跨入 2024 「劫后 70 天」的币安现状如何?

距离赵长鹏卸任币安 CEO、币安被罚数十亿美元等一系列的「币安风波」已过去了两个多月,虽然币安仍然在与美国的监管机构激烈「battle」,但彼时令所有人唏嘘不已的情绪已然逐渐散去。

在这两个月里,加密货币的市场迎来了历史性的时刻:SEC 批准了比特币现货 ETF 申请,加密货币正式走入传统金融市场。回望过去的两个月,在比特币现货 ETF 通过预期的催化下,加密货币市场重新开始加速向前奔跑。而此前被很多人认为可能「元气大伤」的币安,在「劫后 70 天」里,却愈挫愈勇。

市场份额近一年来首次回升

数据是最能体现交易所状况的指标。翻看近几个月的数据,我们可以发现去年持续被监管打压的币安,在尘埃落定之后,出现了「探底回升」的迹象。

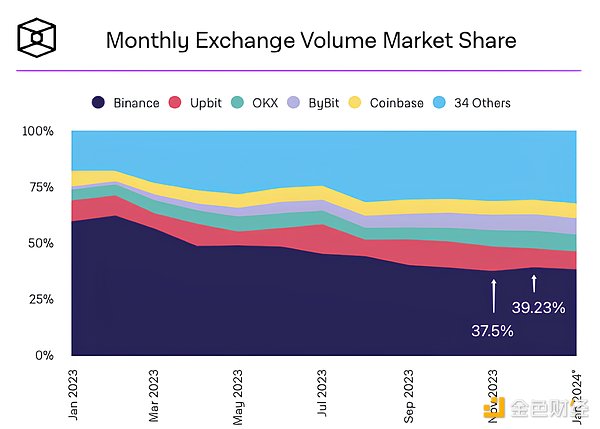

从 2023 年年初开始,按照月交易额计算的加密货币市场份额数据中,币安出现了持续的下滑。据 The Block 数据显示,将支持与不支持 USD 的交易所全部统计在内,币安的月交易额市场占比在 2023 年 2 月达到巅峰的 62.25%,到同年 11 月已跌至 37.5%。在至暗时刻之后,12 月该数据出现了近一年来的首次反弹,回升至接近 40%(在份额下跌期间最高反弹比例不超过 0.2%,可几乎忽略不计)。

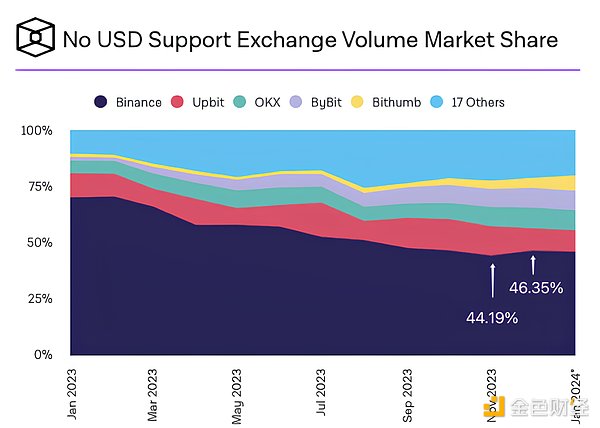

若仅统计不支持 USD 交易的交易所,币安的占比,也从去年 11 月的 44.19% 回升至 46.35%。

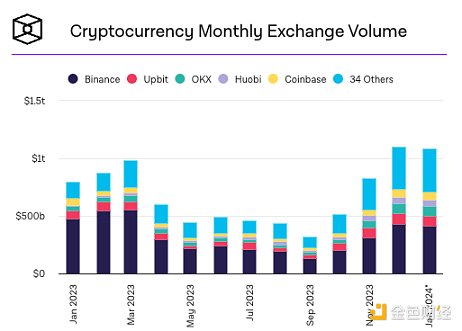

此外,不仅仅是比例,在交易量的绝对值上,币安也在 12 月实现了环比的增长,相较 11 月的 3101.3 亿美元增长 39.5% 至 4326.5 亿美元。

从统计数据中可以看出,以上数据虽然均在 1 月出现了小幅的回落,但依然保持了稳定,并未出现此前的明显下滑。

细化到每种交易产品,据 TokenInsight《加密货币交易所 2023 年终报告》显示,2023 年,币安的现货和衍生品交易份额为 53.7% ,虽然较 2022 年的 60.1% 有所下降,但仍占据市场第一的位置。若拆分为现货和衍生品单独进行比较,币安仍以 55.5% 和 53.4% 的占有率稳坐市场第一。

