比特币暴涨,谁在控盘比特币?

文 | 链得得 王心玉

I'll be right back. I'll be right back. I'll be right back. I'll be right back.

截至链得得发稿,比特币于币安交易所上,BTC/USDT交易对价格再次突破34000美元。过去两个月中,比特币的资产价格飙升,引领了整个全球加密资产行业的牛市回归。机构进场、共识强化、对冲套利、资产避险、货币宽松的宏观环境、连接加密与传统金融市场的通路增多,种种迹象表明比特币已不在局限于小范围的资本游戏中。

In the last two months, the price of Bitcoin’s assets has soared that it has led to a return of cattle throughout the world’s encrypted asset industry. Institutional entry, strengthened consensus, hedges, asset avoidance, a monetary easing macro-environment, and increased access to encryption and traditional financial markets suggest that Bitcoin is no longer limited to small-scale capital games.

究竟谁在控盘比特币?最大的利益攸关方是谁?谁在其中谋取了最大收益?未来比特币的筹码还会以什么格局继续流动?人们一直以来都在探究比特币持仓排行的问题,但是大多数答案使用的数据或太过陈旧,或维度设计不科学,很难让人获得有价值的参考。因此,链得得特为撰文,试图在这个时点解答这一问题。

Who's on the control plate bitcoin? Who's the biggest stakeholder? Who's got the greatest profit in it? What will the future bitcoin chips continue to flow in? People have been asking questions about Bitcoin's siloing, but most of the answers are either too old, or the dimensions are unscientific, making it hard to get valuable references.

首先,要承认一点,由于加密资产的匿名性,任何“持仓榜单”均无法做到100%准确。原因有二:一来,很少有BTC大户会把所有的资产放在同一个地址中,他们大多将资产分散在不同的地址里面;其次,虽然BTC链上信息透明,但是很少有大户会对外公布自己的BTC地址。因此,我们几乎不可能从链上数据了解到谁是BTC持仓大户,以及他们的真实身份。我们只是尽可能通过公开数据、自洽分析维度和行业走访来尽可能识别真假,使表单相对准确。

First, to admit that, because of the anonymity of encrypted assets, no “stork list” can be 100% accurate. For two reasons: first, few BTC large households put all their assets in the same address, most of them spread the assets in different addresses; second, while the BTC chain is transparent, few large households publish their own BTC addresses. Therefore, it is almost impossible for us to know from the data chain who the BTC is and their true identity. We only try to identify the true facts as accurately as possible through public data, self-analysis of dimensions and industry visits.

链得得依据以下三个维度排列出BTC持仓榜单。这三大维度主体分别是:1、以机构或组织形式为主体持有BTC的数量排行。2、以BTC链上单个存储地址最新余额数量为主体的排行。3、以自然人为主体持有BTC数量的排行。

The chain may be arranged according to the following three dimensions. The three dimensions are: 1; the number of BTC holdings held by the main body in the form of an institution or an organization. 2; the number of the most recent balances of the individual storage address on the BTC chain as the main subject. 3 The number of BTC holdings by the natural person as the main subject.

首先,我们先来看一下链得得根据公开数据综合分析统计出的比特币十大持仓机构 。下面会为大家一一分析。

First of all, let's look at the chain, and we'll look at the top ten bitcoins based on a comprehensive analysis of open data. Here's one for you.

最新数据显示,目前这十大机构的总持仓达到了118.5万枚比特币,占目前BTC流通量的6.37%。而根据能搜索到的数据,在2020年年初,这10大机构的持仓量为47.8万,一年内总增长量为60.6万枚BTC。

According to the latest data, the total holdings of these 10 institutions now amount to 1,85,000 bitcoins, or 6.37 per cent of the current circulation of BTC. According to searchable data, the holdings of these 10 institutions at the beginning of 2020 were 478,000, with an overall increase of 606,000 BTCs in one year.

