宏观与微观视角 为什么这轮牛市可能没有山寨季?

作者:Dr. Y.Ting,加密观察员 来源:X,@bitdot_eth

这轮牛市到底会不会有山寨季,我的想法可能和大部分人都不一样,我认为很可能没有山寨季,我会分别从宏观和微观层面说说我的观点。在此之前,为了大家能更好理解,我先把我对宏观经济周期的一些粗浅认知分享给你,如果你认为宏观经济很虚,对你在币圈赚钱也没有帮助,可以直接跳过。 以下是线程...

宏观层面

我们平均每50-60年就会经历一轮完整的康波周期,从回升到繁荣,从繁荣到衰退,从衰退到萧条,最后从萧条过渡到下一轮周期的回升阶段,如此往复。每个改变人类命运的技术创新都推动了新一轮周期的诞生和发展。

我们目前处在第五轮康波周期的萧条阶段,因为推动本轮周期的技术创新已经停滞(本轮周期的技术创新是互联网,看看web2当下哀嚎一片,再对比一下10年前web2的造富效应,如果你对web2比较熟悉,一定会有切身感受这种差距有多大。

全球经济停滞不前;更重要的是,为了应对前面衰退期发生的金融危机(本轮是08年金融危机),各国政府都不得不开启疯狂印钞模式(新冠严重加剧了这个动作),短期拯救了经济,但也同时创造了通货膨胀这颗定时炸弹。为了摘除这颗炸弹,各国政府就不得不又反过来疯狂加息锁表。

这两件事放在一起就造就了萧条阶段。萧条阶段的核心特征是滞胀,对于普通人来说,滞胀要远比通胀或者通缩可怕的多(可以问问你身边从事非web3行业的朋友这几年过的怎么样)。 用一句话来概括一下康波萧条:干啥啥赔钱,干啥成本还都贼高,不管是老板还是打工人,谁的日子都不好过。

肯定很多人会好奇,这跟币圈到底有什么关系?其实关系很大,从19年币圈开始逐步被传统世界接受,到最近的现货ETF通过,如果你对大盘有比较敏感的感知,会发现19年之前庄家的操盘手法和19年之后截然不同,其实本质上是老钱已经逐步进入币圈并替代了原来币圈里的土著庄家。

而老钱和经济的方方面面都牵扯很深,如果整个传统金融市场上都没钱了,币圈一定也会流动性枯竭。而萧条期因为超高的利率,会导致热钱从风险市场转向无风险债券市场,币圈就是风险市场中的风险市场,币圈这两年PVP的原因正在于此。

那么,这轮康波萧条什么时候能结束呢?我们可以从历史中找到规律:当加息加到不能再加,经济已经濒临崩溃,失业率飙升的时候,萧条期就要结束了,所谓的不破不立。很多人预期美联储的降息会很快到来,并且幻想着等降息的时候比特币还不得涨到20万美金?

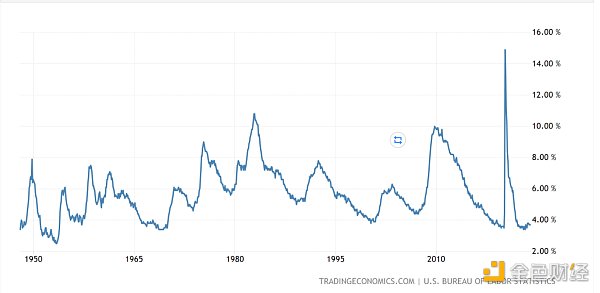

但我觉得这种观点过于乐观了,倒不是我不认为比特币会TO DA MOON,而是降息很可能并没有想象的那么快,目前美国失业率这个判断萧条是否接近尾声的关键指标还仍然处在历史低位(见下图),简单来说就是别看利率这么高,大家的日子过的还有滋有味,那么美联储就有更足的底气来进一步控制通胀。

真正的降息都是被迫的,因为经济要扛不住了没办法才降息,现在看经济还挺能抗,所以我估计这轮高利率时代很可能持续时间会很长,现在的利率已经和08年金融危机发生前差不多(见下图),而高利率持续的时间越长就越有更大概率在某一时刻击垮全球经济,crypto已经融入了传统金融,也无法独善其身。

回到币圈来看这个问题,只要高利率持续,市场上的热钱只会越来越少,没有新资金进场,就只能维持PVP状态,零和甚至负和博弈,场内资金就很难大规模流入到更高风险的山寨币。

微观层面

过去的每轮牛市大概都是按这个规律: 创新技术开启新叙事->早期财富效应->第一浪(泡沫浪潮)->技术的价值远低于预期叙事崩盘->市场超卖触底寻找合理价值->大浪淘沙,大部分项目归零,但同时也跑出来几个真正创造价值的龙头->第二浪(价值浪潮)。

