Galaxy 研究主管:比特币终将翻越忧虑之墙

作者:Alex Thorn,Galaxy 研究主管;编译:Luffy,Foresight News

这是纽约市一个有雾的早晨,我们中的一些人因为昨天加密市场的风暴(译者注:原文发布时间是 3 月 6 日,市场风暴指比特币在突破 6.9 万美元的历史高点后,旋即大幅下跌逾 1 万美元)而感到如坠云雾。今天早上我又对比特币革命和内在价值有一些新的想法。但在谈到这些之前,让我们拨开迷雾,谈谈昨天加密市场发生的事情以及它对牛市意味着什么。

3 月 5 日,Coinbase 上的比特币价格一度达到 69,324 美元,刷新了 2021 年 11 月 10 日创下的历史高点。随后,比特币在经历了 1 万美元的波动,目前交易价格又回到了 6.7 万美元。是的,在 846 天后,比特币又回来了。实物黄金和数字黄金均创下了历史新高。这是 BTC 和 XAU(现货黄金)第一次同时创下历史新高,但这不会是最后一次。

但比特币仍然不适合新手。在创下历史新高后,比特币立即暴跌 14.3%,盘中最低跌至 59,224 美元,期货市场出现多空双爆的情况。仅在美国东部时间下午 2 点至 3 点之间就有 4 亿美元的比特币多头被清算,这又进一步加剧了资金回撤。过去 24 小时(截至美国东部时间周三,3 月 6 日上午 7 点),加密货币期货交易所的多头清算金额超过 8 亿美元(如果包括空头清算,总额超过 10 亿美元)。

不管怎样,这一切都是昨天的事了,已经成为过去,因为现在比特币的交易价格又回到了 6.7 万美元,这实际上比周一早上比特币的开盘价高出了 4000 美元。波动性又回来了,而且当我们克服「忧虑之墙」时,波动性可能会持续存在。

译者注:「忧虑之墙」(Wall of Worry)的比喻来自于华尔街广为流传的谚语,它指代的不是单一引发投资者恐慌的经济衰退、通货膨胀、政治或地缘政治问题,而是以上所有多方面忧虑的集合。

关于上一次突破历史高点的一些背景:比特币这一路并不是那么容易。 2020 年,比特币首次触及之前的 ATH(自 2017 年 12 月 17 日的约为 2 万美元)后,花了 16 天才最终突破。事实上,两次触摸高点之后,比特币的交易价格一度下跌了 12.33%,当然,之后反弹走高。

从心理和技术分析的角度来看,前一个历史高点是重要阻力位,这是完全合理的。具体来说,我妈妈告诉我,她昨天以 68,850 美元的价格出售了一些比特币。我不知道她是如何做到恰好在高点卖出的,她一定不是像我这样的钻石手狂热者。无论如何,我都无法舍弃我的筹码。

但一些沉睡多年的比特币(old coins)确实在昨天苏醒,它们的抛售可能导致了盘中顶部。链上数据表明,2010 年开采的大量比特币昨天在链上发生转账,我们假设这些比特币被出售了。每个人都有一个心理价格,如果这是同一个人并且确实出售了比特币,他们可能希望在 2021 年高点时出售并离场。我猜你可以当 14 年的钻石手,然后发现你的持仓 To The Moon。比特币所有牛市的特点都是老用户将币转移到新用户手中,这就是比特币持有者变得越多庞大的原因。 ( 我要指出的是,这个持有者可以很容易地将他们开采的比特币合并到新的托管钱包中,至少我还没有看到任何链上迹象表明这些比特币被发送到加密货币交易所。)