数据研究过程

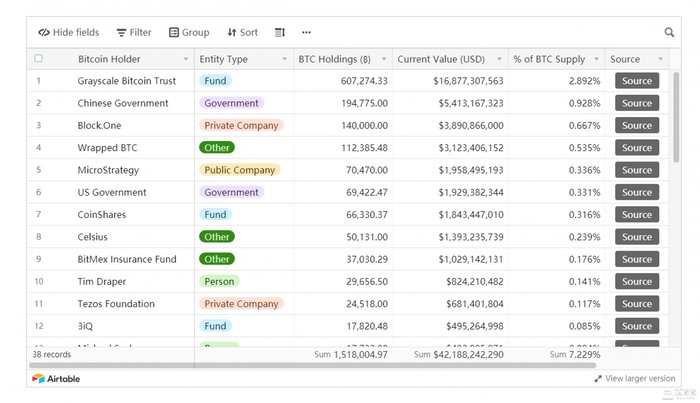

链得得找到了两个比较权威的BTC持仓排行(按公司和组织排序)网站,分别是https://bitcointreasuries.org/和https://www.kevinrooke.com/bitcoin

The chain was able to find two more authoritative BTC holding (sequenced by company and organization) websites: https://bitcointreasuries.org/ and https://www.kevinbrooke.com/bitcoin

Bitcoin Treasuries网站上收集了全球各地40余家公司的BTC持仓,同时还附有数据来源。从网站上可以看到,数据更新时间大多集中于2020下半年,数据来源大多是各个公司自己发布的报告。

Bitcoin Treasuries collects BTC warehouses from more than 40 companies around the world, with data sources. As can be seen from the website, most of the data updates are in the second half of 2020, and most of the data is based on reports published by companies themselves.

另一家网站名为Kevin Rooke。这家网站的BTC持仓大户列表里面收集了38个实体,范围除了上一家网站的公司、基金,还把个人和“其它”类别(例如Wrapped BTC)包含了进去。从灰度BTC持仓的数字来看,Kevin Rooke这家网站的更新速度更快,同时也附有来源,便于读者求证。

Another site is called Kevin Rooke. The BTC web site contains 38 entities, including individuals and “other” categories (e.g., Wrapped BTC), in addition to the company, fund of the site. From the greyscale BTC warehouse figures, Kevin Rooke’s website is being updated more quickly, with a source that will make it easier for readers to verify.

结合两个网站的数据,链得得制作了BTC持仓TOP10(按公司和组织排序)。

Combined with data from two websites, the chain made it possible to produce BTC warehouse toP10 (sequence by company and organization).

在Kevin Rooke网站上,我们看到了“中国政府”和“美国政府”。两个政府的BTC持仓实际上是在两起非法案件中没收的资金。在涉案金额高达42亿美金的Plustoken 传销案中,中国政府没收的BTC数量达19.4万。据新浪财经12月1日报道 ,“这笔比特币已经委托场外公司进行变现处置了。再兑换成人民币后上缴国库,具体什么时候处置掉的没说,但看案件审理进度。大概率是 6 个月前就卖掉了。”

On Kevin Rooke's website, we saw “the Chinese government” and “the United States government.” The government's BTC warehouse was in fact seized in two illegal cases. In the Plustoken case, involving $4.2 billion, the Chinese government confiscated the BTC amount of 194 million.

而美国政府没收的黑市网站“丝绸之路”的近7万枚比特币据推测在11月初被转移到了新地址:bc1qa5wkgaew2dkv56kfvj49j0av5nml45x9ek9hz6。该地址持仓量位居第5名。截至发稿,这笔比特币还没有被移动或变现。

The Government of the United States confiscated nearly 70,000 bitcoins of the black market website Silk Road, presumably transferred to a new address at the beginning of November: bc1qa5wkgaew2dkv56kfvj49j0av5nml45x9ek9hz6. The address is in fifth place. As of the release, the bitcoin had not been moved or realized.

因此,在我们制作的表单中移除了中国政府,而保留了美国政府。

As a result, the Chinese Government was removed from the form we produced and the United States Government was retained.

下面,我们来对榜单中的10大持仓实体进行一一讲解。

Here's what we're going to do with the top 10 entities on the list.

