详解代币奖励机制:空投或质押的奖励到底去哪了

作者:FLORIAN STRAUF;编译:Frost,BlockBeats

编者按:空投或质押的奖励到底去哪里了呢?也许大多数人并没有仔细地想过这个问题。代币激励计划作为区块链行业的一个重要组成部分, 正在被广泛采用, 但市面上分析激励效果的文章却不多,这样的奖励机制真的有效吗?本文对代币奖励机制进行了分析,BlockBeats 将原文编译如下:

最近有人问我这个问题:「代币奖励的接收者如何处理代币?」

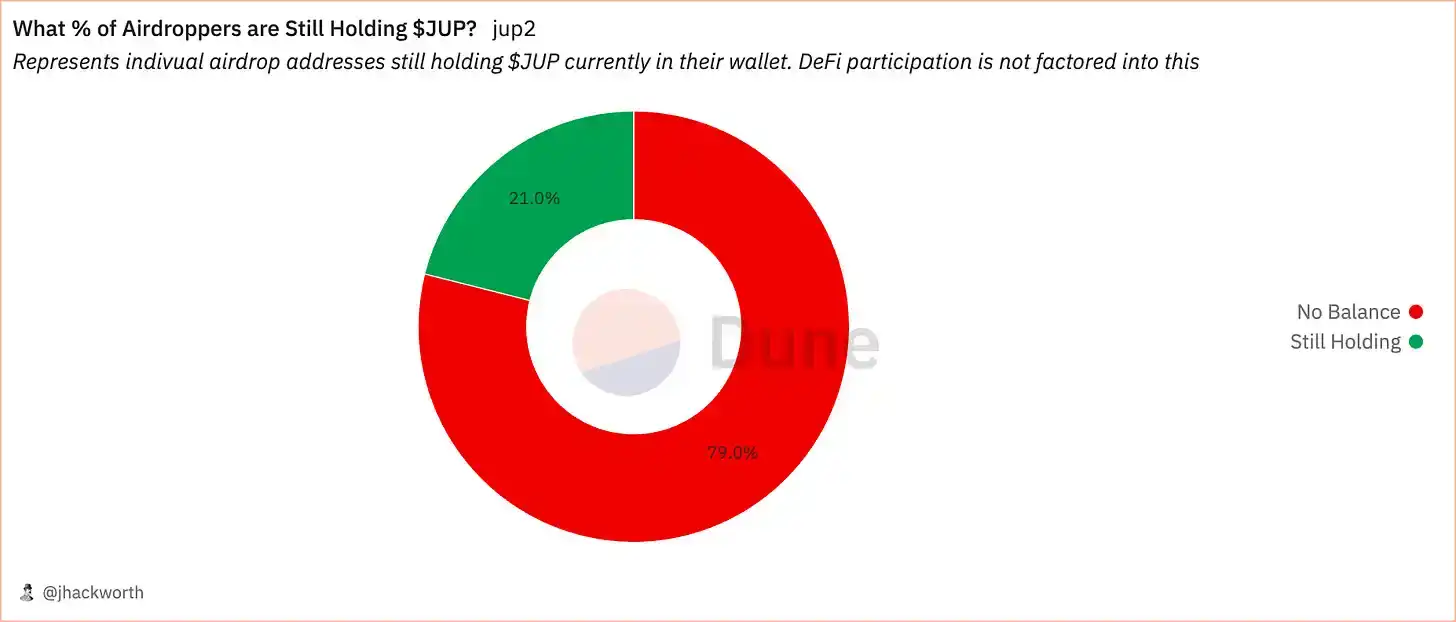

如果我们看看 Jupiter 最近的 $JUP 空投,答案是大多数都在卖出。

奖励接收者有两种选择:出售或持有。

如果我们更深入地分析,出售或持有是个人持有代币的风险偏好的问题。通常,加密货币初创公司风险很大,因此人们对于想要分配多少资金在这个项目上会有一个门槛。如果奖励超过该阈值并且持有的动机不够强,那么它们最终可能会被出售。

为什么要奖励?

