科学家居然还能这么抢比特币NFT?

作者:Cookie;来源:区块律动

过去的一周,有越来越多的朋友问到小编这样一个问题——

明明像 Magic Eden 这样的比特币 NFT 交易市场是「锁单」的,为什么购买的 NFT 最后没有到呢?查看购买交易,显示交易被替换,东西被人「抢单」了。

答案是:你被「RBF」了。

其实这已经不是一个老问题了。去年 11 月底,在 Magic Eden Launchpad 上发行的「OrdiBot」系列成为第一个著名受害者,@mulan_art 的「Unigraphs」系列也马上延迟了在 Magic Eden Launchpad 上的发行,原因正是因为当时「RBF」可以使任何非白单的用户绕过白名单机制来「抢跑」。之后 Magic Eden 针对其 Launchpad 的这个问题做出了修复,现在,Magic Eden Launchpad 白名单铸造不需要再担心被「RBF」了。(相关阅读:白单用户 Mint 遭狙击手「半路抢劫」,Ordibots 将重发空投以弥补损失)

解决方案是铸造交易「Unigraphs」

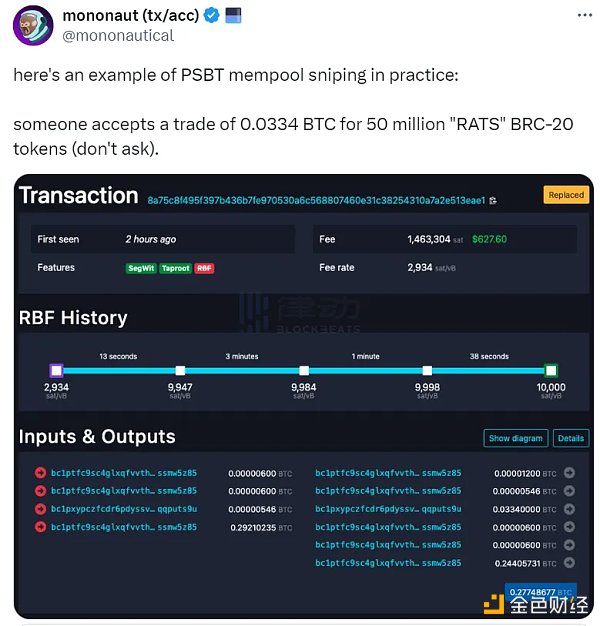

去年底,有人用 0.0334 比特币来「抢跑」5000 万个 BRC-20 Token $RATS 的交易。

而上个月,拥有「金色斗篷」(可以在未来免费获得一个 Taproot Wizards)的「量子猫」cat0673,最先提交交易的买家也被额外支付了 180 美元矿工费的另一位买家给「抢跑」了。而最后成交的买家转手挂了 1.9 比特币卖出去了。

「量子猫」cat0673

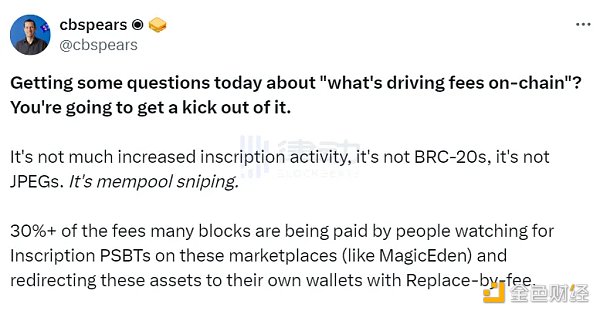

最近比特币生态的火爆,让越来越多的朋友遭遇了这个问题,讨论的声音也越来越多。今天凌晨,小编一直在疑惑到底为什么比特币网络的费率居高不下,尽管昨天晚上到今天凌晨是项目扎堆发行的一天,但是看链上的铭文情况并没有足以把网络搞堵的 BRC-20 或是小图片项目出现。现在小编终于知道为什么了——很多区块 30% 以上的矿工费都是因为「RBF」狙击导致的...

到这里,您可能会疑问:像 Magic Eden 上面只要购买了,那么网页上就不能再有第二个人点击购买按钮,这些「抢跑」是如何实现的?

