比特币现货ETF通过后:上市即大跌、机构打擂台、Coinbase引争议

比特币现货ETF尘埃落定,但市场反应却不尽如意。

一方面,消息面确定后,比特币不涨反跌,在ETF上市第二日便从46000美元上方迅速跌落,一度跌破42000美元,单日跌幅超8.3%,随后持续在42000美元震荡。比特币的迅速下降让行业人士议论纷纷,或将即将到来的大回调取代“牛市”成为了市场关心的话题,此前高呼5万美元的机构们调转话术开始透露3月比特币的可能暴跌。

但另一方面,11只比特币现货ETF上市后备受热捧,资金流入明显,11个获批的ETF 产品首日完成70万笔单独的交易买卖操作,当日交易额超过46亿美元,而据观察,现有的加密产品资金也正快速向ETF涌入。

以此可见,比特币现货ETF的上市,短时间内,似乎真有几家欢喜几家愁之感。

消息落地,比特币迎来大回调?

1月11日,经美国证券交易委员会(SEC)批准,11只比特币现货ETF正式开始上市交易。其中,Grayscale、Bitwise在NYSE Arca上市,ARK21Shares、Invesco Galaxy 、VanEck、WisdomTree、Fidelity 以及Franklin在Cboe BZX 上市,而贝莱德与Valkyrie则在纳斯达克上市。

本以为伴随着历史性的利好,比特币可展翅高飞上探5万新高,却不然上市后比特币快速下跌,两日内均处于大幅震荡中。

当天,在比特币短暂冲高至49000美元创下本年度新高后迅速滑落至46000美元,而在ETF通过的第二日更是持续下跌,一度跌破42000美元,24小时跌幅超过8.3%,现报42669美元。CoinGlass 数据显示,当日24小时全网加密货币市场爆仓的投资者超过 10 万人,爆仓总金额达 3.42 亿美元。受此影响,比特币ETF遭遇普跌,DEFI、FBTC、HODL 和 BRRR跌超6%。

上市第二日比特币爆仓10万人,来源:CoinGlass

对于该暴跌,市场普遍认为是金融领域常规的“流言中买入,确定后卖出”操作。从盘面来看,仅仅在去年的第四季度,比特币就上涨超过60%,这一飞速上涨也正涵盖了价格的预期利好。由于消息面博弈的结束,此前盈利预期落地,因而结利抛售结束FOMO。资金流向也符合市场这一预测,截至1月15日,USDT从1月第一周的18亿美元的市值增持减少至14亿美元,下降23%,而象征美元资金的USDC相比1月第一周市值缩水高达90%,资金的流出也反映出价格的走势。

在此背景下,比特币价格的短期回调也成为了市场关注的话题。除了Arthur Hayes早在比特币ETF通过前就已放出的狠话,其认为由于宏观方向的流动性调整,逆回购的下降等原因,比特币会在3月份迎来暴跌,其他机构也开始相继发声。日本加密货币交易所bitBank 的分析师认为40,000美元的心理水平是近期比特币价格的支撑,10x Research分析师则预计价格将跌至38000美元。

ETF开门红,价格战显露噱头

而另一方面,刚刚获批的比特币现货ETF也开启了正式交易,在交易首日,ETF喜迎开门红。

根据彭博社汇编的数据,11 个获批的 ETF 产品当日交易额超过 46 亿美元。其中,占据市场规模优势、将GBTC转换为ETF的灰度比特币信托基金位于首位,交易额约为23亿美元,贝莱德紧随其后,iShares比特币信托 (IBIT)交易额超过10亿美元,富达的 FBTC 超过6.8亿美元。尽管当天的资金成交更多来源于各大产品的种子基金,但彭博分析师 Eric Balchunas也表示散户同样展现出交易热情。

同时,费率的价格战隐隐开始启动,高费率资金逐步向低费率资金迁移。

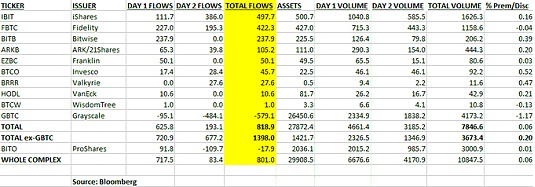

截至1月13日下午,据统计,ETF产品的净流入总额达到 8.19 亿美元。其中,尽管灰度交易额高达23亿美元,但其净资金却呈现外流状态,GBTC资金流出约5.79亿美元,而其他ETF均为资金净流入状态。贝莱德的iSharesBitcoin信托 (IBIT) 以 4.977 亿美元的总流量位于首位,富达次之,筹集 4.223 亿美元,费率最低的0.2%的Bitwise (BITB) 则流入了2.379 亿美元的投资。