奖励是代币发起者手头的一个强大工具。铸造代币不需要任何成本,出售它们可以获得利润。

项目会获得免费的资金,并可以激励其他人(流动性提供者、用户等)与协议进行交互。这样做可以引导市场,并补贴买家和卖家以推动业务发展。

发起者也许希望随着时间的推移,买家和卖家的数量将使市场在没有互联网资金的情况下保持有机运行。

毫无疑问,免费的代币是一个很好的工具。几乎每个推出代币的项目都使用它来进行激励。但问题是,这些激励措施的效果如何?

这样做能有效吗?

质押奖励是一种激励方式。在最初的形式中,质押是一种机制,其中权益证明基础层向验证者支付铸造的互联网货币。

然而,非基础层已采用这种策略来向代币持有者支付费用以留住用户。目前,它是许多协议实现的流行机制。

如果我们谈论来自非基础层的质押奖励,目标通常是保留客户,即人们因持有代币而获得奖励。

代币奖励活动能否留住代币持有者?

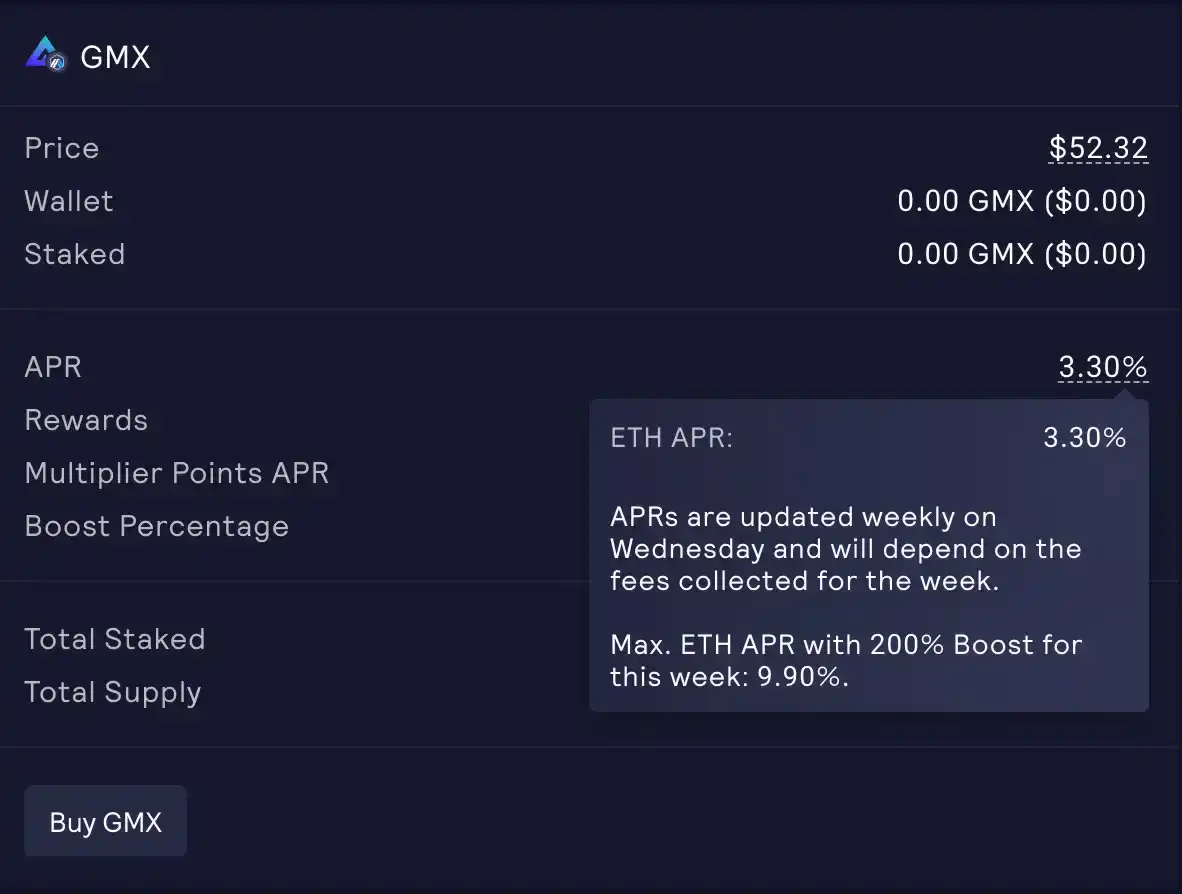

我将$GMX 支付的收益率与公司债券的收益率进行了比较。大多数人不太可能以低至 3-4% 的收益率持有$GMX 等风险资产。他们会对该资产进行低买高卖等行为,因为他们看到了该项目的潜力。