1. 灰度比特币信托

1. Greyscale Bitcoin Trust

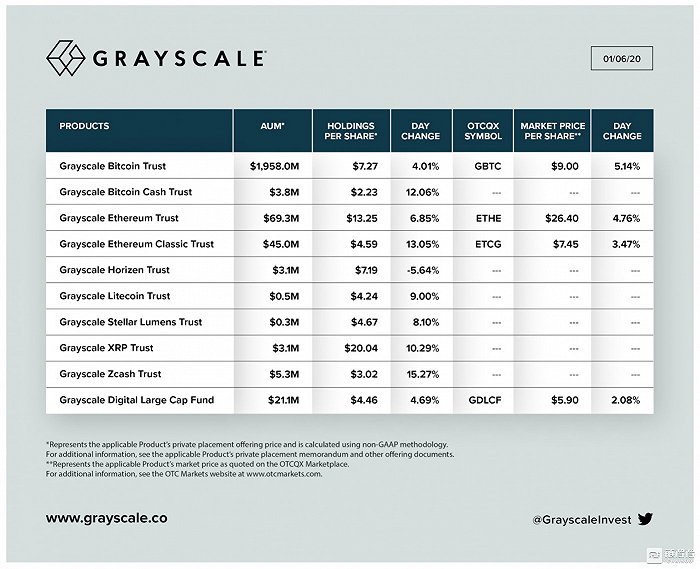

首先,排名第一毋庸置疑是灰度的比特币信托,从其发布最新推特中可以了解到,截至2020年12月30日,灰度比特币信托的总规模达到了160亿美金,约合60.7万比特币,占BTC目前总流通量的近3.26%。

First of all, the first-ranked bitcoin trust, of unquestionable grey scale, is known from its latest tweets that, as at 30 December 2020, it had reached a total size of $16 billion, or approximately 607,000 bitcoins, or nearly 326 per cent of the current total circulation of BTC.

相比之下,在2020年年初,灰度BTC信托的管理资金量仅为19.6亿,按照当时的币价7500美金计算,灰度在今年年初的BTC持仓量约为26万,占当时BTC流通量的1.43%。2020年一年,灰度持仓的BTC数量增加了34.7万枚。

By contrast, at the beginning of 2020, the volume of management funds in the Greyscale BTC Trust was only $1.96 billion. At the current currency value of $7,500, the size of the Grey Level BTC held about $260,000 at the beginning of this year, or 1.43 per cent of the volume of BTC in circulation at that time. In 2020, the number of grey BTC in stock increased by 347,000.

2. Block.one

Block.one是一家软件公司。专为EOS开发而成立。EOSIO软件开发的主要贡献者。Block.one和EOS最出名的是在2018年6月至2019年6月之间进行了为期一年的令牌众筹,产生了40亿美元的总筹款。

Block.one is a software company. It was created for EOS development. The main contributor to EOSIO software development. Block.one and EOS were most well known for their year-long campaign between June 2018 and June 2019, generating $4 billion in total fund-raising.

虽然其它许多代币众筹交易面临严厉的监管,导致罚款,活动终止甚至退还给投资者,但Block.one能够通过与之达成和解的方式解决美国的监管费用。最终SEC处以2400万美元的民事罚款,仅占众筹收益的0.6%。

While many other money-repository transactions are subject to severe regulation, resulting in fines, termination of activities and even refunds to investors, Block.one is able to settle the regulatory costs of the United States through a settlement with it. The final civil fine of $24 million was imposed by SEC, representing only 0.6 per cent of the revenue raised by the public.

