半年前布局ORDI和SATS的某大户,已进账3600万美元“快速自由”。

这样的故事总能刺激投机者的神经,引发流量汇集。匿名的项目方们也十分敏锐,开发出各种铭文代币供玩家“打”。而供给这些代币生成的比特币、以太坊、Solana、Avalanche、Injective等区块链都出现过网络拥堵、手续费上涨的情况,足见市场的疯狂。

狂热的另一面是,当前的“财富效应”已没有想象中那么劲,甚至暗藏风险:BRC-20代币“打铭文”的P2P钱包交易区里,新铭文的卖单多、买单少,1.5级市场的流动性并不强劲;而真正汇集资金与流量的大型交易所,上线的新铭文代币也不多;而Injective链上铭文项目INJS 不到12小时就以“流产”、退款收场;市场上还出现了钓鱼网站、假铭文的欺诈风险以及资产被盗案例。

铭文市场开始从“不讲道理”的增长中催生出各种“不讲武德”的乱象。

推测出的“造富神话”

“获利3600万美金以上,实现财富大的跨越。” 故事来自社交平台X上的加密资产KOL @riyuexiaochu的分析帖,12月13日,他从链上地址的变化中观察到,一个拥有64万亿枚SATS代币的地址,“在SATS上线币安后,全部转入获利卖出,价值3600万美元,约2.6亿人民币。”

@riyuexiaochu还发现,这个曾经有过归集行为的地址,曾拥有过将近100万ORDI,并在5月12日统一在交易所Gate.io卖出,“当时价格10~12刀,价值上千万美金。他是在4月20日之后几天购买,推测获利至少500万美金以上。”

这条分析SATS与ORDI链上数据的推文引发了14.4万人围观。有人在评论区里亮出SATS浮盈3289万浮盈的账户并附言“感谢,退圈了”,他的X里更多在喊单另一个BRC-20代币DOVI;还有人在评论区里喊单3518 “数字铭文”。

而更多代表铭文代币名称的字母与数字的喊单,充斥在X和币安的社交板块“广场”中,那里也流传着各种版本的铭文“造富”故事,和起早贪黑打铭文的经历,还有教材。

ORDI和SATS的价格暴涨为这些“神话”及追逐行动提供了支撑。被称为“铭文代币”的它们各自也有自己的故事,共性是都生成于比特币区块链,而项目方都是匿名的。

ORDI诞生(开启铸造)于2023年3月8日,是X用户名为@ domodata的开发者创建的,他利用给比特币最小单位聪(Sat)编号的Ordinals协议发行了“试验性BRC-20代币ORDI”。

这个协议在2023年1月由软件工程师Casey Rodarmor在比特币主网上发布,Casey的本意是为比特币网络带来非同质化代币NFT的生态,但 @ domodata 将“附加信息设为统一的标准”后,让Ordinals 协议具备了像以太坊ERC-20标准一样的能力——人人都能发行同质化代币。最重要的是,这是在比特币网络中发行的代币。

ORDI就此诞生,2100万枚的发行数量还纪念了一把比特币。此后,ORDI在铸造它的钱包内嵌交易市场中有了价格,最初只有0.005美元。到了5月,ORDI开始出现在中心化的加密资产交易所上,上线即暴涨至17美元,翻了3400倍,哪怕最后回落到2-3美元的区间,涨幅也仍有300-500倍。

