Blast主网正式上线 一览L2新贵链上潜力生态项目(DEX篇)

作者:Climber,比特币买卖交易网

3月1日,Blast 主网正式上线,早期访问用户可以桥接到主网并使用Blast上的 Dapp。目前Blast 主网TVL已超23.6 亿美元,并约有21万名社区用户。

Blast官网自称是唯一一个为ETH和稳定币提供原生收益的以太坊L2网络,平台用户与开发团队都有机会通过获取Blast积分的方式获得Blast空投。

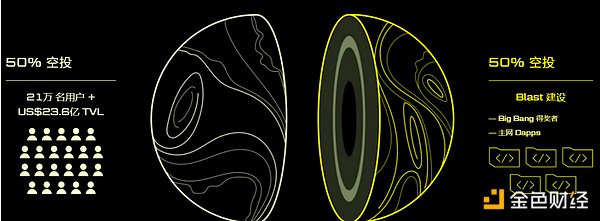

而项目方也明确表示Blast 空投的 50% 分配给 Blast 积分用户,另外 50% 分配给 Blast Dapp。此外,“GOLD”空投将每两周分配给 Dapp,Dapp 可以选择保留空投,不过一些Dapp 已经承诺将所有空投分发给用户。

上个月24号,Blast公布了BIG BANG 竞赛结果,从超 3000 支参赛团队中共筛选出 118 个潜力项目,具体包含 47 个获胜项目(Winners)、31 个亚军项目(Runner-Ups)以及 40 个荣誉项目(Honorables),涉及借贷、DEX、衍生品、GambleFi、NFT/Gaming、Infra 等多个板块。

由于入选项目过百,涉及多个板块类别,比特币买卖交易网在Blast 主网上线之际决定分板块从中甄选出更具发展潜力的项目。本期将先从DEX赛道进行挑选,具体项目如下:

一、Winners

SynFutures:

SynFutures 是一个去中心化的衍生品交易所,任何人都可以列出和交易任何资产的期货和永续合约。SynFutures 通过创建一个开放和无需信任的衍生品市场,定位为衍生品的亚马逊,引入了无需许可的资产列表,并提供最广泛的交易对多样性。

项目共有3次融资经历,共融得3740万美元。SynFutures 的创始团队来自亚洲的 CeFi 超级平台 Matrixport,并且投资方包括Polychain Capital 、Pantera Capital、Dragonfly Capital、Standard Crypto等。

Ambient Finance:

Ambient是一种AMM,它将集中的流动性、可替代的全系列xyk LP令牌和纯链上限价订单结合到一个共同的流动性池中。Ambient是一个单例合约,支持钩子、动态费用、自动复合和节省气体。

2023年7月,以8000万美元 估值完成650万美元种子轮融资。

Thruster:

ThrusterThruster 是 Blast 原生 DEX,利用 Blast 原生收益率、定制流动性解决方案和更简洁的用户界面/用户体验,使交易者、LP 和开发者受益。

Mangrove:

Mangrove是一种基于订单簿的 DEX,允许流动性提供者发布任意智能合约作为报价。这种新的灵活性使流动性提供者能够发布未完全提供的报价。Mangrove 的订单簿列出了承诺而不是锁定的承诺。流动性可以共享、借用、借出,同时显示在 Mangrove 的订单簿中,只有在报价达成时,才能随时获取。

项目分别在2021年7月完成270种子轮融资以及在2023年2月完成740 万美元A轮融资。

Ring Protocol:

Ring协议是Blast去中心化交易的新时代,最大限度地提高了资产利用率。我们的现货DEX Ring Swap允许流动性提供商通过押注标的资产和/或RWA来赚取掉期费用和收益。

2024年3月1日,DEX 项目 Ring Protocol 宣布完成 pre-seed 轮融资,金额未披露。

100x Finance:

100x是为Blast构建的低延迟CLOB DEX,专注于可扩展性,资本效率和流动性。Blast用户可以交易发行前的期货和任何资产,杠杆率为100倍。

Blast Futures Exchange (BFX):

Blast Futures Exchange (BFX)是一个完全集成的、具有本地收益率的订单永久期货交易所。BFX提供全链流动性和最高效率的一体化交易平台。

InfinityPools.finance:

InfinityPools是一种DEX,对任何资产提供无限杠杆,没有清算,没有交易对手风险,也没有预言机。

二、Runner-Ups

Blaster Swap:

Blaster 是基于 Blast 的现货 Dex,也是一个具有批处理交换功能的Meta-DeFi聚合器,用于简化在一个地方浏览各种DeFi功能。批交换-通过最佳路线和价格在单个交易中启用多个交换。

BladeSwap:

BladeSwap是一种veDEX,它将100%的平台费用返还给代币持有者,并通过投票重定向排放。Blade简化了复杂的DeFi成有趣的一键体验与本地批量交易,实时投票和每日免费战利品箱。

HMX:

HMX是一个去中心化永续合约和现货交易所,用户可以在平台上开立高达10000倍的杠杆多头或空头头寸,且无滑点。用户还可以通过将符合条件的资产存入PLP基金,成为HMX交易员的做市商,该基金作为HMX杠杆和现货交易员的流动性。

