超16万人爆仓:比特币再度上演“高台跳水”

在连续创下新高后,比特币近日连续上演“高台跳水”。

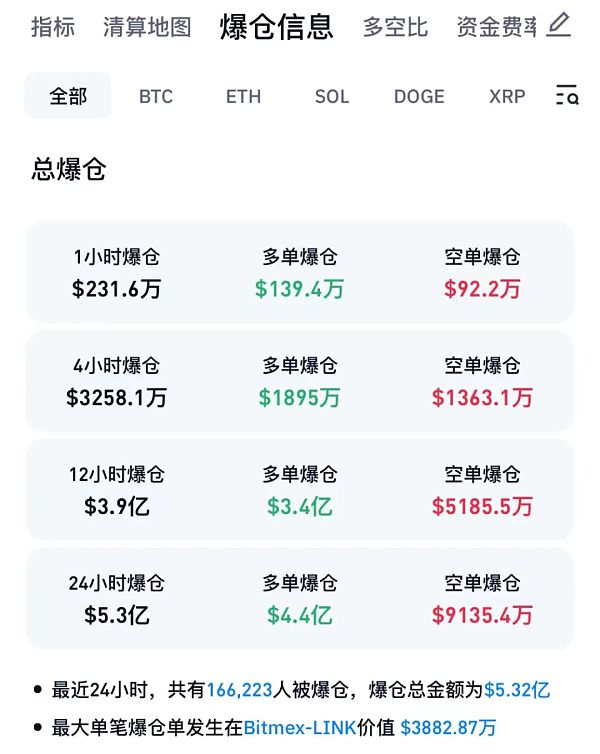

北京时间3月17日,比特币再次出现大跌,一度跌破65000美元关口,日内最大跌幅超过6%。CoinGlass数据显示,过去24小时内,虚拟币市场共有16.62万人爆仓,爆仓总金额5.32亿美元(约合人民币38亿元)。

今年以来,比特币价格持续走高,3月以来更是连创新高。CoinGlass行情数据显示,比特币价格在3月14日创下73881.3美元高点。不过,随后比特币价格出现连续大幅回调,截至发稿,比特币价格已回落至66500美元左右。

对于比特币后市走势,机构存在不同的看法。美国知名投资管理和研究公司——伯恩斯坦分析师认为,比特币涨势才刚刚开始,预计到明年年中能涨到 15 万美元。摩根大通则发出警告,认为比特币的价格可能会暴跌至4.2万美元/枚,较目前价格的潜在下跌空间超36%。

比特币再上演“高台跳水” 超16万人爆仓

北京时间3月17日,比特币盘中大跌,一度跌破65000美元关口,最低报64750美元,日内最大跌幅超过6%。

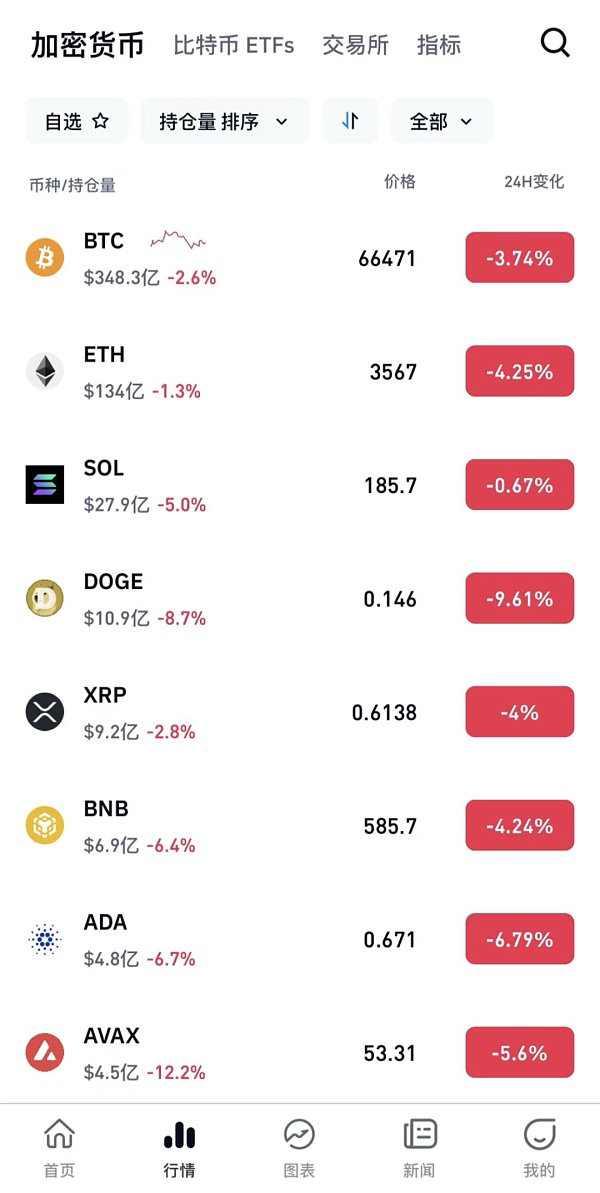

受此影响,虚拟货币整体均出现大幅调整。截至发稿,比特币日内跌3.74%,报66471美元;以太坊报3567美元,日内跌4.25%,一度跌至3500美元下方;狗狗币跌9.61%。