PSBT 交易机制导致的 RBF「抢跑」

首先我们要了解,像 Magic Eden 这样的比特币 NFT 交易市场采用的是 PSBT,即「部分签名的比特币交易」(Partially Signed Bitcoin Transactions)。简单来说,买卖双方都根据 NFT 交易市场提供的包含交易信息模板进行签名,卖方的签名在上架时就完成,而买方则是提交购买时完成。然后市场将买卖双方的两部分签名组合起来进行广播。(相关阅读:Ordinals 创始人怒驳 Yuga Labs 拍卖,为什么 PSBT 才是比特币 NFT 交易的正解?)

但是问题在交易进入 mempool 以后就来了。当组合起来的交易被广播以后,卖方的那部分签名内容就因为交易进入了 mempool 而变得所有人都能看见。卖方的签名内容暴露后,就意味着所有人都可以作为买方进行签名交易。

这样一来,mempool 实际上从「内存池」变为了「PVP 池」——由于比特币相邻两个区块都爆出来的时间间隔往往比较长,在最初的交易被广播后,「狙击手」如果觉得「抢跑」有利可图,就拿着已经暴露的卖方签名重签一个买方为自己的交易,然后利用 RBF 把自己的交易费率拉得飞起,矿工自然会优先打包给的矿工费更高的交易。(简单说下,RBF 就是「费用替换 Replace by Fee」,通过支付更高的交易费用来达成更快的交易确认)

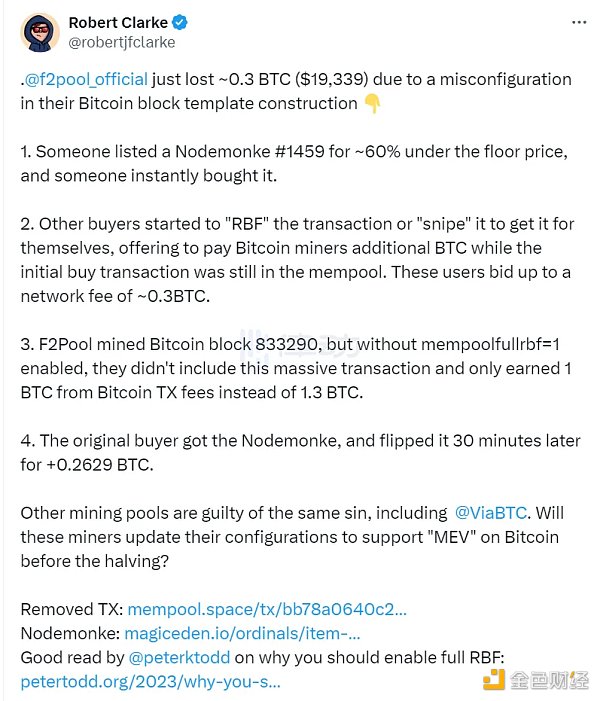

当然「狙击手」们也有翻车的时候。比如 @robertjfclarke 在今年 3 月提到的一笔 NodeMonkes 的「RBF」狙击,因为开采出该区块的 F2Pool 没有允许「full RBF」而导致抢跑交易没有被打包,最终结果是最开始的那位买家成功拿到了这个在当时低于地板价约 60% 的 NodeMonkes,并且在半小时后成功 Flip 收获 0.2629 比特币的利润。

比特币「MEV」使费率估算失灵?

其实 PSBT 导致的 RBF 抢跑和以太坊上拉 Gas 是一样的,区别只是比特币的区块确认时间更长,在以太坊上往往 10 几秒就出下一个块了,大家就很清楚是在「卷」。而比特币上的各种概念大家可能一时间会稍微陌生一些,实际上 RBF 抢跑和以太坊上的 MEV 最终呈现出来的效果还是有点像的。

如果比特币生态持续火爆,对于流动性好、市场表现好的资产,会有越来越多的人进来争夺这块套利空间。小编已经看到有专门提供狙击工具的项目出现了,比如 @goldmine_tools。这样的情况假设真的发生,那么对受到大家追捧的资产来说,预估区块费率实际上就会出现一定程度的失灵,实质上交易变成了价格固定但需要 bid 矿工费的「拍卖」,矿工美滋滋了。

RBF History 越卷越高的费率,受益的实际上是矿工

而对于 Magic Eden 这样的交易市场,我想只是需要更好地让用户了解购买 NFT 的流程实际上是这样的,在此基础上去优化 NFT 的购买流程即可。比如,为大家提供一个 RBF 工具,把现在的前端页面锁单改成「该 NFT 已有 TX Pending」,然后允许大家去支付更高的费率就好了。ETH 上的 NFT 聚合器正是如此,会出现 Pending 提示,但是愿意拉高 Gas 去抢也无妨。

结语

写到最后想起大家可能很关心的一个问题——如果被 RBF 了,会亏矿工费和买东西的钱吗?

