木头姐:Web3万马奔腾

近期,华尔街明星基金经理、方舟投资管理公司的首席执行官“木头姐”凯茜·伍德(Cathie Wood)带领她的ARK研究团队如期发布了名为《Big Ideas 2024》报告。

颠覆性创新技术

在这份长达163页的报告中,“木头姐”继续把目光锁定“颠覆性创新技术”领域,并多次提及区块链领域。

文中将筛选,总结,深度解读其报告中的核心观点。

未来,随着区块链技术大规模采用后,所有的资金和合同都可能转移到公共区块链,以验证数字稀缺性和所有权证明。

金融生态系统很可能会重置,以适应加密货币和智能合约的崛起。

这些技术增加了透明度,减少了资本和监管控制的影响,并降低了合同执行成本。

在这样的世界里,随着越来越多的资产变得像钱一样,以及企业和消费者适应新的金融基础设施,数字钱包将变得越来越必要,而公司结构本身也可能会受到质疑。

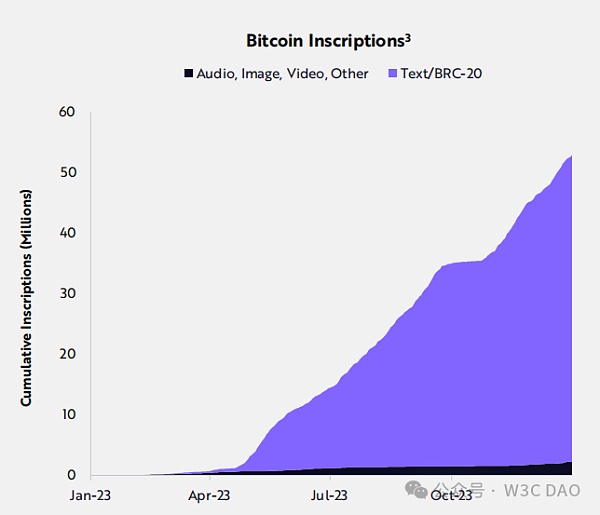

她还提及比特币铭文,其是一项颠覆性的创新,通过为每个比特币Sats引入一个独特的编号系统,而每个Sats都是可识别和不可变的,允许用户记录他们的数据、图像或文本。

与其他区块链不同,比特币铭文位于比特币区块链的基底层。

“在我们看来,这是自由市场的产物,代表着比特币的健康创新。”

深度解读

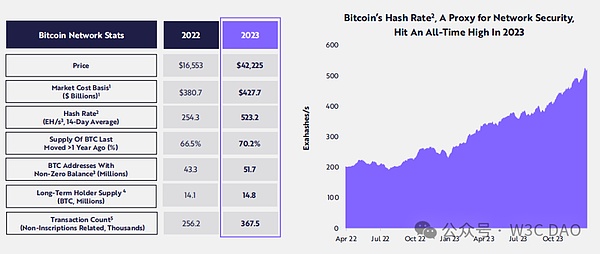

这张图片是关于比特币的基本面和网络统计数据在2022年和2023年之间的对比和分析。

它突出了比特币在各个方面的显著增长,包括价格、市场成本基础、哈希率、一年前移动的比特币供应、非零余额的比特币地址、长期持有者供应和交易数量。

标题是“比特币的基本面在2022年的危机中没有跳过一拍,并在2023年继续加速。”

图片右侧是一个图表,显示了比特币的哈希率随时间的稳步增长,达到了2023年10月的历史最高水平。哈希率是网络安全的一个代理指标。

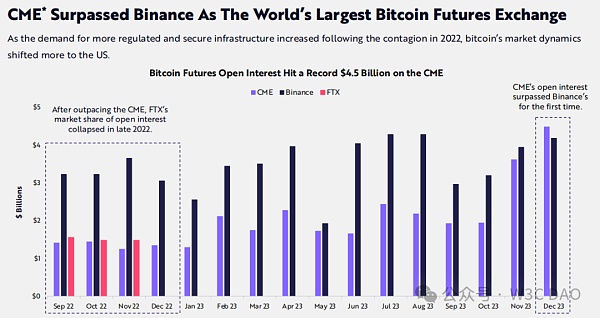

这张图片是关于比特币期货未平仓合约量在CME、币安和FTX之间的对比。

它显示了未来CME由于更多的监管和安全需求而超过了币安,将成为了世界上最大的比特币期货交易所。

图片的标题是“CME 将超过币安,成为了世界上最大的比特币期货交易所”。

副标题解释了背景:“随着2022年危机后对更多监管和安全基础设施的需求增加,比特币的市场动态更多地转向了美国。”而图表显示了“CME上的比特币期货未平仓合约量达到了45亿美元的记录”。