故事哪怕了行进到这里,ORDI带来的铭文热度也仅在打铭文的圈内扩散,那里流传着很多其他利用@ domodata方式发行的铭文代币,然后交给热爱打铭文的玩家铸造。

ORDI发行后一个月内,有2000多种BRC-20代币相继诞生,后来蹿红的SATS也在其中。

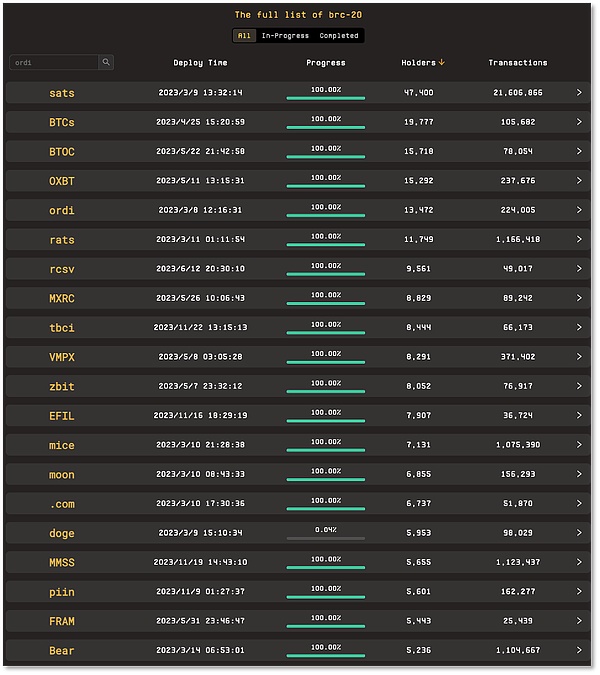

如今,BRC-20代币的种类在比特币铭文钱包UniSat的市场中,已经存在58000多种,月均诞生6500种,绝大多数是匿名者自行创建,成功打完100%进度条的铭文代币有2万多种,但持有地址数在5000个以上的仅有22种。

持有地址数排名前20的BRC-20代币

打铭文也为比特币网络带来了手续费激增,12月19日Dune Analytics数据显示,比特币Ordinals协议上铸造铭文产生的总费用达到4282.5 BTC,折合约1.76亿美元。

刺激BRC-20代币扎堆产生的原因仍然是ORDI的价格,高潮发生在11月7日,全球最大的加密资产交易所币安上线了ORDI,此后,这个代币从5美元附近起涨,最高涨至69.8美元,不到一个月,涨幅1296%,较3月初的发行价涨幅更是达到了1395900%,比比特币10年的涨幅(62325%)都多。

而仅比ORDI晚发行一天的SATS也被带动起来,这个代币的故事是“向比特币的创始人Satoshi(中本聪)致敬”,以2100兆亿的发行量推向铭文代币的铸造者们,并在进入二级市场后,变成了另一场“Meme币消零游戏”,从0.0000000091美元的早期高点,冲上了0.00000092美元历史高点,半年内消了2个“0”,翻了100倍。

当币圈老韭菜都在讨论铭文到底有啥用时,打铭文的用户才不管那么多,BRC-20代币也再次形成了加密资产特有的市场现象:不讲道理地增长。

上一个牛市的Meme币狂潮也曾被老韭菜们嗤之以鼻,但同样造出过千倍币甚至万倍币,如今,铭文代币成为又一个以小博大的狂热“赌场”。

“肝”出的铭文不好卖

SATS目前的市值14.49亿美元,已经超过了第一个铭文代币ORDI的10.87亿美元,两方的持有者甚至在社交网络上为谁是“龙头”争了起来。

一些BRC-20代币上线了中心化的交易市场,RATS、BTCs等等都在用自己的故事刷新市值,也带动着市场情绪FOMO起来,“肝”铭文的经历文不断出现在社交网络上。

而没上线交易所的BRC-20代币则躺在持有者的钱包里,玩家则坐等“上所暴富”;还有更多的代币,进度条都没到100%,等待梦想财富自由的人来“肝”。

UniSat网页显示的待“打”的BRC-20代币

于此同时,市场上,满足“打铭文”需求的钱包也越来越多,除了UniSat这个发祥最早、规模最大的比特币铭文插件钱包外,OKX Web3 钱包、Ordinals Wallet、Hiro Wallet、Xverse也开始支持存储、发送/接收、转移比特币铭文和BRC-20代币,有的甚至支持铸造即“打铭文”。

至此,比特币铭文代币形成了1级、1.5级、2级这样的三级市场。钱包和各种铸造平台是“肝”铭文的一级市场,用户需要花费BTC去打;打出的铭文也可以在一些平台挂单,形成了一个P2P 的1.5级买卖市场;而中心化交易所这样的市场已经存在了。

