LD Capital宏观周报:股币双牛、新的宽松 超过97%的比特币盈利

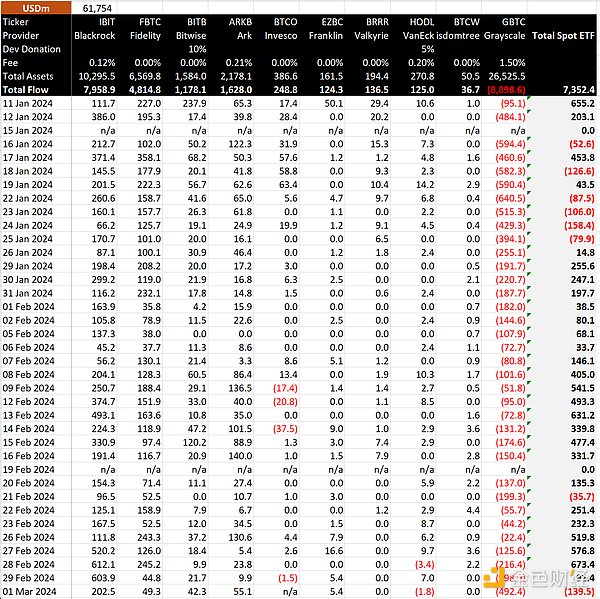

十只现货比特币 ETF 可以说是历史上最成功的金融产品之一,上周交易量和资金流入均创下新高。总净流入达到73.5亿美元。贝莱德的IBIT短短七周内达到 100 亿美元资产大关,这是 ETF 达到这一数字的最快速度,并且规模超过了最大的白银ETF。

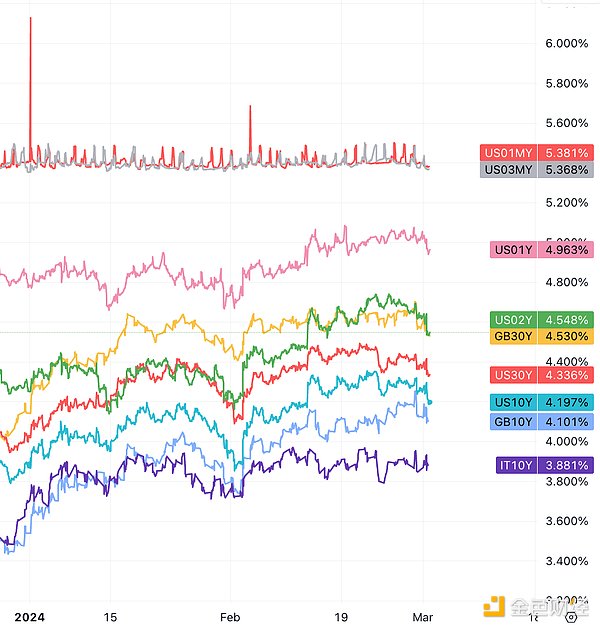

2 月份可以看出来,如果债市收益率上升的原因是积极因素(经济增长强劲而不是美联储加息),股市在这种环境下就能表现良好。尽管利率上升,上个月标准普和纳指上涨 5%左右,而且全球股市也创出历史新高,全球多个主要股指创下历史新高,包括德国、法国 、日本。芯片股大幅上涨,NVIDIA又又又涨了30%,AMD涨20%,博通和TSMC涨17%。芯片股的逻辑还是越接近AI产业链上游的涨的越多,至于下游软件公司尤其是大科技表现一般,例如谷歌过去一个月跌4%,苹果跌2.4%,微软涨3%,Meta因为500亿回购涨27%。原油价格小幅上涨WTI接近80美元。美元指数先涨后跌基本走平。比特币和以太坊涨了近50%。

与去年收益率上升引发股市和加密货币回调的几个时期不同,全球股市在短期和长期利率重新上行的情况下能够坚挺并上涨,主要三个原因:1)第四季度企业盈利业绩表现强劲;2) NVIDIA 的前景激发了人们对人工智能的新热情;3)强劲的经济增长。

周五公布的美国经济数据疲软和美联储理事讲话令市场的货币宽松预期升温,美债收益率跳水明显。美国2月ISM制造业指数意外降至七个月新低47.8,连续16个月收缩,新订单、就业均萎缩。

