一文看懂同构绑定技术及其发展前景

作者:字节君;编译:字节元 CKB

在区块链行业中,“同构绑定” 一词最早出现在 Nervos CKB 联合创始人 Cipher 撰写的《RGB++ Protocol Light Paper》。同构绑定是比特币一层资产发行协议 RGB++ 所使用的核心技术之一,通过这项技术,RGB++ 可以解决 RGB 协议遇到的各种问题,并赋予 RGB 更多的可能性。

然而,很多人不知道的是,同构绑定技术并不仅限于赋能 RGB 协议,事实上,它也可以用到其他使用了 UTXO 特性的一层资产发行协议(比如 Runes、Atomical、Taproot Assets 等)当中,为这些资产带来无须跨链、不损失安全性的图灵完备合约扩展和性能扩展。

今天的这篇文章,我们将通过通俗易懂的语言,向大家详细介绍同构绑定这项技术及其发展前景。

什么是同构绑定?

同构绑定技术的使用前提是同构。以太坊等 EVM 区块链使用的是账户模型,这是另一种记账方式,UTXO 模型和账户模型的区别类似于现实生活中使用纸币和使用银行转账的区别。所以,如果 EVM 的区块链想要赋能使用了 UTXO 特性的一层资产发行协议,就很难使用同构绑定技术了,必须选择传统的跨链桥方案,通过锁定/铸造、销毁/铸造或者锁定/解锁,来实现资产的转移和性能扩展。

CKB 区块链的 Cell 模型是比特币 UTXO 模型基础上的改进版本,它与 UTXO 模型同宗同源。所以,我们可以通过同构绑定技术,将一条区块链上的 UTXO 一一绑定或者映射到另一条区块链的 UTXO 中。以 RGB++ 协议为例,由于 RGB 资产本质上寄生于比特币 UTXO,所以 RGB++ 协议可以利用同构绑定技术,将比特币 UTXO 一一映射到 CKB 区块链的 Cell 当中,这样我们就可以利用 CKB 区块链来替代 RGB 的客户端验证。

为了更好的理解同构绑定技术,我们用地皮和地契作为类比对象:

1. 如果我们把比特币主网比作是土地,张三通过 RGB++ 协议发行了一个资产,这个资产是纸质地契,对应 100 亩的地皮。纸质地契存储在比特币区块链上(即 UTXO 中,张三拥有这个 UTXO),同构绑定技术相当于在 CKB 区块链上为这份纸质地契开具了一份对应的电子版地契(存在 Cell 中,张三拥有这个 Cell)。

2. 张三把其中的 40 亩地皮转让给他的亲戚李四,于是原 100 亩纸质地契销毁,生成新的纸质地契,其中一份纸质地契为 40 亩,另一份为 60 亩,依然存放在比特币区块链上,不同的是,40 亩的地契存放在李四控制的 UTXO 中,60 亩的地契存放在张三控制的 UTXO 中。需要特别说明的是,比特币区块链在这里的作用,是防止张三将 100 亩的纸质地契多次使用(即双花),而不是验证新生成的地契地皮面积加起来是不是正好等于 100 亩。换句话说,在原始的 RGB 协议之下,李四拿到的地契上面是不是写着 40 亩这件事需要李四自己验证,而且李四还要自己去验证张三提供的地皮溯源证明(原始的 RGB 协议需要客户端验证,而客户端验证这件事需要用户自己去进行)。

3. 部署在 CKB 区块链上的比特币轻客户端,对发生在比特币区块链的 “销毁 100 亩的纸质地契,生成一份 40 亩的纸质地契和一份 60 亩的纸质地契” 这件事情进行验证,验证它是否真的发生了。

4. 验证通过后,CKB 区块链上的 100 亩电子版地契销毁,生成一份 40 亩的电子版地契,存放在李四控制的 Cell 中,以及一份 60 亩的电子版地契,存放在张三控制的 Cell 中。需要特别说明的是,由于 CKB 区块链是图灵完备的,所以它可以验证并确保新生成的两份电子版地契的地皮面积加起来正好是 100 亩,而李四也能一眼就看到自己的地契上写着的是 40 亩(因为 CKB 区块链上的数据公开可见)。因此,RGB++ 协议可以替代 RGB 协议的客户端验证,即省略掉李四在第 2 步的验证(包括地皮溯源验证)。