在这种情况下,我认为代币奖励活动无法留住持有者,或者作用非常小。

平均客户保留率

代币持有者和客户并不相同,但存在一些重叠。

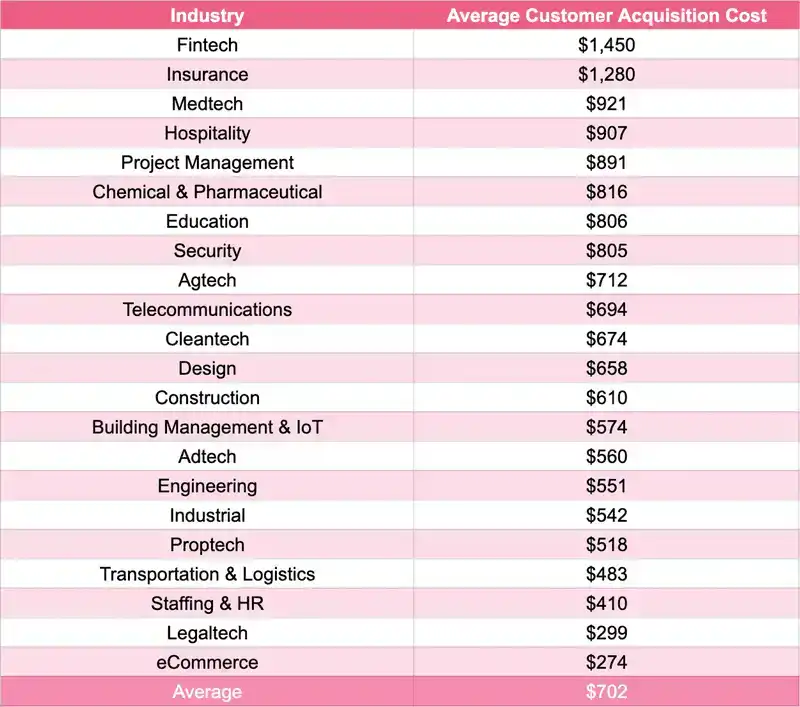

我们可以将奖励作为留住客户或代币持有者的成本。它类似于股息作为留住股东的机制(只不过股息不是实物支付)。

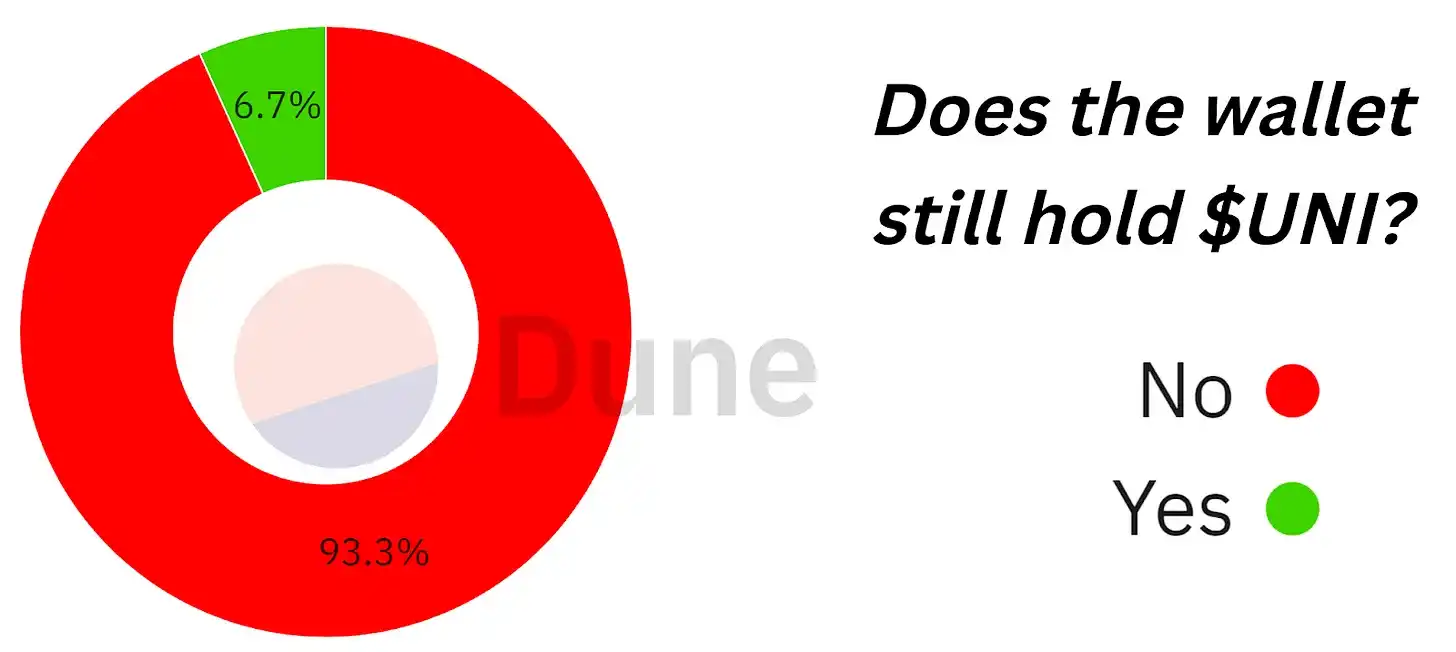

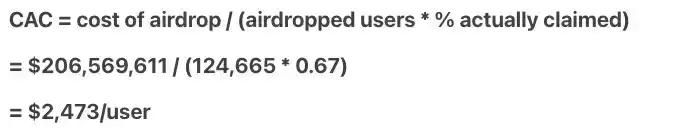

同样,空投可以被视为一种获客成本。不幸的是,关于质押奖励有效性的数据并不多,但有一些空投很好的例子。

