木头姐突发:比特币占净资产比超25%

作者:安迪·瑟沃

“木头姐”凯西·伍德(Cathie Wood)不是那类咄咄逼人或喜欢夸夸其谈的人,但她确实有着强烈的个人观点,而且乐意与人分享她的观点,说服人们相信她的投资理论——人工智能、机器人、能源存储、DNA测序和区块链等技术将改变我们的世界——是她的激情所在,甚至是她的使命。

伍德是资管规模为300亿美元的方舟投资(ARK Invest)的创始人、首席执行官兼首席投资官。本周,我在南卡罗来纳州基瓦市召开的全球体育领袖大会上采访到了她。

伍德谈到了特斯拉、马斯克与X、加密货币、英伟达与人工智能以及她的信仰等话题,她还提到了一位亿万富豪投资人曾抛给她的救命稻草。

伍德谈特斯拉与马斯克

本周早些时候,电动汽车制造商特斯拉公布的交付数据低于预期,股价随后大幅下跌。我向伍德指出,一些分析师认为特斯拉的好日子已经过去了,伍德说她不这么认为。伍德是特斯拉的大投资者,她相信特斯拉的股价能涨1000%以上。

伍德说:“我们完全不同意这种观点。”她随后谈到了对特斯拉自动驾驶出租车(robotaxi)业务的看法。伍德说:“今早我听到有人说,‘特斯拉有能力推出自动驾驶出租车,但要等到多年以后了’,我们不这么看,鉴于人工智能带来的突破,我们认为自动驾驶出租车的机会即将到来。”

伍德认为,自动驾驶出租车业务的“毛利率在80%至85%之间,该业务好比软件即服务。目前电动汽车业务的毛利率在15%到17%之间,我们认为该业务的毛利率能达到25%至30%”。

伍德继续说道:“大多数分析师将特斯拉归类为一家汽车公司,但它根本不是一家汽车公司,而是一家机器人、能源存储和人工智能公司,这些将在它的利润率中体现出来。”

“汽车行业——比如福特和通用——正在远离电动汽车,这是一个很大的错误,因为它们盈利的唯一途径是扩大电动汽车的规模,因此,可以说它们是在把市场拱手让给特斯拉,随着特斯拉汽车的价格在五年内将至2万至2.5万美元的区间(目前均价为3万至4.5万美元),其他汽车公司的产品将被淘汰。”

我问伍德现在是否在买入特斯拉的股票。

她说:“是的,我们在每个交易日结束时都会披露持仓情况和交易情况。”

伍德后来告诉我,几年前特斯拉股价接近峰值时她卖掉了一些股票,但她现在在买,“低买高卖,对吧?”她说。

我问伍德是否担心马斯克的行为以及他发生的变化。

伍德说:“哦,不,他和过去没有任何不同。老实说,我们已经见过他很多次了,我认为他正在高度关注于他旗下公司的‘进入壁垒’以及如何推动技术向前发展。我们正在了解更多关于他准备做的事情,我认为他正在改变我们的世界,拯救人类对他来说是一件极其重要的事。我们应该去看他做了什么,而不是他说了什么。”

伍德说的也许有一定的道理,也许人们过于关注马斯克接手X后掀起的大大小小的风暴,而忘了他仍然对打造特斯拉充满热情。

伍德对X的看法和别人不一样,她说:“社交媒体正在不断发展变化,X对于我们来说是最重要的平台,我认为它正在变成一个知识工作者的平台。我们正在融入所有这些创新社区,他们喜欢我们的研究,支持我们,不像金融市场上的一些人认为我们完全是疯了。”

伍德谈英伟达

英伟达是伍德密切关注的另一家知名公司,她很早就买了英伟达的股票,但在最近股价暴涨之前卖掉了股票,我问她为什么要卖。

伍德说:“人们都说我们卖得太早了,每次看到有人这么说我都觉得很有意思。10年前方舟投资成立时,英伟达的股价是4美元,当时英伟达只是一家PC游戏芯片公司,我们对该公司进行了最初的研究后认为,GPU将成为机器人和自动驾驶汽车的大脑,因此我们很早就将其归类为人工智能芯片公司,方舟旗舰基金在英伟达股价从4美元涨到400美元期间一直持有这只股票,涨了100倍挺不错的。现在股价是900美元。”

伍德认为,英伟达“目前的股价消化了所有人工智能项目的承诺100%都会兑现的预期”,她认为这有点过于乐观,“所有相关项目都需要时间,英伟达仍然是最重要的人工智能芯片公司,遥遥领先,但我认为英伟达将面临库存问题,未来将面临很多竞争”。

伍德最大的持股是Coinbase

人们对伍德的“卷土归来”毁誉参半,我向她指出了这一点,她也承认确实是这样。

伍德说:“自成立以来,旗舰基金ARK Innovation的复合年回报率为11%,是的,我们经历了繁荣也经历了萧条,2021年我们的旗舰基金在11个月的时间里上涨了近400%。