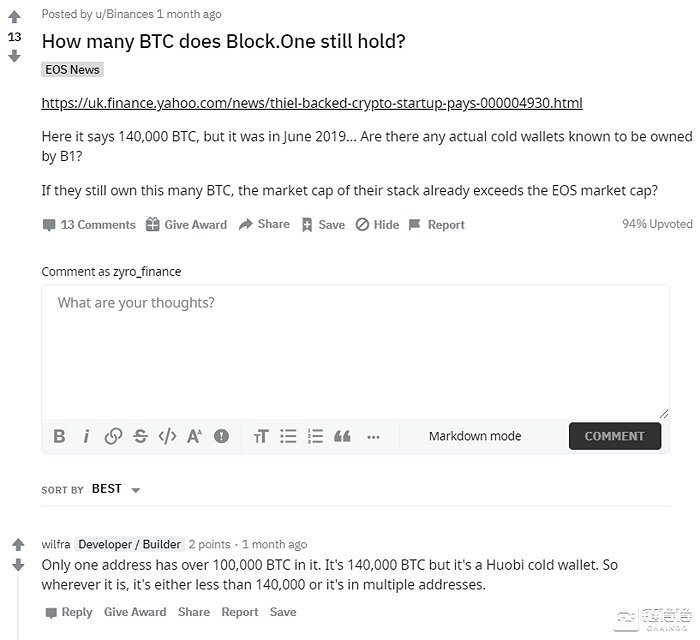

Block.one 比特币持仓量的最新数据来源于雅虎财经在2019年5月22号发表的一篇名为《Thiel-Backed Crypto Startup Pays Out 6,567% Return》的报道。报道中指出,“据知情人士透露,Block.one 公司持有多达 14 万比特币,使其成为原始加密货币最大的持有者之一。而在一封电子邮件中,该公司表示,截至 5 月 15 日随着比特币今年的反弹,上述的由于流动性产生的加密货币损失已完全恢复。”

Block.one's latest data on the holdings of Bitcoin is based on a report published by Yahoo Finance on 22 May 2019, entitled Thiel-Backed Crypto Startup Pays Out 6,567% Returrn, which states that “Block.one, according to informed sources, holds up to 140,000 bitcoins, making it one of the largest holders of the original encrypted currency.” In an e-mail, the company stated that the above-mentioned losses of encrypted currency due to liquidity had fully recovered as of May 15 as the currency rebounded this year.”

链得得发现,在一个月前,Reddit上也网友提问:“在2019年Block.One被报道拥有14万枚BTC, 有没有人知道他们的冷钱包地址?如果他们现在(2020年11月14日)还拥有同样数量的BTC,那么他们的市值已经超过EOS了。”

The chain found that, a month ago, Reddit also asked the Internet: “In 2019 Block.One was reported to have 140,000 BTCs, does anyone know their cold wallet address? If they now have the same number of BTCs (14 November 2020), their market value is already greater than EOS.”

一名网友回答说:“现在BTC链上余额最多(14万)的地址属于火币的冷钱包,所以Block.one可能是将自己的BTC资产分散在了不同的地址,或者是余额已经不足14万。”

One of the web users replied: “Now that the highest remaining (140,000) in the BTC chain is a cold wallet in the currency, Block.one may have dispersed his BTC assets at different addresses, or the balance is already less than 140,000”.

3. Wrapped BTC

WBTC是一种比特币的衍生资产,是发行在以太坊网络上的比特币,可以理解为 1 WBTC=1 BTC。这个就像USDT与美元挂钩,WBTC 通过与比特币锚定,实现价值转移,从而使得比特币可以间接用在以太坊网络上。每向智能合约抵押一枚比特币,便自动生成一枚 WBTC;反之,每赎回一枚比特币,便销毁一枚 WBTC。WBTC主要被BTC的持有者用来参与以太坊生态中DeFi项目。

WBTC is a derivative of Bitcoin, distributed on the Etherm network, and is understood to be 1 MBTC = 1 BTC. This, like USDT pegged to the dollar, is a value transfer by anchoring with Bitcoin, which allows Bitcoin to be used indirectly on the Etherton network. For each smart contract to mortgage a bitcoin, it automatically generates a WBTC; conversely, for each to redeem a bitcoin, it destroys a WBTC. The WBTC is mainly used by BTC holders to participate in the DeFi project in the Taiyu ecology.