此外,北京时间 1 月 18 日晚间,彭博社发表文章称,DefiLlama 数据显示,自 11 月 21 日与美国监管机构达成和解协议以来,币安已录得净流入 46 亿美元,远超其他交易所的资金流入量。1 月份迄今(截至 18 日)为止,币安平台已吸引了 35 亿美元的资金,超过了自 2022 年 11 月以来的任意月份单月的资金流入量。

图片来源:彭博社

进击的 Launchpool 与 BNB 的价值回归

从 12 月中旬至今,币安高频推出了 6 个 Launchpool 项目,而在之前推出 6 个项目的周期长达半年以上。用户使用 FDUSD、TUSD、BNB 参与质押「挖矿」来获得新项目代币奖励的 Launchpool 是币安的一大杀手锏。虽然各个交易所都有相应的产品,但币安的 Launchpool 以及 Launchpad 无疑是市场关注的焦点。

据币安的数据显示,最近推出的 6 个参与 Launchpool 的项目,每次的参与金额都高达几十亿美元,人次从十几万到几十万人不等。伴随着用户参与热情的,就是新美元稳定币 FDUSD 发行量的日渐增长。

First Digital USD(FDUSD)是由香港数字资产信托机构 First Digital 最初于 2023 年 6 月宣布推出的美元稳定币。据 First Digital Labs 提供的信息显示,截至 2023 年 11 月 30 日,FDUSD 的发行量约为 9.66 亿枚,而该数字到 12 月 31 日时已涨至超 18 亿枚。据 CoinGecko 数据显示,目前 FDUSD 的发行量可能已接近 26 亿枚(具体数据仍需等待官方统计)。

除了 FDUSD 受益之外,BNB 也在近期扭转了颓势。

在 2022 和 2023 年,受到整体市场气氛的低迷与监管机构重拳出击的影响,BNB 价格从 2022 年年初的超 500 美元最低跌至 180 美元附近。虽然在 2022 年年底反弹至最高逼近 400 美元,但去年还是在各种监管动作的影响下跌回 200 美元附近。

而监管的靴子落地之后,加之密集的 Launchpool 活动刺激,BNB 从 200 美元最高反弹至 340 美元附近,跑赢了大盘的平均涨幅,也一定程度上重新建立了市场对 BNB 的信心。

值得一提的是,伴随这一切改变的并不只有监管的落地,还有新 CEO Richard Teng 的上任。币安近月来的改变,可能也与 Richard Teng 反复强调的将以用户为中心的战略路径有关。

改变,不止于数据

除了数据层面「可视化」的成果,币安近期各方各面均在持续推进。

全球化方面,本月 16 日,币安发表博客称,在泰国获得加密资产交易和经纪商牌照后,Gulf Binance 旗下加密资产交易和经纪商平台正式在泰国展开全面运营,以 Binance TH by Gulf Binance (Binance TH)的名义向所有符合资格的用户开放。

币安在博客中表示,Binance TH 平台已采用了专为泰铢交易对所设计的订单簿,使泰国用户可以使用本地货币进行交易。同时,通过与哈萨克斯坦 AIFC 金融服务管理局(AFSA)所监管的加密资产交易所 Binance Kazakhstan 的订单簿进行整合,用户也可以通过 Binance TH 平台使用加密资产经纪商服务。

交易所功能方面,币安重点向笔者展示了跟单功能发布了的最新进展。币安的跟单交易功能于去年 10 月推出,推出后三个月的周平均交易量超过了 20 亿美元。据本月 16 日发布的博客显示,币安的跟单交易最新的更新中新增了模拟跟单交易、私人聊天室以,并引入了夏普比率指标使得用户可以更好地评估带单交易员的业绩。

币安首席技术官 Rohit Wad 表示,跟单交易是希望建立一个社交交易平台。事实上,笔者认为跟单交易是一种可以提高用户粘性的产品,用户在与有经验的投资者交流的过程中会逐渐形成对产品的使用习惯,而此举也将帮助币安进一步稳固行业龙头的位置。

此外,币安成功通过 SOC 2 Type II 合规审计也是一个重要的里程碑。SOC 2 由美国注册会计师协会 (AICPA) 制定,采集企业的数据安全性、可用性、处理完整性、机密性和隐私方面的信息,对企业用于保护信息的控制措施进行审计。对于时常被诟病「不透明」的加密货币交易所,通过 SOC 2 审计是对币安在内控机制完善性的一个肯定。

