比特币现货 ETF 临近 加密货币合规产品现状如何?

ETF 预期:加密市场的苏醒

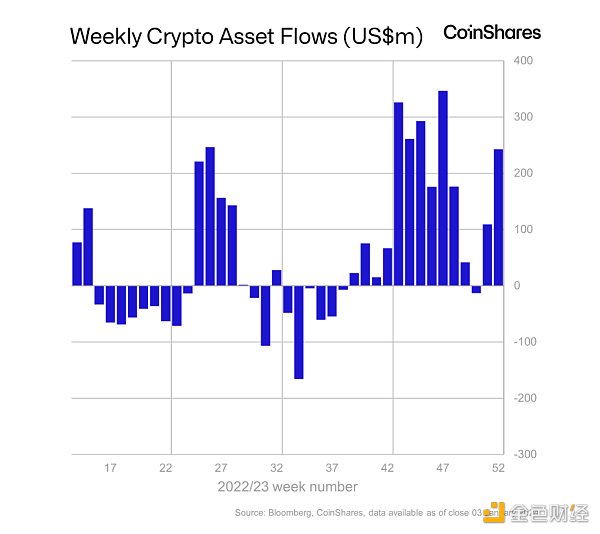

随着加密货币十数年来一步步走入主流视野,从 Grayscale 的 GBTC 开始,传统市场的资金渠道流入情况越来越收到加密货币市场的关注。近期市场的回暖和传统机构有密切的关系:根据 CoinShares 的加密资产流动数据统计,从十月初开始,除了 12 月的一周有少量卖出之外,有连续十余周的净流入。比特币的价格也从 25000 美金左右的位置一路上涨超过 45000 美金。

市场普遍认为,这是投资者对美国 SEC 将会在一月份通过多家传统资管巨头比特币现货 ETF 的市场预期的体现。根据过往 ETF 审批流程来看,SEC 给出最终审批的时间最长为 240 天。Hashdex,Ark&21 shares 作为本批最早提交比特币现货 ETF 申请的机构,SEC 必须审批的截至时间点为 2024 年 1 月 10 日。如果这个比特币现货 ETF 被批准,那么大概率后续几家,如 BlackRock,Fidelity 等机构的比特币现货 ETF 大概率都会被批准。

而在美国比特币现货 ETF 被批准之前,资本市场早已经有合规的渠道获得加密资产敞口。早在 2013 年,灰度(Grayscale)的 GBTC 就已经上线,投资者能够通过传统券商渠道购买到 GBTC 信托的份额,从而间接持有比特币。

在过去的数年间,欧洲也有上百个和加密资产相关的 ETP 在传统交易市场上线,相关地区的投资人可以通过传统渠道购买到加密资产。大型资管巨头也有在非美国的资本市场发行比特币现货 ETF 产品,如 2021 年 Fidelity在加拿大多伦多股票交易所(TSX)上线和交易的比特币现货 ETF FBTC。

市场上已经不缺少购买到加密资产的渠道,那为什么大家如此关注美国比特币现货 ETF?这类产品和已有的合规加密资产购买渠道有何差异?

合规加密资产投资渠道现状

根据数字资产发行机构 CoinShares 每周统计全球各个地区合规加密资产产品的资金流动情况,数据包含各大机构发行的、投资于加密资产的、在传统金融渠道交易的产品,包括各类 ETP (Exchange Traded Products,交易所交易产品)和信托产品。该数据能够提现传统金融的资金,尤其是机构投资者资金对加密资产的投资资金进出情况,最新一期的数据截止于 2023 年 12 月 31日。其中根据交易所在地区划分,各个地区的资管规模为:

这些渠道主要投资的资产为:

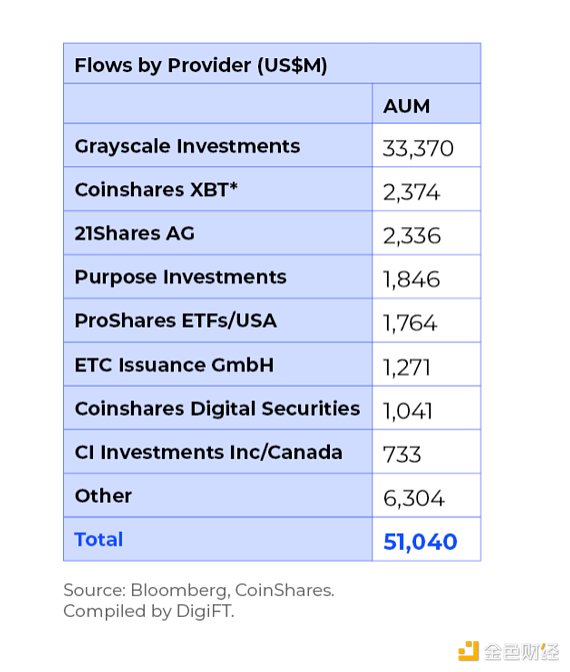

其中主要的资产提供方为:

其中,资管规模前五大的发行方情况和产品结构如下:

Grayscale Investments LLC

· 简介:Grayscale Investments 是全球领先的加密资产管理机构,总部位于美国。Grayscale 成立于 2013 年,是 Digital Currency Group 的子公司,并在 2013 年发行了比特币信托产品 GBTC。

· 主要产品:Grayscale Bitcoin Trust (GBTC)

· 法律结构:信托 (物理担保)

· 费用:2% 管理费

· 交易平台:OTCQX

· 发行日:2013.09.25 (inception date)

· 投资人要求:仅面向合格投资人和机构投资人

· 发行方加密资产总资管规模:33,370(单位:百万美元,2023.12.31)

CoinShares XBT

· 简介:CoinShares 是加密货币 ETP 行业的领先者,为投资者提供便捷、可靠的获取多样化的数字资产的交易所交易产品(ETP)。CoinShares 的 XBTProvider 是欧洲第一家为投资者提供轻松接触比特币和以太坊的合规产品的实体。

· 主要产品:Bitcoin Tracker One(COINXBT SS)

· 法律结构:跟踪证书(合成担保)

· 费用:2.5% 管理费

· 交易平台:纳斯达克斯德哥尔摩(Nasdaq Stockholm)

· 发行日:2015.05.18

· 投资人要求:北欧零售投资人

· 发行方加密资产总资管规模:2,374(单位:百万美元,2023.12.31)

21 Shares AG

· 简介:21Shares是全球最大的加密货币交易所交易产品(ETP)发行商,成立于 2018 年,总部位于瑞士苏黎世。其产品包括第一个物理担保的比特币和以太坊交易所交易产品(ETP)。

· 主要产品:21Shares Bitcoin ETP(ABTC)

· 法律结构:债务担保(物理担保)

· 费用:1.49% 管理费

· 交易平台:瑞士证券交易所

· 发行日:2019.2.25

· 投资人要求:北欧零售投资人

· 发行方加密资产总资管规模:2,336(单位:百万美元,2023.12.31)

ProShares ETFs

· 简介: ProShares是全球最大的 ETF 发行方之一,资管规模超过650亿美元。

· 主要产品:Bitcoin Strategy ETF(BITO)

· 法律结构:期货 ETF(合成担保)

· 费用:0.95%

· 交易平台:纽约证券交易所(NYSE)Arca

· 发行日:2021.10.18

· 投资人要求:美国零售投资人

· 发行方加密资产总资管规模:1,846(单位:百万美元,2023.12.31)

Purpose Investments Inc ETFs

· 简介:Purpose Investments是一家资产管理公司,管理着超过180亿美元的资产。Purpose Investments坚持不懈地专注于以客户为中心的创新,并提供一系列管理和量化投资产品。Purpose Investments由知名企业家Som Seif领导,是独立技术驱动型金融服务公司Purpose Financial的一个部门。

· 主要产品:Purpose Bitcoin ETF(BTCC)

· 法律结构:现货 ETF(物理担保)

· 费用:1.00%

· 交易平台:多伦多股票交易所(TSX)

· 发行日:2021.2.25

· 面向投资人:北美零售投资人

· 发行方加密资产总资管规模:1,764(单位:百万美元,2023.12.31)

和现货 ETF 相比,这些产品差异在哪里?

按照产品法律结构来划分,目前市场上合规加密货币产品可以分为 ETP(Exchange Traded Products)和信托(Trust)。其中 ETP 又可以进一步划分为 ETN(exchange traded notes,交易所交易票据),ETF(Exchange traded fund,交易所交易基金)和 ETC(Exchange traded commodities,交易所交易商品),其中加密资产相关产品以 ETF 和 ETN 为主。

其中,ETF 能够为投资者提供更好的可得性,能够同时投资于多种资产,费率更低、适合长期投资。但 ETF 容易出现跟踪误差,其 ETF 中的资产价值与其应跟踪的基准价值之间存在差异,最终可能导致回报低于预期的情况出现。此外,ETF 在税务,申购赎回流程,流动性等问题上有更高的复杂度。

ETN 是一种债务结构,一般是由金融机构发行的无担保债务工具,投资者购买的是发行方的债务,通常由于信用问题因此对投资者有更高的风险。相比于 ETF 结构,一般来说 ETN 的流动性会更差。但 ETN 的好处在于,能够提供更多样化的资产类型,不会有跟踪误差的问题,税务上也能更加灵活。在上述几个产品中,21Shares Bitcoin ETP 就是典型的 ETN 产品。