链得得在之前的文章也介绍过,比特币暴涨与WBTC也密切相关。流动性挖矿效应刺激WBTC需求增加,WBTC进一步导致比特币需求上涨,从而推动二级市场比特币购买效应增强,导致比特币价格上涨。

The chain has also been described in previous articles, and the surge in bitcoin is closely linked to the WBTC. The effect of mobile mining has spurred increased demand in the WBTC, which has led to further increases in bitcoin demand, thus driving the secondary market to become more effective in bitcoin, leading to higher Bitcoin prices.

在WBTC的官网,也可以找到所有WBTC协议的BTC托管地址:

On the WBTC network, the BTC hosting address for all WBTC protocols can also be found:

截至发稿,WBTC协议中的比特币数量为113,225.6419 枚。

As of the date of issuance, the number of Bitcoin in the WBTC agreement was 113,225.6419.

Debank数据显示,在2020年初,WBTC的BTC锁仓数量仅为589个。2020年WBTC协议的BTC持仓上涨了190倍。

Debank data show that at the beginning of 2020 there were only 589 BTC lock-ups in WBTC. In 2020, the BTC held a 190-fold increase in the WBTC agreement.

4. MicroStrategy

MicroStrategy Incorporated是一家提供商业智能、移动软件和基于云的服务的美国上市公司。 该公司由Michael J. Saylor和Sanju Bansal于1989年创立,开发用于分析内部和外部数据的软件,以便做出业务决策和开发移动应用程序。

MicroStrategy Incorporated, a United States listed company that provides business intelligence, mobile software and cloud-based services, was created in 1989 by Michael J. Saylor and Sanju Bansal to develop software for the analysis of internal and external data for business decision-making and mobile applications.

8月11日,MicroStrategy宣布已在比特币上投资了2.5亿美元;9月8日,MicroStrategy再宣布投入1.75亿美元购买比特币,至此该公司在比特币上的投资规模已经达到4.25亿美元;12月21日,CEO Michael Saylor 在推特上宣布:MicroStrategy以6.5亿美元现金购入约29,646枚比特币。至此,MicroStrategy BTC总持仓量已达70,470枚。有趣的是, 这笔持仓目前价值约为20.44亿美金,而Michael Saylor在推特中特别指出, MicroStrategy买入这些BTC只花了11.25亿美金。

On 11 August, MicroStrategy announced that it had invested $250 million in bitcoin; on 8 September, MicroStrategy announced another $175 million to buy bitcoins, so that its investment in bitcoin had reached $425 million; and on 21 December, CEO Michael Saylor announced on Twitter that MicroStrategy had purchased about 29,646 bitcoins for $650 million in cash. To that end, MicroStrategy BTC had a total stock of 70,470. Interestingly, it currently had a stock value of approximately $2,044 million, while Michael Saylor noted in Twitter that MicroStrategy had spent only $1,125 million on BTCs.

相比之下,在2020年年初,并没有出现MicroStratrgy投资比特币的消息。链得得在2020年1月到6月的区间内搜索“MicroStrategy”和“BTC”、“Bitcoin”字眼,也未见任何有效信息。

By contrast, in early 2020, there was no news of MicroStragy investing in bitcoin. The chain had to search the areas between January and June 2020 for the words “MicroStrategy” and “BTC” and “Bitcoin” without any valid information.

5. 美国政府

“丝绸之路”是一个在线黑市,出售毒品、被盗的信用卡,甚至能买凶杀人。它于2013年被美国政府关闭。丝绸之路创始人于 2015 年被正式起诉,但留下了总值 10 亿美元的巨大谜团。美国国税局刑事调查部门聘用了第三方公司来分析“丝绸之路”的比特币交易,后来发现这些比特币被一个名为“Individual X”的人所拥有,此人之前用黑客手段从暗网上夺走了这些比特币。

The Silk Road is an online black market that sells drugs, stolen credit cards, and even buys murder. It was shut down by the US government in 2013. The founder of the Silk Road was formally indicted in 2015, but left a huge mystery worth $1 billion.