例如,7% 的空投接收者在空投后的某个时间仍然持有 $UNI。这在某种程度上与上面 Jupiter 的空投活动相匹配。

Kerman Kohli 详细分析了 Looksrare 空投的客户获取成本,详情可参考本文。

尽管空投与质押并不完全可比,但它们都显示奖励活动的用户保留率较差,所以我认为二者在结果上是大致相同的。

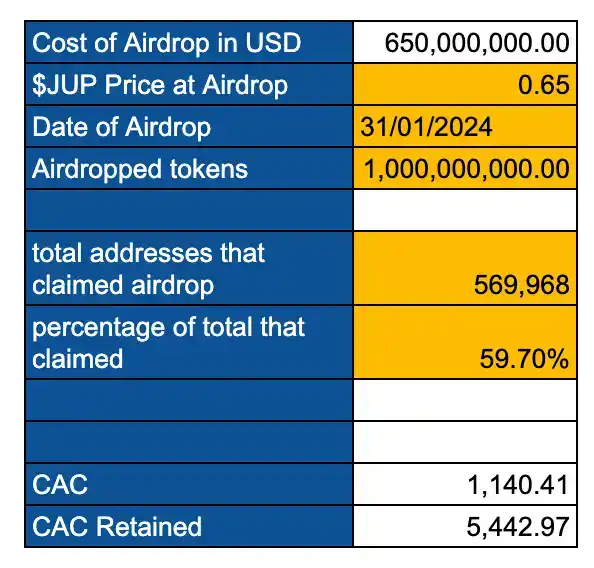

顺便一提。这是 Jupiter 的空投情况:

Dune: https://dune.com/jhackworth/jupiter-airdropDune

对比 (来源 source):