美联储理事沃勒(下一任美联储主席热门候选人)暗示将实行反向“扭转操作”(QT),也就是美联储在资产负债表上应该“买短卖长”。他还希望看到联储持仓中机构MBS降至零、短债在表内占比提高。沃勒的讲话暗示Fed希望降低短债收益率,也就是更贴近货币市场的利率要降低,属于一种鸽派信号,另外一定程度上可以缓解收益率曲线倒挂幅度。

在全球金融危机之前,Fed的投资组合中大约有三分之一是短期国债。如今短期国债规模不到国债持有量的5%。

在同一日的活动中,达拉斯联储主席洛瑞·洛根再次强调,随着银行储备金数降,美联储可能会开始放缓其缩表速度。美债、黄金大涨、美股指又创历史新高。

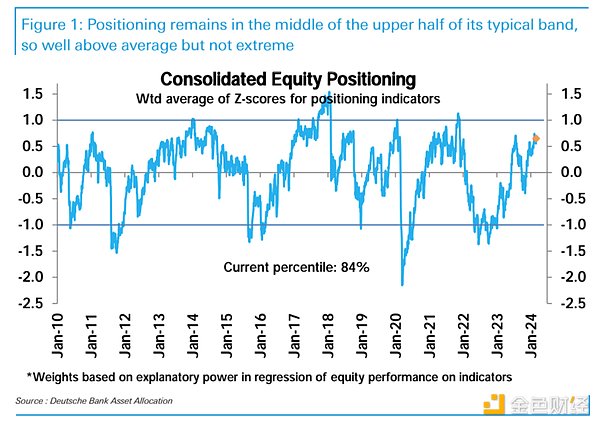

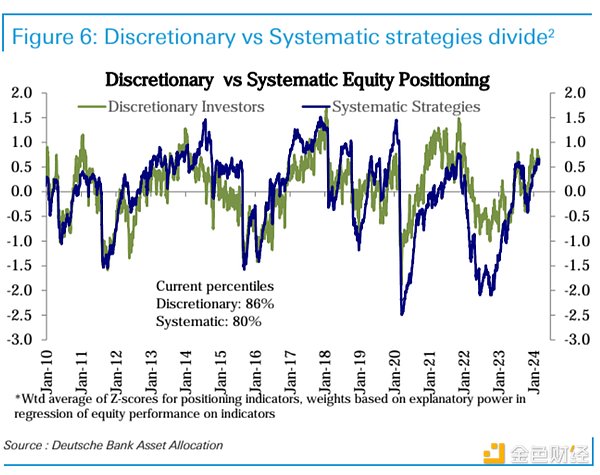

至于最近的上涨是否过热,历史表明市场仍然没有进入过热状态,但涨速可能会放缓,波动性可能会增加。

与过去 12 次牛市相比,当前牛市的前 16 个月涨幅 (42%) 低于平均水平 (50%)。(这种统计在币圈不适用)

未来如果美联储政策逐渐放松货币政策将有利于经济扩张并推动风险资产进一步上涨。美银在上周评论中写道:“美联储的降息正在激发‘动物精神’并推动风险资产的发展”。

然而,股市不会永远上涨。当投资者的情绪过于乐观时,市场往往会变得更加震荡。目前投资者情绪虽然转为乐观,但还没有达到极端水平。投资者应保持对回报和波动性的合理预期,历史来看平均每年会出现三次 5% 的回调和一次 10% 的修正。

All About Bitcoin

十只现货比特币 ETF 可以说是历史上最成功的金融产品之一,上周交易量和资金流入均创下新高。总净流入达到73.5亿美元。贝莱德的IBIT短短七周内达到 100 亿美元资产大关,这是 ETF 达到这一数字的最快速度,并且规模超过了最大 的白银ETF。

周五出现了七个交易日来首次净流出,主要因为GBTC连续两日大幅流出近11亿美元导致,市场猜测此次抛售背后的主要原因可能是贷款机构 Genesis还款所致。Genesis于 2 月 14 日获得破产法院批准,出售 3500 万股 GBTC 股票(当时价值 13 亿美元,现在约为 19 亿美元),但过去两周 GBTC 的资金流出一直不多,直到周四出现飙升,不过这一抛压目前看起来已经消化了大半。

目前我们可以期待大型机构陆续“投降”。

Bitwise首席投资官Matt Hougan表示目前的需求主要来自零售投资者、对冲基金和独立财务顾问。他预计,随着更大的美国券商开始参与,对现货比特币ETF的需求将进一步增加。因为美国一些最大的银行包括美国银行、富国银行、高盛和摩根大通,但这些银行尚未向客户提供BTC ETF。