今年11月,这笔资产已经被美国执法机关缴收,并且转移到了下面这个地址:bc1qa5wkgaew2dkv56kfvj49j0av5nml45x9ek9hz6。(信息来源:BBC新闻)

In November this year, the assets were seized by United States law enforcement agencies and transferred to the following address: bc1qa5wkgaew2dkv56kfvj49j0av5nml45x9ek9hz6. (Source: BBC News)

6. CoinShares

CoinShares 是欧洲最大的数字资产管理公司,旗下主要有两款比特币基金:'Bitcoin Tracker One'和 'Bitcoin Tracker Euro'。根据CoinShares官网数据,截至发稿,两款产品共有管理资产18.43亿美金,合约55,797枚比特币。相比之下,从其官网上的历史数据可知,在2020年1月2日,CoinShares旗下的两款产品总管理资产数额为676万美金,结合当时币价,合约900枚BTC。

CoinShares, the largest digital asset management company in Europe, has two main Bitcoin funds: 'Bitcoin Tracker One' and 'Bitcoin Tracker Euro'. According to CoinShares official data, the two products had a combined management asset of $1,843 million and a contract of 55,797 bits. By contrast, it is clear from the official online historical data that, on 2 January 2020, the two products under CoinShales had a total management asset of $6.76 million, with a contract of 900 bits of BTC combined with the current currency price.

7. Celsius

Celsius 是一个中心化的借贷平台。简单来说,它可以让你借贷加密资产,并获得收益。借贷过程全部在 Celsius App上完成。在Celsius的App上支持多达33种不同的加密货币。 Celsius 官网称存比特币能获得高达6.2%年化,目前Celsius的总管理资产达48.33亿美金(包括BTC在内的所有加密货币)。可惜的是,链得得并没有找到其BTC持仓的具体数量,所以选择沿用Kevin Rooke网站的数据。而年初的数据我们暂时无从知晓。

Celsius is a central lending platform. Simply put, it allows you to borrow encrypted assets and gain revenue. The lending process is all done on Celsius App. Supports up to 33 different types of encrypted currencies on Celsius App. Celsius official network claims that Bitcoins can be saved up to 6.2% a year, and the total management assets of Celsius now amount to $4,833 million (all encrypted currencies, including BTC). Unfortunately, the chain has not found the exact amount of its BTC warehouse, so it chose to use data from Kevin Rooke.

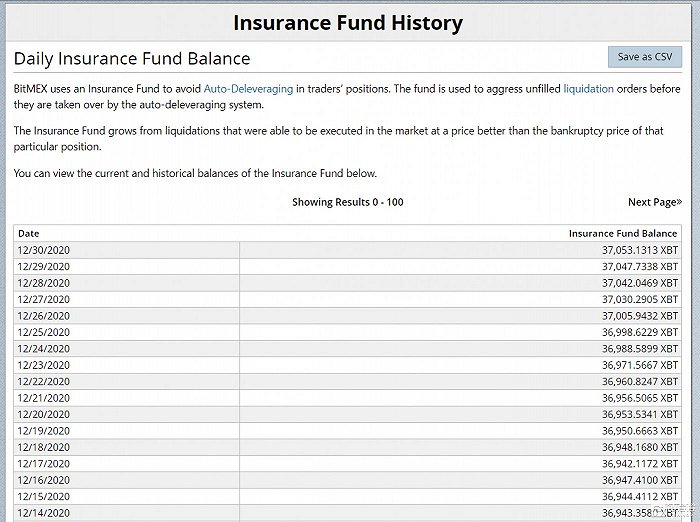

8. BitMEX保险基金

8. BitMEX Insurance Fund

简单来说,BitMEX使用保险基金来避免交易者头寸中的自动去杠杆化。BitMEX 开发了一个保险基金系统,帮助确保赢家获得预期利润,同时仍然限制了亏损交易者的下跌负债。

In short, BitMEX uses insurance funds to avoid automatic deleveraging in traders’ positions. BitMEX has developed an insurance fund system that helps to ensure that the winners earn the expected profits, while still limiting the deficit traders’ declining liabilities.