铭文市场已在币安 Web3 钱包将上线铭文市场

论币安近期讨论度最高的产品,则非币安 Web3 钱包莫属了。在 Web3 钱包方面,OKX、Bitget Wallet 等产品享受了第一波行业的红利,基于交易所本身的用户体量加上不断集成的新项目、新功能,早期的拓荒者们抢占了先机。

在该方面,币安显得有些后知后觉,而为了将落下的「功课」补上,币安也在迎头直追。上本月初,币安发布 Web3 钱包更新,本次更新新增了对 29 个 DEX 和 15 个跨链桥的支持,并集成了包括 1inch、Compound、Convex、Curve、CyberConnect、Frax Finance、GMX、MakerDAO、Maverick 和 Radiant Capital 等 19 款 DApp,还新增了对 opBNB 和 Linea 的支持。

在社区的期盼声中,铭文市场终于在 2 月 1 日登陆币安 Web3 钱包。币安铭文市场集成 Unisat,支持超 6 万种最受欢迎的 BRC-20 代币,通过 DApp 支持多个其他链,且支持旨在加快交易速度的 BTC 交易加速器。在后续不断的迭代优化后,相信币安可以交出更让人满意的答卷。币安相关人员向 Foresight News 透露,此前市场上关于「币安 Web3 钱包将上线铭文市场」的传闻是确有其事,而且铭文市场即将推出,但目前没有具体的时间信息。作为 Web3 市场的「新概念」,虽然有很多钱包早已支持了铭文交易等功能,但鉴于还在早期,币安仍有机会在该领域「弯道超车」。

币安的「三驾马车」

经过多年的发展,币安已经形成了「交易所 + Binance Labs + 币安 Web3 钱包」三驾马车的整体格局。

其中,交易所永远是核心中的核心,Binance Labs 作为附属的投资与孵化结构,借由行业龙头地位带来的优质资源与积累的资金优势,可以支持优质项目更快地发展。对项目而言,在发行代币之后无需为上线交易所以及建立代币资产流动性而担忧,币安也可以利用该优势网罗更多需要支持的优质项目与优秀团队,吸引更多用户,二者相辅相成。

而作为新产品的 Web3 钱包,一方面是降低了新用户进入 Web3 的门槛,另一方面也为交易所已有用户转向链上市场提供了便利。未来,用户可以直接在单个 App 中与各类 DApp 交互,无需繁琐得根据不同场景切换不同工具。在下一个市场周期中,币安积累的优势将进一步扩大,交易、投资孵化、Web3 钱包三驾马车将进一步融合,形成交易所的生态闭环。

刚刚过去的 2023,币安在扩大规模的过程中,为其早期的野蛮生长付出了不可谓不惨痛的代价,市场份额的下降也印证了所谓的「攻城容易,守城难」。但值得庆幸的是,当下币安已经在探索攻守之间的平衡。