ETF资金流入情况统计,来源:彭博社

对此,摩根大通也对高达1.5%费率的灰度表示质疑,其认为灰度即将面临获利结算以及资金外流的双重困境,一方面,由于投资者此前在二级市场购入的折价GBTC获利了结,约30亿美元可能会退出灰度比特币信托基金 (GBTC),并迁移到新的现货ETF;与此同时,由于费率不具竞争力,以基金形式持有加密货币的机构投资者可能会从期货ETF和GBTC转向更便宜的现货ETF。

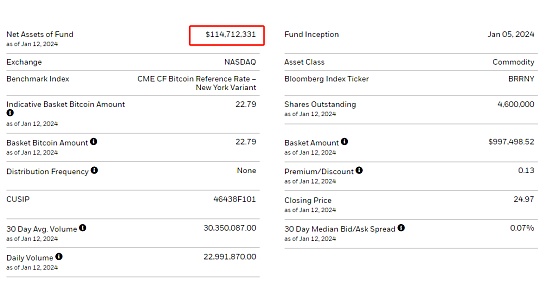

从目前的状态看,鉴于标的价格表现不佳,比特币现货ETF也均处于下跌状态,在11个ETF中,根据雅虎截至1月12日公布数据,IBIT下跌最为显著,达到6.23%,其他ETF也普遍下跌6%。而从ETF的资产管理净值来看,灰度的GBTC仍以超过269亿美元的资产总额占据绝对优势地位,BitWise的BITB以2.42亿美元位于第二位,贝莱德IBIT则为1.14亿美元,富兰克林 EZBC、富达 FBTC、Valkyrie BRRR、VanEck HODL等目前尚不足1亿美元。

贝莱德IBIT ETF净资产,来源:ishares官网

尽管ETF的讨论如火如荼,但也并不意味着所有的机构都对此表示欢迎。由于比特币价格涨跌剧烈,出于对投资者的保护,已有四家华尔街机构明确表示不向客户提供比特币相关产品。管理资产约8万亿美元的全球第二大资产管理公司Vanguard表示,鉴于比特币产品与股票、债券和现金等长期投资组合资产类别产品不一致,将不允许其客户购买最近推出的11只现货比特币ETF中的任何一只。财务顾问美林证券 (Merrill Lynch)、 Edward Jones和Northwestern Mutual也相继对客户表示政策暂不允许投资该类资产。

可以看出,从长期来看,尽管比特币ETF将吸引海量的机构新资金这一共识仍旧坚挺,但从短期而言,加密产业内部的资金的内部消化或将成为ETF的重要趋势。上述摩根大通就对此现象有所预计,其认为即使新资金并不流入,在现有加密产品大量转向新创建ETF的背景下,新ETF仍可能吸引高达360亿美元的资金流入。

而现有存量资金的转向,无疑预示着ETF之间的竞争将日益激烈,对此,Ark Invest 的CEO Cathie Wood也直言,预计11只现货比特币ETF 中可能只有 3-4 只能够在 5 年后继续运营。

Coinbase引争议,托管中心风险凸显

在ETF发行方之外,闷声发大财的Coinbase也引来了新的质疑。在11只ETF产品中,有8只产品的的托管人为Coinbase,这也让Coinbase股票暴涨220%,然而,这种高度依赖单一托管方的方式让市场认为产生了中心化风险。

11家ETF中有8家选择了Coinbase作为托管方,来源:X平台

为便于理解,在此简单介绍一下比特币现货ETF的运作方式以及主要角色。在简化的ETF模型中,主要存在5个角色,一是ETF 的管理公司,即ETF的发行方,如前述的贝莱德、灰度等机构均是该类角色;二则是市场投资者,包含散户和机构;三是托管方;剩下的则是做市商与授权参与者AP,通常情况下,后两者并不为同一机构承担,但现实中该种情况也普遍存在。

ETF发行方以管理费为唯一收益,主要作用即创建ETF份额,并将ETF份额对应实物BTC的价格,同时将实物BTC托管于由注册托管人管理的安全数字金库中,或者更直接,即放置于数字钱包中。发行方创建ETF份额后,交由授权参与者,由AP将其投放于市场,市场中零售商与散户就可通过经纪商或交易所进行竞价交易。