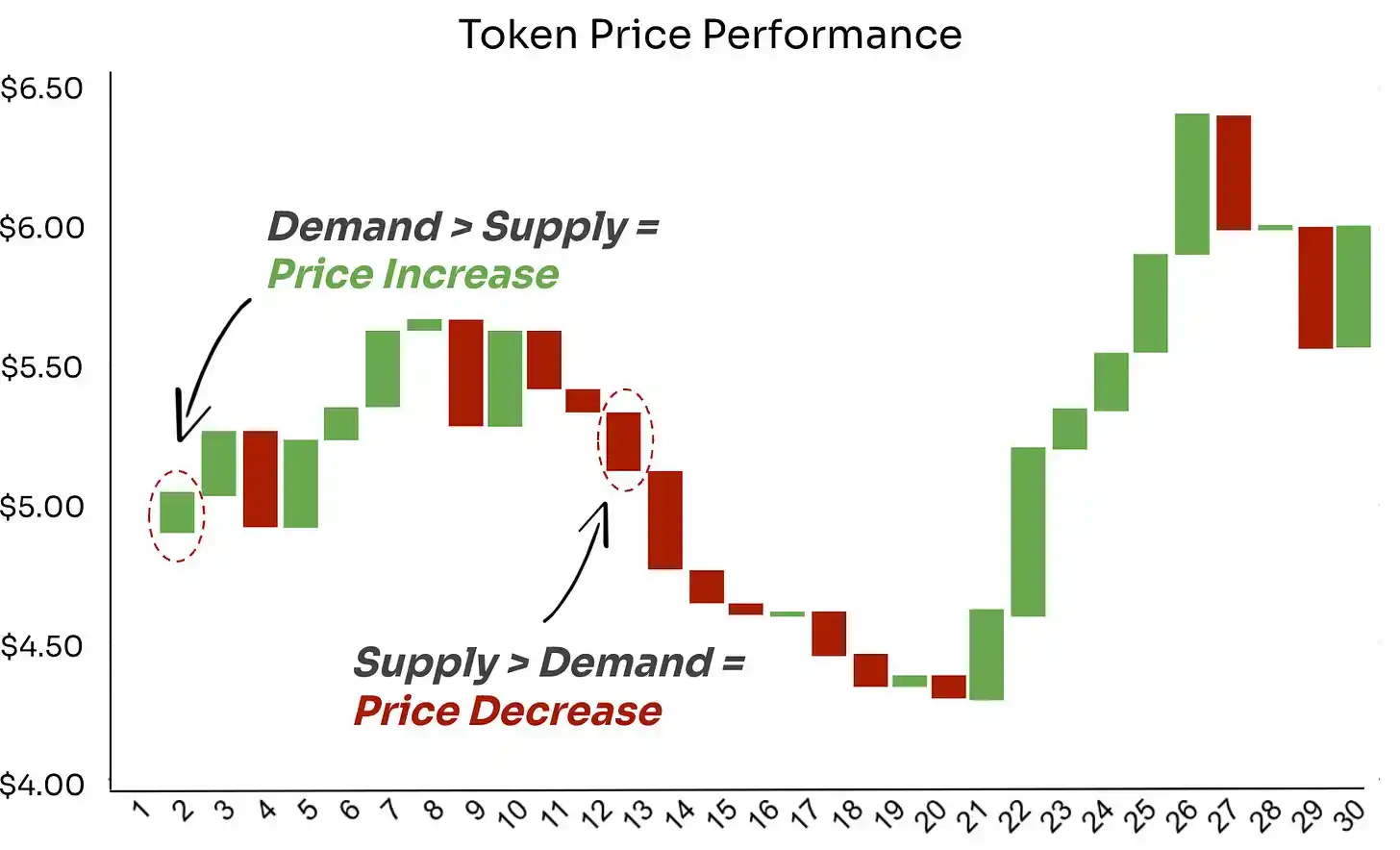

供应满足需求

糟糕的是,项目不仅花费金钱,还花费代币来获取客户。其中许多代币最终将成为市场上的抛售压力。

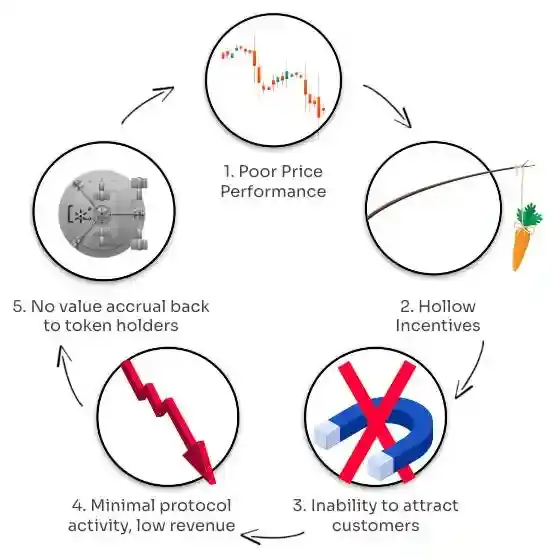

如果他们没有遇到可以承受这份抛压的买家,代币价格可能会下跌,从而使激励措施减弱,可能会形成以下循环。

我想说的是,代币激励是有帮助的,但它们可能并不像人们想象的那么有效,当代币的流通较大时,人们需要有一个强大的理由购买和持有。如果用户会这样做,那么它应该具有丰厚的实际收益、治理权、代币回购等机制,或者是一个稳定增长的项目。

Where did the award of airdrop or pledge go? Perhaps most people have not carefully thought about this question. As an important part of the blockchain industry, token incentive plan is being widely used, but there are not many articles on the market to analyze the incentive effect. Is this incentive mechanism really effective? This paper analyzes the token incentive mechanism and compiles the original text as follows. Recently, someone asked me this question, how do the recipients of token incentives handle tokens? If we look at the recent ones, The answer to the airdrop is that most of them are selling. Explain in detail the token reward mechanism. Where did the airdrop or pledge rewards go? The reward recipients have two choices: to sell or hold. If we analyze the problem that selling or holding is the risk preference of individuals holding tokens, cryptocurrency startups are usually risky, so people will have a threshold for how much money they want to allocate in this project. If the rewards exceed this threshold and the motivation for holding them is not strong enough, then they may eventually be sold. Why? Incentives and rewards are a powerful tool for token sponsors. Casting tokens does not require any cost to sell. They can make profits. Projects can get free funds and encourage others to interact with agreements. This can guide the market and subsidize buyers and sellers to promote business development. The sponsors may hope that the number of buyers and sellers will keep the market running organically without Internet funds over time, and there is no doubt that it is free. Token is a very good tool, which is used to motivate almost every project that introduces tokens, but the question is how effective these incentives are. Can pledge reward be an incentive method? In the original form, pledge is a mechanism, in which the basic layer proves the rights and interests and pays the verifier the minted internet currency, but the non-basic layer has adopted this strategy to pay the token holders to retain users. At present, it is a popular mechanism for many agreements to be realized if we talk about it. The goal of pledge reward from the non-basic level is usually to retain customers, that is, people get rewards