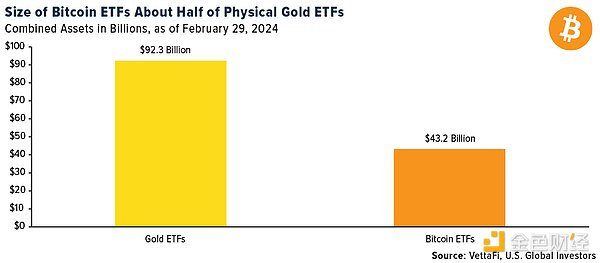

目前还不清楚围绕比特币的兴奋是否正在吸走黄金的资金,但黄金的价格走势和投资水平之间似乎确实存在一些脱节,这种脱节已经持续了1年以上。从历史上看,黄金价格和黄金支持的 ETF 持有量一直同步交易,但从 2023 年开始,两者开始脱钩,如下所示。这可能是由多种因素造成的,包括投资者情绪的变化、货币政策、投资组合平衡、货币波动等。

对于投资周期长或风险偏好较大的投资者来说,比特币是最佳选择,其波动性大约是其同类黄金的八倍。贵金属的 10 天标准差为 ±3%,而比特币的 10 天标准差为 ±25%。

近几个月金价的驱动因素似乎发生了变化。几十年来,黄金与实际利率呈反比关系 — — 收益率下降则上涨,反之亦然 — — 但自 2020 年疫情爆发以来,这种模式被打破。在Covid之前的20年里,黄金和实际利率具有高度负相关系数。不过,从那时起,相关性已转为正值,并且这两种资产现在经常朝同一方向移动。

目前普遍认为央行的购买活动是黄金的新驱动力。自2010年以来,金融机构(主要是新兴经济体的金融机构)一直是金属的净买家,以支持本国货币并实现去美元化。

爱德华·斯诺登上周分享了他对 2024 年的预测,即国家政府将被发现秘密购买比特币,他称,比特币是“黄金的现代替代品”