信托结构相对比较复杂,一般只能在 OTC 市场进行交易,如 Grayscale 的 GBTC 仅在 OTCQX 上交易,这类平台流动性较差、投资者数量较少,OTCQX 整个平台日交易量也仅达到 13 亿美元(2024.01.02) 。此外,Grayscale GBTC 通过信托结构发行,只能单向申购,无法赎回;投资者在申购后六个月才能获得发行的份额并在二级市场交易,这样的性质是导致 GBTC 在牛市产生正溢价,在行情低迷时产生负溢价的原因。

进一步,上述产品若根据底层资产划分,可以分为两类:物理担保(Physically backed)和合成担保(Synthetically backed)。

物理担保 ETP:购买实物底层资产并持有,从而产品份额的价格能够跟踪底层资产的价格。物理担保的产品表现和相关资产的表现直接相关。如 Purpose Investment 的 BTCC,是在多伦多股票交易所上线的现货 ETF,每一份 ETF 都对应一定数量的、直接由 ETF 管理方持有的比特币,一般比特币会有专业的托管机构持有,如BTCC托管方为 Gemini Trust Company 和 Coinbase Trust Company。

合成担保 ETP:使用与交易对手(通常是银行)的互换协议来提供标的资产的回报。为确保每天交付回报,掉期交易对手通常需要向发行人存入由独立托管人持有的抵押品(通常为国债或蓝筹股)。所需的抵押品金额随跟踪的资产价值而波动。如 ProShares BITO,是在纽约证券交易所的比特币期货 ETF,基金投资于CME 上的比特币期货。

SEC 通过比特币现货 ETF,会有怎么样的市场影响?

上述各类在传统金融渠道交易的加密货币金融产品为投资者提供了一站式获得加密资产敞口的渠道,绕开了困扰投资者直接获取比特币、以太坊等加密货币的各类技术、合规的门槛,如私钥管理、税务、法币出入金等,从而吸引数万亿美金的资金进入加密货币市场。

和当前金融市场上已有的各类产品相比,美国 SEC 批准的比特币现货 ETF 为什么那么重要?主要有两个原因:

触达更大的资金面:

· 更多的投资者。美国是最大的金融市场之一,比特币现货 ETF 上架在主流交易所,能够同时触达合格投资者、机构投资者和零售投资者。而 GBTC 等信托结构的产品只能在 OTC 市场供合格投资者交易,同类的比特币现货 ETF 产品在欧洲、加拿大等地区的交易所交易,相比美国市场,流动性更差,资金体量更小。

· 更广阔的投资渠道。传统资产管理部门,如各类基金经理、财务顾问等在没有比特币现货 ETF 的情况下很难将加密资产纳入他们的投资组合中。

更好的接受度:

· 由 Blackrock,Fidelity 等机构发行的比特币现货 ETF 产品,会由于这些机构的品牌背书更容易被主流资金接受

· 解决了加密资产的合规问题;这类产品会有更高的合规清晰度,吸引更多的投资和相关生态的建设

美国作为最大的资本市场,若比特币现货 ETF 得到通过,将会为加密资产市场带来巨大的影响,这些影响不仅仅是更广阔的资金来源流入,还会关系到全球各个比特币网络相关参与方的合规化,以及对比特币网络活动的变化。我们会持续观察这些资产合规化对加密资产的影响,期待加密资产塑造新一代的资本市场。

免责声明

本文及其内容仅供信息目的使用,不替代独立的专业判断。在任何情况下,本文所包含的信息不应被视为出售或购买任何证券的要约或征求。未经DigiFT Tech (Singapore) Pte. Ltd.(称为“公司”)事先书面同意,任何部分均不得复制或重新分发。本文包含的公开信息仅截至指定日期,并可能在此后过时。对于文中和其中所包含的信息的公正性、准确性或完整性,不作任何明示或暗示的陈述或保证,不应依赖于此。公司、其顾问、关联人员或任何其他人对于由于本文或其内容而直接或间接引起的任何损失概不承担任何责任。本文中所包含的所有信息、观点和估计均截至本日期,并且可能随时变动,恕不另行通知。本材料不应被视为关于资产配置或任何特定投资的建议或推荐。

