暴富成暴负?教你识破Rug Pull

对于所有加密货币爱好者而言,Web3世界充满了机遇、挑战和危机。每天都有大量新的代币项目上线,似乎到处都是致富的机会,但实际上潜在的风险无处不在。土狗项目层出不穷,用户防不胜防。这种情况下,我们应该如何判断项目的可靠性,规避Rug Pull风险,守住我们的钱袋子呢?别急,本文将给你带来全面的Rug Pull判断方法论,让你最大程度避免资产损失。

基础工具使用

观察走势图并验证交易量

使用多链DEX加密分析工具——DEX Screener,通过观察代币走势图,我们可以注意到是否存在异常的买入和卖出比例,以规避土狗项目创造的虚假交易量。同样,对于新上线的代币,如果出现可疑的高交易量和单笔交易量,也应引起警惕。

https://dexscreener.com/

检查交易记录

DEX Screener等工具可以列出所有的交易记录,我们可以简单地查看所有买入和卖出操作的地址。如果发现同一个地址频繁进行操作(如下图所示),这也是一个非常可疑的信号。

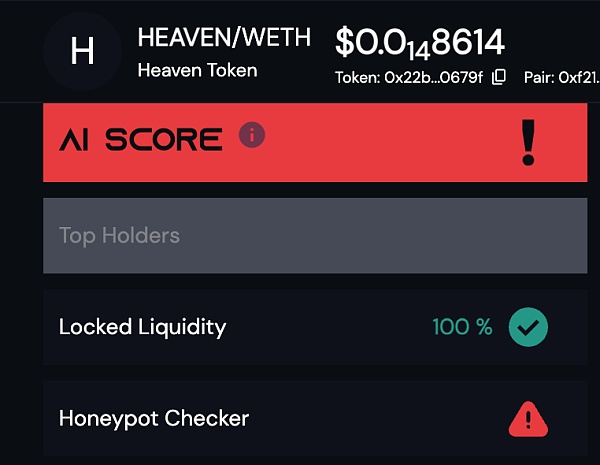

使用Honeypot和代币风险监测功能

包括DEX Screener 和 Advantis.AI 在内的平台,会提供 Honeypot 检测和一些基础的代币风险项检测功能,同样可以辅助用户进行判断投资风险。如图,当用户对某一Token进行检索时,平台会自动给出该Token的风险等级,用户可以根据风险等级来判断是否需要及时撤出资金。

https://advantis.ai/

使用MetaSleuth检测Rug Pull

检测部署者资金来源

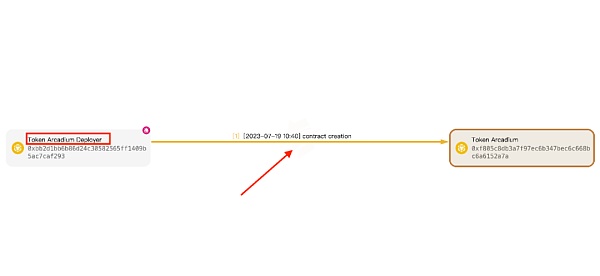

对于一个代币而言,除了代币本身的合约地址和交易对地址外,部署者(Deployer)地址也非常重要。通过观察这个地址在区块链上的资金关系,我们可以更好地评估一个项目的风险情况。

要找到部署者地址,可以直接在 MetaSleuth (https://metasleuth.io) 中输入代币的合约地址。在生成的资金流图中,查找合约创建边——'contract creation'。该边所在的交易即为该代币合约的创建交易,而交易的发起者即为部署者。随后,可以进一步分析部署者的资金来源。

合约创建关系示例

为了有效规避风险,用户可以注意以下常见的部署者资金来源,这些来源可能带来高风险情况:

资金来自混币服务或无 KYC 的闪兑服务(如Fixedfloat)。这是恶意代币部署者为了避免被追踪到真实身份而选择的一种方式。

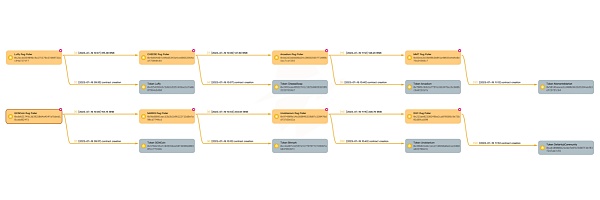

资金携带其他非法来源。下图展示了一个Rug Pull网络,其中显示的所有代币在很短的时间内发生了Rug Pull。骗子利用上次Rug Pull后的获利资金转移到下一个地址,然后由该地址部署新的代币并诱骗新的受害者。

https://metasleuth.io/result/bsc/0xde621749c3d39250d4a454fafbbeb18cabd824f5?source=64681083-27e7-4b42-a816-db6c0f9869f3

