Coinbase 能否借力比特币 ETF 再创辉煌?

作者:Tanay Ved、Matías Andrade,Coin Metrics

翻译:善欧巴,比特币买卖交易网

近年来,加密货币的普遍接受度发生了显着变化,从相对默默无闻走向主流视野。比特币现货交易所交易基金 (ETF) 的推出及其卓越表现推动了这一转变,吸引了分析师、银行家和技术专家的关注。

随着数字资产领域不断发展,技术、监管和市场动态的交织为利益相关者呈现出了一幅复杂的局面。尽管在美国面临监管挑战,严格的监管限制银行和金融机构直接托管加密货币,但该行业的增长势头不可否认。本文将探讨现货比特币 ETF 的推出和 Coinbase 近期表现之间的相互作用,并强调它们的动态以及更广泛的影响。

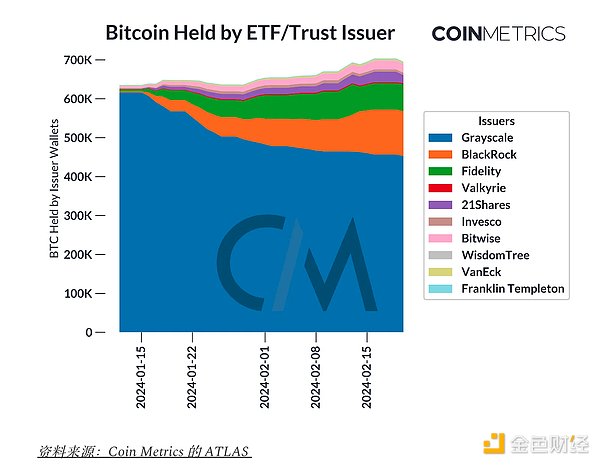

ETF 流量和余额

自 ETF 获批以来,我们看到 BTC 在发行者之间的分布迅速变化,从灰度 (Grayscale) 流出,流向新批准的 ETF。这种偏好部分原因是,新 ETF 的费用比灰度比特币信托 (GBTC) 的 1.5% 要低得多,富达和贝莱德的费用是 0.25%(两者都在初始阶段豁免或降低费用)。另一个原因是几个重要 GBTC 持有人清算,例如 FTX 卖出了大约 10 亿美元,以及数字货币集团的 Genesis 投资。尽管如此,自 ETF 正式启动以来,流入资金超过 48 亿美元,其中超过 370 亿美元的供应被交易所交易产品吸收。

在现货比特币 ETF 上市之前,作为规模最大的上市加密货币交易所,并且持有 11 只比特币 ETF 中的 8 只的 Coinbase 成为众所瞩目的焦点。市场充斥着各种猜测和分歧的观点,围绕这些产品对 Coinbase 业务的潜在影响展开热议。

一些人认为,随着数字资产行业扩张,Coinbase 将从中获益,市场覆盖面扩大,新的收入渠道开启。另一些人则认为,ETF 具有竞争性的费用结构可能会让用户远离 Coinbase,从而降低交易量并影响其手续费收入。

鉴于此,Coinbase 正处于一个关键时刻,在现货 ETF 推出、与美国证券交易委员会的监管斗争以及日益兴盛的数字资产市场背景下,面临着复杂交织的挑战和机遇。

解锁关联:Coinbase 盈利报告解读

上周,Coinbase 发布了 2023 年第四季度财报,总收入为 9.54 亿美元,远远超过华尔街 8.26 亿美元的预期。进一步深入分析其收入来源,可以将其分为两大驱动因素:交易收入和订阅和服务收入,每个类别都在 Coinbase 的业务中发挥着至关重要的作用。

交易收入的复苏

盈利报告的一个主要亮点是交易收入的增长,从 3.22 亿美元增长到 5.29 亿美元,同比增长 64%,占总收入的 55%。这一反弹尤其值得注意,因为在 2023 年的第二和第三季度,由于交易量萎缩,交易收入一直落后于订阅和服务收入。这次增长是由多种因素推动的,包括市场情绪改善和数字资产市场中风险偏好活动增加。

