血流成河:比特币再度暴跌

4月13日,虚拟货币市场又血流成河。其中,比特币价格一度跳水超6000美元,从67100美元跌至61000美元下方。CoinGlass数据显示,24小时内,虚拟币市场共有29.63万人爆仓。

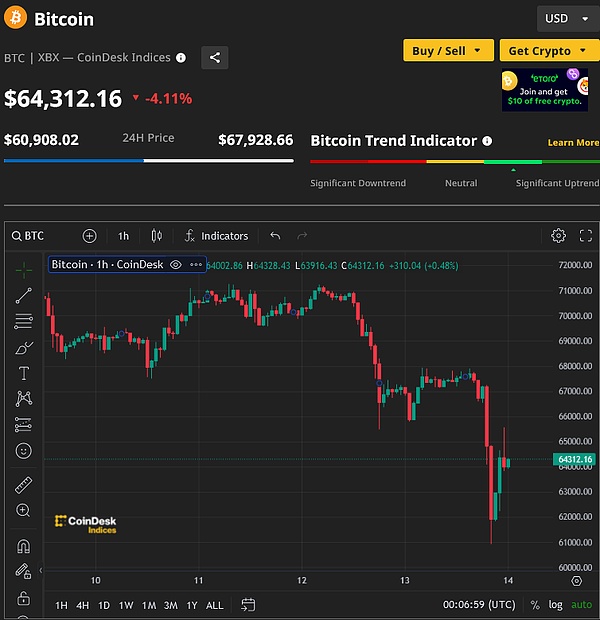

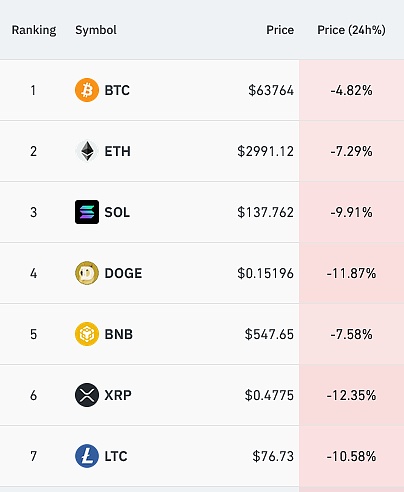

CoinGlass数据显示,刚刚过去的24小时内,虚拟币市场共有29.63万人爆仓,爆仓总额达到9.2亿美元。比特币价格过去两天跳水近1万美元,从71000美元跌至65000美元下方之后,又跌至61000美元下方。截至发稿时,比特币报64312美元。另外,以太坊、狗狗币、SOL币整个虚拟货币板块大幅下跌。

暴跌原因

目前主流的观点原因主要就三点:

1、一个是美联储降息的不确定,主流机构都迷茫了,之前猜测5月份,6月份,7月份的-----现在都不敢确定了,老美的通胀高企,美联储的鹰派言论----

2、地缘政治原因,伊朗和以色列随时可能会爆发zz,都在恐慌。

3、未来两三个月内可能将面临比特币矿工的大面积出售风险。

要我说原因,就是一些幕后资本狗庄们在收割而已,加密市场连续涨了有半年左右时间了,该洗一洗了。任何金融市场不可能一直涨,当然也不会一直跌,涨涨跌跌才是正常。各位注意风险吧!