可以看出,AP是市场上最为重要的参与者,实际上,尽管发行方承担发行任务,但具体的赎回与创建份额操作却是由AP来完成,AP的主要收益就是销售产品、提供流动性并进行套利操作。因此在AP选择时,发行方通常会选择具备足够资质与操作能力的机构作为AP。目前,11家ETF均选择了实力雄厚、主营ETF的Jane Street作为指定授权参与者,贝莱德和景顺额外加入了摩根大通,GBTC则加入了Virtu Americas。

回到托管方,托管方作为资产的放置与管理者,主要承担金库的义务,收入结构很简单,即根据托管资产收取比例的托管费用。发行商对其的要求无非是三个,一是合规资质,二是安全稳健,而由于加密的特殊需求,对于加密领域有所布局也较为重要。在美国严密的监管下,满足这三个条件的托管方寥寥无几,因而Coinbase成为了托管的香饽饽。

但Coinbase,自身却也问题重重。

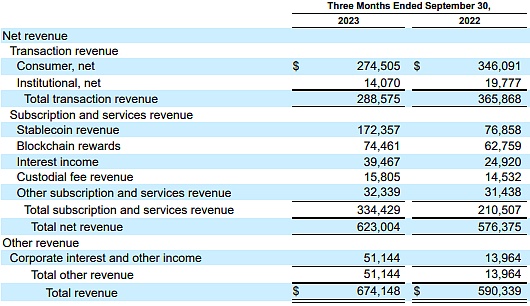

一是合规层面,Coinbase与SEC此前针对未经注册的交易所和经纪自营商的指控尚处于诉讼中,仅这一点,Coinbase的合规性就值得怀疑,尽管首席财务官 Alesia Haas 表示,公司的托管业务并未涉及正在进行的SEC案件,且托管机构资金原则上与其他业务完全分离,但市场对此仍表示犹豫。二则是集中风险,Coinbase承担8个ETF的托管业务,若出现任何企业问题,将给ETF带来重创。由于交易收入占比Coinbase 收入比高达43%,诉讼中所提到的未注册证券若成立,Coinbase自身业务也将受到巨大影响,进而可能产生连锁反应,这也是目前Coinbase必须硬刚SEC的主要原因。瑞穗证券分析师 Dan Dolev也强调,Coinbase 近三分之一的收入“处于危险之中”,因为该交易所的负面结果可能会导致其服务分离。

交易收入是Coinbase的主要收入,来源:Coinbase财报

此外,短期内,ETF的通过对于Coinbase也可谓喜忧参半。一方面,新资金的涌入会带来交易量的上涨,而另一方面,此举会倒逼Coinbase削减交易费用,以对抗成本更低的现货ETF产品。

整体来看,比特币现货ETF仅仅上市不足一周,已开始从资金流向、市场价格、生态竞争等方向给加密市场带来影响,尽管后续是否真有数百亿美金进入尚不可知,但可以预见,ETF所带来的“鲇鱼效应”,仍将在很长一段时间持续。