以上 4 个步骤正好对应同构绑定技术的 4 个运行过程:将 UTXO 映射到 Cell 中,验证交易,跨链验证,在 CKB 上进行状态变更。

如果你想更深入地了解这 4 个过程,推荐阅读 UniPass Wallet 创始人知县写的文章《Isomorphic Binding: The Heartbeat of Cross-Chain Synchronization in RGB++》:

https://mirror.xyz/zhixian.eth/2xAcBzO28RueHTaNFMU2MTaM1jFT0MoV0ZtXb7madxk

安全性分析

为了更方便地理解同构绑定的安全性,我们还是以 RGB++ 协议为例。

上文地皮和地契的类比,我们可以清楚地看到,存放在比特币 UTXO 中的纸质地契,其安全性和防止双花,主要依赖于比特币区块链的安全性,而比特币是迄今为止运用时间最长、最安全的 PoW 链。

通过同构绑定技术生成的电子版地契,其安全性和防止双花,主要依赖于 CKB 区块链的安全性。CKB 从一开始就采用了和比特币完全一样、久经时间检验的 PoW 共识机制,最大程度地保障安全性和去中心化。目前,CKB 在挖的矿机由世界上最大的 AISC 矿机厂商比特大陆生产,CKB 当前的全网算力约为 271 PH/s,已经创下历史新高。要伪造或重构一条 PoW 链是极其困难的,因为需要重新计算每个区块的算力,所以我们可以信任 CKB 区块链的安全性。

当然,你也可以选择不信任,那你需要做的就是上文例子中的第二步,自己亲自验证地契上面是不是写着 40 亩以及张三提供的地皮溯源证明是否真实有效。这也是 RGB 协议的做法,用户需要自己完成客户端验证;RGB++ 协议只不过是多提供了一种选择,除了选择自己完成客户端验证之外,还可以选择相信 CKB 区块链的验证,CKB 区块链在这里仅作为 DA 层和状态公示来使用,纸质地契交易的安全性甚至和 CKB 没有关系。

RGB++ 协议并不仅仅让 CKB 区块链充当 DA 层,它还支持 Jump 操作,让比特币区块链上的资产可以随时到 CKB 区块链上(以及反向操作)。因为 CKB 区块链图灵完备,在上面可以搭建借贷、DEX 等 DeFi 应用,所以 Jump 过来的资产可以参与比如抵押借贷、质押生息、交易等各种金融活动。

拿着 Jump 过来的资产在 CKB 链上参与各种活动,其安全性依赖于 CKB 区块链的安全性,而在上文我们介绍了 CKB 区块链其实也非常安全。如果你还是不信任 CKB 区块链的安全性,你拿到 CKB 链上的资产后,可以直接 Jump 回到比特币区块链上,变成比特币区块链上的资产。

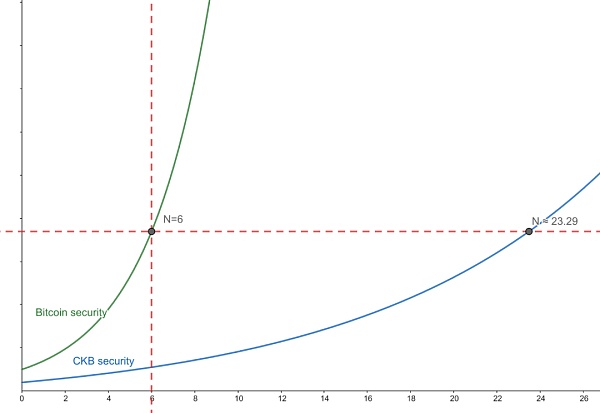

Jump 功能的风险点在于区块重组,而这可以通过多等几个区块确认来规避。在比特币链上,6 个区块确认后被认为交易不可逆。PoW 确认数和安全性不是线性关系,推翻 PoW 区块的难度随着区块的推进指数增长,所以在 CKB 区块链上,要实现比特币 6 个区块确认同等的安全性,大约只需 24 个区块确认,而 CKB 的平均出块时间约为 10 秒,24 个区块确认的时间实际上要远远低于比特币 6 个区块确认的时间。

PoW 安全性的示意图(非理论计算)