昨天全球市场陷入了疯狂

不光是加密市场,昨夜整个全球金融市场都陷入了疯狂。史诗级上涨的金价,北京时间23:00左右启动下跌,自高点一度下跌近100美元,这应该是史上最大盘中跌幅。

同一时间,美国原油、布伦特原油也双双下挫,自高点一路下跌2美元。

美国股市全线下跌,且跌幅均超1%。道指下跌1.24%,标普500指数下跌1.46%,纳指回落1.62%。与此同时,华尔街的“恐惧指数”——VIX——飙升至 10 月份的水平。

先是《华尔街日报》一则“伊朗或在未来两天内袭击以色列”的报道,让全球市场如临大敌。并引发了周五整个市场的避险争夺战,促使交易员抛售股票,转而购买黄金和美元。

但进入晚间,一切都进入了下跌模式:金价自高当日点一度下跌近100美元,这应该是史上最大盘中跌幅;油价也出现超1%的跌幅;美国股市全线下跌,且跌幅均超1%;比特币更是一夜跌去了一周的涨幅。

一天之内,市场氛围两次被烘托到“崩盘”的程度。先是“黄金、原油、美元”同日狂飙,反映出这场危机对市场的重大影响。然后是“黄金、原油、美股”暴跌(注意前后三个市场的组合不同),又让人们觉得是一个暴跌的开始。

自从美联储2022年3月启动加息周期以来,一直在努力抑制市场的波动,现在随着人们失去“降息预期”的共识,市场也随之脱缰。

第一,下周一绝不会平静。就像一个从高空坠落的球体,它不会立刻停在地面上,而是会弹起,引发次生灾害。如果周末期间,伊朗向以色列发动袭击,那么周一我们将会见到数十年难得一见的场景。

第二,美国股市恐慌情绪回归,芝加哥期权交易所波动率指数(俗称 Vix)周五突破17,收于去年10月以来的最高水平——表明投资者正在押注动荡上升。另外,根据美国银行的数据,截至周三的一周,美国大盘股刚刚录得自 2022 年 12 月以来最大单周资金流出。

第三,美元指数已经升至年内高位,并且周五收于当日最低点,涨势丝毫没有止步迹象。美元如果继续上涨,将会成为全世界的灾难。

金融市场就像是一头脱缰的野马,可能冲向任何地方。

1、没人知道黄金暴跌的原因,就像暴涨时没人能说清楚一样。唯一能够确定的是,全球市场的波动性将大增,因为市场对美联储首次降息时机失去了共识,6月、7月、9月、12月或者今年不降息,华尔街给出了各种答案。“美联储何时降息”对市场来说就像之路的明灯,而灯灭了,投资者便失去了方向。这就好比在逛商场的顾客,买东西的时候灯突然灭了。随之而来的肯定是恐慌,人们下意识地想要逃离,但找不到出口在哪,很容易造成踩踏事件——这就是金融市场现在正在发生的。

2、美股的下跌不同以往。过去下跌,美联储可以暗示即将放松政策,而现在美联储手里什么也没有。本周多位美联储高官发表了讲话,他们的保持的空前的团结“不急于降息、还没到降息的时候”,现在美联储也不知道什么时候降息,他们在等待经济数据指引。当前的这场危机,可能至少要持续到4月29日。

3、而地缘政治风险,让这场危机变复杂。金融市场知道的是,伊朗随时可能,也一定会对以色列发动袭击。投资者始终身处如临大敌的状态,他们无法同时应对美联储降息预期大变,和随时可能爆发的战争风险。就像停电的商场,又遭遇了地震,里面的人很难逃出来。现在要做的,已经不是研究刚刚发生了什么,而是找个地方躲起来。

