SAGA经济模型解析:通往可负担区块之路

作者:0xLoki,ABCDE 研究员 来源:@Loki_Zeng

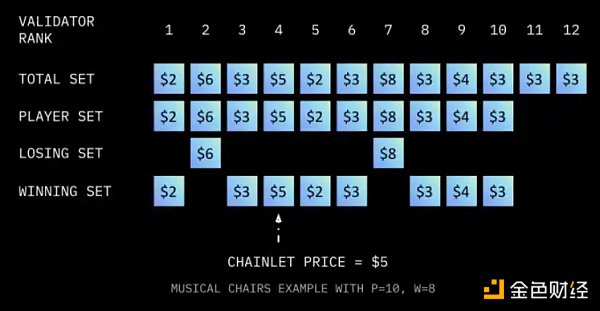

SAGA 商业模式的本质是向下游需求方分发区块空间,涉及到的一个关键问题就是如何定价,SAGA 采用了一种独有的「音乐椅定价」进行:

(1)假设初始状态下有 a=12 个验证者,SAGA 希望从中选择 8 个进行委托验证;

(2)首先 SAGA 按照质押率排名从中选取一定数量的验证者进入出价环节,例如 p=10,那么排名第 11 和第 12 的验证者将被淘汰;

(3)接下来 10 个验证者进行报价,按照报价从低到高进行排序,选择其中 8 个作为委托验证人,同时价格按照 8 个验证者中价格最高者确定,报价为 6 美元和 8 美元的 2 号、7 号验证者被淘汰,剩下 8 个验证者入围,并同意按照 5 美元进行定价。

这个机制看起来非常复杂,但可以实现一个目标:通过内卷提供尽可能便宜的区块空间(或者叫有效定价)。

以上述案例为例,如果验证者想要获取奖励,就必须确保自己进入前 8。第一步需要确保自己的质押量足够,这有点类似 EOS 过去的超级节点,第 21 名和第 22 名的奖励存在显著差异。

第二步是通过报价入围。代入单个节点视角,报价 0.01 和报价 5 美元,最终获得的订单价格都是 5 美元,但是 5 美元需要冒着被淘汰的风险,所以尽可能地报低价。

但逐渐地,大部分验证者就会发现这是无止境的内卷,价格逐步向 0 便宜,所以如果考虑到验证者的成本(包括代币的机会成本),更加稳妥的方式是报一个略高于自己成本的价格。所以实际过程中定价会接近【成本 + 少量利润】,长期看会处于一个非常低的区间,这个过程中还会不断淘汰高成本的验证者。

下表可以看出,坎昆升级以后,ETH L2 便宜了很多,但仍然不够便宜,特别是相对 Solana 而言。从技术角度,我们需要 BTC/ETH 这样的安全性,但从商业角度,大规模应用也确实无法承受 0.1U/ 笔的交易费用,所以「极低并且稳定的费用」是非常有意义的。

另外 SAGA 的收费模式也和其他公链有所区别,用户不需要直接支付网络费用,应用可以自行决定收费方式(例如订阅制、买断制、广告收费甚至完全免费),这也更加符合 Web2 的商业模式惯例,提供了更多灵活性。

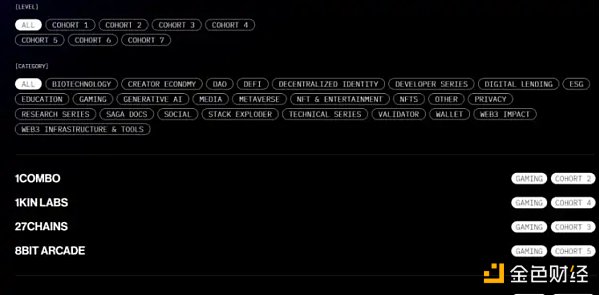

另一个有意思的事情是,SAGA 的激励测试网 Saga Pegasus 目前已经有几百个协议,截至 2024 年 4 月 1 日,该计划包括 350 个项目。这些项目中有 80% 是游戏。大约 10% 的项目是 NFT 和娱乐,10% 是 DeFi。这个数据也和经济模型体现了一致性——SAGA 更加适合轻资产、高用户数量、高用户频次的场景。

