比特币物以稀为贵

作者:Alexander Osipovich

比特币为何在本周创下纪录高位?这一全球市值最大加密货币的拥趸们说,这是传统的供求法则的功劳。

就像任何大宗商品的价格一样——无论是黄金、石油还是大豆,比特币的价格对需求波动非常敏感。今年1月份推出直接持有该数字货币的美国ETF、也就是现货比特币ETF之后,对比特币的需求激增。

自那以后,投资者向这些ETF狂投了数十亿美元。上述资金流入促使这些基金购买比特币以满足相关需求,从而推高了价格走势。

但比特币与其他商品的不同之处在于其供应受到严格限制,这种动态可能导致价格大幅飙升。

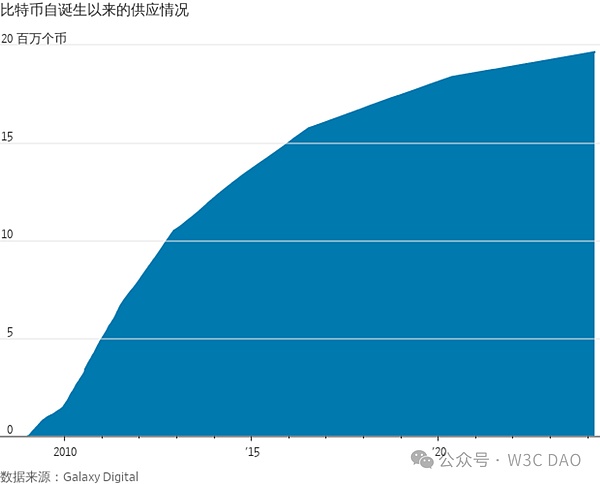

支撑比特币的计算机代码规定了2,100万枚比特币的硬性上限。其中90%以上的供应已经开采出来了。为了扩大供应,数字运算计算机运行算法来“挖掘”新币。

但每天只能挖出大约900枚新比特币,预计在下月出现被称为“减半”的周期性事件后,这一速度将会下降。大约在2140年,当最后一枚比特币被挖出来时,其供应最终将停止增长。

Galaxy Digital研究主管Alex Thorn说:“比特币是世界上最稀缺的资产之一,而且正日益紧俏。”

谁也不能保证比特币会持续上涨。目前的高价可能会鼓励持有者卖出手中的比特币,锁定利润。之前的几轮比特币牛市之后都出现了毁灭性的暴跌:上一次在2021年11月达到峰值后,比特币在接下来的一年里下跌了70%以上。

包括政府官员和在这波涨势中一直保持观望的华尔街高管在内的怀疑论者仍然认为,比特币是一种投机资产,没有内在价值。

用经济学术语来说,比特币的供应极度缺乏弹性,这意味着它不会对价格变动做出反应。具有这种特性的商品很容易突然出现大幅的价格震荡。例如,天然气生产商无法在短期内大幅增加天然气产量,以利用高价格。

但从长期来看,天然气价格持续走高会促使钻探者去发掘新的天然气来源。同样,当金价长期处于高位时,金矿开采者就可以开展成本高昂的新开采项目,在更偏远的地方搜寻黄金。

比特币却不是这样。比特币代码中的规则限定了挖矿者可向市场引入的新币的速度,这个速度会定期减半。

在过去,比特币的价格会在这样的“减半”之前攀升,因为加密货币投资者预计供应会更加紧张。化名中本聪(Satoshi Nakamoto)的比特币创造者提出了比特币应该有一个固定的最大供应量的想法,他曾写道,这样的设计将使比特币的价值不会受到通胀影响。

投资公司Swan Bitcoin的私人客户服务主管Steven Lubka说:“从根本上说,比特币没有能力为市场带来额外的供应。”

这使得比特币对需求的增长非常敏感,自1月11日推出以来,新的比特币ETF一直在大举买入比特币。

当天,九只新的现货比特币ETF首次上市交易,而一只现有的基金Grayscale Bitcoin Trust也转换成了ETF。从那以来,净流入这些ETF的资金已接近80亿美元,流入这九只新基金的资金量超过Grayscale的资金流出量。

据投资研究公司ByteTree估计,截至本周二,全球ETF或其他投资基金持有的比特币占全球总供应量的5%,高于1月11日上述美国新ETF开始交易时的4.4%。

当ETF为满足投资者需求而购买新的比特币时,它们通常依赖于自营交易公司,如芝加哥交易巨头DRW Holdings旗下的Cumberland或纽约的Jane Street Capital。这些公司的加密货币交易部门会在数字货币市场上寻找大量比特币,以满足基金的买单需求。

随着美国证券交易委员会首次批准直接投资于比特币的交易所交易基金,预计将有数十亿美元流入这一市场。

一些分析师表示,从持有大量比特币的投资者那里获得比特币已变得越来越困难。公开的区块链数据显示,全球约1960万枚比特币中的大部分供应都放在数字钱包里,这些钱包很少动用这些比特币,可能是因为它们属于拒绝出售的长期比特币持有者,也可能是因为持有者丢失了密码,导致他们的比特币无法获取。

瑞士私人银行瑞士宝盛(Julius Baer)的分析师Manuel Villegas在上周的一份研究报告中表示,在过去六个月中,大约80%的比特币供应没有转手。Villegas写道,再加上ETF的流入,以及数据显示交易所可供出售的比特币库存有限,这“可能会加剧供应紧张”。