目前只有萨尔瓦多政府主动购买国比特币,目前在其国库中持有 2381 枚比特币,目前较买入成本可能浮盈40%。

根据intotheblock统计,目前超过97%的比特币地址实现盈利,创下2021年11月以来的最高盈利水平。

上次我们观察到如此大比例的盈利地址时,比特币的价格约为 69,000 美元,接近历史最高点。

但这么看显然没有意义,当每一轮牛市末尾时由于价格往往远超上一轮峰值,盈利的比例肯定是高的,我们更应关注每轮牛市开始时的盈利比例变化

2013年1月 BTC价格14,前高23,盈利比例时隔17个月首次回到90%以上,到下次高点涨幅40倍

2016年6月 BTC价格716,前高1100,盈利比例时隔31个月首次回到90%以上,到下次高点涨幅28倍

2020年8月 BTC价格11500,前高19500,盈利比例时隔32个月首次回到90%以上,到下次高点涨幅4.5倍

2023年2月 BTC价格 51000,前高69000,盈利比例时隔27个月首次回到90%以上,到下次高点涨幅?倍

可以看出在BTC价格在达到前高的60~70%左右时,盈利比例会升到90%以上,此时用户试图实现回本的抛售压力不再产生重大影响,后面理论上牛市会走的更顺畅。

而且从过去三次历史来看,首次触及90盈利门槛后会随着价格继续上涨而多次触及这个区域。

不过过去三次触及后的价格涨幅呈现递减状态,随着市场的成熟这是正常的。

根据指数衰减模型的拟合本轮触及90%后的最大涨幅在390%,以51000为基准高点价格在25万左右。

关注4月回调

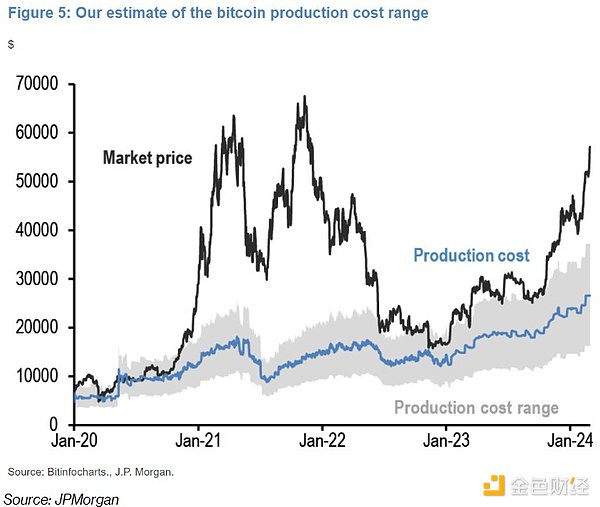

摩根大通分析师上周发布报告预测,4月份比特币减半可能会导致矿商盈利能力下降,加上生产成本的增加,可能会对比特币价格造成下行压力。

从历史上看,比特币的生产成本一直是其价格下限的关键决定因素。比特币的平均生产成本目前为每枚26500美元,减半后将立刻翻倍至53000美元。不过减半后网络算力可能下降 20%,所以可能会将估计的生产成本和价格降低至 42,000 美元。这一价格也是JPM预测BTC可能回调的最低点。

尤其是生产成本较高的矿商,由于盈利能力预计下降而面临重大压力。离减半越近矿商股涨幅可能受到更多抑制。

Meme 币暴动与山寨季

比特币今年引领了加密货币的发展,但山寨币的表现可能很快就会开始跑赢。

上周以狗为主题的代币 DOGE 和柴犬(SHIB)上涨了 50%~100%,而新MEME如PEPE、BONK和 Dogwifhat (WIF) 的价格在此期间涨了100~200%。

上周“巨大”的MEME币反弹可能是即将到来的altseason的“早期迹象”。不过本轮跟之前不一样的是资金主要由机构推动,不能保证流向比特币的资金最终会流向较小的资产。但随着主流币价格走高可能会带动存量资金的风险偏好,这部分钱大概率会流向风险更高的资产,这是人性使然。

有分析指出,要确认altseason,需要寻找的关键信号是 ETH 突破 3500 美元的价格门槛。

VC会回归加密货币吗?

自 2022 年 3 月以来,对加密初创公司的风险投资首次增加, 2023 年第四季度达到 19 亿美元。根据最近的 PitchBook 报告,这一数字较第三季度增长 2.5%。

最近一个月多家初创项目宣布了融资,其中包括 Lava Protocol、Analog、Helika、Truflation 和 Omega 等。A16z宣布 向以太坊的restaking协议 EigenLayer 投资1 亿美元。Binance Labs宣布在一月的种子轮融资中总计投资了 320 万美元。

Avail 宣布获得由Founders Fund和Dragonfly 领投的 2700 万美元种子轮融资。风险投资公司 Hack VC 则筹集了 1.5 亿美元,用于投资早期加密货币和AI初创公司。

