比特币生态的新变量 BRC20 是否会重塑减半叙事?

伴随着现货比特币 ETF 的通过,接下来最重要的加密世界叙事无疑就是第四次比特币减半,预计为 2024 年 4 月 22 日,届时区块奖励将从 6.25 BTC 降至 3.125 BTC。

作为加密行业最重要的叙事之一,「比特币减半」一直是提振市场信心的良药,那本轮减半周期会和此前压着相同的韵脚么?2023 年以来比特币生态的新变量有可能会产生哪些意想不到的影响?

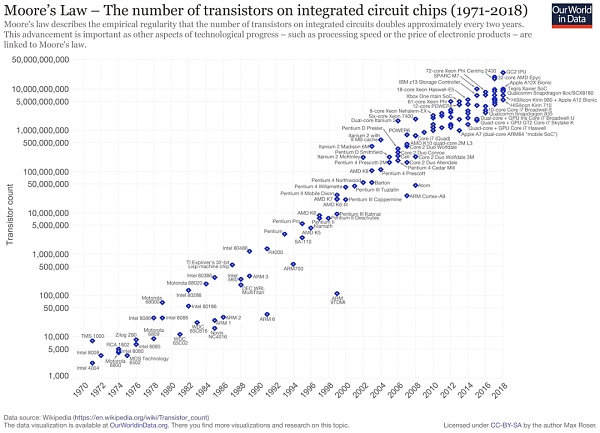

「摩尔定律」上的 PoW 挖矿

《Bitcoin becomes the flag of technology》一文提到,几十年来单位芯片上「Transistor Count(晶体管数量)」的增长变化图,在「摩尔定律」的支配下,呈肉眼可见的恐怖增长态势。

映射到比特币挖矿芯片等矿机领域,比特币挖矿登堂入室的这十年里,借由比特币等 PoW 币种激励下对「算力之美」的追求,挖矿硬件历经了从 CPU 到 GPU 再到 FPGA、ASIC 的演化,芯片制程也从上百纳米到几十纳米再到如今的 7 纳米甚至更小,逐步逼近了天花板,再往下就要涉及量子领域。

圈内资本向来喜欢集体豪赌「减半盛事」,从 2018 年到 2020 年的熊牛周期就是如此,比特币挖矿领域建立在这一积极的势头上,不断增长的算力、新硬件、即将到来的奖励减半等因素将决定行业和比特币的总体增长,如今更是如此:

就在昨天的 2 月 3 日,据 BTC.com 数据显示,比特币挖矿难度在区块高度 828,576 处迎来挖矿难度调整,挖矿难度上调 7.33% 至 75.5 T,续创历史新高。目前全网平均算力为 550.07 EH/s,此外本次 7.33% 的挖矿难度上调幅度也创下自 2023 年 3 月以来的最高记录。

现在我们则处在新一轮减半周期的腰部,距离下一次的比特币还有两年的窗口期,这也可能是绝大部分此轮从业者和投资者入圈第一次(或第二次)亲身见证并经历的比特币减半「盛事」,机制设计的精妙注定会给大家留下深刻印象。

减半的历史轮回

对加密行业来说,每轮减半确实都是一次的盛事,尤其是比特币前两次减半周期,都出现了数十倍的惊人涨幅(短期看两次减半后,都伴随着利多出尽出现了的短期下跌,但随后在调整完成,走出了长期上涨行情)。

不过 2020 年第三次减半开始,由于行业从业人数、市场关注度以及配套基础设施的完善性都比之前有了显著的提升,比特币再也不是局限在极客圈子的小众产品,开始了与更多外界因素的联动。

简单地概括:

第一次减半之前,圈内极客们更关心的是比特币作为电子现金的可能性;

第二次减半周期中,关于比特币的关注点转变到了其成为支付工具的属性,也引发了一系列争论(随后的 BCH 分叉几乎是圈内的顶流);

而在第三次减半周期,比特币已经成为一种另类资产,关注传统机构与资本的布局开始成为主旋律;

所以相比前两次减半,比特币第三次减半的热度也是空前的,与此同时,比特币第三次减半时世界整体政经环境也影响了它的表现:

在宏观因素的影响下,5 月 11 日减半前两个月的 3 月 12 日 ——3 月 13 日,比特币从 7600 美元开始一路下行,先是跌至 5500 美元震荡。后续更一路下破支撑点位,最低下探到 3600 美元,整体市值转瞬蒸发 550 亿美元,全网爆仓 200 多亿人民币,精准实现了「价格减半」。

不过随后在 5 月减半后,DeFi 盛夏开启了新一轮的牛市周期,比特币也直冲 6 万美元,相比减半前的最低点翻了将近 20 倍。

总的来看,根据历史减半周期的规律,从传统的角度来看,在比特币的减半时价格会回到上一轮牛市价格的一半——也即到 2024 年 4 月份的时候,比特币价格可能会在 30000 美元左右。