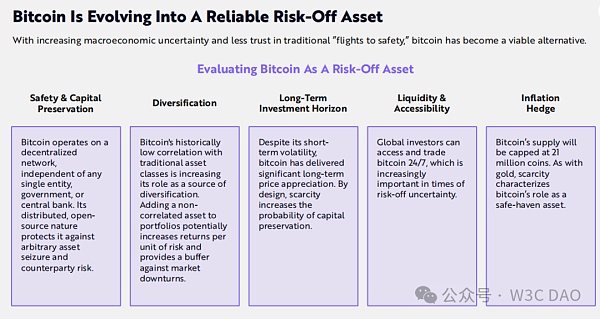

这张图片是关于比特币如何在宏观经济不确定性和对传统“避险资产”的信任下降的情况下,演变成为一个可靠的避险资产。它从以下几个方面评估了比特币作为避险资产的价值:

安全性和资本保值:比特币运行在一个去中心化的网络上,不受任何单一实体、政府或中央银行的影响。它的开源性质保护它免受任意的资产没收和对手方风险。

多元化:比特币与传统资产类别的相关性很低,增强了它在投资组合多元化中的作用。将一个非相关的资产加入投资组合,可能会提高单位风险的收益,并在市场下跌时提供一个缓冲。

长期投资视角:尽管比特币存在短期波动,但由于其设计和稀缺性,它有着显著的长期价格增长的潜力。

流动性和可及性:全球的投资者可以24/7地访问和交易比特币,突出了它在避险不确定性时期的重要性。

通胀对冲:比特币的供应上限为2100万枚。它的稀缺性特征使它与黄金作为通胀对冲的角色相一致。。

关于智能合约

智能合同部署在公共区块链上,为寻租中介机构和传统金融基础设施提供了一种全球、自动化和可审计的替代方案。

在2022年的“加密货币危机”之后,一些数字资产解决方案获得了支持,包括稳定币、代币化的财政基金和规模化技术。

根据ARK的研究,随着链上金融资产价值的增加,与去中心化应用程序相关的市场价值的年增长率可以达到32%,从2023年的7750亿美元增长到2030年的5.2万亿美元。

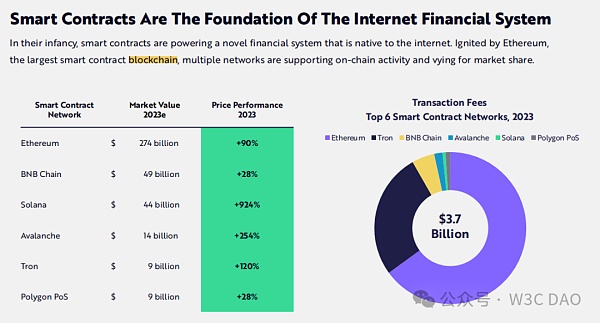

表格显示了不同的智能合约网络,包括以太坊、币安链、Solana、Avalanche、波场和Polygon PoS。

表格还显示了它们在2023年的预计市值和价格表现。以太坊以2740亿美元的市值和+90%的价格表现领先。

图片的右侧是一个饼图,标注了“2023年前6大智能合约网络”。它直观地表示了这些网络的交易费总额为37亿美元。

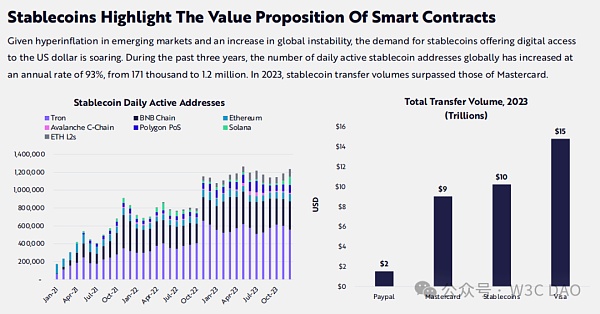

这张图片是关于稳定币在传统金融系统中的价值主张的对比和分析。

由于新兴市场的高通胀和全球不稳定性的增加,稳定币作为一种提供数字化美元接入的方式,需求飙升。

它还展示了两个图表,一个是不同区块链网络的稳定币日活跃地址数,从2021年1月到10月有显著的增长;另一个是2023年的总转账量,以万亿美元为单位,将PayPal、Mastercard、稳定币和Visa进行了比较。显示了稳定币预计在2023年将超过Mastercard,但仍低于Visa的总转账量。

写在最后

众所周知,木头姐,她的投资理念是选择那些能够改变世界的公司,而不是那些随着世界的改变而不会被改变的公司。

可以说,她是比特币的忠实粉丝,曾多次认为比特币有望达到100万美元/枚的价格目标。

正如ARK研究团队发布《Big Ideas 2024》报告中提及,未来,所有资金都可能转移到公共区块链Layer1上,金融生态系统很可能会重置,公司和社会体系本身也将受到影响。