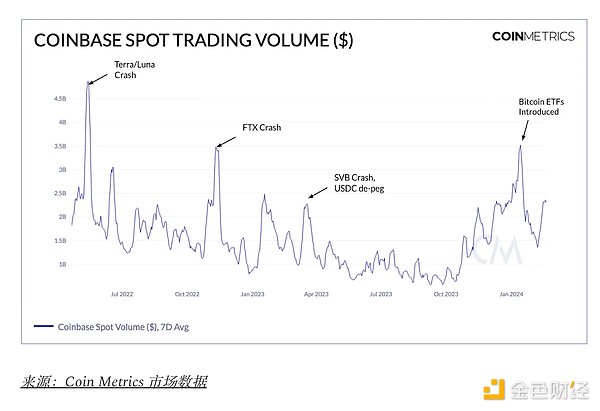

在 ETF 推出之前,Coinbase 上的现货交易量攀升至 $3.5B,与 2022 年第四季度的水平相当,只有 2022 年夏天围绕 Terra Luna 崩盘的疯狂交易量才超过了这一水平。虽然消费者和机构业务都受益,但零售量却大幅下降。第四季度的重要贡献者,环比增长 163%。

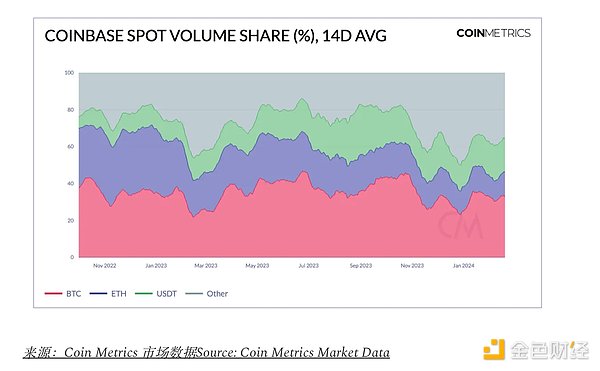

除了按用户类型划分交易量外,另一个有趣方面是交易量的资产构成。在第四季度,Coinbase 上交易的 “其他” 资产和 Tether (USDT) 的份额相对于 BTC 和 ETH 有所增长。 “其他” 资产所占比例增加了 14%,占总交易量的 42% 和交易收入的 57%。相反,BTC 和 ETH 交易量的份额分别下降了 4% 和 18%。

这一趋势不仅反映了市场周期的当前阶段,也凸显了以消费者为导向的交易量日益增长的影响力,这体现在像 Solana (SOL)、Avalanche (AVAX) 和其他生态系统相关代币的活动增加上。

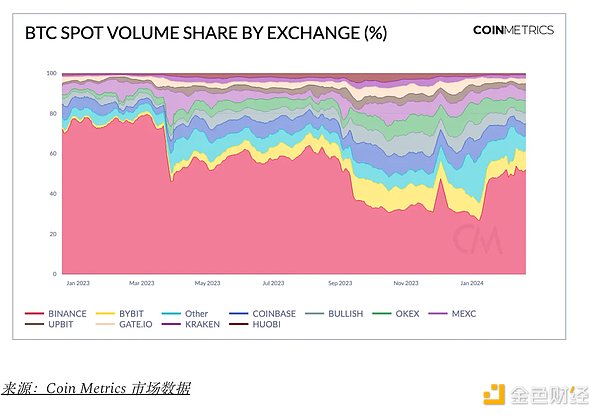

这一发展也提出了一个关键问题:现货比特币 ETF 的推出(以及预计推出的现货以太坊 ETF)是否会导致这些资产的交易量进一步萎缩?虽然无法预见全部影响,但一个值得注意的趋势是,继 1 月份 ETF 推出后,币安的 BTC 交易量份额同步上升。我们每周 “市场状况” 资讯中的 “总体交易量” 部分可以帮助监测这些动态。

订阅和服务收入的影响力日益增长

虽然交易活动仍然是业务的核心方面,但 Coinbase 已将其业务扩展到其他几个垂直领域。这包括质押服务、与 Circle 合作的稳定币、引入 Base 的 Layer-2 以及作为现货比特币 ETF 主要托管人进一步实现其托管业务的货币化。总而言之,这些类别的令人印象深刻的扩张使订阅和服务收入同比增长 33%,现在占 Coinbase 总收入组合的 39%。

在这个类别中,历史上贡献最大的收入来自稳定币,尽管它在第四季度有所下降。这些收入源于 Coinbase 与 Circle (USDC 稳定币的发行商) 的收入分成协议。Coinbase 通过在其平台上持有 USDC 获得了大量收入,其收益与 USDC 流通供应量和现行利率挂钩——这些因素会影响 USDC 储备产生的利息收入。尽管整个 2023 年 USDC 的供应量一直在减少,但上升的利率缓解了其对收入的不利影响。