再质押rollups 项目AltLayer 获得 1440 万美元战略融资,由 Polychain Capital 和 Hack VC 共同牵头。

数字资产交易平台Ouinex 通过种子轮和私募轮从社区筹集了超过 400 万美元。

人工智能 (AI) 支持的预测市场PredX,筹集 50 万美元的种子前资金

资金流向

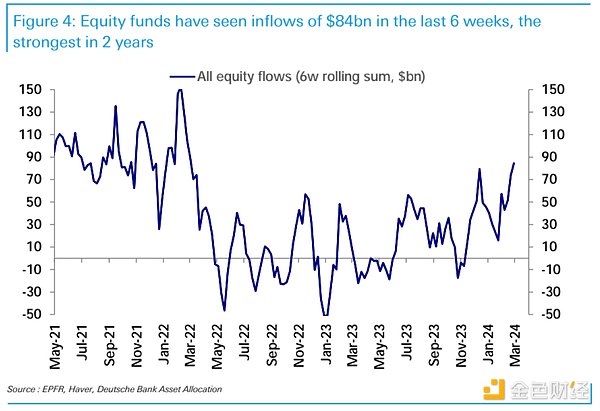

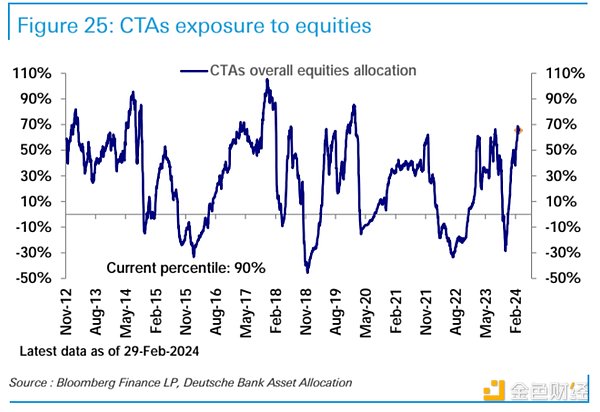

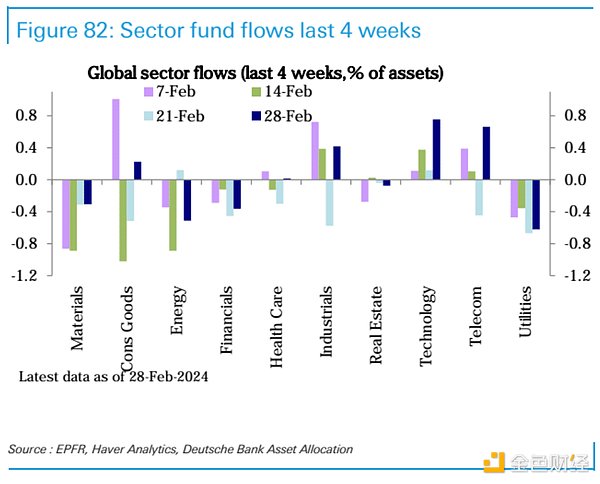

股票基金连续第六周迎来强劲流入 (100 亿美金),总流入金额 (840 亿美金) 为两年来最高。 其中美国股票基金 (113 亿美金) 是流入的主要来源。 科技类基金流入 (47 亿美金) 也升至 6 个月来最高。 债券 (138 亿美金) 和货币市场基金 (387 亿美金) 也录得强劲流入。流入包括苹果和英伟达等大公司在内的科技股的资金流入达到 47 亿美元,创下 8 月份以来的最高水平,并有望创下 988 亿美元的年度纪录。