这么说可能有点抽象,我们举两个例:

ETH:

ETH开启了区块链的可编程时代,相当于让区块链从诺基亚变成了智能手机,这是颠覆性创新技术,同时ERC20标准使得人人可以发行资产,ICO带来了早期财富效应,各种公链层出不穷,17年牛市就是泡沫催生的第一浪,随后大家发现空气币真的就只是空气。

市场对可编程区块链的预期太高,现实缺是只能制造空气币,叙事崩盘18年熊市,18年底市场超卖触底,大部分L1公链项目归零,跑出来了真正创造价值的龙头ETH,后续包括到现在都属于可编程区块链的第二浪,市场只认有价值的公链。

DEFI:

uniswap创造了颠覆性的AMM机制使链上清算成为可能,这是去中心化金融的根基(如果链上不能清算,链上借贷就无从谈起),从DEX到DEFI,19年DEFI summer,财富效应推升泡沫带来第一浪->随后动物园叙事崩盘->大浪淘沙后大部分当年的DEFI项目已经归零,少部分有价值的龙头DEFI和DEX延续至今。

从韭菜的角度看,第一浪最容易暴富,啥都不用懂,只要梭对了叙事赛道,买什么都发财;第二浪赚钱难度指数升高,只有那些拥有超过市场大部分人能力的人才能赚钱,不仅要梭对赛道,还要梭对龙头。

从项目的角度看,第一浪也最容易暴富,PPT+fork估值百亿不是梦,需要做的就是一定不要做事,会搞事炒概念最重要;第二浪赚钱难度也指数升高,赛道商业模式有自造血,和竞品PVP能胜出才能活下来,活下来就是垄断躺赚。

这个规律中,每一轮新叙事的第一浪都是由泡沫推动的,从圈内小范围财富效应到圈内大规模财富效应,最后成功出圈吸引圈外新韭菜入场,就是这些新资金推动了牛市的主升浪,最终也是因为新资金耗尽,牛市见顶崩盘。

那么,现在回来再看一下这波牛市,仿佛并不是由某个创新技术造成财富效应,从而吸引圈外新韭菜入场推动牛市主升浪的剧本,推动这波牛市主升浪的是ETF!ETF确实让海量的老钱新韭菜入场了,但问题的关键是,ETF只能买 $BTC,在 $BTC 上赚钱了,他们只能cash out成美元,不能继续投资山寨币。

(就像你买沪深300指数基金,你的钱基金只会帮你买那300支股票,你想通过这个基金买第301支股票是买不了的),这和以外资金外溢导致的山寨季(狗庄拉主流币,赚钱后资金外溢拉山寨币,赚钱后资金重回主流币)有本质区别,所以我们这次看到了一些很奇怪的现象:

a) BTC猛涨,山寨币缺不跟,不断被BTC吸血 b) 感觉市场应该很热,但好像韭菜的热情又并不像之前牛市那么高,大部分人也没赚到钱,并没有过往牛市的大规模财富效应 c) 当前合约未平仓头寸体量历史新高(见下图),标明市场是极度火热的,与2)韭菜的感知形成鲜明对比。

总结

基于宏观原因,全球可投资风险资产的热钱总数一定是减少的,在这个基础上再加上微观原因,我认为这轮牛市大概率是BTC的牛市,能够外溢到山寨币的资金要远比过往几轮牛市少,山寨仍然以场内存量资金PVP为主。在降息周期没有到来之前,真正的造富大牛市很难到来。