这是全球市场一场深刻地革命。

On January, the virtual currency market became a river of blood again, in which the price of bitcoin once plunged beyond the US dollar and fell below the US dollar. The data showed that there were 10,000 people in the virtual currency market within an hour. The data showed that in the past hour, there were 10,000 people in the virtual currency market, and the total amount of positions was 100 million dollars. The price of bitcoin plunged nearly 10,000 dollars from the US dollar to below the US dollar in the past two days, and then fell below the US dollar. At the time of publication, bitcoin reported US dollars, and the whole virtual currency sector of dogecoin currency in Ethereum fell sharply. The main reasons for the current collapse are three points. One is the uncertainty of the Fed's interest rate cut. The mainstream institutions are all confused. They have guessed the month before, but now they are not sure about the high inflation in the United States and the hawkish remarks of the Federal Reserve. Geopolitical reasons Iran and Israel may break out at any time, and they are all in panic. In the next two or three months, they may face the risk of large-scale sale of bitcoin miners. I would say the reason is that some behind-the-scenes capital dogs are harvesting, and the encryption market has continued to rise for half. It's time to wash it for about years. It's impossible for any financial market to go up all the time. Of course, it won't go up all the time. It's normal to go up and down. Pay attention to the risks. Yesterday, the global market went crazy, not just the encryption market. Last night, the whole global financial market went crazy. The price of gold rose at an epic level. It started to fall around Beijing time, and it once fell from a high point to nearly US dollars. This should be the biggest intraday decline in history. At the same time, American crude oil Brent crude oil also fell from a high point and all the way The decline across the board exceeded that of the Dow, while the S&P index fell and the Nasdaq fell. At the same time, the fear index of Wall Street soared to the level of January. First, a report in the Wall Street Journal that Iran or Israel would attack in the next two days made the global market formidable, and triggered a battle for safety in the whole market on Friday, which prompted traders to sell stocks and buy gold and dollars instead, but everything entered a downward mode in the evening. The price of gold fell nearly US dollars from the high point of the day, which should be the largest market in history. The decline in oil prices also exceeded the decline in oil prices. The US stock market fell across the board and fell more than Bitcoin. The market atmosphere was set off twice in one day to the extent of collapse. First, the surge of gold, crude oil and US dollars on the same day reflected the major impact of the crisis on the market. Then, the combination of gold, crude oil and US stocks plummeted, which made people feel that it was the beginning of a plunge. Since the Federal Reserve started the interest rate hike cycle in June, it has been trying to curb market fluctuations. With the consensus that people lose the expectation of interest rate cuts, the market will also get out of control. The first Monday will never be calm, just like a ball falling from the sky. It will not stop on the ground immediately, but will bounce up and cause secondary disasters. If Iran attacks Israel during the weekend, then we will see a rare scene in decades on Monday. Second, the US stock market panic will return to the Chicago Board Options Exchange Volatility Index, commonly known as Friday, which broke through the highest level since last month, indicating that investors are betting. Note: Turbulence is rising. In addition, according to the data of Bank of America, as of the week of Wednesday, large-cap stocks in the United States have just recorded the largest weekly capital outflow since September. The third dollar index has risen to a high level in the year and closed at the lowest point of the day on Friday. If the dollar continues to rise, it will become a disaster all over the world. The financial market is like a runaway wild horse, which may rush to any place. No one knows the reason for the plunge in gold, just as no one can say clearly when it is soaring. However, the volatility of the global market will greatly increase because the market has lost consensus on the timing of the Fed's first interest rate cut every month or this year. Wall Street has given various answers. When the Fed cuts interest rates, it is like a beacon of the road to the market, and when the lights go out, investors lose their direction. It is like when customers shopping in shopping malls suddenly go out, which must be followed by panic. People subconsciously want to escape but can't find the exit, which is easy to cause stampede. This is the financial market now. The ongoing decline in US stocks is different from the past decline. The Fed can hint that it is about to relax its policy, but now there is nothing in the hands of the Fed. This week, many senior Fed officials made speeches. They are in an unprecedented unity and are not in a hurry to cut interest rates. Now the Fed does not know when to cut interest rates. They are waiting for economic data to guide the current crisis, which may last at least until March, and geopolitical risks complicate the crisis. The financial market knows Iran. It is possible and certain to attack Israel at any time. Investors are always in a state of being enemies. They can't cope with the big change in the expectation of the Fed's interest rate cut and the risk of war that may break out at any time. Just like a shopping mall with a power outage and an earthquake, it is difficult for people inside to escape. What we have to do now is not to study what just happened, but to find a place to hide. This is a profound revolution in the global market. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。