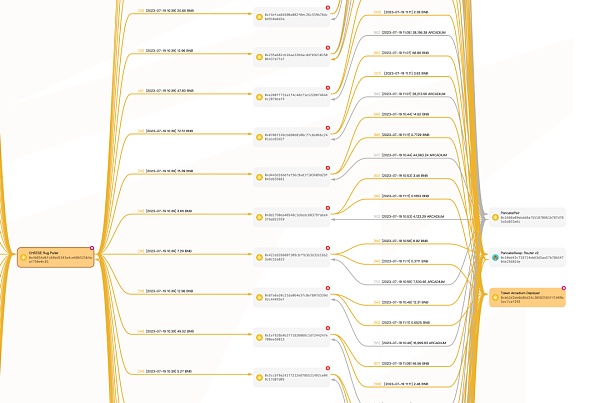

检测流动性来源

诈骗项目方非常熟练地制造虚假流动性,如下图所示。他们将之前获得的利润资金分散到许多不同的地址中,这些地址只进行了购买代币的操作,同时还有一些地址负责卖出代币的任务。这些虚假构建的流动性诱使受害者误以为该代币非常受欢迎,然而他们并不知道一旦投资进去就会被欺骗。

https://metasleuth.io/result/bsc/0x4b854d6fc84bd5343a4ce68652564aaf750e0c65?source=b50ccfcd-f5c9-4d49-8138-1d9c40181aaf

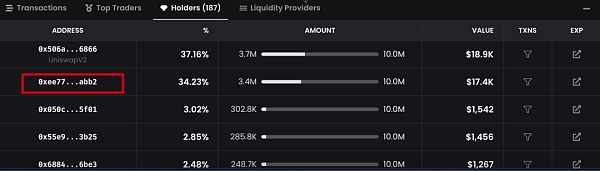

关注Top Holder

下图所示是一个代币的Top Holder列表,排名第二的持有者的持有量与流动性池几乎相当,这意味着该持有者有能力随时将资金从池中全部提取。

通过在MetaSleuth中进一步追踪该地址的资金来源,我们可以发现该地址就是该代币的部署者,在合约创建时为自己铸造了大量代币。这种项目存在着极高的风险。

总结

在投资前,用户应该进行适当的尽职调查(DYOR),利用成熟的分析平台(如DEX Screener)和 MetaSleuth 这类资金追踪平台来辅助投资决策,以最大限度地规避风险。观察走势图并验证交易量,检查交易记录是常用的方法之一。此外,通过MetaSleuth等工具追踪部署者的资金来源和流动性来源也是规避风险的有效途径。确保代币项目的真实性和可靠性,可以帮助加密货币爱好者作出更明智的投资决策,从而在Web3世界中获得更好的回报并降低风险。

For all cryptocurrency lovers, the world is full of opportunities, challenges and crises. Every day, a large number of new token projects are launched. It seems that there are opportunities to get rich everywhere, but in fact, potential risks are everywhere, and users can't prevent them. In this case, how should we judge the reliability of the projects, avoid risks and keep our money bags? Don't worry, this article will bring you a comprehensive judgment methodology, so that you can avoid asset losses to the greatest extent by using basic tools, observing the trend chart and testing it. Securities trading volume uses multi-chain encryption analysis tools. By observing the trend chart of tokens, we can notice whether there is an abnormal ratio of buying and selling to avoid the false trading volume created by the local dog project. Similarly, for newly launched tokens, if there is a suspicious high trading volume and a single trading volume, we should also be vigilant. Tools such as checking trading records can list all trading records. We can simply check the addresses of all buying and selling operations. If we find the same address, we will operate frequently, as shown below. This is also a very suspicious signal use and token risk monitoring function. The platform including and will provide detection and some basic token risk detection functions, which can also assist users to judge the investment risk. For example, when users search for a certain item, the platform will automatically give the risk level. Users can judge whether it is necessary to withdraw funds in time according to the risk level, and detect the source of funds of the deployer except the contract address and the token itself for a token. The transaction is also very important to the address of the deployer outside the address. By observing the financial relationship of this address on the blockchain, we can better evaluate the risk of a project. To find the deployer's address, we can directly enter the contract address of the token in the generated capital flow diagram to find the contract creation edge. The transaction where this edge is located is the transaction of the token contract creation, and the initiator of the transaction is the deployer. Then we can further analyze the source of funds of the deployer. Example of contract creation relationship in order to be effective. Risk-averse users can pay attention to the following common sources of funds for deployers. These sources may bring high-risk situations. The funds come from mixed currency service or no flash exchange service. For example, this is a way that malicious token deployers choose to avoid being traced to their true identities. The following figure shows a network in which all the tokens displayed have occurred in a short time. The scammers use the last profitable funds to transfer to the next address, and then deploy new tokens from this address. Deceive new victims to detect the source of liquidity fraud. The project party is very skilled in creating false liquidity. As shown in the figure below, they spread the profits and funds they obtained before to many different addresses. These addresses only carry out the operation of buying tokens, while some addresses are responsible for selling tokens. These falsely constructed liquidity induce victims to mistakenly think that the token is very popular, but they do not know that once they invest, they will be deceived. The figure below shows a list of tokens. The holding amount of the second holder is almost equal to that of the liquidity pool, which means that the holder has the ability to withdraw all the funds from the pool at any time. By further tracing the source of the funds at this address, we can find that the deployer of the token cast a large number of tokens for himself when the contract was created. This kind of project has extremely high risks. Before investing, users should conduct appropriate due diligence and use mature analysis platforms such as this kind of fund tracking platform to assist investment decision. It is one of the common methods to observe the trend chart and verify the transaction volume to avoid risks to the maximum extent. In addition, it is also an effective way to avoid risks by tracking the source of funds and liquidity of the deployer through tools such as tools. Ensuring the authenticity and reliability of token projects can help cryptocurrency lovers make more wise investment decisions, thus obtaining better returns and reducing risks in the world. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。