当交易者持有未平仓杠杆仓位时,如果其维持保证金太低,其仓位就会被强制平仓(即强平)。与传统市场不同,交易者的盈利和亏损并不反映他们在市场上平仓的实际价格。在 BitMEX 上,如果一个交易者被强平,其与仓位相关的权益会下降到零。

Unlike traditional markets, traders’ profits and losses do not reflect their actual prices. On BitMEX, if a trader is better off, its rights and interests associated with the position are reduced to zero.

BitMEX官网显示,截至2020年12月30日,其保险基金持有的BTC总量为37,053,与2020年初的33,491 BTC相比,BitMEX在2020年共购入3500枚比特币。

The BitMEX network showed that, as of 30 December 2020, its insurance fund held a total of 37,053, and that BitMEX purchased 3,500 bitcoins in 2020 compared to 33,491 BTC at the beginning of 2020.

9. Tezos基金会

Tezos是一个用于智能合约和分布式应用程序的分布式区块链平台。它已经通过众筹募集了价值2.3亿美元的比特币和以太坊,成为史上第二大加密货币众筹。

Tezos is a distributed block chain platform for smart contracts and distributed applications. It has raised $230 million worth of bitcoins and Etheria as the second largest encrypted currency in history.

Tezos会发表基金会半年度更新报告,在今年7月31日发表的最近一期的更新中我们可以看到其BTC持仓量为24,518枚。其新的半年度报告也将很快更新,届时,链得得对此持仓列表进行更新。

Tezos will publish the Foundation’s semi-annual update, the latest of which was published on 31 July this year. The BTC has a warehouse capacity of 24,518. Its new semi-annual report will also be updated very soon, and the chain will have to update the list.

相比之下,在2020年初,Tezos基金会的BTC持仓为31,846枚,是列表中唯一一个BTC持仓不升反降的机构。

By contrast, at the beginning of 2020, the BTC of the Tezos Foundation had 31,846 warehouses, the only BTC-run institution in the list.

10. Galaxy Digital

Galaxy Digital是一家业务以区块链投资为主、财务公开透明的上市加密货币投资银行,由华尔街传奇对冲基金经理、亿万富翁迈克·诺沃格拉茨(Mike Novogratz) 创立。公司的主要业务是为第三方投资者提供资产管理服务,比如通过基金的形式募集资金。

Galaxy Digital, an encrypted currency investment bank based on block-chain investments and transparent financial disclosure, was created by the Wall Street legend hedge fund manager, Mike Novogratz. The company’s main business is to provide asset management services to third-party investors, for example, by raising funds through funds.

在其公布的2020年第三季度报告中可以看到,目前Galaxy Digital总共持有16402枚比特币,与年初相比增长了5000枚比特币。而由于其2020年第四季度最新报告还未公布,暂无法得知目前Galaxy Digital最新的BTC持仓数量。 更新后,链得得也将会对此持仓榜单进行更新。

As can be seen in its published report for the third quarter of 2020, Galaxy Digital currently holds a total of 16,402 bits, an increase of 5,000 bits compared to the beginning of the year. Given that its latest report for the fourth quarter of 2020 has not yet been published, it is not yet possible to know the current number of Galaxy Digital’s latest BTC holdings.

Galaxy Digital一直致力于成为“加密货币领域的高盛”,Mike Novogratz更是比特币的狂热信徒,经常在社交媒体上宣传比特币。其在接受CNN采访时甚至呼吁新投资者可以用2%到3%的净资产投资比特币。

Galaxy Digital has been working to become a “gnostic in encryption money”, and Mike Novogratz is a fan of Bitcoin, often promoting Bitcoin in social media. In an interview with CNN, he has even called for new investors to invest in Bitcoin with 2 to 3% of their net assets.