伍德说,在旗舰基金和许多高涨的股票和基金一起大幅下跌后,投资者变得更加保守了。

“现在投资者涌向了基准指数,比如标普500指数和纳斯达克指数。现在的纳斯达克和我在20世纪八、九十年代看到的纳斯达克已经不一样了,该指数已经成为一只相当成熟的指数。我经常说我们的持股是‘新的纳斯达克’,实际上我挺喜欢这其中的心理因素,因为我更愿意在人们怀疑、害怕、不愿去相信的时候进行投资,这就是我们的现状。”

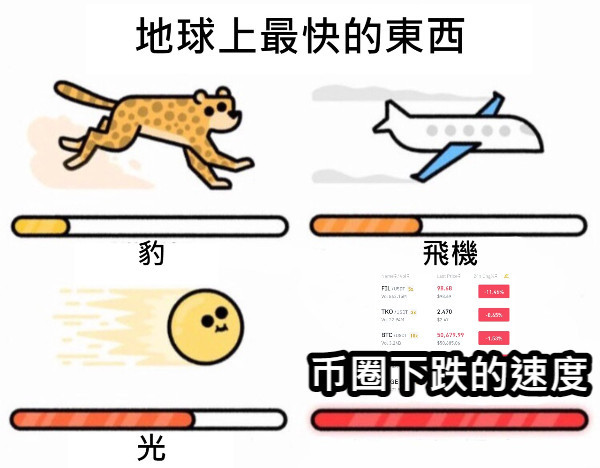

伍德最大的持股是Coinbase,而不是特斯拉,这可能和一些人想的不太一样,她是加密货币的忠实信徒,净资产中比特币的占比在25%以上。

“当比特币价格为250美元时,我们向客户提供了比特币敞口,现在价格大约是66000美元,我们认为比特币的上涨才刚刚开始,为什么这么说?全球货币体系通常是按国家划分的,比特币具有全球性、数字化、去中心化的和私有等属性,它让政府和人类脱离了这个体系。

我的导师(经济学家)阿特·拉弗(Art Laffer)对于我们有可能回到私人资金时代、回到美联储成立之前的时代感到非常兴奋。目前有这么一个人——美联储主席鲍威尔——正在以他自己的方式左右市场,我认为这太疯狂了,自保罗·沃尔克(Paul Volcker)以来情况一直如此。

我认为比特币将成为另一种货币,在尼日利亚和埃及等国非常有用,这两个国家的货币分别贬值了60%和40%。我刚刚了解到印度卢比在过去10年里贬值了一半。”

我问伍德怎么看加密货币被毒贩和罪犯使用这一事实。

“当颠覆性创新出现时,你说的这个问题是人们说我们不愿意接受它的第一个理由,互联网刚诞生时也是如此。

至于关于加密货币引发的环境问题,你可以回顾一下互联网诞生的早期,也有人说‘你知道互联网使用的电力和这个或那个国家一样多吗?’现在比特币挖矿已经有一半是用可再生能源完成的,比特币挖矿实际上可以进入公用事业生态系统,把比特币挖矿机放置在天然气田中,而不是燃烧或排放。”

伍德谈信仰

我还和伍德谈了她的信仰。她的公司名来自约柜(Ark of the Covenant),约柜是一个木制箱子,据说里面装着十诫。伍德的很多投资都是基于技术和科学,对她来说,宗教信仰和科学是分开的,还是相互影响的?

“2000年科技和电信泡沫破裂以及2008年至2009年金融危机之后,投资界进入了避险模式,这是我不得不自己创办公司的原因之一。目前人们对过去的投资多于对未来的投资,如果创新平台——机器人技术、能源存储、人工智能、区块链技术和基因测序——颠覆了传统的世界秩序,那么他们投资的这些公司将处于危险之中。”

“回到你问的信仰这个问题上来,我们正在投资于创新,我们从未见过这样一个创新的丰饶时期,所有创新平台都正在汇集在一起,我们将看到巨大的变化,再过5到10年,你就认不出这个世界了。”

伍德在采访结束时向亿万富豪托德·博利(Todd Boehly)致谢,博利是Eldridge Industries的创始人兼首席执行官,他的公司先是在2020年底借钱给方舟投资,以防止一家私募股权控制的公司行使获得伍德公司控股权的期权,然后在第二年买下了这家私募股权公司的初始投资。

伍德说:“我们非常感谢托德·博利,要不是因为他,我们早就死了。”