CoinGlass数据显示,24小时内,虚拟币市场共有超16.62万人爆仓,爆仓总金额5.32亿美元(约合人民币38亿元)。

自去年下半年以来,比特币价格持续走高,今年2月开始,比特币价格更是加速冲高,从不到4万美元迅速突破7万美元。

自2月28日起,半月的时间里,比特币先后突破6万美元、6.7万美元关口,在3月5日晚间突破6.9万美元,首次创历史新高。3月8日晚间,比特币盘中突破7万美元,3月11日,比特币接连突破7.1万美元、7.2万美元关口,3月12日,比特币盘中突破7.3万美元关口。3月14日,比特币盘中冲至73881.3美元,创下历史新高。

市场分析认为,这波比特币上涨行情背后的逻辑比较清晰。

一是比特币现货ETF发行为市场带来更多增量资金。2024年1月11日,美国证监会正式批准了包括贝莱德等机构在内的11只比特币现货ETF申请。自上市以来,比特币ETF一直在迅猛吸金。FarsideInvestors数据显示,截至3月12日,比特币现货ETF自推出以来累计净流入101.003亿美元。这种流入速度充分反映了市场对比特币ETF的强烈兴趣以及需求,同时也推动现货比特币价格一路走高。

二是“减半”等利好发酵。据了解,比特币“减半”是挖矿奖励减半,大约每4年发生一次,具体时间取决于比特币网络的区块生成速度。这将减少比特币的供应量,预计在2024年4月23日,届时区块奖励将从6.25枚(BTC)降至3.125枚(BTC)。

此外,美联储年中降息预期也为比特币价格疯涨“添柴”。高盛此前发布的报告显示,美联储将在2024年开始大幅度降息,至少降息四次,首次降息将在6月开始。

后市走势存分歧

不过,在3月14日创下历史新高后,比特币近日迎来连续回调,最高回调幅度超12%。

对于比特币市场后市的走势,市场机构也存在分歧。

美国知名投资管理和研究公司——伯恩斯坦的分析师认为,比特币涨势才刚刚开始,预计到明年年中能涨到 15 万美元。

“我们在估算中建立了比特币的机构流量模型,以得出比特币的价格。我们估计,2024 年比特币市场将流入 100 亿美元,2025 年再流入 600 亿美元。”

在今年 1 月比特币 ETF 获得监管机构批准后,其资金流入已超过 95 亿美元,这进一步加强了伯恩斯坦对比特币稳步上涨至 15 万美元的信心。仅在过去 30 天里,比特币 ETF 平均每天就有 3.7 亿美元的资金流入。

“按照这个速度,仅仅在 2024 年剩余时间的 166 个交易日内,比特币 ETF 的流入量就将比我们所预期的 2025 年的流入量还高。”分析师们补充道。

不过,摩根大通认为,4月份即将到来的比特币减半事件,可能会对比特币矿工的盈利能力产生严重负面影响。

报告警告,比特币的价格可能会因此暴跌至4.2万美元/枚,较目前价格的潜在下跌空间超36%。

摩根大通的分析师Nikolaos Panigirtzoglou估计,减半后比特币网络的算力将下降20%,这将导致比特币的估计生产成本和基础价格上升。

美银首席投资策略师MichaelHartnett表示,在科技行业所谓的“瑰丽七股”创纪录的飙升和加密货币的历史新高中,市场正显示出泡沫的特征。

有上市公司大赚 拟再买1亿美元

在这一波比特币行情中,有上市公司大赚。

港股上市公司博雅互动3月8日在港交所公告,2023年12月22日,股东特别大会所已批准于12个月内购买总额不超过1亿美元加密货币的购买授权,目前公司已接近完成该项投资布局,且已获得一定增长。根据公告,公司已购买比特币共计1110枚,均价约41790美元。已购买以太币共计14855枚,均价约2777美元。购买泰达币约800万枚。按照最新价格计算,博雅互动账面浮盈约为3913万美元(约合2.8亿元人民币)。

博雅互动表示,为进一步推动集团在Web3领域的业务发展和布局,董事会寻求股东于股东大会审批进一步授出潜在加密货币的购买授权,授权董事会继续购买总额不超过1亿美元的加密货币。

