黄金涨涨涨一天一个价 该不该行动?

近期,全球黄金市场持续火热,4月8日,国际金价再次刷新历史新高,每盎司达到了2353美元,而国内部分品牌足金饰品零售价也报价接近每克720元。这一连串的新高刷新,引发了市场的广泛关注和投资者的热情追捧。

数据显示,过去10天里,黄金价格有9天出现上涨,而在过去7周中,更是有6周呈现走高态势。这样的走势在历史上可谓罕见。而值得一提的是,仅在刚刚过去的3月份,人民币计价的黄金价格就单月涨幅达到了9.68%,再次刷新了纪录。

下单量猛增,银行购金需“等货”

投资者对于黄金的追捧似乎越来越热烈,这也在一定程度上导致了金条等投资黄金产品的供货紧张。从银行购买金条通常需要锁定金价后,再根据客户购买的产品从供应工厂或者仓库调货。然而,近期金条下单量的大幅增长导致了供货的紧张局面,银行不得不等待或者催促供货,而客户的等待周期也因此变得更长,通常需要7个工作日才能收到。

多种因素促使金价上涨

金价连续创下历史新高,这一现象的背后,是诸多因素的交织与影响,从地缘政治风险升级到货币政策的不确定性,都为黄金这一避险资产注入了强劲的动力。

1. 主要受各央行购金操作的推动

近年来,逆全球化的趋势逐渐加强,这对美元的信用基础构成了挑战。自2018年以来,逆全球化的加速逐步侵蚀了美元信用的根基,导致市场对美元的信心有所动摇。此外,美国国内的经济政策和外交行为也对美元的强势地位产生了影响。而自2022年俄乌冲突以来,全球美元储备快速回落,而黄金储备明显增加。

中国央行连续17个月增持黄金,3月对应增持金额超1400亿元

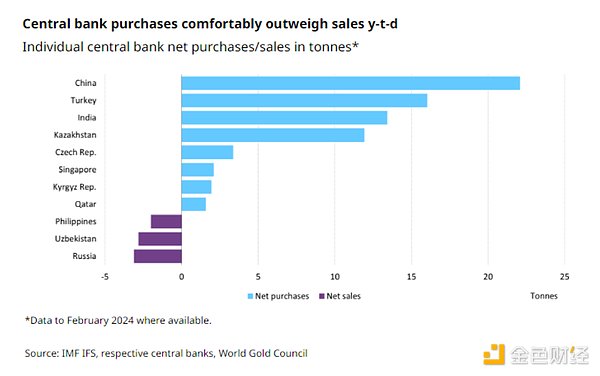

根据世界黄金协会日前发布的报告,今年2月全球央行净买入19吨黄金,为连续第九个月增长。除我国外,哈萨克斯坦国家银行净买入6吨黄金,年内已增持12吨黄金;印度储备银行也净买入6吨,年内增持黄金超13吨;捷克国家银行增持2吨左右,为连续第12个月黄金购买量在1吨以上。此外,还有土耳其央行增持了4吨,新加坡金融管理局净买入2吨等。

同时在国内,由于资产荒的现象,传统的投资渠道如股市和房地产市场持续下跌,各种基金及理财产品也备受质疑。在这种情况下,投资者开始寻找其他能够保值的投资渠道,黄金作为一种传统的避险资产,自然成为了他们的首选。数据显示国内民间购金量远超央行。

2. 美元降息预期

市场普遍预期,未来美元可能会进入降息周期。降息通常会导致货币贬值,进而推高非生息资产如黄金的价格。过去的数据显示,历次美联储货币政策由紧转松几乎都伴随着黄金价格的大幅上涨。在低利率环境下,投资者更倾向于购买黄金等避险资产,以保护其财富不受通货膨胀的侵蚀。

3. 地缘政治风险与避险需求

当前全球地缘政治风险不断上升,特别是中东等地区的紧张局势,使得市场避险情绪升温。在这种乱世之中,黄金作为一种避险资产,其价值得到了市场的认可。投资者购买黄金以规避潜在的政治风险,从而推高了黄金价格。

金价后市走势现分歧

对于黄金后市的走势,市场存在一定的分歧。部分投资者认为黄金价格上涨过快,可能导致市场出现过热,存在一定的泡沫风险。

而部分投资者持续看好金价,认为尽管金价经历了较大的上涨,但仍有诸多因素支撑着金价继续上涨。地缘政治紧张局势、美联储的货币政策等因素,尤其是全球范围内央行对黄金储备的增持,以及市场对通胀的担忧,都为金价提供了持续上涨的动力。

4E黄金交易,支持300倍杠杆多空交易

黄金市场的未来走势引发了投资者们的热议与分歧。在这样的市场环境下,投资者们也开始寻找适合自己的投资渠道。

4E作为一家全球领先的合规交易平台、阿根廷国家队官方全球合作伙伴,为投资者提供了一种便捷而灵活的黄金交易选择。通过4E,投资者可以享受到高达300倍的杠杆交易,支持多空双向操作,而且最低投资门槛仅需不到8美元。同时4E还支持加密货币、外汇、美股、指数,石油白银等大宗商品,为投资者提供广阔的投资机会。