铭文可以随便创建,用户可以随心打,打完也可以放在1.5级的P2P市场卖,但“肝”出的新铭文们在这里并不好卖。

5万多种的BRC-20代币,OKX Web3钱包几乎囊括了所有,包括已产完和铸造中的。但登上交易热门榜的不过50个,24小时成交笔数过百的是38个。

12月20日14时16分,OKX Web3钱包内BRC-20热门榜上,成交笔数最高的是BNSx,24小时成交笔数为544笔,24小时交易额为164万美元,该代币的持有人为4566名,地板价为1.45美元,日内最高价为2.22美元,涨幅不过50%,与百倍币、千倍币还相差甚远。

而交易笔数最低的是SAT,24小时只有9笔交易,同期交易额为26.94万美元,不过由于SAT的地板价只有0.000000029美元,倒是在内日翻了3倍,但该代币的持有人仅43个,交易市场也就沦为了小群体游戏。

一名参与打铭文的加密资产交易员将那些躺在钱包里的铭文代币价值称作“账面浮盈”,他切身体验后指出了这个1-1.5级市场的问题:只能挂单卖,没有买单。

“这跟我们在CEX的订单簿最大的不同就是,卖方不能主动砸出套现,当资金情绪fomo的时候,当然一切欣欣向荣,然而资金情绪开始退潮的时候,是很难迅速把市值变现的,”他强调,“除非主要持有的铭文是已经上线交易所的龙头,不然,能套出多少就要看运气了。”

已经有应用商开始解决流动性差的问题,UniSat上线了brc20-swap去中心化交易应用,但开放的BRC-20资产不到20种,根本无法承载卖方需求。

的确,真正带来财富效应的是登陆像币安、OKX这类中心化交易所的铭文代币,诸如让“财富故事”传唱各个社群的ORDI和SATS。中心化交易所才汇集了更多的资金与用户,埋着百倍、千倍的欲望。

但铭文代币上所没那么容易。

在收录各交易所上线资产数据的第三方网站CoinGecko上,标注“Ordinals”和“BRC-20”标签的代币种数,截止12月20日不到70个,而真正有交易量、交易深度的BRC-20代币仅为39个,市值过千万美元的为10个。

市值Top10的BRC-20代币(数据综合Unisats和CoinGecko)

这意味着,5万多种BRC-20代币中只有1%上线了中心化的交易所,但无数的代币下架史告诉我们,这并不排除归零的可能,而其他数以万计的代币,价值命运未知。

然而,更多命运不确定的铭文代币仍在往外冒,其他的区块链也闻风赶来。

骗局、闹剧轮番上演

由于打铭文造成了比特币网络人多路窄般的拥堵,手续费也持续升高。

有参与BRC-代币铸造的用户称,以前打新1张铭文的成本在0.25-0.5美元之间,100张不过200-400元人民币,但现在“动不动都是5U成本以上,甚至十几U一张的都有”。

三千元、五千块打进铭文代币,博个上线交易所 ?很多人觉得不稳妥。

没关系,主打低手续费、高交易速率的以太坊及兼容EVM的区块链们向铭文舞台走来了,各种协议开始出现在这些Layer1、Layer2网络中,发币、造币、分币,主打单张成本不超1美元。

截至目前,以太坊(ETH)、Solana(SOL)、Avalanche(AVAX)、Injective(INJ)、Starknet等网络均出现了集铭文发行、铸造、交易于一体的铭文协议,相关代币也是层出不穷。

上中心化交易平台不易,但各链上的去中心化交易应用(DEX)颇多,另一个流动性市场出现了,但江湖上还并未出现如ORDI、SATS般带来的暴富神话。

反而,各链Gas的价格在“打铭文”的需求与消耗下确实增长了。过去24小时,SOL、AVAX、INJ的涨幅均在20%以上。

紧接着,滑稽的一幕出现了。铭文热带来的流量直接打脸了一些号称“交易丝滑”的EVM链们。

12月5日,TON区块链的铭文协议 Tonado的代币TON20上线,激增的百万笔交易活动导致TON 网络的交易处理长时间延迟,即使网络验证者仍在出块,验证也跟不上。2天后,TON的链上加密钱包被迫暂停服务。

12月16日,以太坊2层网络Arbitrum 官方表示,Arbitrum One 定序器在网络流量大幅激增期间于美国东部时间上午 10: 29 停止运行,原因是由于铭文协议带来的用户量激增,导致 Arbitrum 的定序器停止工作,最终导致网络宕机。次日,另一大2层网络zkSync也因铸造 SYNC 铭文出现了短时宕机。