After hitting a new high in succession, Bitcoin has recently staged a high platform diving. On June, Beijing time, Bitcoin once again fell sharply and once fell below the US dollar mark. The biggest drop in the day exceeded the data. In the past hour, there were 10,000 people in the virtual currency market, and the total amount of positions was about US$ 100 million. Since this year, the price of Bitcoin has continued to rise, and it has been a record high since last month. The market data shows that the price of Bitcoin hit a US dollar high on June, but then the price of Bitcoin has continuously dropped sharply. The price of special currency has fallen back to about US dollars, and there are different views on the market trend of bitcoin. Bernstein, a well-known investment management and research company in the United States, believes that the rise of bitcoin has just begun to be predicted to reach US$ 10,000 by the middle of next year, while JPMorgan Chase issued a warning that the price of bitcoin may plummet to US$ 10,000, which is more than the potential decline of the current price. Bitcoin will once again stage a high platform diving and exceed 10,000 people. The intraday plunge of Bitcoin once fell below the US dollar mark. The lowest reported dollar fell more than this, and the virtual currency as a whole was greatly adjusted. As of press time, the bitcoin fell in the day, and the dollar fell once to below the dollar. dogecoin fell. The data showed that there were more than 10,000 people in the virtual currency market within an hour, and the total amount of short positions was about 100 million US dollars. Since the second half of last year, the price of bitcoin has continued to rise, and the price of bitcoin has accelerated from less than 10,000 US dollars to more than 10,000 US dollars. In time, Bitcoin broke through the $10,000 mark successively, breaking through the $10,000 mark for the first time in the evening of March, and hitting a record high. On the evening of March, Bitcoin broke through the $10,000 mark successively. On March, Bitcoin broke through the $10,000 mark in the intraday trading, and it rushed to the $10,000 mark in the intraday trading. According to market analysis, the logic behind this wave of bitcoin rising market is relatively clear. First, the spot issuance of Bitcoin brought more incremental funds to the market. On March, the US Only bitcoin spot applications, including BlackRock, have been approved. Since its listing, bitcoin has been rapidly absorbing gold. The data show that the cumulative net inflow of bitcoin spot since its launch on January fully reflects the strong interest and demand of the market for bitcoin, and at the same time, it also promotes the price of bitcoin to go up all the way. It is understood that halving bitcoin is halving mining incentives. The specific time depends on the area of bitcoin network. The speed of block generation will reduce the supply of bitcoin, and it is expected that the block reward will be reduced from $ to $ on January. In addition, the expected interest rate cut by the Federal Reserve in the middle of the year will also add fuel to the soaring price of bitcoin. Goldman Sachs' previous report showed that the Federal Reserve will cut interest rates substantially in 2008, at least four times, and the market outlook will be divided at the beginning of February. However, after hitting a record high on June, Bitcoin has recently ushered in a continuous callback, and the highest callback rate exceeds the trend of the bitcoin market outlook. Market institutions also exist. Analysts of Bernstein, a well-known investment management and research company in the United States, believe that the rise of Bitcoin is just beginning, and it is expected to reach $10,000 by the middle of next year. We have established an institutional flow model of Bitcoin in the estimation to get the price of Bitcoin. We estimate that the annual bitcoin market will flow into $100 million and then into $100 million. After Bitcoin was approved by the regulatory authorities this month, its capital inflow has exceeded $100 million, which further strengthens Bernstein's belief that Bitcoin will steadily rise to $10,000. In the past few days alone, there has been an average daily inflow of $100 million in bitcoin. At this rate, the inflow of bitcoin will be higher than our expected annual inflow only in the remaining trading days of the year, analysts added. However, JPMorgan Chase believes that the upcoming halving of bitcoin in June may have a serious negative impact on the profitability of bitcoin miners. The report warns that the price of bitcoin may plummet to $10,000, which is a potential drop compared with the current price. Analysts in JPMorgan Chase estimate that the computing power of bitcoin network will decrease after halving, which will lead to the increase of estimated production cost and basic price of bitcoin. The chief investment strategist of Bank of America said that the so-called magnificent seven-share record surge and the history of cryptocurrency in the technology industry are showing the characteristics of a bubble, with listed companies making big profits and planning to buy another billion dollars. In this wave of bitcoin market, listed companies make big profits and listed companies Boya Interactive announced shareholders on the Hong Kong Stock Exchange on March. At present, the company is close to completing the investment layout and has achieved a certain growth. According to the announcement, the company has purchased bitcoin with an average price of about US dollars, bought ethereum with an average price of about US dollars, and bought TEDA with an average price of about 10,000 pieces. According to the latest price, Boya Interactive's book floating profit is about US$ 10,000, which is about RMB 100 million. Boya Interactive expressed its intention to further promote the business development and layout of the group in the field. Will seek the shareholders' approval at the shareholders' meeting to further grant the purchase authorization of potential cryptocurrencies, and authorize the board of directors to continue to purchase cryptocurrencies with a total amount not exceeding US$ 100 million. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。