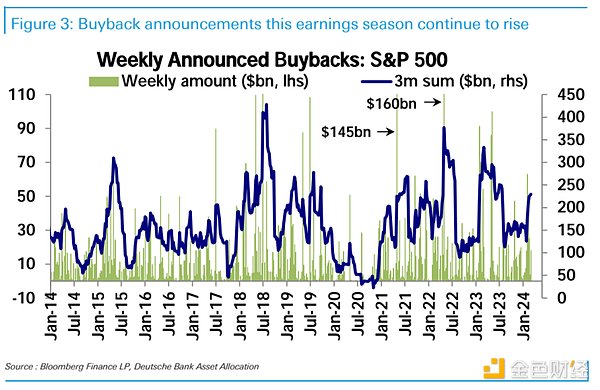

回购力度从每季度1500亿美元水平上升至2250亿美元

Ten spot bitcoins can be said to be one of the most successful financial products in history. Last week, the transaction volume and capital inflow reached new highs, and the total net inflow reached $ billion. In just seven weeks, BlackRock reached the asset mark of $ billion, which was the fastest speed to reach this figure and exceeded the largest silver month. It can be seen that if the reason for the increase in bond market yield is positive factors, strong economic growth rather than the Fed's interest rate hike, the stock market will perform well in this environment, despite the increase in interest rates. The monthly standard Pratt & Whitney Index rose around, and the global stock market also hit a record high. Many major global stock indexes hit a record high, including German, French and Japanese chip stocks, which rose sharply and rose again. The logic of Broadcom and chip stocks is still closer to the upstream of the industrial chain, and the more they rose. As for downstream software companies, especially big technology companies, for example, Google fell in the past month, Apple fell, Microsoft rose, and crude oil prices rose slightly, close to the US dollar. The US dollar index rose first and then fell, which basically leveled bitcoin. There are three main reasons why the global stock market can stand firm and rise when the short-term and long-term interest rates rise again. The prospect of strong corporate earnings performance in the fourth quarter has stimulated people's new enthusiasm for artificial intelligence. Strong economic growth Macro Weekly, stocks, currencies, bulls, new loose bitcoin profits, weak US economic data released on Friday and speeches by Fed directors have made the market currency. Loose expectations are heating up, and the yield of US bonds is diving obviously. The monthly manufacturing index of the United States unexpectedly fell to a seven-month low, shrinking new orders for consecutive months, and shrinking employment. Federal Reserve Governor Waller, the next popular candidate of the Federal Reserve Chairman, hinted that the reverse operation twist would be implemented, that is, the Fed should buy short and sell long on its balance sheet. He also hoped to see the institutions in the Fed's positions fall to zero, and the proportion of short-term debts in the table would increase. Waller's speech hinted that he hoped to reduce the yield of short-term debts, that is, the interest rate closer to the money market would be Reducing the signal belonging to a pigeon faction can also alleviate the upside-down range of the yield curve to some extent. Before the global financial crisis, about one third of the portfolio was short-term treasury bonds, and now the scale of short-term treasury bonds is less than the holdings of treasury bonds. At the same day's event, Dallas Fed President Lori Logan once again stressed that with the decrease of bank reserves, the Fed may start to slow down its contraction, and the US debt and gold rose sharply, and the US stock index reached a record high. As for whether the recent rise is overheated or not, the history shows that the market. The market has not yet entered an overheated state, but the rate of increase may slow down, and the volatility may increase. Compared with the previous bull market, the previous month's increase of the current bull market is lower than the average level. This statistic is not applicable in the currency circle. In the future, if the Fed's policy is gradually relaxed, monetary policy will be conducive to economic expansion and promote the further rise of risky assets. In its comments last week, Bank of America wrote that the Fed's interest rate cut is stimulating animal spirits and promoting the development of risky assets. However, the stock market will not rise forever when investors' mood is too high. When optimistic, the market tends to become more volatile. At present, although investor sentiment has turned optimistic, it has not yet reached an extreme level. Investors should maintain reasonable expectations for returns and volatility. Historically, there will be an average of three callbacks and one correction every year. Ten spot bitcoins can be said to be one of the most successful financial products in history. Last week, the transaction volume and capital inflow both reached new highs, and the total net inflow reached US$ 100 million. BlackRock's asset mark reached US$ 100 million in just seven weeks. The fastest speed and scale exceeded that of the largest silver macro weekly, and the new loose-exceeded bitcoin profit appeared for the first time in seven trading days on Friday, mainly because of the sharp outflow of nearly 100 million US dollars for two consecutive days, which led to market speculation that the main reason behind the sell-off may be that the loan institution repaid the loan and was approved by the bankruptcy court to sell 10,000 shares, which was worth 100 million US dollars at that time, but now it is about 100 million US dollars, but the capital outflow in the past two weeks has been small until Thursday. At present, it seems that most of this selling pressure has been digested. At present, we can expect large institutions to surrender one after another. The chief investment officer said that the current demand mainly comes from retail investors, hedge funds and independent financial advisers. He predicted that the demand for spot bitcoin will further increase as larger American securities firms begin to participate, because some of the largest banks in the United States include Bank of America, Wells Fargo, Goldman Sachs and JPMorgan Chase, but these banks have not yet provided customers with macro weekly reports. At present, it is not clear whether the excitement surrounding bitcoin is sucking up gold funds, but there does seem to be some disconnect between the price trend of gold and the investment level. This disconnect has been going on for more than years. Historically, gold prices and gold-backed holdings have been trading synchronously, but since 2000, the two have been decoupled. As shown below, this may be caused by many factors, including changes in investor sentiment, monetary policy, portfolio balance, currency fluctuations and so on. For investors with long investment cycle or high risk appetite, Bitcoin is the best choice, and its volatility is about eight times that of similar gold. The daily standard deviation of precious metals is zero, while the driving factor of gold price seems to have changed in recent months. For decades, gold has been inversely related to the real interest rate, while the yield has decreased, and vice versa. However, this model has been broken since the outbreak of the epidemic in. The highly negative correlation coefficient, however, has turned positive since then, and the two assets are now often moving in the same direction. At present, it is generally believed that the central bank's purchase activities are the new driving force of gold. Since 2000, financial institutions, mainly those in emerging economies, have been net buyers of metals to support their own currencies and realize dollarization. Edward Snowden shared his prediction last week that the national government will be found to secretly buy bitcoin, which he called a modern substitute for gold. At present, only the Salvadoran government has taken the initiative to buy bitcoin, which is currently held in its national treasury. At present, it may be more profitable than the purchase cost. According to statistics, the bitcoin address that is currently exceeded has achieved the highest profit level since June. Last time we observed such a large proportion of profitable address, the price of bitcoin was close to the all-time high, but it is obviously meaningless to look at it this way. At the end of each bull market, because the price often far exceeds the peak profit ratio of the last round, we should pay more attention to the change of the profit ratio at the beginning of each bull market. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。