因此,想要获得更好的安全性,就选择多等几个区块确认;想要兼顾用户体验,就做一些取舍和产品优化。关于 RGB++ 安全性的更多讨论,推荐阅读《RGB++ 深入讨论(1): 安全性分析》:

https://talk.nervos.org/t/rgb-1/7798

同构绑定技术的发展前景

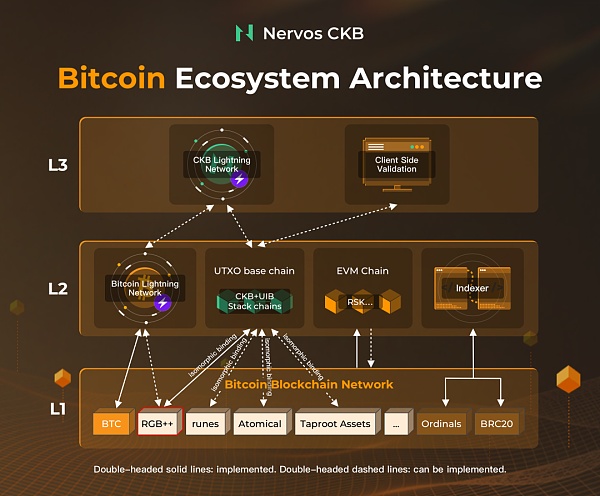

正如文章开头提到的,同构绑定技术并不仅限于赋能 RGB 协议,事实上,它也可以用到其他使用了 UTXO 特性的一层资产发行协议当中。下面这张图很好地诠释了同构绑定(isomorphic binding)技术的用武之地:

从图中我们可以看到,利用同构绑定技术,我们能把比特币一层资产发行协议 Runes、Atomical、Taproot Assets 等发行的资产,通通绑定或者映射到 CKB 的 Cell 中,为这些资产带来无须跨链、不损失安全性的图灵完备合约扩展和性能扩展。

除了比特币一层发行的资产,我们还可以利用同构绑定技术,将其他泛 UTXO 模型的区块链(比如 Dogechain、Ergo、BCH、BSV、LTC 等)上发行的资产映射到 CKB 的 Cell 中。这是一个非常有想象力的蓝图,加上 Jump 操作,CKB 区块链就成了所有寄生于 UTXO 的加密资产的大集市,“条条大路通 CKB”。

总结

同构绑定技术源于 RGB++ 协议,RGB++ 通过同构绑定将比特币 UTXO 映射到 Nervos CKB 的 Cell 上,从而解决原 RGB 协议在实际落地中的技术问题,并提供更多的可能性。但同构绑定技术并不仅限于赋能 RGB 协议,也不仅限于比特币一层,实际上它可以用到任何使用了 UTXO 特性的泛 UTXO 区块链的一层资产发行协议当中,并利用 Jump 技术,为这些资产带来无须跨链、不损失安全性的图灵完备合约扩展和性能扩展。

UTXO 是同构绑定技术的使用前提,而 PoW 为同构绑定提供足够的安全保障。CKB 作为一条 UTXO+PoW 的链,会让同构绑定技术大放异彩,在不久的将来,我们或许会看到 “条条大路通 CKB” 场景。