Bitcoin spot dust settled, but the market reaction was not satisfactory. On the one hand, after the news was confirmed, Bitcoin fell rapidly from the top of the US dollar on the second day of listing, and once fell below the US dollar for a single day, and then continued to fluctuate in the US dollar. The rapid decline of Bitcoin has made people in the industry talk about it or will replace the bull market with the upcoming big callback, which has become a topic of concern to the market. Institutions who had shouted for $10,000 before began to disclose the possible plunge of Bitcoin in the month, but on the other hand, only Bitcoin spot. Listed reserve funds flowed in obviously 10,000 individual transactions were completed on the first day of the approved products, and the transaction volume on that day exceeded US$ 100 million. It is observed that the existing encryption product funds are also rapidly pouring in, which shows that in a short period of time, it seems that there are really a few happy and sad news that Bitcoin has ushered in a big correction. After the approval of the US Securities and Exchange Commission, only Bitcoin spot officially started listing and trading, including listing and BlackRock and Na. Stark's listing thought that Bitcoin could soar to a new high with historic benefits, but otherwise, Bitcoin fell rapidly within two days after listing, and then fell rapidly to the US dollar on the same day, and then fell to the US dollar on the second day after it was passed, and once fell below the US dollar for an hour, the decline exceeded the reported US dollar. The data showed that more than 10,000 investors broke positions in the whole network cryptocurrency market on the same day, with a total amount of US$ 100 million affected. Bitcoin suffered a general decline and fell beyond the second day of listing. The source of bitcoin exploded. The plunge market is generally considered to be a routine rumor in the financial field. From the disk, bitcoin rose more than this rapid increase in the fourth quarter of last year, which also covered the expected price benefits. Because of the end of the news game, the profit expectation landed before the profit selling ended, and the flow of funds was also in line with the market forecast, which was the market value of $100 million from the first week of June. The decrease in holdings to US$ 100 million symbolizes that the market value of US dollar funds has shrunk by as much as the outflow of funds in the first week of last month, which also reflects the price trend. In this context, the short-term correction of bitcoin prices has also become a topic of market concern, except for the harsh words that were released long before bitcoin was passed, which believed that bitcoin would plummet in May due to the liquidity adjustment in the macro direction and the decline in reverse repurchase, and other institutions began to voice one after another. The psychological level is the support of the recent bitcoin price. Analysts expect that the price will fall to the US dollar, and the price war will show its gimmicks. On the other hand, the newly approved bitcoin spot has also opened a formal transaction, and the transaction volume of the approved products on the first day is over 100 million US dollars, of which the gray bitcoin trust fund that will occupy the market size advantage will be in the first place, with a transaction volume of about 100 million US dollars, followed by BlackRock. Fidelity's capital turnover exceeded US$ 100 million. Although the transaction of funds on that day was more from the seed funds of major products, Bloomberg analysts also said that retail investors also showed their enthusiasm for trading, and the price war of rates vaguely began to start the gradual migration of high-rate funds to low-rate funds. According to statistics, the total net inflow of products reached US$ 100 million by the afternoon of March, among which although the gray transaction volume was as high as US$ 100 million, its net capital was in an outflow state, while others were in a net inflow state. Ryder's trust ranked first with a total flow of US$ billion, followed by Fidelity, which raised US$ billion, and the lowest rate flowed into the investment capital inflow of US$ billion. Bloomberg, a statistical source, also questioned the gray scale with a high rate. JPMorgan Chase believed that the gray scale was about to face the double dilemma of profit settlement and capital outflow. On the one hand, investors may withdraw from the gray scale bitcoin trust fund and move to a new spot because of the discount they bought in the secondary market. Due to the uncompetitive rate, institutional investors who hold cryptocurrency in the form of funds may turn from futures and cheaper spot. From the current situation, bitcoin spot is also in a state of decline due to the poor performance of the underlying price. According to the data released by Yahoo as of March, the decline is the most significant, reaching other general declines, while from the perspective of the net asset management value, BlackRock still occupies an absolute dominant position with total assets exceeding US$ 100 million. Official website, the source of BlackRock's net assets, is less than 100 million US dollars. Although the discussion is in full swing, it does not mean that all institutions welcome it. Due to the sharp rise and fall of bitcoin prices, for the protection of investors, four Wall Street institutions have clearly stated that they will not provide customers with bitcoin-related product management assets of about one trillion US dollars. The second largest asset management company in the world said that in view of bitcoin products and long-term portfolio asset categories such as stocks, bonds and cash, Inconsistent products will not allow its customers to buy any financial consultant Merrill Lynch in the recently launched spot bitcoin, and they have also told customers that the policy is not allowed to invest in such assets for the time being. It can be seen that in the long run, although the consensus that Bitcoin will attract a large amount of new institutional funds is still firm, in the short term, the internal digestion of funds within the encryption industry will become an important trend. JPMorgan Chase predicted this phenomenon, and he thought that even if new funds did not flow in. Under the background of a large number of encrypted products turning to new creation, the new products may still attract as much as hundreds of millions of dollars of capital inflows, and the turn of existing stock funds undoubtedly indicates that the competition between them will become increasingly fierce. It is also blunt to predict that only the spot bitcoin may only continue to operate after the year, which leads to controversy, and the risk of the custody center is highlighted outside the issuer, which also leads to new doubts. In only one product, the custodian is artificial, which also makes the stock soar. However, this high dependence on a single custody. Party's way makes the market think that there is a centralized risk. For the sake of understanding, here is a brief introduction to the operation mode of bitcoin spot and the main roles. In the simplified model, there are mainly two roles: one is the management company, the issuer such as BlackRock Gray mentioned above, the other is the market investor, including retail investors and institutions, and the other is the custodian. Usually, the latter two are not undertaken by the same institution, but in reality, it is also common for the issuer to take management fees as the only income, that is, creation. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。