2024年比特币有何期待

作者:David Liang,coindesk 翻译:善欧巴,比特币买卖交易网

美国监管机构可能在明年批准现货比特币 ETF 的预期正在推动比特币价格上涨。根据 Path Crypto 的 David Liang 的说法,随着我们接近 2024 年 4 月的减半,我们可能会看到比特币价格出现放缓。

自 10 月份以来,对现货比特币 ETF 申请批准的乐观情绪引发了 BTC 价格上涨近 49%。出于后勤和一致性原因,证券交易委员会可能会同时批准或拒绝多项申请。(除非另有说明,所引用的数字截至 12 月 18 日。)

现货 BTC 交易集中在几个交易所:Coinbase、Binance、Bybit 和 OKX。它们约占现货 BTC 交易的 65%。Binance占35.5%,Bybit、OKX和Coinbase分别占11.3%、9.2%和8.9%。

自 2021 年初以来,BTC 平均订单规模一直在下降,约为 1,652 美元。虽然较小的订单规模与零售客户相关,但许多(如果不是大多数)机构将交易订单分成较小的订单,以最大限度地减少滑点。仅根据订单规模分析就认为零售客户对 BTC 近期交易模式负有主要责任是不明智的。

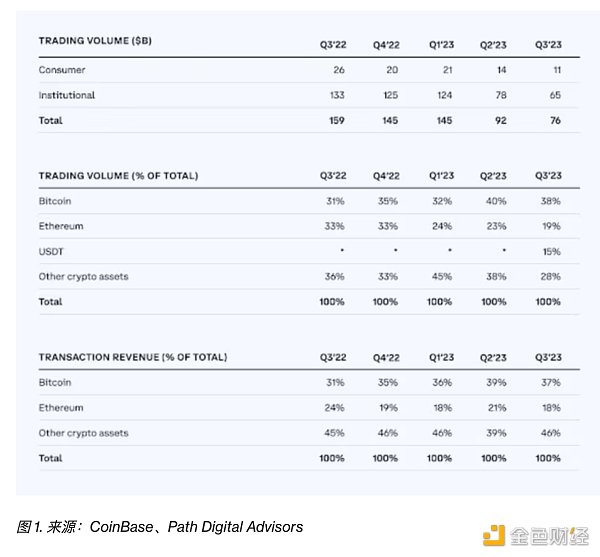

Coinbase 的 2023 年第三季度交易摘要显示,过去四个季度环比指标中有三个交易量出现下降。去年,零售和机构交易者的交易量以类似的速度下降,第三季度零售和机构客户的交易量分别约为 42 亿美元和 247 亿美元。

比特币期货市场

比特币期货市场

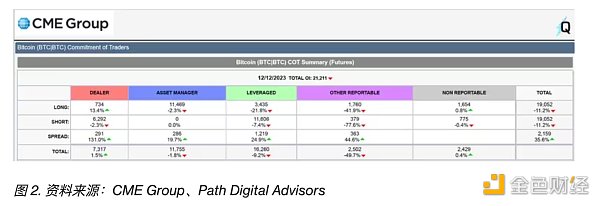

CME 集团的 BTC 期货未平仓合约规模达到 45.5 亿美元,占比约为全部 BTC 未平仓合约的 25%。当前未平仓合约规模达到了自 2022 年第二季度以来的最高水平。

CME BTC 期货头寸的大部分由资产管理公司和杠杆基金持有,前者表现出看涨偏倚,后者表现出看跌偏倚。这似乎很直观,因为资产管理公司往往比其他买方客户采取更长的时间框架来进行投资。相反,对冲基金和商品交易顾问 (CTA) 往往采取更短的时间框架进行交易,并进行基差交易和对冲。

机构投资者在加密货币领域变得更加活跃。CME 集团指出,“平均大额比特币未平仓合约持有者,至少有 25 个合约,在 2023 年 11 月 7 日当周创下了历史新高。”

资金费率将永续期货价格与现货价格对齐。当资金费率为正时,持有多头合约的投资者向持有空头合约的投资者支付资金费,反之亦然。资金费率与 BTC 现货价格呈上升趋势,表明看涨情绪和偏差。

比特币展望

The expectation that American regulators may approve the spot bitcoin next year is pushing up the price of bitcoin. According to the statement, as we approach the halving of February, we may see the price of bitcoin slow down. The optimism about the approval of the spot bitcoin application since January has triggered the price increase. For logistical and consistency reasons, the Securities and Exchange Commission may approve or reject multiple applications at the same time, unless otherwise specified. As of March, spot transactions are concentrated in several exchanges and they account for about the share of spot transactions and the average order size has been declining by about US dollars since the beginning of the year. Although the smaller order size is related to retail customers, it is unwise for many institutions to think that retail customers are mainly responsible for recent trading patterns only based on the analysis of order size. The summary of transactions in the third quarter of last year shows that in the past four years. Three of the quarter-on-quarter indicators showed a decline in trading volume. Last year, the trading volume of retail and institutional traders declined at a similar rate. In the third quarter, the trading volume of retail and institutional customers was about $ billion and $ billion respectively. The size of the futures open contracts of Bitcoin Futures Market Group reached $ billion, accounting for about all open contracts. The current open contracts reached the highest level since the second quarter of 2008. Most of future positions's open contracts were managed by asset management companies and banks. The former shows bullish bias and the latter shows bearish bias, which seems intuitive, because asset management companies often take a longer time frame to invest than other buyers. On the contrary, hedge funds and commodity trading consultants often take a shorter time frame to trade and make basis trades, and hedge institutional investors become more active in the cryptocurrency field. The group pointed out that the average large bitcoin open contract holder has at least one contract that set a calendar in the week of June. The record high capital rate aligns the perpetual futures price with the spot price. When the capital rate is positive, investors holding long contracts pay capital fees to investors holding short contracts, and vice versa. The rising trend of capital rate and spot price indicates bullish sentiment and deviation of Bitcoin outlook. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

最近,BTC 价格与消费者兴趣之间的历史关系已经解除耦合。如果消费者兴趣完全由零售客户驱动,那么似乎是以下两种情况之一:

零售客户在没有进行研究的情况下进行交易,

机构投资者对价格产生了过大的影响。

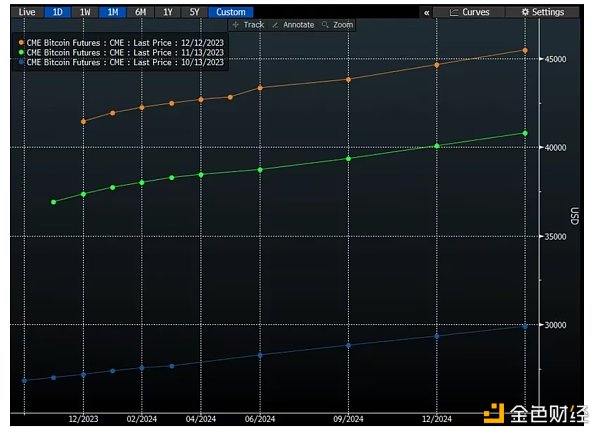

机构投资者的情绪似乎是积极的。2023 年第四季度每个月的期货曲线平行向上移动,表明机构投资者存在看涨活动和多头偏倚。

ETF 批准已经充分计入比特币价格,因此公告带来的积极势头可能会被交易者平仓所抵消。这表明在公告后的几天内可能会出现回归均值。此后,市场可能会重新调整其对 4 月的减半的关注。

图 3. 资料来源:彭博社、Path Digital Advisors LLC

图 3. 资料来源:彭博社、Path Digital Advisors LLC

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。