进入 2024,已然摆脱了笼罩了近一年的阴霾的币安,将面向未来,重新出发。

It has been more than two months since Zhao Changpeng stepped down and was fined billions of dollars. Although the currency security is still fierce with the American regulatory agencies, the emotion that made everyone cry at that time has gradually dissipated. In these two months, the cryptocurrency market ushered in a historic moment, and the bitcoin spot application cryptocurrency officially entered the traditional financial market. Looking back on the past two months, the cryptocurrency market resumed under the expected catalysis of bitcoin spot. Qian An, who had been thought to be weakened by many people before, became more and more frustrated the day after the robbery. The market share rose for the first time in the past year. Looking at the data in recent months, we can find that Qian An, who was continuously suppressed by the supervision last year, showed signs of bottoming out after the dust settled. From the beginning of the year, the market share data of cryptocurrency calculated according to the monthly transaction volume showed a continuous decline. According to the data, it will be supported and exhausted. According to all the statistics of the exchanges held, the market share of the monthly trading volume of the currency security reached its peak in June, and fell to the darkest hour in the same year. The data rebounded for the first time in the past year and rose to near the highest rebound ratio during the period of share decline. If only statistics are taken, the proportion of the currency security of the exchange that does not support trading has also rebounded from last month, not only in terms of the absolute value of trading volume, but also in terms of the month-on-month growth compared with the month of 100 million US dollars. From the statistical data, it can be seen that although the above data showed a slight decline in June, they remained stable and did not show the previous obvious decline. According to the year-end report of the cryptocurrency exchange, the trading share of spot and derivatives in the year was the first in the market, although it decreased compared with that in the previous year. If it was split into spot and derivatives, it would still be the first in the market with the share of sum. In addition, it was the evening of Beijing time. According to an article published by Bloomberg, the data show that since the settlement agreement was reached with the US regulatory authorities on April, the net inflow of Coin Security has been $ billion, far exceeding the inflow of funds from other exchanges. So far, Coin Anping Taiwan has attracted $ billion, exceeding the inflow of funds in any month since June. Image source: Bloomberg's attack and the return of value. Since the middle of the month, Coin Security has launched a project, and the period of launching a project before has been more than half a year for users. It's a big killer for Coin 'an to get the token reward for new projects by participating in pledge mining. Although all exchanges have corresponding products, Coin 'an is undoubtedly the focus of market attention. According to the data of Coin 'an, the amount of participation in each of the recently launched projects is as high as several billion dollars, ranging from hundreds of thousands to hundreds of thousands of people. With the enthusiasm of users, the increasing circulation of new dollars is stable, which was first announced by the Hong Kong Digital Assets Trust in June. According to the data, the current circulation may be close to 100 million pieces, and the specific data still need to wait for official statistics. In addition to benefiting, the decline was recently reversed in and due to the downturn of the overall market atmosphere and the heavy blow of the regulatory authorities, the price dropped from the lowest over-US dollar at the beginning of the year to near the US dollar, although it rebounded to the highest near the US dollar at the end of the year. After the influence of various regulatory actions fell back to the vicinity of the US dollar and the boots of supervision landed, coupled with intensive activities, the average increase of the market rebounded from the highest value of the US dollar to the vicinity of the US dollar, which also re-established the confidence of the market to a certain extent. It is worth mentioning that all these changes have been accompanied by not only the landing of supervision, but also the new currency. The changes in recent months may also be related to the repeated emphasis on the user-centered strategic path. The changes are not limited to data, except data visualization. In recent days, all sides of the currency security have continued to promote globalization. This month, Japan Currency Security published a blog saying that its encrypted asset trading and brokerage platform was officially put into full operation in Thailand after obtaining the license of encrypted asset trading and brokerage in Thailand. In the blog, Currency Security said that the platform has adopted an order book specially designed for Thai baht trading, so that Thai users can trade in local currency, and at the same time, through financial services management with Kazakhstan. The order book of the crypto-asset exchange supervised by the Bureau is integrated, and users can also use crypto-asset brokers to serve the functions of the exchange through the platform. In terms of the documentary function, the latest development of the documentary transaction function of the Currency Security is mainly shown to the author. After the introduction of the documentary transaction function of the Currency Security last month, the average weekly transaction volume exceeded 100 million US dollars. According to the blog released on the th of this month, the latest update of the documentary transaction of the Currency Security has added a private chat room to simulate documentary transactions and introduced the Sharp ratio. Indicators enable users to better evaluate the performance of traders with bills. The chief technical officer of Coin Security said that documentary trading is to build a social trading platform. In fact, I believe that documentary trading is a product that can improve users' stickiness. Users will gradually form the habit of using products in the process of communicating with experienced investors, which will also help Coin Security further stabilize its position as a leader in the industry. The successful passing of the compliance audit of this foreign currency security is also an important milestone. The Association of Accountants has formulated the collection of information on data security, availability, integrity, confidentiality and privacy of enterprises, and audited the control measures used by enterprises to protect information. For cryptocurrency exchanges that are often criticized for being opaque, passing the audit is an affirmation of the perfection of the internal control mechanism of currency security. The inscription on the market of currency security wallets will be launched. The product that has been discussed the most recently is the currency security wallet, which has enjoyed the dividend base of the first wave of industries. Due to the user size of the exchange itself and the new projects and functions that are constantly integrated, the pioneers in the early days seized the opportunity. In this respect, the currency security seems to be a little late, but in order to make up the lost lessons, the currency security is also catching up. At the beginning of this month, the currency security released a wallet update. This update added support for a cross-chain bridge and integrated support for the sum. In the expectation of the community, the inscription market finally landed on the month. The currency security wallet market integrated support for more than 10,000 kinds of the most popular tokens by supporting multiple other chains and supported it. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。