币圈大洗牌:灰度基金黯然离场 贝莱德基金崭露锋芒

世链牛比特(niubite.com)分享,Cobo 联合创始人兼 CEO 神鱼在 2024 香港 Web3 嘉年华《圆桌讨论:比特币十五年》中预测:

“2030 年比特币价格到达 150 万美元”的预测还是保守,比特币将在一两个周期后迎来大规模应用的爆发,届时还会有数倍空间,参与的核心玩家是大型金融机构。

“加密货币机构化”毫无疑问是未来的大趋势,经过十多年的发展,加密货币从小众边缘资产正在向主流资产靠近,加密市场从只有少数极客参与逐步过渡到将由金融机构主导。

例如,现货比特币 ETF,金融资产代币化等,也都需要有金融机构的参与和主导。而在这些金融机构中,贝莱德作为全球第一资管巨头,不但在传统金融拥有巨大的影响力,而且也开始在 Web3 进行深度布局,它在 Web3 的影响力,已超过了灰度和微策略,将成为新的引领者。

贝莱德在 Web3 主要有哪些布局呢?

一、微策略大股东

提起微策略(MicroStrategy)大家并不陌生,也就是那个持续买入比特币的美国上市公司,其实该公司的主营业务是商业分析软件。

在 2020年,董事会一致同意将比特币纳入公司主要的储备资产,此后,微策略多次加仓,数次在跌破成本价时依然大胆买进。

微策略的这种“傻瓜式”买买买比特币的举动,在许多投资“大神”看来是不明智的甚至是愚蠢的。

但孰不知就是这种傻傻的买入策略,让微策略赚得盆满钵满。

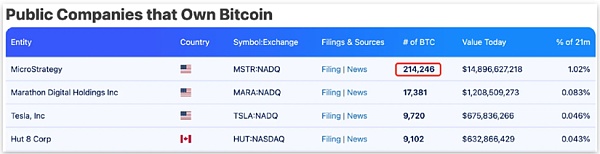

微策略持有比特币数量已超过 21万枚,每一枚的平均成本为 35160 美元,以4月10日比特币市价来算,微策略已浮盈 72亿美元。

微策略这种持续买入策略,不但在比特币持仓上赚了很多钱,而且还带动股票价格飙升,可谓是一举多得。

值得一提的是,微策略的主营业务收入表现日益不佳,然而其比特币持仓规模却不断扩大。这一现象导致了该公司的股票价格与比特币价格之间形成了深度的绑定关系。

而在比特币价格暴涨时,微策略公司股票暴涨的幅度更大,即股票价格有了相当大的溢价。

例如,最近一年比特币涨幅为 131%,而微策略股票涨幅则达到了 360%,涨幅相差将近 3倍,最近半年比特币涨幅为 150%,但微策略股票涨幅达到了 323%,涨幅相差2倍。

正是由于存在长期溢价,对于许多机构或散户来说,投资微策略股票,不但比直接投资比特币能获取更高(两倍或更多)的收益,而且还省去了私钥管理、合规等不必要的麻烦。

所以,在现货比特币 ETF 在被 SEC 批准通过之前,持有微策略股票,其实也就相当于间接投资比特币,这也是许多资管机构持有微策略股票的主要原因。

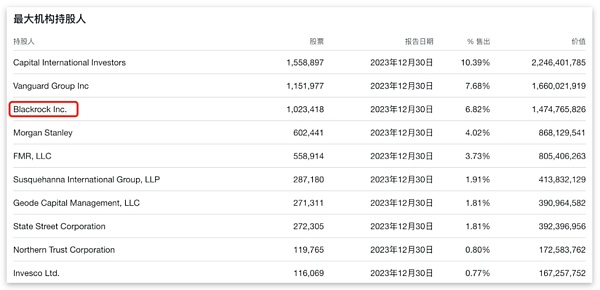

而在微策略股票的持仓大户中,我们就看到了贝莱德的身影。

根据雅虎财经的数据统计,在微策略的最大机构持股人中,贝莱德排名第三,持股市值达到了 14亿美元,贝莱德正是通过这种形式,间接持有了比特币风险敞口。

二、现货比特币 ETF

截止目前,贝莱德对于加密市场的最大贡献,莫过于现货比特币 ETF 了。

2023年6月份,贝莱德向 SEC 提交了现货比特币 ETF 的申请,经过与 SEC 半年多的沟通、磨合,SEC 最终在 2024 年 1 月 11 日同时批准了 11 只现货比特币 ETF。

事实上,现货比特币 ETF 早在 2013 年便被提出了,不过在长达十年的时间里,SEC先后拒绝了超过30项类似申请。

由此可见,贝莱德在推动现货比特币 ETF 获批的进程中,起到了非常关键的作用,这主要得益于贝莱德在美国政界、金融界的巨大影响力。

贝莱德作为世界第一大资管机构,手里掌管的资金规模在 10万亿美元左右,可谓是富可敌国。

同时,贝莱德和美国政府也有着密不可分的关系,在去年美国硅谷银行出现暴雷后,“华尔街清道夫”贝莱德被聘为顾问,帮助美国政府安排出售1140亿美元由破产的 Signature Bank 和硅谷银行所持1140亿美元证券。