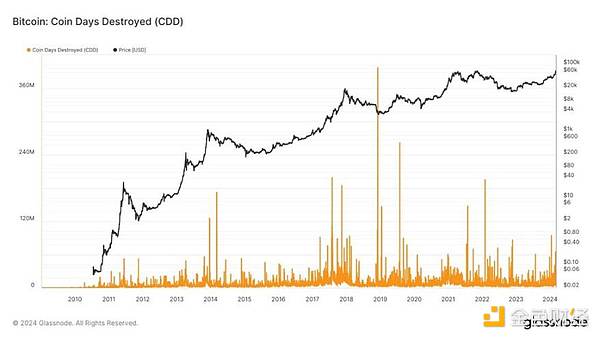

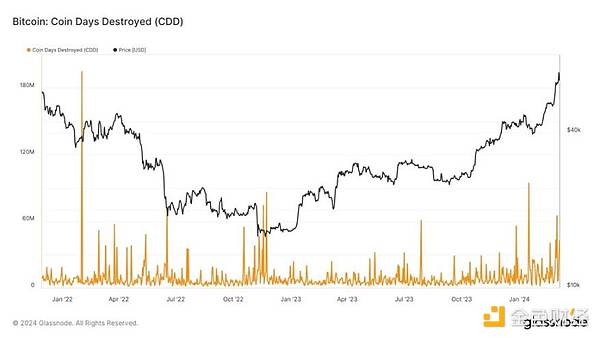

事实上,如果我们看看 Coin Days Destroyed(CDD)指标,可以发现沉睡比特币的变动往往标志着牛市峰值或熊市底部。该指标获取一笔交易中的代币数量(或给定日期的所有交易),并将代币数量乘以自这些代币上次转账以来的天数。例如,如果我今天购买 1 枚比特币,将其放入冷钱包,然后最终在 300 天后将其转移到链上,那么我的这笔交易对 CDD 指标贡献值就是 300。随着过去几周比特币价格走高,我们可以看到一些较高 CDD 数值。

顺便说一句,其中一些峰值(例如 2022 年初的峰值)是由于特殊情况造成的(2022 年初的峰值是由于美国政府在 2 月 22 日早些时候从 Bitfinex 黑客手中没收了 36 亿美元的比特币)。当美联储扣押这些比特币并将其转移到他们控制的钱包中时,会对 CCD 指标造成干扰。话虽如此,我们并没有看到大量沉睡比特币涌入市场——为了摆脱 OG,市场似乎需要走得更高。

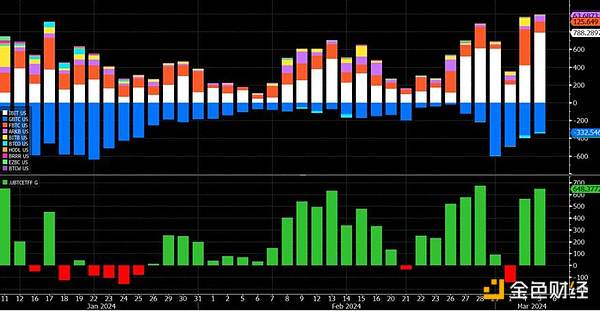

昨天,比特币 ETF 的日成交量创下历史新高,超过 100 亿美元。这是比特币 ETF 有史以来流入量最大的一天,也是自上市以来净流入量第二大的一天(净流入 6.48 亿美元)。净流入的比特币数量超过 1 万枚(超过每日比特币产量约 950 BTC 的 10 倍)。 ETF 的增长速度确实令人震惊。正如我上周所写,资金流入不仅在持续,而且似乎仍在加速。这种势头停不下来,也不会停下来。

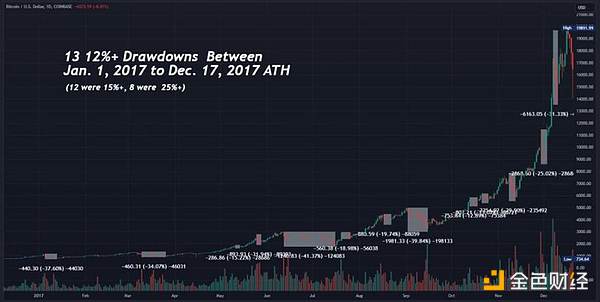

毫无疑问,随着牛市的继续,我们将攀上「忧虑之墙」。牛市是非线性的,并且充满了大量的修正行情。据我统计,从 2017 年 1 月 1 日到 2017 年 12 月 17 日约 2 万美元的历史高点,比特币经历了 13 次 12% 以上的下跌(其中有 12 次跌幅超过 15%,8 次跌幅超过 25%) 。

同样的故事在 2020 年再次上演。从 2020 年 3 月 12 日新冠疫情期间价格低点(3858 美元)到 2021 年 4 月 14 日 64,899 美元之间,比特币有 13 次 10% 以上的回撤(其中 7 次回撤幅度超过 15% ) 。

因此,昨天的价格走势并没有让我认为比特币不会再次走高。尽管我的读者不会对我认为比特币会走高感到惊讶。我们正在让持有比特币 ETF 的新朋友们接受比特币波动之火的洗礼。这只是「达赖喇嘛」的价格模式(这是一个古老的 meme,但它确实有效)。