Recently, Kathy Wood, CEO of Ark Investment Management Company, the star fund manager of Wall Street, led her research team to release a report on disruptive innovation technology as scheduled. In this full-page report, Sister Mu continued to focus on the field of disruptive innovation technology and mentioned the blockchain field many times. This paper will screen and summarize the core ideas in the report. In the future, with the large-scale adoption of blockchain technology, all funds and contracts may be transferred to public blockchains for inspection. Digital scarcity and ownership prove that the financial ecosystem is likely to be reset to adapt to the rise of cryptocurrency and smart contracts. These technologies have increased transparency, reduced the impact of capital and regulatory control, and reduced the cost of contract execution. In such a world, as more and more assets become like money, and enterprises and consumers adapt to the new financial infrastructure, digital wallets will become more and more necessary, and the company structure itself may be questioned. She also mentioned the inscription of Bitcoin, which is one of them. A subversive innovation allows users to record their data, images or texts by introducing a unique numbering system for each bitcoin, each of which is identifiable and immutable. Unlike other blockchains, the bitcoin inscription is located at the bottom of the bitcoin blockchain. In our view, this is the product of the free market and represents the healthy innovation of bitcoin. In-depth interpretation of this picture is about the comparison and analysis of bitcoin fundamentals and network statistics between years, which highlights the bitcoin in each year. Significant growth in these aspects includes price, market cost, basic hash rate, bitcoin moved one year ago, bitcoin address with non-zero balance, long-term holder supply and number of transactions. The title is that the fundamentals of bitcoin did not skip a beat in the crisis of 2000 and continued to accelerate in 2000. On the right side of the picture is a chart showing that the hash rate of bitcoin has increased steadily with time, reaching the highest level in history in June. The hash rate is an agent indicator of network security. This picture is about the uneven bitcoin futures. The comparison of warehouse contracts between Bi 'an and Bi 'an shows that Bi 'an will become the world's largest bitcoin futures exchange in the future due to more regulatory and security requirements. The title of the picture is to surpass Bi 'an to become the world's largest bitcoin futures exchange. The subtitle explains the background. With the increasing demand for more regulatory and security infrastructure after the crisis in, the market dynamics of Bitcoin have turned to the United States, and the chart shows that the amount of open contracts of Bitcoin futures in the world has reached. This picture is about how Bitcoin has evolved into a reliable safe-haven asset under the circumstances of macroeconomic uncertainty and declining trust in traditional safe-haven assets. It evaluates the value, security and capital preservation of Bitcoin as a safe-haven asset from the following aspects. Bitcoin runs on a decentralized network and is not affected by any single entity government or central bank. Its open source nature protects it from arbitrary asset confiscation and counterparty risk diversification ratio. The low correlation between special currency and traditional asset classes enhances its role in portfolio diversification. Adding an unrelated asset to the portfolio may increase the return of unit risk and provide a buffer for long-term investment when the market falls. Although bitcoin has short-term fluctuations, it has significant potential for long-term price growth due to its design and scarcity. The liquidity and accessibility of global investors can effectively visit and trade Bitcoin, which highlights its risk aversion and uncertainty. Importance Inflation Hedging The supply limit of Bitcoin is 10,000 pieces. Its scarcity makes it consistent with the role of gold as an inflation hedge. The deployment of smart contracts on public blockchains provides a global automated and auditable alternative for rent-seeking intermediaries and traditional financial infrastructure. After the cryptocurrency crisis in 2000, some digital asset solutions were supported, including the study of financial funds and large-scale technical basis for stabilizing currency tokens. The increase in the value of financial assets and the annual growth rate of market value related to decentralized applications can reach from $ billion in to $ trillion in. The table shows different smart contract networks, including the Ethereum currency chain wave field and table, and also shows their estimated market value and price performance in. Ethereum leads the picture with a market value of $ billion and a price. On the right side is a pie chart marking the big smart contract networks years ago, which visually shows that the total transaction fees of these networks are This picture is about the comparison and analysis of the value proposition of stable currency in the traditional financial system. Due to the high inflation in emerging markets and the increase of global instability, the demand for stable currency as a way to provide digital dollar access has soared. It also shows two charts. One is that the number of daily active addresses of stable currency in different blockchain networks has increased significantly from year to month, and the other is that the total transfer amount in the year is trillions of dollars, which shows the forecast of stable currency. It is well known that Mujie's investment philosophy is to choose companies that can change the world instead of those that will not change with the change of the world. It can be said that she is a loyal fan of Bitcoin and has repeatedly thought that Bitcoin is expected to reach the price target of $10,000. As mentioned in the report released by the research team, all funds may be transferred to the public blockchain in the future, and the financial ecosystem will probably be reset and the social system itself will be affected. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。