Author Bytejun compiles the word isomorphic binding in the blockchain industry. Isomorphic binding written by co-founders is one of the core technologies used in the first-tier asset distribution protocol of Bitcoin. Through this technology, various problems encountered by the protocol can be solved and more possibilities are given. However, what many people don't know is that isomorphic binding technology is not limited to enabling protocols. In fact, it can also be used in other first-tier asset distribution protocols that use features, such as. In today's article, we will introduce isomorphic binding technology and its development prospect in detail through easy-to-understand language. The premise of isomorphic binding technology is that isomorphic ethereum and other blockchains use account model, which is another bookkeeping method. The difference between account model and account model is similar to the difference between using paper money and using bank transfer in real life, so if the blockchain wants to It is difficult to use isomorphic binding technology to empower a layer of asset issuance protocol that uses characteristics. Traditional cross-chain bridge scheme must be chosen to realize asset transfer and performance expansion through lock casting, destruction casting or lock unlocking. The model of blockchain is an improved version based on bitcoin model, which is of the same origin as the model, so we can bind or map one blockchain to another through isomorphic binding technology. Take the protocol as an example, because assets are inherently parasitic. In bitcoin, the protocol can map bitcoins into the blockchain one by one by using isomorphic binding technology, so that we can use the blockchain to replace the client verification. In order to better understand the isomorphic binding technology, we use land and title deed as analogy objects. If we compare the bitcoin main network to the land Zhang San, we issue an asset through the agreement, which is a paper title deed corresponding to an acre of land. The paper title deed is stored on the bitcoin blockchain, that is, Zhang San has this isomorphic binding technology. It is equivalent to issuing a corresponding electronic title deed for this paper title deed on the blockchain. Zhang San owns this title deed and transfers the mu of land to his relative Li Si, so the original mu of paper title deed is destroyed to generate a new paper title deed, one of which is mu and the other is still stored in the bitcoin blockchain. The difference is that the mu title deed is stored in the middle mu title deed controlled by Li Si. What needs special explanation is the role of the bitcoin blockchain here. It is to prevent Zhang San from using the paper title deed of mu for many times, that is, double flowers instead of verifying whether the land area of the newly generated title deed is exactly equal to mu. In other words, under the original agreement, the title deed that Li Si got said that mu needs Li Si's own verification, and Li Si also needs to verify the land traceability provided by Zhang San. It is proved that the original agreement needs client verification, and the client verification needs users to carry out bitcoin light client-side verification on the blockchain. It happened that the destruction of mu of paper title deed in Bitcoin blockchain generated a mu of paper title deed and a mu of paper title deed. It was verified whether it really happened. After the verification passed, mu of electronic title deed on the blockchain was destroyed, and an mu of electronic title deed was stored in Li Si's control room and an mu of electronic title deed was stored in Zhang San's control room. It needs to be specially explained that because the blockchain is Turing's complete, it can verify and ensure two newly generated electronic versions. The land area of the title deed adds up to exactly mu, and Li Si can see at a glance that mu is written on his title deed. Because the data on the blockchain is publicly visible, the protocol can replace the client verification of the protocol, that is, Li Si's verification in the second step, including the land traceability verification, is omitted. The above steps correspond to the operation process of isomorphic binding technology, which will be mapped to the cross-chain verification of the middle verification transaction. If you want to know more about this process, it is recommended to read the state change written by the founder magistrate of a county. In order to understand the security of isomorphic binding more conveniently, we still take the agreement as an example. We can clearly see that the security and prevention of double flowers of paper title deeds stored in bitcoin mainly depend on the security of bitcoin blockchain, and bitcoin is an electronic title deed generated by isomorphic binding technology which has been used for the longest time so far. Its security and prevention of double flowers mainly depend on the security of blockchain from the beginning. The time-tested consensus mechanism, which is exactly as long as Bitcoin, ensures the safety and decentralization to the maximum extent. The mining machine currently being dug is produced by Bitland, the world's largest mining machine manufacturer. At present, the computing power of the whole network has reached a record high. It is extremely difficult to forge or reconstruct a chain, because we need to recalculate the computing power of each block, so we can trust the security of the blockchain. Of course, you can also choose not to trust it. What you need to do is the second step in the above example. Personally verify whether the title deed says mu and the land traceability certificate provided by Zhang San is true and effective. This is also the practice of the agreement. The user needs to complete the client verification agreement by himself, but it only provides an additional choice. In addition to choosing to complete the client verification by himself, he can also choose to believe in the verification of the blockchain. Here, the blockchain is only used as a layer and status publicity to use the security of paper title deed transactions and even has nothing to do with it. The agreement does not only let the blockchain act as a layer, but also supports the operation. The assets on the bitcoin blockchain can go to the blockchain at any time and operate in reverse. Because the blockchain is complete, applications such as lending can be built on it, so the assets that come over can participate in various financial activities such as mortgage, loan, pledge and interest-bearing transactions. Holding the assets that come over to participate in various activities on the chain depends on the security of the blockchain. In the above, we introduced that the blockchain is actually very safe. If you still don't trust the security of the blockchain, you can. The risk of directly returning to the bitcoin blockchain to become an asset function on the bitcoin blockchain lies in the block reorganization, which can be avoided by waiting for several more block confirmations. After the confirmation of the last block on the bitcoin chain, it is considered that the number of irreversible confirmations and security are not linear. It is difficult to overthrow the block. With the increase of the push index of the block, it only takes about one block confirmation to realize the same security on the blockchain, and the average time for block confirmation is about seconds. Therefore, the schematic diagram of security is far less than that of the confirmation of each block in bitcoin. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。