市场持续火热,黄金投资也呈现出前所未有的机遇。无论是关注短期波动,还是长期趋势,都需要充分考虑市场因素和个人风险偏好,做出明智的投资决策。作为一家专业的投资服务平台,4E始终致力于为广大投资者提供安全、稳定、高效的服务,让投资者能够在黄金市场中把握机会,实现财富增值。

Recently, the global gold market continues to be hot, and the international gold price has once again reached a record high of US dollars per ounce, while the retail price of some domestic brands of gold jewelry is also close to RMB per gram. This series of new highs has aroused widespread concern in the market and the enthusiasm of investors. The data show that the price of gold has risen one day in the past few days, and it has been rising in the past week. This trend is rare in history, but it is worth mentioning that it is only in the past month. The price of gold rose once again in a single month, setting a new record. The number of orders soared, and banks needed to wait for goods to buy gold. Investors seemed to be more and more enthusiastic about gold, which also led to the tight supply of investment gold products such as gold bars. Buying gold bars from banks usually requires locking in the price of gold, and then transferring goods from supply factories or warehouses according to the products purchased by customers. However, the recent sharp increase in the number of orders for gold bars has led to the tight supply situation, and banks have to wait or rush to supply goods. As a result, the waiting period of households has become longer. Usually, it takes working days to receive a variety of factors, which have prompted the price of gold to rise and hit a record high. Behind this phenomenon are the interweaving and influence of many factors, from geopolitical risk escalation to the uncertainty of monetary policy, which have injected a strong impetus into gold, a safe-haven asset, mainly driven by the purchase of gold by central banks. In recent years, the trend of anti-globalization has gradually strengthened, which has posed a challenge to the credit base of the US dollar. In addition, the domestic economic policy and diplomatic behavior of the United States have also had an impact on the strong position of the US dollar. Since the conflict between Russia and Ukraine in, the global US dollar reserve has dropped rapidly, while the gold reserve has increased significantly. According to the report released by the World Gold Council a few days ago, the net purchase of tons of gold by the global central bank this month is the ninth consecutive month of growth, except for Kazakhstan, China. Stan National Bank bought tons of gold, and the Reserve Bank of India also bought tons of gold during the year. The Czech National Bank bought tons of gold for the third consecutive month, and the Turkish central bank bought tons of gold. At the same time, due to the phenomenon of asset shortage, traditional investment channels such as the stock market and real estate market continued to decline, and various funds and wealth management products were also questioned. Under this circumstance, investors began to look for it. As a traditional safe-haven asset, gold has naturally become their first choice. The data show that the domestic private purchase of gold far exceeds the expectation of the central bank's interest rate cut in US dollars. It is widely expected that the US dollar may enter the interest rate cut cycle in the future, which usually leads to currency depreciation and then pushes up the price of non-interest-bearing assets such as gold. Past data show that the tight monetary policy of the Federal Reserve has almost always been accompanied by a sharp rise in the price of gold. In the low interest rate environment, investors are more inclined to buy. Gold and other safe-haven assets to protect their wealth from inflation, geopolitical risks and safe-haven demand. At present, global geopolitical risks are rising, especially the tension in the Middle East and other regions has warmed up the market risk aversion. In this troubled times, gold, as a safe-haven asset, has been recognized by the market, and investors have bought gold to avoid potential political risks, thus pushing up the price of gold. There are some differences on the market trend of the gold market. Some investors believe that the rapid rise of gold price may lead to overheating in the market, and there is a certain bubble risk, while some investors continue to be optimistic about the price of gold. They believe that although the price of gold has experienced a great rise, there are still many factors supporting the price of gold to continue to rise, geopolitical tensions, the Federal Reserve's monetary policy and other factors, especially the global central bank's increase in gold reserves and the market's concerns about inflation, all provide the driving force for the price of gold to continue to rise. The future trend of the gold market has caused heated discussion and disagreement among investors. Under such a market environment, investors have also begun to look for their own investment channels. As a leading global compliance trading platform, the official global partner of Argentina's national team has provided investors with a convenient and flexible gold trading option. Through leveraged trading, investors can enjoy up to times of long-short two-way operation, and the minimum investment threshold is less than US dollars, while also supporting cryptocurrency, foreign exchange and US stocks. Commodities such as index, oil and silver provide broad investment opportunities for investors. The market continues to be hot, and gold investment also presents unprecedented opportunities. Whether it is concerned about short-term fluctuations or long-term trends, we need to fully consider market factors and personal risk preferences and make wise investment decisions. As a professional investment service platform, we have always been committed to providing safe, stable and efficient services for investors, so that investors can seize the opportunity to realize wealth appreciation in the gold market. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。