for holding tokens. Can token reward activities retain token holders? Explain the token reward mechanism. Where did the rewards of airdrop or pledge go? I compared the rate of return I paid with the rate of return of corporate bonds. Most people are unlikely to hold risky assets with a low rate of return. They will buy low and sell high on the assets because they see the potential of the project. In this case, I think that the generation. Currency reward activities can't keep the holders or have little effect. The average customer retention rate is different between token holders and customers, but there is some overlap. We can regard the reward as the cost of keeping customers or token holders. It is similar to dividend as a mechanism to keep shareholders, except that dividend is not paid in kind. The same airdrop can be regarded as a customer acquisition cost. Unfortunately, there are not many data about the effectiveness of pledge rewards, but there are some good examples of airdrops, such as the airdrop receiver after airdrop. It is still held at a certain time, which matches the above airdrop activities to some extent. Explain in detail the token reward mechanism, where the airdrop or pledge rewards go, and analyze in detail the customer acquisition cost of airdrop. Please refer to this article to explain in detail where the token reward mechanism, where the airdrop or pledge rewards go. Although airdrop and pledge are not completely comparable, they all show that the user retention rate of reward activities is poor, so I think the results are roughly the same. By the way, this is the airdrop situation. Coin reward mechanism Where did the award of airdrop or pledge go? Compare the sources. Explain in detail where did the award of airdrop or pledge go? What's worse is that the project not only spends money but also spends tokens to get customers, many of which will eventually become selling pressure in the market. Explain in detail where did the award of airdrop or pledge go? If they don't meet the buyer who can bear the selling pressure, the price of tokens may fall, which may weaken the incentive measures. What I want to say is that token incentives are helpful, but they may not be as effective as people think. When the circulation of contemporary coins is large, people need a strong reason to buy and hold them. If users will do this, it should have rich practical benefits, governance rights, token repurchase and other mechanisms or a stable growth project. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。