出于娱乐的目的,我昨天同一个人辩论了比特币的内在价值。我知道,这不是对时间的有效利用。中本聪曾经写道:「如果你不相信我或者不明白,对不起,我没有时间试图说服你。」嗯,我确实有时间。这位人士认为,美元具有内在价值,因为它得到了美国政府的「充分信任和信用」的支持,我觉得这很滑稽,不是因为美元没有得到美国政府的充分信任和信用的支持,或者这样的信用没有价值,或者将来不会有价值。我可以提出这些论点。但在我看来,拥有内在价值的东西就意味着它可以被消费。石油可以被燃烧来为发动机提供动力,玉米可以被食用,甚至黄金可以被制成装饰性珠宝 ( 我猜想这在技术上很重要)。

因此,我认为美元没有内在价值,除非你打算烧掉你的钞票来给你的身体取暖。确实,货币工具不需要具有内在价值,而且我认为当今世界的法定货币都没有任何内在价值。事实上,对于金钱来说,没有所谓的内在价值可能会更好。毕竟,金钱是一种工具,我们可以用它来储存劳动成果,以便跨越空间和时间进行交易,而不是每次我们想要转移财富时都需要转移我们的体力劳动或财产。为什么要用一堆其他用例来阻碍这个工具,这些用例可能只会降低工具的实用性。比特币只是将这个概念发挥到了极致,几乎就像中本聪在想「如果我们能够拥有法定货币的所有属性而没有它的任何缺点,会怎么样?」如果我们可以拥有一种可替代的、易于转让的、可分割的全球货币,只不过它是没有重量的、不是由任何央行发行的,而且(顺便说一句)它在数学上有固定的供应量,那会怎样呢?

这个人不准备接受这个论点,他反驳我说, 「你所说的太疯狂了,世界不是这样运作的」。当权者——精英、根深蒂固的中间人等——想让你相信世界是僵化的,系统是安全的,机构是永久性的,一切都已经清清楚楚,一切都没有改变过。过去的动荡?我们解决了这个问题。你没看过课本吗?你不可能拥有过去 5000 年文明史中没有人想到过的一些新颖的解决方案。重新发明金钱?我们在 1910 年 11 月在杰基尔岛上就解决了这个问题。这些想法是愚蠢的。

世界比人们意识到的要复杂得多,也要古老得多。革命之所以具有破坏性,正是因为它们推翻了现有的秩序,但革命只是教科书上的内容。如果革命没有颠覆既定的体系和思维方式,我们的教科书上就不会出现革命。所以,一切还没有弄清楚。人类的进步,就像比特币图表一样,是非线性的。当我们寻找光时,我们断断续续地跳来跳去,质疑自己和之前的假设。 (说到这里,看看我今天早上在看到的这张搞笑的图表——真是个 shitcoin )。创新需要抛弃或至少不断发展过去的想法。事物变化越多,它们就越保持不变,但事物确实会发生变化。