Will there be a fake season in this bull market? My idea may be different from that of most people. I think there is probably no fake season. I will talk about my views from the macro and micro levels respectively. Before that, I will share with you some superficial knowledge of the macroeconomic cycle for you to better understand. If you think that the macro economy is empty and it is not helpful for you to make money in the currency circle, you can skip the following: the macro level of threads. We will experience one round on average every year. The complete cycle of Campo is from recovery to prosperity, from prosperity to recession, from recession to depression, and finally from depression to the recovery of the next cycle. Every technological innovation that changes human destiny has promoted the birth and development of a new cycle. We are currently in the depression stage of the fifth cycle of Campo, because the technological innovation that promoted this cycle has stopped. The technological innovation of this cycle is the Internet. Look at the current mourning and compare the effect of making wealth years ago. If you are familiar with it, There must be a personal feeling of how big this gap is. The global economy is stagnant. More importantly, in order to cope with the financial crisis that occurred in the previous recession, this round is the financial crisis of 2000. All governments have to start the crazy printing mode. COVID-19 has seriously aggravated this action, saving the economy in the short term, but at the same time creating the time bomb of inflation. In order to remove this bomb, all governments have to raise interest rates and lock the watch in reverse. Together, these two things have created the nuclear of the depression stage. The heart characteristic is that stagflation is far more terrible for ordinary people than inflation or deflation. You can ask your friends who are engaged in non-industry around you how they have been in recent years, and sum up in one sentence what Compaq does, what loses money, and what costs are high. No matter who is the boss or the employee, life is hard. Many people will be sure to wonder what this has to do with the currency circle. In fact, it has a lot to do with it. From the beginning of the year, the currency circle has been gradually accepted by the traditional world to the recent spot pass. If you have a comparison with the market, A more sensitive perception will find that the banker's trading methods before the year are completely different from those after the year. In fact, the old money has gradually entered the currency circle and replaced the indigenous banker in the original currency circle. The old money and all aspects of the economy are deeply involved. If there is no money in the whole traditional financial market, the currency circle will certainly dry up, and during the recession, because the ultra-high interest rate will lead to the hot money changing from the risk market to the risk-free bond market currency circle, which is the reason for these two years in the risk market. Just here, when will this round of Campo Shaw come to an end? We can find the law from history. When the interest rate is increased to the point where the economy is on the verge of collapse and the unemployment rate is soaring, the recession will come to an end. Many people expect the Fed to cut interest rates soon and fantasize that Bitcoin will not rise to US$ 10,000 when the interest rate is cut. But I think this view is too optimistic, not that I don't think Bitcoin will, but that the interest rate cut is probably not as fast as I thought. The former unemployment rate in the United States, the key indicator to judge whether the depression is coming to an end, is still at a historical low. See the figure below. Simply put, despite the high interest rate, everyone's life is still full of flavor, so the Fed will have more confidence to further control inflation. The real interest rate cut is forced because the economy can't bear it. Now, the economy is quite resistant, so I estimate that this round of high interest rate era is likely to last for a long time. The current interest rate has already occurred with the financial crisis in 2008. See the picture below, and the longer the high interest rate lasts, the greater the probability that it will crush the global economy at a certain moment. As long as the high interest rate lasts, the hot money in the market will be less and less, and without new funds entering the market, it will only maintain a zero-sum or even negative-sum game, so it will be difficult for the funds in the market to flow into the higher-risk cottage currency on a large scale. In the past, every round of bull market was probably based on this law to innovate technology and open new ones. The value of the wealth effect in the early narrative, the first wave of bubble technology, is much lower than expected. The narrative collapse, the oversold market, the bottoming out, and the search for reasonable value. Most of the projects have gone to zero, but at the same time, several real value-creating leaders have emerged. The second wave of value may be a bit abstract. We cite two examples to open the programmable era of blockchain, which is equivalent to turning blockchain from Nokia to smart phone. This is a subversive innovation technology, and at the same time, standards enable everyone to issue assets, bringing early wealth. The rich effect of various public chains is the first wave of the bubble. Later, everyone found that the air currency is really just the air market's expectation of the programmable blockchain is too high. The reality is that it can only create the air currency narrative collapse. At the end of the bear market, the market oversold and bottomed out. Most of the public chain projects came out to zero, and the second wave, which belongs to the programmable blockchain until now, only recognized the valuable public chain and created a subversive mechanism to make the liquidation on the chain possible. It is the foundation of decentralized finance. If the chain can't be liquidated, there is no way to talk about the wealth effect from to, which pushed up the bubble and brought the first wave. Then the zoo narrative collapsed. After the big wave of sand scouring, most of the projects in that year have been zero, and a few valuable bibcock have been continued to this day. From the perspective of leeks, the first wave is the easiest to get rich, and you don't need to understand anything. As long as you get the right narrative track, the second wave will make money. Only those who have the ability to surpass most people in the market can make money. Not only to the track, but also to the leader. From the point of view of the project, the first wave is also the easiest to get rich. The valuation of 10 billion yuan is not a dream, but it is necessary not to do anything. The concept of speculation is the most important. The difficulty of making money in the second wave is also exponentially increasing. The business model of the track can only survive if it is self-hematopoietic and competitive products can win. In this law, the first wave of each new narrative is driven by bubbles, from the small-scale wealth effect in the circle to the large-scale wealth effect in the circle, and finally it successfully attracts the circle. It is these new funds that promote the bull market's main surge, and finally it is because the new funds run out that the bull market has peaked and collapsed. Now come back and look at this bull market as if it was not caused by some innovative technology, so as to attract new leeks from outside the circle to promote the bull market's main surge. What drives this bull market's main surge is that a large number of old Qian Xin leeks have indeed been allowed to enter the market, but the key point is that they can only make money by buying dollars, just like you buy the Shanghai and Shenzhen index fund, your money fund will only help you buy that stock, but you can't buy it through this fund. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。