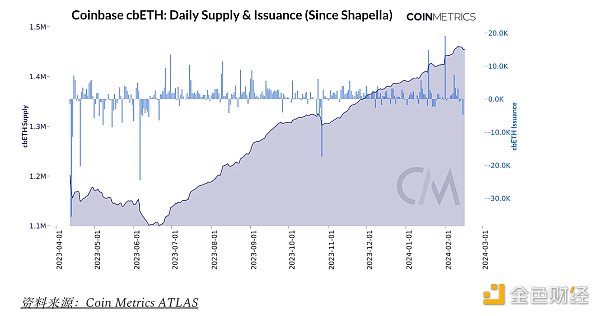

收入增长的另一个主要途径是“区块链奖励”。这涵盖了 Coinbase 的质押即服务业务,允许用户质押他们的资产以确保权益证明 (PoS) 网络的安全,例如以太坊、Solana 等。尽管其质押业务面临美国证券交易委员会 (SEC) 的监管审查,区块链奖励板块同比增长 53%,环比增长 28%。这种增长主要归功于 ETH 质押,这反映在质押余额的增加,以及 Coinbase 的流动质押代币 cbETH 的发行量增加,该代币在第四季度供应量超过 140 万个。随着资产价格上涨,Coinbase 25% 的 ETH 质押佣金也显著提高了区块链奖励收入。

除了核心业务之外,Coinbase 还拥有几个新兴板块,例如其 Layer-2 解决方案 Base、国际衍生品交易所和其风险投资组合,这些将在 2024 年第一季度采用 FASB 会计准则后按公允价值实现。此外,Coinbase 还很有利于利用现货比特币 ETF 的持续流入,从长远来看增加托管费收入。总而言之,Coinbase 通过拓宽其商业模式和收入来源,以及引入具有高增长潜力的新服务,巧妙地应对熊市,减少了对交易收入的依赖。这种战略性多元化,再加上积极的监管方法和成本削减,都提升了其在数字资产领域的优势地位。

结论

今年前两个月,比特币 ETF 获得了大量资金流入,表明市场对其认可度很高。与此同时,Coinbase 的盈利报告凸显了其强劲的根基,为未来增长做好了充分准备。虽然 ETF 对 Coinbase 长期走向的影响还有待观察,但它们相互之间的影响都预示着该行业积极的势头。比特币自 2021 年 12 月以来首次突破 1 万亿美元市值,现货以太坊 ETF 的预期以及即将到来的减半,都预示着数字资产生态系统即将迎来一个激动人心的时期。