2023年6月完成私募轮融资,金额未披露。

Opyn:

Opyn Markets是永续合约版Uniswap。任何人都可以未经许可地在任何资产上部署合约交易市场。TradFi保证金满足线性、曲线、单一lp和灵活抵押品。

项目共融得886万美元。

三、Honorables

Definitive:

Definitive是 DeFi 的执行平台和 API,提供跨多种 DeFi 协议的非托管智能合约和自动化服务。每个 Definitive 智能合约都由强大且专有的链下引擎支持。他们协同工作,为最终用户简化 DeFi 执行,从复杂的收益策略到高频交易算法。

2023年11月,项目完成410万美元融资。

RogueX:

RogueX是无许可现货和永久DEX,允许在RogueX托管的任何流动性池进行永久和现货交易。Rogue 也是 Maverick 的流动性引擎,为用户提供了获得 veMAV 投票权的机会,而无需自己锁定 MAV,同时为 Maverick 的 AMM LP 提供更高的收益。

Core Markets:

基于意向的永久DEX提供:链上任何地方可用的配对最多,目前超过250对;链上最深的流动性。OTC意图架构消除了对LP的需求。

SuperCharged:

游戏化预测市场,包括x1000加密货币期货和预测市场。

The author Bitcoin trading network was officially launched on March, and early visitors can bridge to the main network and use it. At present, the main network has exceeded 100 million US dollars, and there are about 10,000 community users. official website claims to be the only Ethereum network platform user who provides primary income for stable coins. Both users and development teams have the opportunity to get airdrops by earning points, and the project party also clearly stated that airdrops will be allocated to the users with points. In addition, airdrops will be allocated every two weeks to those who can choose to keep airdrops. Some have promised to distribute all airdrops to users. Last month, the results of the competition were announced. A total of potential projects were selected from the overspent teams, including a winning project, a runner-up project and an honorary project, which involved many sectors such as loan derivatives. Because the selected projects involved more than 100 sectors, Bitcoin Trading Network decided to select projects with more development potential by sectors when it was on the main online line. In this period, the specific projects will be selected from the track first. One is to go to the center. By creating an open and trustless derivatives market, anyone can list and trade the futures and perpetual contracts of any asset, positioning Amazon as a derivative, introducing a list of assets without permission and providing the widest range of transactions. The founding team with a total financing experience of 10,000 US dollars for diversified projects comes from a super platform in Asia, and the investors include a full range of tokens with centralized liquidity and pure chain limit orders. Merging into a common liquidity pool is a single contract, which supports hook dynamic fees to automatically compound and save gas. The annual valuation of $10,000 is completed. The seed round financing of $10,000 is a customized liquidity solution and a simpler user interface, which benefits traders and developers. It is an order book-based method that allows liquidity providers to issue any smart contract as a quotation. This new flexibility enables liquidity providers to issue quotations that are not fully provided. The order book lists the commitments instead of locked commitments. Liquidity can be shared, borrowed and displayed in the order book at the same time. Only when the quotation is reached can the project be obtained at any time. The seed round financing agreement was completed in May and the million-dollar round financing agreement was completed in May. This is a new era of decentralized trading, which maximizes the asset utilization rate. Our spot allows liquidity providers to earn swap fees and benefits by betting on the underlying assets and/or. The project announced the completion of round financing. The undisclosed amount is built for low delay, focusing on scalability, capital efficiency and liquidity. Users can trade futures before issuance and leverage ratio of any asset is doubled. It is a fully integrated order permanent futures exchange with local yield, which provides full-chain liquidity and the highest efficiency. It is an integrated trading platform that provides unlimited leverage for any asset, no liquidation, no counterparty risk and no prediction machine. Second, it is based on spot and an aggregator with batch exchange function. In order to simplify browsing various functions in one place, batch exchange enables multiple exchanges in a single transaction through the best route and price. It returns the platform fees to token holders and redirects emissions through voting, which simplifies the complicated and interesting one-click experience with local batch transactions. Real-time voting and daily free trophy boxes are a decentralized permanent contract and spot exchange. Users can open leveraged long or short positions on the platform up to times, and users can pass without slippage. Deposit qualified assets into the fund and become a market maker of traders. The fund is used as leverage and liquidity of spot traders. The amount of private placement financing is completed every year. The undisclosed version is a perpetual contract. Anyone can deploy contract trading on any asset without permission. The market margin meets the linear curve. The single and flexible collateral project has a total of ten thousand dollars. Third, it provides an execution platform and provides unmanaged smart contracts and automation services across multiple agreements. Each smart contract is powerful and proprietary. Under-chain engine supports them to work together to simplify the execution for the end users, from complex income strategy to high-frequency trading algorithm. The project completed in October and October, and the financing of 10,000 US dollars is unlicensed spot and permanently allowed to conduct permanent and spot transactions in any managed liquidity pool. The liquidity engine also provides users with the opportunity to obtain voting rights without locking themselves, and at the same time, it provides higher returns. Intention-based permanent matching is available anywhere in the chain. At present, it exceeds the deepest liquidity intention in the chain. The framework eliminates the demand for gamification forecasting markets, including cryptocurrency futures and forecasting markets. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。