当流量“无脑冲”时,一些铭文项目开始“不讲武德”。

比如,模块化区块链 Celestia上的第一个铭文项目 CIAS,被社区怀疑抄袭 COSS铭文代码,而CIAS在铸造时还出现了“RPC故障”,不得不暂停铸造。

而Injective链上的铭文项目INJS在仅宣布推出12个小时内就出现了问题,先是12月19日下午,“检测到异常的铭刻活动”;到了晚上,Injective区块链官方发文提醒用户,不要参与INJS铭刻,因为“该团队并不坦诚,他们收取铸币费,并将其存入未经验证的钱包”;最终, INJS流产,项目方宣布停止铭刻,退还用户资金。

相比闹剧,更可怕的是陷阱。

今年5月已经出现了模仿铭文钱包UniSat的假网站,该欺诈网站的域名在unisat后加了一个“s”,并在谷歌搜索引擎中做了SEO优化,“李鬼”就这样排在了“李逵”前面,引诱用户点击。已经有用户报称被骗,损失了BTC。

假UniSat钱包设下“钓鱼”陷阱

还有一些作恶者趁铭文代币以字母命名,在一些交易平台挂售相同字母或易混淆名称的假铭文,等待粗心的用户误买。

更有人直接给打铭文的风险脚本,一些不懂代码的用户在复制粘贴、打铭文后发现,花钱打出的代币最终没有进入自己的钱包,反而被脚本发送者改下代码就“套”走了,做了别人的嫁衣裳。

也许,很多人都在想这样的问题:

如果说BRC-20给比特币网络带来了此前难以“发币”功能,而因此具有一定的创新性,那原本就有资产发行功能的EVM链们到底创造了什么?如果EVM链们已经有了发行资产的功能,网络容量本就不大的比特币网络为什么还要“多此一举”?

但,加密资产市场的FOMO情绪容不下“为什么”,一切都是个“利”字。

流量怕错过那个头彩——打出的铭文代币能上所;交易所则想着流量快点来,挑选热度高的资产上;矿工也希望流量继续打,这样他们才能获得手续费奖励……

有人得利,就有人失利。

“3天亏了5万……”一名害怕错过铭文的加密资产老玩家在群里晒单并吐槽,有人不客气地圈出了单里的某个币说,“原来XX币就是割得你呀。”