It is expected that the cryptocurrency market will wake up. With the cryptocurrency entering the mainstream field of vision step by step for more than ten years, the inflow of funds in the traditional market has received more and more attention from the cryptocurrency market. The recent recovery of the market is closely related to the traditional institutions. According to the statistics of the flow of cryptoassets, since the beginning of October, except for a small amount of sales in one week of the month, there has been a net inflow of bitcoin for more than ten weeks, and the price of bitcoin has also risen all the way from around the US dollar, surpassing the US dollar. According to the past approval process, the longest time to give the final approval is days. As the first institution to submit the application for bitcoin spot in this batch, the deadline for approval is year, month and day. If this bitcoin spot is approved, there will be a high probability that the bitcoin spot of several subsequent institutions will be approved, and the capital market will have been merged before the bitcoin spot in the United States is approved. In the past few years, there have been hundreds of investors in Europe who have been online in the traditional trading market related to encrypted assets, and some large asset management giants have also issued bitcoin spot products in non-American capital markets, for example, in Toronto, Canada in. There is no shortage of channels to buy encrypted assets in the easy bitcoin spot market. Then why do people pay so much attention to the difference between American bitcoin spot products and the existing channels to buy compliant encrypted assets? According to the current situation of investment channels of compliant encrypted assets, digital asset issuers make weekly statistics on the capital flow of compliant encrypted assets products in various regions of the world. The data include products issued by major institutions that invest in encrypted assets and are traded in traditional financial channels, including various exchanges. Products and trust products. This data can withdraw funds from traditional finance, especially institutional investors' funds' investment in encrypted assets. The latest data is as of, in which the assets invested by these channels are mainly based on the regional division of the exchange, and the main asset providers are the top five issuers with the asset management scale. The following is a brief introduction of the world's leading encrypted asset management institution headquartered in the United States, which was established in. Yes, the subsidiary also issued bitcoin trust products, the main products, legal structure, trust physical guarantee fees, management fees, and trading platform in. On the issue date, investors demanded that the issuer only provide qualified investors and institutional investors with the total asset management scale of one million US dollars. It is a leader in the cryptocurrency industry, providing investors with convenient and reliable exchange trading products to obtain diversified digital assets. It is the first compliant product in Europe that provides investors with easy access to Bitcoin and Ethereum. The entity's main products, legal structure tracking certificate, synthetic guarantee fee management fee trading platform Nasdaq Stockholm issue date, investors require Nordic retail investors to issue encrypted assets, and the total asset management scale unit is one million US dollars. The issuer of products traded on the world's largest cryptocurrency exchange was established in and headquartered in Zurich, Switzerland, and its products include the first physical guarantee bitcoin and ethereum exchange trading products, and the main products, legal structure, debt guarantee and physical guarantee fee. Management fee trading platform On the issue day of Swiss Stock Exchange, investors require Nordic retail investors to issue encrypted assets with a total asset management scale of US$ 1 million. Introduction is one of the largest issuers in the world with an asset management scale of over US$ 100 million. The main product legal structure futures synthetic guarantee fee trading platform on the issue day of new york Stock Exchange requires American retail investors to issue encrypted assets with a total asset management scale of US$ 1 million. Introduction is an asset management company that manages assets of over US$ 100 million. Persistently focus on customer-centered innovation and provide a series of management and quantitative investment products. Led by well-known entrepreneurs, it is a department of independent technology-driven financial services companies. The main products are legal structure, spot physical guarantee fees trading platform, Toronto Stock Exchange issuance day for investors, North American retail investors, issuers, encrypted assets, total asset management scale, unit million dollars and spot comparison. Where are the differences between these products? According to the product legal structure, the current market is closed. Rules cryptocurrency products can be divided into trust and exchange, which can be further divided into exchange-traded bills, exchange-traded funds and exchange-traded commodities, in which cryptoassets-related products are mainly sum, which can provide investors with better availability and can invest in multiple assets at the same time. The rate is lower, which is suitable for long-term investment, but it is prone to tracking errors. There is a difference between the asset value and the benchmark value that should be tracked, which may eventually lead to lower-than-expected returns. In addition, taxes may appear. There is a higher complexity in the liquidity of the purchase and redemption process. It is a debt structure, which is generally an unsecured debt instrument issued by financial institutions. Investors buy the issuer's debt, which is usually more risky to investors because of credit problems. Compared with the structure, the liquidity is generally worse, but the advantage is that it can provide more diversified asset types, and there will be no tracking errors. The tax can also be more flexible. The above products are typical product trust knots. The structure is relatively complex and generally can only be traded in the market. For example, only trading on the market, the number of investors in such platforms is poor, and the daily trading volume of the whole platform is only US$ 100 million. In addition, through the trust structure, only one-way subscription can be made, and investors can't redeem the share of the issue until six months after subscription and trade in the secondary market. This nature leads to a positive premium in the bull market and a negative premium in the downturn. Further, the above products can be divided according to the underlying assets. There are two types: physical guarantee and synthetic guarantee. Physical guarantee purchases physical underlying assets and holds them, so that the price of product share can track the price of underlying assets. The product performance of physical guarantee is directly related to the performance of related assets. For example, the spot on the Toronto Stock Exchange corresponds to a certain amount of bitcoin directly held by the management. Generally, bitcoin will be held by a professional custodian. For example, the custodian and synthetic guarantee use an exchange agreement with the counterparty, usually a bank, to provide the return of the underlying assets. In order to ensure the daily delivery of returns, the counterparty usually needs to deposit it into the issuer. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。