The author Andy Sewo's sister Kathy Wood is not the kind of aggressive or boastful person, but she does have strong personal views and is willing to share her views with others to convince people that her investment theory, artificial intelligence, robots, energy storage, sequencing and blockchain technologies will change our world, which is her passion and even her mission. Wood is the founder, CEO and chief investment officer of Ark Investment, which has an asset management scale of 100 million US dollars. This week, I am in South Carolina. She was interviewed at the Global Sports Leaders Conference held in Washi. Wood talked about Tesla Musk and cryptocurrency NVIDIA and artificial intelligence and her beliefs. She also mentioned that a billionaire investor had thrown her a lifeline. Wood talked about Tesla and Musk. Earlier this week, the delivery data released by electric car manufacturer Tesla was lower than expected, and then its share price fell sharply. I pointed out to Wood that some analysts thought Tesla's good days were over. Wood said she didn't. Yao thinks that Wood is a big investor in Tesla. She believes that Tesla's share price can go up. Wood said that we totally disagree with this view. She then talked about her views on Tesla's self-driving taxi business. Wood said that this morning I heard someone say that Tesla has the ability to launch self-driving taxis, but it will be many years later. We don't think so. In view of the breakthrough brought by artificial intelligence, we think that the opportunity of self-driving taxis is coming. Wood thinks that the gross profit margin of self-driving taxi business is The business is like software as a service. At present, the gross profit margin of electric vehicle business is between and. We think the gross profit margin of this business can reach to. Wood continued, most analysts classify Tesla as an automobile company, but it is not an automobile company at all, but a robot energy storage and artificial intelligence company, which will be reflected in its profit margin. Automobile industries such as Ford and General Motors are moving away from electric vehicles, which is a big mistake because they are the only way to make profits. The diameter is to expand the scale of electric vehicles, so it can be said that they are handing over the market to Tesla. As the price of Tesla will be in the range of $10,000 to $10,000 in five years, the current average price is $10,000 to $10,000. The products of other automobile companies will be eliminated. I asked Wood if he was buying Tesla's shares now, and she said yes, we would disclose the positions and transactions at the end of each trading day. Wood later told me that she sold some shares when Tesla's share price was near the peak a few years ago, but She is buying low and selling high now, right? She said, I asked Wood if he was worried about Musk's behavior and the changes he had made. Wood said, Oh, no, he is no different from the past. Honestly, we have seen him many times. I think he is paying close attention to the entry barriers of his companies and how to promote the development of technology. We are learning more about what he is going to do. I think he is changing our world and saving mankind is an extremely important thing for him. We should go and see him. There may be some truth in what Wood said instead of what he said. Maybe people pay too much attention to the storms caused by Musk after he took over and forget that he is still passionate about building Tesla. Wood has different views from others. She said that social media is constantly developing and changing, which is the most important platform for us. I think it is becoming a platform for knowledge workers. We are integrating into all these innovative communities. They like our research and support. We are not like Kim. Some people in the financial market think that we are completely crazy. Wood talks about NVIDIA NVIDIA, another well-known company that Wood pays close attention to. She bought NVIDIA's stock very early, but sold it before the recent stock price surge. I asked her why she wanted to sell it. Wood said that people said that we sold it too early. Every time I saw someone say this, I found it interesting. When Ark Investment was established years ago, NVIDIA's share price was US dollars. At that time, NVIDIA was just a game chip company. We started the company. After research, we think it will become the brain of robots and self-driving cars, so we have long classified it as an artificial intelligence chip company, Ark Flagship Fund, which has been held in NVIDIA since its share price rose from US dollars to US dollars. This stock has doubled quite well, and now its share price is US dollars. Wood thinks that NVIDIA's current share price has digested the expectation that all the promises of artificial intelligence projects will be fulfilled. She thinks this is a bit too optimistic, and all related projects will take time. NVIDIA is still the most important labor. Smart chip companies are far ahead, but I think NVIDIA will face inventory problems and a lot of competition in the future. Wood's biggest shareholding is that people have mixed feelings about Wood's comeback. I pointed this out to her, and she also admitted that it is true. Wood said that since its establishment, the compound annual rate of return of the flagship fund has been yes, and we have experienced prosperity and depression. Our flagship fund has risen nearly in the past month. Wood said that the flagship fund has fallen sharply with many soaring stocks and funds. After the fall, investors have become more conservative. Now investors flock to benchmark indexes such as the S&P index and the Nasdaq index. The current Nasdaq is different from the Nasdaq I saw in the 1980s and 1990s. This index has become a fairly mature index. I often say that our shareholding is the new Nasdaq. In fact, I quite like the psychological factors, because I prefer to invest when people are suspicious, afraid and unwilling to believe. This is our current situation. It may be different from what some people think. She is a loyal believer in cryptocurrency, and the proportion of bitcoin in net assets is above. When the price of bitcoin was US dollars, we provided customers with bitcoin exposure. Now the price is about US dollars. We think that the rise of bitcoin has just begun. Why do you say that the global monetary system is usually divided by countries? Bitcoin has the properties of global digitalization, decentralization and private ownership, which has separated the government and human beings from this system. My mentor economist traver is very excited that we may return to the era of private capital and the era before the establishment of the Federal Reserve. At present, there is such a person, Federal Reserve Chairman Powell, who is controlling the market in his own way. I think this is crazy. It has been the case since Paul Volcker. I think Bitcoin will become another currency and be very useful in Nigeria and Egypt. The currencies of these two countries have depreciated by half respectively, and I just learned that Indian Rupee has depreciated by half in the past year. I asked Wood what he thought of the fact that cryptocurrency was used by drug dealers and criminals as a subversive innovation. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。