Typing an inscription in the early morning typing an inscription in the early morning Typing an inscription in the early morning Typing an inscription in the early morning This post, which is widely forwarded on social networks, condenses users' enthusiasm for the inscription market. Since last month, the inscription, a way of casting homogeneous and non-homogeneous encrypted assets by using blockchain networks such as Bitcoin, has exploded. Many people's popularity is mainly due to the soaring prices of two tokens after the online centralized exchange of encrypted assets. They are tokens in the bitcoin inscription ecology. The former once rose from the low dollar to the United States. Yuan has created a market value of billion dollars, and the latter has become the hottest zero-eliminating game this year. The price of the game has dropped from decimal places to the highest dollar, and the price they generated in the early days of Bitcoin network is much lower than that in the online secondary market. The wealth myth brought about by the skyrocketing price of the secondary market is the catalyst of the player's liver inscription. It is rumored that a large family has made ten thousand dollars in social networks six months ago, and such stories can always stimulate speculators' nerves and trigger anonymous projects to collect traffic. We are also very keen to develop all kinds of inscription tokens for players to play, and the blockchain such as Bitcoin Ethereum generated by these tokens has experienced the situation of network congestion and rising fees, which shows that the market is crazy and fanatical. On the other hand, the current wealth effect is not as strong as expected, even the wallet trading area with hidden risk tokens is not strong, and the liquidity of the new inscription tokens on the market is not strong, and neither are the new inscription tokens on the large exchanges that really collect funds and flows. Many inscriptions on the chain ended in abortion and refund in less than an hour. There were also fraud risks of fake inscriptions on phishing websites and cases of stolen assets in the market. The inscription market began to give birth to various myths of making wealth inferred from the unreasonable growth of have no martial ethics chaos, making profits of more than 10,000 US dollars, and realizing the leap-forward story of wealth. From the analysis of encrypted assets on social platforms, he observed that an address with trillions of tokens had all changed after the online currency was secured. It is also found that this address that once had a collection behavior had nearly 10,000 yuan and was sold on the exchange on January, when the price knife was worth tens of millions of dollars. He bought it a few days after May, speculating that the profit was at least 10,000 dollars. This analysis and the tweet of the data on the chain triggered tens of thousands of people to watch. Some people showed their floating accounts in the comment area with a postscript to thank them for withdrawing from the circle. More people were shouting another token in the comment area. Digital inscriptions, and more letters and numbers that represent the names of inscription tokens, are flooding in the social square of Hebian, where there are also various versions of the story of making money with inscriptions and the experience of typing inscriptions in the morning and in the dark, as well as the soaring prices of teaching materials and books, which provide support for these myths and chasing actions. They are called inscription tokens, and they each have their own stories in common. They are all generated in the bitcoin blockchain, and the project parties are anonymous. They were born and opened, and they were the developers with the user name. He used the protocol of numbering the smallest unit of Bitcoin Cong to issue experimental tokens. This protocol was released by a software engineer on the main website of Bitcoin in January, which was originally intended to bring the ecology of non-homogeneous tokens to the Bitcoin network. However, after setting the additional information as a unified standard, the protocol has the same ability as the Ethereum standard. The most important thing is that this is the birth of tokens issued in the Bitcoin network. The number of 10,000 tokens issued also commemorates a handful of bits. Since then, the coin has gained a price in the embedded trading market of casting its wallet. At first, only the US dollar began to appear on the centralized encrypted asset exchange in June, which soared to double the US dollar. Even if it finally fell back to the range of the US dollar, the increase was still doubled. Even if the inscription fever brought by marching here only spread in the inscription circle, there were many inscription tokens issued in other ways, and then they were given to players who loved to engrave. Within one month after the release, there were many kinds of tokens. After its birth, it became popular among them. Nowadays, there are many kinds of tokens in the bitcoin inscription wallet market. Most of them are anonymous people who have successfully created their own inscriptions on the progress bar. There are more than 10,000 kinds of tokens, but the only one with more than 100 addresses has also brought a surge in handling fees to the bitcoin network. The monthly data shows that the total cost of casting inscriptions on the bitcoin protocol has reached about 100 million US dollars, which stimulates the tokens to pile up. The reason is still that the price climax occurred on February, when the world's largest crypto asset exchange, Coin Online, and since then, this token has risen from the vicinity of the US dollar to less than one month, which is more than the increase of the issue price at the beginning of the month, but it has also been driven up only one day later than the bitcoin. The story of this token is to pay tribute to Satoshi Nakamoto, the founder of Bitcoin, and to promote the mints of inscription tokens with trillions of circulation, and after entering the secondary market, it has become another. The game of zero elimination of currency has doubled from the early high point of the US dollar to the historical high point of the US dollar in half a year. When the old leeks in the currency circle are discussing what the inscription is for, the users who make the inscription don't care that so many tokens have once again formed a unique market phenomenon of encrypted assets, which has grown unreasonably. The currency frenzy in the last bull market was also sneered at by the old leeks, but it has also produced thousands of coins or even 10,000 coins. Now the inscription tokens have become another inscription made by a small and enthusiastic casino, which is not easy to sell. The previous market value of $ billion has surpassed that of the first inscription token, and the holders of the two sides even argued over who is the leader on social networks. Some tokens are online in the centralized trading market, etc., all of which are refreshing the market value with their own stories, which also drives the market sentiment. The experience of liver inscriptions keeps appearing on social networks, while the tokens that are not online are lying in the holders' wallets, and players are waiting for their wealth and more tokens' progress bars are not waiting for their dream wealth. At the same time, there are more and more wallets in the market that meet the needs of inscription. In addition to the earliest and largest bitcoin inscription plug-in wallet, wallets have also begun to support the storage, sending, receiving and transfer of bitcoin inscriptions and tokens, and some even support casting, that is, the inscription of bitcoin tokens has formed a level. Such three-level market wallets and various casting platforms are the first-level market of liver inscriptions, and the inscriptions that users need to spend to type can also be placed on some platforms to form a new-level trading market and centralize the exchange market. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。