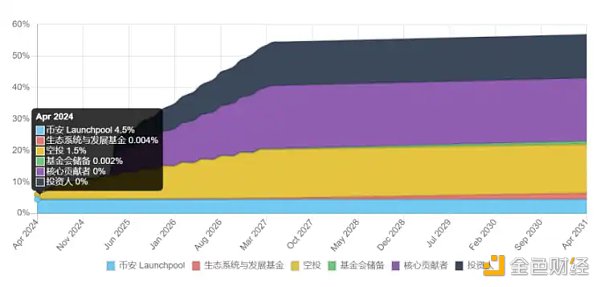

最后需要关注的是代币分配,按照 Binance 公布的信息,初始流通量只有 4.5% 的 Launchpool 和 1.5% 的空投,而生态系统和基金会份额基本可以忽略:

(1)75% 的筹码 Binance Launchpool,抛压非常有限;

(2)总量 15.5% 的空投只发放了 1.5%,很有可能后面还有很多轮,再考虑到激励测试网上还有几百个项目(可能发币),发币以后 SAGA 仍然值得继续参与(尤其是质押)

SAGA 详细信息:https://binance.com/zh-CN/research/projects/saga

The essence of the author-researcher source business model is to distribute the block space to the downstream demanders. One of the key issues involved is how to price the block space. A unique music chair pricing is used to make assumptions. In the initial state, there is a verifier who wants to choose one of them for entrusted verification. First, a certain number of verifiers are selected according to the pledge rate to enter the bidding process. For example, the verifiers ranked first and second will be eliminated, and then the verifiers will make quotations, and the quotations will be sorted from low to high. Choose one of them as the entrusted verifier, and at the same time, the price is determined according to the number of the highest price among the verifiers. The verifier is eliminated, and the remaining verifier is shortlisted and agrees to price in US dollars. This mechanism seems very complicated, but it can achieve a goal of providing the cheapest block space through the involution or effective pricing. Take the above case as an example. If the verifier wants to get the reward, he must ensure that his pledge amount is sufficient before entering the first step. This is somewhat similar to the past, where there is a significant difference between the first place and the first place in the super node. The second step is to substitute the quotation into a single node perspective. The final order price of the quotation and the quotation dollar is US dollars, but the US dollar needs to risk being eliminated, so the low price is quoted as much as possible, but gradually most verifiers will find that this is endless, and the price of involution is gradually getting cheaper. Therefore, if the cost of the verifier, including the opportunity cost of tokens, is considered, it is more prudent to quote a slightly higher price. Because of the price of its own cost, the pricing will be close to the cost in the actual process, and a small amount of profit will be in a very low range in the long run. In this process, high-cost verifiers will be eliminated continuously. As can be seen from the table below, Cancun is much cheaper after upgrading, but it is still not cheap enough, especially from a technical point of view, we need such security, but from a commercial point of view, large-scale application can not afford the transaction cost of pens, so the extremely low and stable cost is very meaningful. The mode is also different from other public chains. Users don't need to pay the network fees directly. Applications can decide their own charging methods, such as subscription system, buyout system, advertising fees or even completely free. This is more in line with the business model convention, which provides more flexibility. Another interesting thing is that there are hundreds of agreements on the incentive test network at present. As of March, the plan includes six projects. Some of these projects are games, and the related projects are entertainment. This data is also more consistent with the economic model. Adding a scene suitable for light assets, high number of users and high frequency of users, the last thing we need to pay attention to is that token distribution is airdropped according to the published information, and the share of ecosystem and foundation can be basically ignored. The total amount of airdrops is only distributed, and it is very likely that there will be many rounds in the future. Considering that there are hundreds of projects on the incentive test network that may issue coins, it is still worth continuing to participate, especially the pledge details. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。