不会。

In the past week, more and more friends have asked Xiaobian such a question. Obviously, the bitcoin trading market like this is locked. Why didn't the purchase arrive at last? Looking at the purchase transaction, it shows that the replaced thing was robbed. The answer is that you were robbed. In fact, this is not an old problem. The series released in the world at the end of last year became the first famous victim, and the release in the world was immediately delayed because it was possible to make any non-white orders at that time. After users bypassed the whitelist mechanism to get away with it, they fixed this problem. Now whitelist casting doesn't need to worry about being robbed by snipers halfway, and the solution is to make up for the loss. At the end of last year, someone used bitcoin to get away with thousands of transactions. Last month, the first buyer who submitted a quantum cat with a golden cloak and could get one for free in the future was also robbed by another buyer who paid an extra dollar for miners. The buyer who finally clinched the deal changed hands and sold the bitcoin. Recently, the popularity of bitcoin ecology has caused more and more friends to encounter this problem, and the voices of discussion have become more and more. This morning, Xiaobian has been wondering why the rate of bitcoin network remains high. Although last night to this morning was the day when the projects were released together, the inscriptions on the chain were not enough to block the network or the small picture projects appeared. Now Xiaobian finally knows why there are many blocks. The above miners' fees are all caused by sniping. Here, you may wonder how the second person can't click the buy button on the webpage as long as you buy it. First of all, we need to understand that the bitcoin trading market like this adopts a partially signed bitcoin transaction. Simply put, both buyers and sellers sign according to the template containing trading information provided by the trading market. The seller's signature is completed when it is put on the shelf, while the buyer is. It is completed when the purchase is submitted, and then the market combines the signatures of both buyers and sellers for broadcasting. The founder angrily refutes why the auction is the right solution to the bitcoin transaction, but the problem comes after the transaction is entered. When the combined transaction is broadcast, the signature content of the seller becomes visible to everyone because of the transaction. After the exposure, it means that everyone can sign the transaction as a buyer, which actually changes from the memory pool. In order to pool, because the time interval between the two adjacent blocks of Bitcoin is often long, after the initial transaction is broadcast, snipers will sign a buyer's own transaction with the exposed seller's signature if they think it is profitable, and then use their own transaction rate to fly up. Miners will naturally give priority to the miners with higher transaction costs. Simply put, it is cost replacement to achieve faster transaction confirmation by paying higher transaction costs. Of course, snipers also have rollover. Sometimes, for example, in this month, a sniper mentioned that the block was not allowed to be mined, which led to the rush-off transaction not being packaged. The final result was that the initial buyer successfully got the profit that was lower than the floor price at that time and successfully harvested bitcoin after half an hour. Bitcoin made the rate estimation fail. In fact, the rush-off caused by it was the same as the pull-up in Ethereum, except that the block confirmation time of Bitcoin was longer, and the next block was often released in a few seconds in Ethereum. It is clear that the various concepts on Bitcoin are unfamiliar to you for a while. In fact, the effect of rushing away is still a bit similar to that of the ethereum. If the bitcoin ecology continues to be hot, more and more people will come in to compete for this arbitrage space for assets with good liquidity and good market performance. Xiaobian has seen that there are projects that provide sniper tools. For example, if such a situation really happens, then estimate the blocks for assets that are sought after by everyone. In fact, the rate will fail to a certain extent. In essence, the transaction will become an auction with a fixed price but a miner's fee. The miners are flattered, and the higher the rate is, the miners will actually benefit. For such a trading market, I think it is only necessary to better let users know the purchase process. On this basis, the optimized purchase process can, for example, provide a tool for everyone to change the current front-end page lock list into the existing one and then allow everyone to pay a higher rate. Well, that's exactly what happens to the aggregator in the world, but there's no harm in being willing to pull it up and grab it. At the end of the conclusion, I think of a question that everyone may be very concerned about. Will it lose miners' fees and money for buying things if it is won? No. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。