现货比特币 ETF 这一里程碑式的利好,极大地推动了比特币的合规化进程,而这一史诗级的利好,主要就是由贝莱德所推动的。

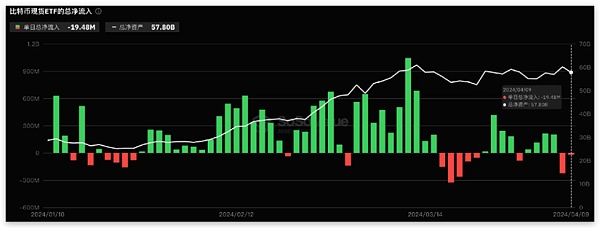

截止目前,现货比特币 ETF 总资产净值为 578 亿美元,ETF 净资产比率(市值较比特币总市值占比)达 4.25%,历史累计净流入已达 123.7 亿美元,而贝莱德 IBIT 是净流入最多的现货比特币 ETF。

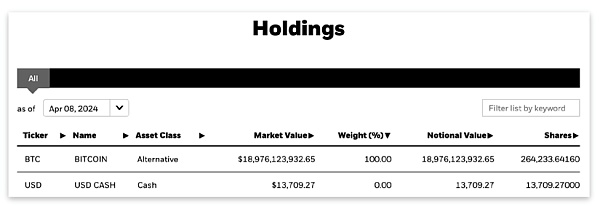

据统计,目前贝莱德比特币 ETF 持有的比特币数量已突破了 26 万枚,已超过微策略(MicroStrategy)的比特币持有量(21万枚)。

灰度作为上轮牛市重要推动力量,目前持有的比特币数量为 31万枚,也仅比贝莱德 IBIT 持有的数量多了 5万枚。

随着灰度现货比特币 ETF 的不断流出,以及贝莱德现货比特币 ETF 的不断流入,贝莱德 IBIT 持有的比特币数量一定会超过灰度 GBTC 的持有量,进而成为持有比特币数量最多的机构,这也意味着贝莱德将取代灰度,成为这一领域新的引领者。

三、入局 RWA 赛道

在现货比特币 ETF 通过后,贝莱德 CEO 拉里·芬克表示,下一步趋势是金融资产的代币化。

RWA(现实世界资产)代币化,是本轮牛市的一大催化剂,同时也将是未来几年加密市场的一大趋势。

对于 Web3 来说,DeFi 挖矿收益越来越低,它急需现实世界资产的补充,而对于 Web2 来说,它需要通过区块链技术大幅降低管理成本。RWA 在 Web2 资产和 Web3 资产之间搭建起了一座桥梁,现实世界百万亿美元体量的资产将会通过 RWA 进入到 Web3。

根据波士顿咨询集团分析,到2030年,代币化资产市场预计将达到16万亿美元的规模,这也意味着代币化的巨大潜力。显然,贝莱德早已盯上了这块蛋糕。

3月20日,贝莱德宣布推出了其首个在公共区块链上发行的代币化基金,即贝莱德美元机构数字流动性基金(BUIDL)。

据悉,BUIDL将通过聚焦于RWA的数字资产Securitize进行认购,为合格投资者进行服务,资金将由官方托管机构持有。该基金将总资产100%投资于现金、美国国债和回购协议,让投资者在持有区块链上的代币的同时赚取收益。

贝莱德与 Securitize 合作推出代币化基金,引发了 RWA 赛道的暴涨,例如,ondo、RIO、CFG 以及 GFI 代币等都出现了超过1倍的涨幅。以贝莱德的巨大影响力,必将会加速 RWA 赛道的发展。

总之,无论是把 Web3 资产带入到 Web2 世界的现货比特币 ETF,还是把 Web2 资产带入到 Web3 世界的 RWA 代币化,在这两个探索方向上,贝莱德都起到了至关重要的作用,通过它的全球影响力,将会加速 Web2 与 Web3 的融合,而且也将会带动更多机构入场,在推动区块链技术的大规模应用的进程中,贝莱德功不可没。