朋友们,请系好安全带,我们的征程才刚刚开始。要有信念,如果可以的话,请将你的比特币保管在自己的钱包,然后享受市场上有史以来最伟大的游戏。

The author's research director compiled that it was a foggy morning in new york, and some of us felt like a fog because of the storm in the encryption market yesterday. The market storm means that Bitcoin fell by more than 10,000 dollars immediately after breaking through the historical high of 10,000 dollars. This morning, I had some new ideas about the bitcoin revolution and intrinsic value, but before talking about these, let's get rid of the fog and talk about what happened in the encryption market yesterday and what month it means to the bull market. The price of bitcoin once reached a record high of USD on January, and then it experienced a fluctuation of USD 10,000. At present, the transaction price has returned to USD 10,000. Yes, it is the first time that both physical gold and digital gold have reached a record high, but it will not be the last time. However, bitcoin is still not suitable for novices. After hitting a record high, bitcoin immediately plunged and the lowest price fell to the USD futures market. In the case of long-short and double-explosion, hundreds of millions of dollars of bitcoin bulls were liquidated only between pm and pm EST, which further aggravated the withdrawal of funds. In the past hours, as of the morning of Wednesday, March, EST, the amount of long-term liquidation of cryptocurrency futures exchange exceeded hundreds of millions of dollars. If the total amount of short-term liquidation exceeded hundreds of millions of dollars, all this was yesterday anyway, because the transaction price of bitcoin has now returned to tens of thousands of dollars, which is actually more than that of Monday morning. The opening price of bitcoin is higher than that of the dollar, and the volatility is back, and when we overcome the wall of worries, the volatility may persist. The metaphor of the wall of worries comes from a proverb widely circulated on Wall Street. It refers not to a single economic recession, inflation, politics or geopolitical issues that cause investors to panic, but to a collection of all the above concerns. The last time Bitcoin broke through the historical high, it was not so easy. Before Bitcoin first touched it in. It took a genius to finally break through after it was about $10,000 on January. In fact, after touching the high point twice, the transaction price of bitcoin once fell. Of course, it rebounded and rose. From the perspective of psychological and technical analysis, the previous historical high point was an important resistance level. Specifically, my mother told me that she sold some bitcoins at the price of US dollars yesterday. I don't know how she did it. She must not be a diamond fanatic like me. Anyway, I am. I can't give up my chips, but some bitcoins that have been sleeping for many years did wake up yesterday. Their selling may have led to a large number of bitcoins mined in the chain at the top of the session next year being transferred on the chain yesterday. Let's assume that these bitcoins have been sold, and everyone has a psychological price. If this is the same person and they do sell bitcoins, they may want to sell and leave at the high point of the year. I guess you can be the diamond hand of the year and find out all the characteristics of the bull market in your position. It is the old users who transfer the coins to the new users, which is why the number of bitcoin holders becomes more and more huge. I want to point out that this holder can easily merge the bitcoins they mined into the new escrow wallet. At least I haven't seen any signs on the chain that these bitcoins are sent to the cryptocurrency exchange. In fact, if we look at the indicators, we can find that the changes in sleeping bitcoins often mark the peak of a bull market or the bottom of a bear market. This indicator obtains tokens in a transaction. Quantity or all transactions on a given date, and multiply the number of tokens by the number of days since the last transfer of these tokens. For example, if I buy a bitcoin today and put it in a cold wallet, and then finally transfer it to the chain in the next day, then the contribution value of my transaction to the index is that as the price of bitcoin has gone up in the past few weeks, we can see some higher values. By the way, some of the peaks, such as the peak at the beginning of the year, are due to special circumstances, and the peak at the beginning of the year is due to the US government in June. Earlier in the day, hundreds of millions of dollars of bitcoin were confiscated from hackers. However, when the Federal Reserve seized these bitcoins and transferred them to wallets under their control, the indicators would be disturbed. Nevertheless, we did not see a large number of sleeping bitcoins flooding into the market. In order to get rid of the market, it seems that it is necessary to go higher. Yesterday, the daily turnover of bitcoin reached a record high of more than hundreds of millions of dollars, which is the largest inflow in the history of bitcoin and the second largest net inflow since its listing. The net inflow of bitcoin exceeds 10,000 pieces, and the growth rate is really shocking. As I wrote last week, the inflow of funds is not only continuing, but also seems to be accelerating. This momentum will not stop and will not stop. There is no doubt that with the continuation of the bull market, we will climb the wall of anxiety. The bull market is nonlinear and full of a lot of corrections. According to my statistics, bitcoin has experienced more than one decline from the historical high of about 10,000 US dollars from March to March. The story of falling more than once and falling more than the same story was staged again in 2006. From the low price of US dollars during the new crown epidemic in February to the US dollars on March, there were more than times of withdrawal of Bitcoin, one of which was more than that. Therefore, yesterday's price trend did not make me think that Bitcoin would not go up again, although my readers would not be surprised that Bitcoin would go up. We are letting new friends who hold Bitcoin be baptized by the fire of bitcoin fluctuations. This is just the price model of the Dalai Lama. This is one. An old one, but it does work. For entertainment purposes, I debated the intrinsic value of Bitcoin with a person yesterday. I know this is not an effective use of time. Satoshi Nakamoto once wrote that if you don't believe me or understand, I'm sorry, I don't have time to try to convince you. Well, I do have time. This person thinks that the US dollar has intrinsic value because it has the full trust and credit support of the US government. I think this is funny, not because the US dollar doesn't have the full trust and trust of the US government. I can put forward these arguments, but in my opinion, what has intrinsic value means that it can be consumed, oil can be burned to power engines, corn can be eaten, and even gold can be made into decorative jewelry. I guess this is technically important, so I don't think the dollar has intrinsic value unless you plan to burn your banknotes to warm your body. Indeed, monetary instruments don't need intrinsic value, and I don't think legal tender in today's world has any intrinsic value. In fact, it doesn't matter to money. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。