网络数据洞察

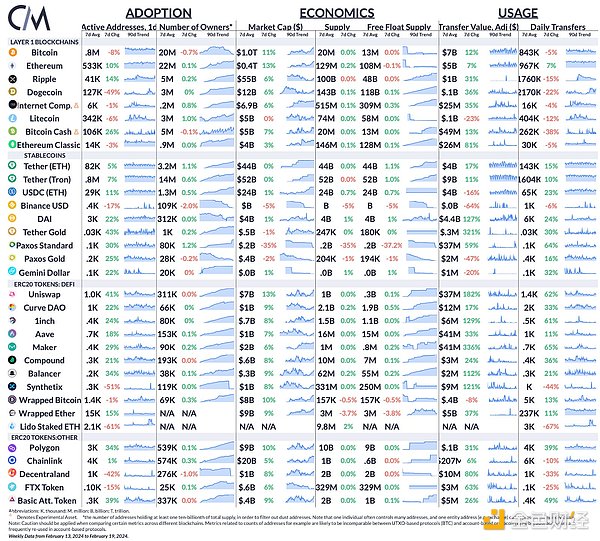

比特币和以太坊市值本周进一步扩大,分别上涨11%和13%。以太坊的活跃地址增加了 10%,而比特币的活跃地址则下降了 8%。

In recent years, the general acceptance of cryptocurrency has changed significantly from relative obscurity to mainstream vision. The launch of bitcoin spot exchange trading fund and its outstanding performance have promoted this change, attracting the attention of analysts, bankers and technical experts. With the continuous development of digital assets, the interweaving of technical supervision and market dynamics has presented a complicated situation for stakeholders, despite the regulatory challenges and strict regulatory limits in the United States. Banks and financial institutions directly manage cryptocurrencies, but the growth momentum of the industry is undeniable. This paper will discuss the interaction between the launch of spot bitcoin and its recent performance, and emphasize their dynamics and wider impact on traffic and balance. Since the approval, we have seen a rapid change in the distribution among issuers, from gray outflow to newly approved preference, partly because the new fees are much lower than those of gray bitcoin trust. Fidelity and BlackRock are both in the initial stage. Another reason for the exemption or reduction of fees is that several important holders have liquidated, for example, selling about $100 million and digital currency Group's investment. Nevertheless, since its official launch, the inflow of funds has exceeded $100 million, of which more than $100 million has been absorbed by exchange-traded products. Before the spot bitcoin went public, it was the largest listed cryptocurrency exchange and held only one bitcoin, which became the focus of attention. The market is full of various speculations and divergent views around these products. The potential impact of products on business is hotly debated. Some people think that with the expansion of the digital asset industry, it will benefit from it, and the market coverage will be expanded, and new revenue channels will be opened. Others think that the competitive fee structure may keep users away, thus reducing the transaction volume and affecting their fee income. In view of this, it is at a critical moment, and it is facing complex and intertwined challenges and opportunities in the context of the regulatory struggle with the US Securities and Exchange Commission and the increasingly prosperous digital asset market. Interpretation of linked earnings report released last week, the total revenue of the fourth quarter of 2008 was $ billion, far exceeding Wall Street's expectation of $ billion. Further in-depth analysis of its revenue sources can be divided into two major driving factors: transaction income and subscription and service income. Each category plays a vital role in the business. One of the main highlights of the recovery of transaction income is that the growth of transaction income has increased from $ billion to $ billion, which is particularly noteworthy. Because in the second and third quarters of 2008, due to the shrinking transaction volume, the transaction income has been lagging behind the subscription and service income. This growth is driven by many factors, including the improvement of market sentiment and the increase of risk preference activities in the digital asset market. Before the launch, the spot transaction volume climbed to the same level as that in the fourth quarter of 2008. Only in the summer of 2008 did the crazy transaction volume around the collapse exceed this level. Although both consumers and institutional businesses benefited, the retail volume dropped sharply. In addition to dividing the transaction volume by user type, another interesting aspect of the contributor's chain growth is that the composition of the transaction volume is the proportion of other assets traded in the fourth quarter has increased compared with that of other assets, and the proportion of other assets has increased, while the proportion of total transaction volume and transaction income has decreased respectively. This trend not only reflects the current stage of the market cycle, but also highlights the growing influence of consumer-oriented transaction volume, which is reflected in other ecosystems. This development also raises a key question on the increase of activities related to tokens. Whether the launch of spot bitcoin and the expected launch of spot Ethereum will further reduce the trading volume of these assets, although it is impossible to predict all the impacts, a noteworthy trend is that the share of trading volume of Coin 'an has increased synchronously after the launch in June. The overall trading volume part of our weekly market information can help monitor the influence of these dynamic subscriptions and service income, although the trading activity is growing. Mobile is still the core aspect of the business, but it has expanded its business to several other vertical areas, including the introduction of pledge service and cooperative stable currency, and further monetization of its custody business as the main custodian of spot bitcoin. In short, the impressive expansion of these categories has made the subscription and service income increase year-on-year, and now it accounts for the total income portfolio. The largest contribution in this category in history comes from stable currency, although it declined in the fourth quarter. The income sharing agreement with the issuer of stable currency has gained a lot of income by holding it on its platform, and its income is linked to the circulation supply and the current interest rate. These factors will affect the interest income generated by the reserve. Although the supply has been decreasing throughout the year, the rising interest rate has alleviated its adverse impact on income. Another main way of income growth is blockchain reward, which covers the pledge service business, allowing users to pledge their assets to ensure the security of the rights and interests certification network, for example. Taifang, etc., although its pledge business is facing the regulatory review of the US Securities and Exchange Commission, the blockchain reward plate has increased year-on-year and month-on-month. This growth is mainly attributed to the pledge, which is reflected in the increase in the pledge balance and the increase in the circulation of mobile pledge tokens. The supply of this token in the fourth quarter exceeded 10,000, and the pledge commission with the increase in asset prices also significantly increased the blockchain reward income. In addition to the core business, it also has several emerging plates, such as its solution, the International Derivatives Exchange. And its venture capital portfolio, which will be realized at fair value after adopting accounting standards in the first quarter of, in addition, it is also conducive to using the continuous inflow of spot bitcoin to increase the custody fee income in the long run. In short, it has reduced its dependence on trading income by broadening its business model and income sources and introducing new services with high growth potential. This strategic diversification, together with active supervision methods and cost reduction, has enhanced its advantages in the field of digital assets. Status Conclusion In the first two months of this year, Bitcoin received a large amount of capital inflows, indicating that the market recognized it highly. At the same time, the profit report highlighted its strong foundation and made full preparations for future growth. Although the impact on the long-term trend remains to be seen, their mutual influence indicates the positive momentum of the industry. The expectation that Bitcoin has exceeded the trillion-dollar market value of spot Ethereum for the first time since January and the upcoming halving indicate that the digital asset ecosystem is about to usher in an exciting period. Network data insight, the market value of Bitcoin and Ethereum has further expanded this week, respectively. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。