而减半后极有可能开启一轮新的牛市周期,如今的体量或许较难在实现 10 倍以上的涨幅,但超越上轮牛市高点的 6 万美元还是相当值得期待。

比特币生态的新变量

不过与此同时,在比特币已经历经三次减半,区块奖励降为 6.25 个、已挖出数量达 1900 万以上的大背景下,其实很多情况、很多事情也到了换一个新视角重新思量的时候了。

尤其是本轮比特币减半之外,整个行业以及比特币自身相比之前几次减半都出现了一些值得关注的新变量。

减半规则背后的动态博弈

我们可以简单了解下比特币减半的基础知识:比特币的机制设计决定了矿工的角色异常重要,是维系整个系统交易运作的基石,而目前矿工的收入主要来源于两部分——区块奖励和手续费。

其中区块奖励开始是 50 个比特币,规则是每四年减半一次,目前已经减半过三次是 6.25 个,下次减半在 2024 年,这样一直持续减下去,到 2140 年比特币就不再有区块奖励;

而手续费则会一直存在(文章开头提到的门罗币就是这种情况),所以说将来矿工的收入就将变得很单一,只有手续费奖励。

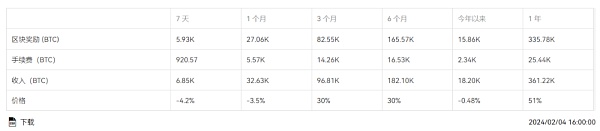

其实目前比特币矿工的手续费收入已经超过了区块奖励,成为收入的核心。所以这也意味着矿工的角色会一直存在,但收入模式会彻底改变:

随着区块奖励逐步递减直至趋于零,那么手续费重要性就会越来越高,直到最终成为唯一收入来源(这也是矿工执念大区块的原因之一:区块越大,相同时间内所能够打包的交易越多,手续费就越多)。

虽然逻辑上可以像跷跷板一样通过手续费的提高来弥补区块奖励减少的缺损,但手续费过高又不利于比特币推广使用:

矿工维护网络提供价值,离不开足够的利益激励;用户使用网络创造价值,受不起高企的手续费用;

比特币整个经济系统的反馈微调,一直都是处在这样不间断的矛盾之中,却又始终能够通过各方充分的博弈达到动态均衡。

BRC20 带来的变量

而 2023 年以来比特币生态尤其是 BRC20 的繁荣,掀起了「BitcoinFi」的新浪潮,比特币生态内部交易的活跃达到新峰值,从而助推比特币的手续费收入激增。

尤其是在此背景下,Ordinals 等协议创新伴随着 ORDI、SATS 等龙头项目的攻城略地,深度影响了比特币网络的费率模型——最直接地,就是彻底改变了比特币的经济模型和激励模型。

Dune 最新数据显示,截至 2 月 4 日,Ordinals 铭文铸造的累计费用超 6000 枚 BTC,超过 2.5 亿美元。

其中 2023 年 12 月 17 日的 BTC 挖矿手续费收益更是创近 5 年来新高,达到 696 BTC(约 3000 万美元),占据矿工当日总收入的 4 成有余。

而矿工手续费收入的历史平均数据往往占比只有 2% 左右,而近三个月的平均数据却达到了超 15%,创下历史纪录。

随着此次减半的临近,后续区块奖励逐步递减直至趋于零,那么手续费重要性就会越来越高,直到最终成为唯一收入来源。

而 2023 年的 BRC20 则相当于提前做了一次预演,后续无论是否成功,伴随着后续比特币减半的发生,这条路上的探索势必会更加受到关注。

如果说以前的比特币只有占有「道统认知」和总市值优势,铭文潮则直接大幅度提高了比特币生态的新资产丰富度,人类对新资产的需求是永恒存在的,同时它也间接提高了开发者数量和用户基数。

与此同时,RGB 协议、Slashtags(服务比特币闪电网络生态的身份账户、联系人、通信、支付)、集成众多 P2P 服务的 Impervious 浏览器、基于 Taproot 的资产协议Taro、闪电代币 OmniBOLT 等新创新都颇值得期待。

总的来看,现在我们则处在新一轮减半周期的尾部,这也可能是绝大部分此轮从业者和投资者入圈第一次(或第二次)亲身见证并经历的比特币减半盛事,而接下来减半后比特币及本轮周期会如何走向,还是未知之数。