还有人说,有大量卖家愿意在比特币反弹时抛售比特币,这可能是比特币本周短暂突破2021年纪录后势头停滞的一个原因。

DRW关系管理主管Rob Strebel说,在最近几周资金大量流入ETF的情况下,Cumberland在寻找比特币以满足ETF对比特币的需求方面并没有遇到困难。他说,公司从大型加密货币投资者那里获得了大量比特币,这些投资者在比特币价格较低时买入,并借此机会获利回吐。

“当你看到一个市场呈抛物线走势时,就像比特币一样,这自然是一个卖出的机会,”Strebel说。“尤其是当人们回忆起2021年的上一轮牛市时,就会从桌面上拿走一些筹码。”

Why did the author Bitcoin hit a record high this week? Fans of the world's largest cryptocurrency by market value say that this is due to the traditional law of supply and demand, just like the price of any commodity. The price of both gold, oil and soybean bitcoin is very sensitive to the fluctuation of demand. After the launch of spot bitcoin in the United States, which directly owns digital currency, in this month, the demand for bitcoin surged. Since then, investors have poured billions of dollars into these funds. Buying bitcoin to meet the relevant demand has pushed up the price trend, but the difference between bitcoin and other commodities is that its supply is strictly limited, which may lead to a sharp rise in prices. The computer code supporting bitcoin stipulates a hard upper limit of 10,000 bitcoins, of which more than 10,000 bitcoins have been mined. In order to expand the supply, the digital computing computer runs an algorithm to mine new coins, but only about new bitcoins can be dug up every day. It is expected that there will be a cyclical event called halving next month. After that, this speed will drop about in, when the last bitcoin is dug up, its supply will eventually stop growing. The research director said that bitcoin is one of the scarcest assets in the world and it is becoming increasingly scarce. No one can guarantee that bitcoin will continue to rise. The current high price may encourage holders to sell their bitcoin and lock in profits. After the previous rounds of bitcoin bull market, there was a devastating plunge. After the last peak in June, bitcoin fell in the following year. Skeptics, including government officials and Wall Street executives who have been on the sidelines in this wave of rising prices, still believe that bitcoin is a speculative asset with no intrinsic value. In personal capital's view, the supply of bitcoin is extremely inelastic, which means that it will not respond to price changes. Commodities with this characteristic are prone to sudden large price shocks. For example, natural gas producers cannot significantly increase natural gas production in the short term to take advantage of high prices, but in the long run, natural gas prices are extremely inelastic. The continuous rise of the grid will encourage drillers to explore new natural gas sources. Similarly, when the price of gold is at a high level for a long time, gold miners can carry out expensive new mining projects and search for gold bitcoin in more remote places, but this is not the case. The rules in the bitcoin code limit the speed at which miners can introduce new coins into the market, which will be halved regularly. In the past, the price of bitcoin will rise before this halving, because cryptocurrency investors expect that the supply will be more tight. The creator of Bitcoin put forward the idea that Bitcoin should have a fixed maximum supply. He once wrote that the value of Bitcoin will not be affected by inflation. The private customer service director of the investment company said that fundamentally Bitcoin is unable to bring additional supply to the market, which makes Bitcoin very sensitive to the growth of demand. Since its launch on May, new Bitcoin has been buying bitcoin in large quantities. On the same day, nine new spot bitcoins were first listed and one existing one was traded. Since then, the net inflow of these funds has been close to 100 million dollars, and the outflow of these nine new funds has exceeded. According to investment research company's estimation, as of Tuesday, the global or other investment funds held more bitcoin than the global total supply. When the United States first started trading, they usually relied on proprietary trading companies such as the encrypted goods of Chicago trading giants or these companies in new york to buy new bitcoins to meet the needs of investors. The currency trading department will look for a large number of bitcoins in the digital currency market to meet the fund's demand for payment. With the first approval of the US Securities and Exchange Commission for exchange-traded funds that directly invest in bitcoin, it is expected that billions of dollars will flow into this market. Some analysts say that it has become increasingly difficult to obtain bitcoins from investors who hold a large number of bitcoins. The published blockchain data shows that most of the supply of about 10,000 bitcoins in the world is in digital wallets, and these wallets rarely move. These bitcoins may be used because they belong to long-term bitcoins holders who refuse to sell, or because the holders have lost their passwords, so their bitcoins cannot be obtained. In a research report last week, analysts of Swiss private bank Baosheng said that about the supply of bitcoins has not changed hands in the past six months, coupled with the inflow and data showing that the stock of bitcoins available for sale in the exchange is limited, which may aggravate the shortage of supply. Some people say that a large number of sellers are willing to Selling Bitcoin when it rebounds may be one reason why the momentum of Bitcoin has stagnated after it briefly broke through the annual record this week. The head of relationship management said that in recent weeks, there was no difficulty in finding Bitcoin to meet the demand for Bitcoin. He said that the company got a lot of Bitcoin from large cryptocurrency investors, who bought it when the price of Bitcoin was low and took this opportunity to take profits. When you see a parabolic trend in a market, it is naturally an opportunity to sell, especially when people recall the last bull market last year. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。