The Co-founder and Divine Fish of the World Chain Niubitsharing discussed Bitcoin at the Hong Kong Carnival Roundtable. It is predicted that the annual bitcoin price will reach 10,000 US dollars in 15 years. It is still conservative. Bitcoin will usher in the outbreak of large-scale application in one or two cycles, when there will be several times of space to participate. The core players are large financial institutions. The institutionalization of cryptocurrency is undoubtedly the general trend in the future. After more than ten years of development, cryptocurrency is moving from small marginal assets to mainstream assets, and the cryptocurrency market is close to only a few. The gradual transition from geek participation to financial institutions, such as the token of spot bitcoin financial assets, also needs the participation and leadership of financial institutions. Among these financial institutions, BlackRock, as the world's number one asset management giant, not only has great influence in traditional finance, but also begins to carry out in-depth layout. Its influence has surpassed the gray scale and micro-strategy. Will BlackRock become a new leader? What are the main layouts of micro-strategy? It is no stranger for everyone to propose micro-strategy. It's the American listed company that keeps buying Bitcoin. In fact, the company's main business is business analysis software. After the board of directors unanimously agreed to include Bitcoin in the company's main reserve assets in, Microstrategy has repeatedly increased its positions several times. This stupid buy buy's move to buy Bitcoin when it fell below the cost price is unwise or even stupid for many investment gods, but everyone knows that it is this stupid buying strategy that makes Microstrategy earn a lot of money. The number of bitcoins has exceeded 10,000 pieces, and the average cost of each piece is US dollars. Based on the market price of bitcoins on the month and day, Microstrategy has made a profit of US$ 100 million. This continuous buying strategy not only makes a lot of money in bitcoin positions, but also drives the stock price to soar. It is worth mentioning that the income performance of Microstrategy's main business is getting worse, but the scale of its bitcoin positions is expanding, which leads to a deep bond between the company's stock price and bitcoin price. However, when the price of bitcoin skyrocketed, the stock price of micro-strategy company soared even more, that is, the stock price had a considerable premium. For example, in the last year, the increase of bitcoin was zero, but the increase of micro-strategy stock was nearly double. It is precisely because of the long-term premium that for many institutions or retail investors, investing in micro-strategy stock can not only get twice or more higher income than directly investing in bitcoin, but also save money. Unnecessary troubles such as private key management compliance are eliminated, so holding micro-strategy stocks in the spot bitcoin before it is approved is actually equivalent to indirectly investing in bitcoin, which is also the main reason why many asset management institutions hold micro-strategy stocks. Among the large holders of micro-strategy stocks, we have seen BlackRock's figure. According to the statistics of Yahoo Finance, BlackRock ranks third among the largest institutional shareholders of micro-strategy, and its stock market value has reached US$ 100 million. Up to now, BlackRock's greatest contribution to the encryption market is spot bitcoin. In January, BlackRock submitted an application for spot bitcoin, and after more than half a year of communication, it finally approved only spot bitcoin at the same time on October. In fact, spot bitcoin was put forward as early as in, but it has rejected more than one similar application in ten years. This shows that BlackRock has been promoting the approval of spot bitcoin. It has played a very important role, which is mainly due to BlackRock's great influence in American political and financial circles. As the world's largest asset management institution, BlackRock has a wealth of about one trillion dollars. At the same time, BlackRock has an inseparable relationship with the US government. After the thunderstorm in Silicon Valley Bank in the United States last year, BlackRock, a street sweeper, was hired as a consultant to help the US government arrange the sale of billion dollars of spot bitcoin held by bankrupt and Silicon Valley banks. This milestone benefit has greatly promoted the compliance process of bitcoin, and this epic benefit is mainly driven by BlackRock. Up to now, the total net asset value of spot bitcoin is $100 million, and the market value accounts for $100 million compared with the total market value of bitcoin. BlackRock is the spot bitcoin with the largest net inflow. According to statistics, the number of bitcoins held by BlackRock Bitcoin has exceeded 10,000, which has exceeded the micro-strategy. As an important driving force of the last bull market, the number of bitcoins currently held by BlackRock is only 10,000, which is only 10,000 more than that held by BlackRock. With the continuous outflow of gray-scale spot bitcoins and the continuous inflow of black-scale spot bitcoins, the number of bitcoins held by BlackRock will definitely exceed that held by gray-scale and become the institution with the largest number of bitcoins, which also means that BlackRock will replace gray-scale as the new leader in this field. After the spot bitcoin passes, BlackRock Larry Fink will enter the track. It shows that the next trend is the token of financial assets. The token of real-world assets is a big catalyst for this bull market and will also be a major trend in the encryption market in the next few years. For me, the mining income is getting lower and lower, and it urgently needs the supplement of real-world assets. For me, it needs to greatly reduce the management cost through blockchain technology and build a bridge between assets. According to the analysis of Boston Consulting Group, the real-world assets with a volume of tens of billions of dollars will pass into. The market of token assets is expected to reach the scale of trillion dollars, which also means the huge potential of token. Obviously, BlackRock has already set its eyes on this cake. On April, BlackRock announced the launch of its first token fund issued in the public blockchain, namely BlackRock Dollar Agency Digital Liquidity Fund. It is reported that the fund will be subscribed for by focusing on digital assets to serve qualified investors, and will be held by an official custodian. The fund will invest its total assets in cash, US Treasury bonds and repurchase agreements. Investors earn profits while holding the tokens in the blockchain. BlackRock's cooperation with the launch of token funds has triggered the skyrocketing of the track. For example, tokens and so on have all increased more than twice. BlackRock's great influence will definitely accelerate the development of the track. In short, whether it is the spot bitcoin that brings assets to the world or the token that brings assets to the world, BlackRock has played a vital role in these two exploration directions. Through its global influence, it will accelerate the integration with and will also drive more institutions to enter the market. BlackRock has played an important role in promoting the large-scale application of blockchain technology. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。