With the adoption of spot bitcoin, the most important narrative of the encrypted world is undoubtedly the fourth halving of bitcoin, which is expected to be on June, when the block reward will be reduced from one of the most important narratives in the encryption industry. The halving of bitcoin has always been a good medicine to boost market confidence. Will this halving cycle have the same rhyme as before? What unexpected impact will the new variables of bitcoin ecology have on Moore's Law? Mining on a unit chip in recent decades is mentioned. Under the control of Moore's Law, the growth and change chart of the number of tubes is a horrible growth trend that can be seen by the naked eye. It is mapped to the field of mining machines such as bitcoin mining chips. In the past ten years, bitcoin mining has entered the room, and the pursuit of the beauty of computing power has been stimulated by bitcoin and other currencies. The mining hardware has undergone an evolution from time to time, and the chip manufacturing process has gradually approached the ceiling from hundreds of nanometers to dozens of nanometers, and now it is even smaller. Further down, it will involve the quantum field. Capital in the circle has always liked to gamble and reduce collectively. This is the bear-cow cycle of the semi-event from to. The mining field of Bitcoin is based on this positive momentum. The increasing computing power, the upcoming reward of new hardware and other factors will determine the overall growth of the industry and Bitcoin. This is even more true now. According to the data of yesterday's month, the difficulty of bitcoin mining ushered in the height of the block, and the difficulty of mining was adjusted to a record high. At present, the average computing power of the whole network has also been increased since September. Now we are at the waist of the new round of halving cycle, and there is still a window of two years before the next bitcoin. This may also be the exquisite design of the bitcoin halving event witnessed and experienced by most practitioners and investors for the first time or the second time in this round, which is bound to impress everyone. The historical cycle of halving is indeed a great event for the encryption industry, especially the first two halving cycles of Bitcoin have appeared dozens of times. In the short term, after the increase was halved twice, it was accompanied by a short-term decline, but then it went out of the long-term rising market after the adjustment was completed. However, the third halving began in 2006, because the number of employees in the industry, the market attention and the perfection of supporting infrastructure have improved significantly compared with before. Bitcoin is no longer limited to the niche products in the geek circle, and it has started to be linked with more external factors. Simply sum up, before the first halving, geeks in the circle were more concerned about Bitcoin as an electronic phenomenon. The possibility of gold In the second halving cycle, the focus on Bitcoin changed to its nature as a payment tool, which also triggered a series of debates. The subsequent bifurcation was almost the top flow in the circle. In the third halving cycle, Bitcoin has become an alternative asset, and the layout of traditional institutions and capital began to become the main theme. Therefore, compared with the previous two halving cycles, the third halving of Bitcoin was unprecedented. At the same time, the overall political and economic environment of the world also affected it when Bitcoin was halved for the third time. It is manifested in the influence of macro factors. On the first day of next month, bitcoin started to fall from the US dollar all the way down, and then it broke the lowest support point all the way down. On the whole, it found that the overall market value of the US dollar evaporated in a short time, and the price was halved by more than 100 million yuan. However, after the month was halved, a new bull market cycle was launched in midsummer, and bitcoin also went straight to 10,000 US dollars, which was nearly doubled compared with the lowest point before halving. Generally speaking, according to the law of historical halving cycle. From the traditional point of view, when bitcoin is halved, the price will return to half of the price of the last bull market, that is, by May, the price of bitcoin may be around US dollars, and after halving, it is very likely to start a new bull market cycle. Today's volume may be difficult to achieve more than twice the increase, but it is still worth looking forward to the new variable of bitcoin ecology, but at the same time, bitcoin has been halved three times and the number of blocks has been reduced to 10,000 In the above background, in fact, it is time for many situations and things to be reconsidered from a new perspective, especially in this round of bitcoin halving. Compared with the previous halving, there have been some new variables worthy of attention in the whole industry and bitcoin itself. We can briefly understand the basic knowledge of bitcoin halving. The mechanism design of bitcoin determines that the role of miners is extremely important, and the current income of miners is the cornerstone to maintain the trading operation of the whole system. It mainly comes from two parts: the block reward and the handling fee. The block reward started as a bitcoin rule, and it has been halved once every four years. At present, it has been halved three times. It will be halved next time, and it will continue to be reduced until, and there will be no block reward in bitcoin, but the handling fee will always exist in Monroe coin mentioned at the beginning of the article. This is the case, so the income of miners will become very simple in the future, only the handling fee reward. In fact, the handling fee income of bitcoin miners has exceeded the block award at present. Encouragement has become the core of income, so it also means that the role of miners will always exist, but the income model will be completely changed. As the block reward gradually decreases until it approaches zero, the importance of handling fees will become higher and higher until it finally becomes the only source of income. This is one of the reasons why miners cling to large blocks. The bigger the block, the more transactions they can package at the same time, the more handling fees they will have. Although logically, they can make up for the loss of block reward by raising the handling fees like a seesaw, they can. The high renewal fee is not conducive to the promotion and use of Bitcoin. Miners can't maintain the value of the network without enough benefits to encourage users to use the network to create value. The feedback fine-tuning of Bitcoin's entire economic system has always been in such an uninterrupted contradiction, but it has always been able to achieve the variables brought about by dynamic equilibrium through the full game of all parties. Since the year, Bitcoin ecology, especially the prosperity, has set off a new wave, and the activity of internal transactions in Bitcoin ecology has reached a new peak. In this context, the surge of fee income for boosting Bitcoin, especially the innovation of agreements and other leading projects, has deeply affected the rate model of Bitcoin network. The most direct thing is to completely change the economic model and incentive model of Bitcoin. The latest data shows that the cumulative cost of inscription casting as of March exceeds US$ 100 million, of which the mining fee income on March has reached a new high of about US$ 10,000 in recent years, accounting for more than half of the miners' total income that day, while the historical average data of miners' fee income often accounts for only about 30%, while the average data in the past three months has reached a record high. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。