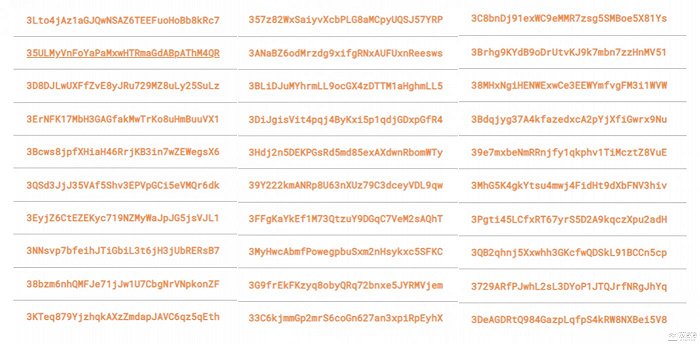

这张表里显示了BTC链上余额排名前十的钱包地址,其中有三个是交易所的冷钱包地址,第六名是前文提到的美国政府没收的比特币,而其它6个钱包的幕后主人并没有明确的答案。

This table shows the top ten wallet addresses in the BTC chain, three of which are the exchange's cold wallet addresses, the sixth is the Bitcoin confiscated by the United States Government, as mentioned above, and the owner of the other six wallets does not have a clear answer.

维度三:自然人BTC持仓榜单

Dimension III: Natural person BTC holds a warehouse list

和公司不同,个人的比特币持仓没有可供查询的披露数据,而网上对于比特币的持仓大户也是众说纷纭。以下数据来自2020年4月TravelbyBit的一篇名为《比特币十大亿万富翁》的文章。

Unlike companies, individual bitcoins do not have disclosure data that can be consulted, and there is a lot of talk online about Bitcoins owners. The following data is from an article by TravelbyBit in April 2020 entitled Bitcoins Billionaires.

1. 中本聪 Satoshi Nakamoto(暂定为自然人)

1. Satoshi Nakamoto (tentatively natural person)

中本聪是比特币的开发者或团体使用的化名,也是比特币社群公认的拥有最多BTC资产的个人。2013年,名叫“Sergio”的网友发表了一篇推测BTC缔造者中本聪拥有BTC数量的文章。文章指出,从2019年1月3号到2010年1月25日,中本聪一共挖出了100万枚上下的比特币,截至2021年1月4日,这些BTC总价值约为318亿美元。 而中本聪从未动过这些比特币。

In 2013, an online friend named “Sergio” published an article presumably that BTC creators had BTC numbers. According to the article, from January 3, 2019 to January 25, 2010, HCB dug a total of 1 million bitcoins up and down, with a total value of about $31.8 billion as of January 4, 2021.

在Bitcoin Forum上,有用户指出,中本聪所有拥有的这些比特币分散于1万到2万个BTC地址中。

On Bitcoin Forum, users pointed out that the bitcoin owned by Hmong was spread among 10,000 to 20,000 BTC addresses.

但是值得注意的是,文章作者Sergio在文章中发表声明,表示自己无法100%确定这些BTC的拥有实体就是Satoshi,但是可以肯定这100万上下数量的BTC都属于同一实体,而且该实体从区块1就已经开始挖矿了,同时其挖矿的硬件性能和在创世区块中保持一致。

It is worth noting, however, that the author of the article, Sergio, made a statement in which he stated that he could not be 100 per cent sure that the BTC-owned entity was Satoshi, but that it was certain that the 1 million BTCs belonged to the same entity and that the entity had started mining from block 1, while its mining hardware was consistent with the creation block.

2. 文克莱沃斯兄弟

2. Brother Vincleworth >/strang >

泰勒·文克莱沃斯和卡梅隆·文克莱沃斯(Tyler and Cameron Winklevoss)被称为文克莱沃斯双胞胎。他们曾是奥运会划船手和风险投资家,并于2002年初创立了一个社交网站ConnectU。2008年,他们起诉马克·扎克伯格(Mark Zuckerberg)窃取了他们的想法,因为扎克伯格于2004年才创建了Facebook,最后这对双胞胎获得了6500万美元的和解费。后来两兄弟开始投资比特币初创公司,如比特币支付处理器公司BitInstant,和许多其他公司。2014年,他们推出了加密货币交易所Gemini,允许用户购买、出售和存储数字资产。据说,他们2013年拥有的比特币占比近1%,目前价值超过67.2亿美元。

Taylor and Cameron Winklevos were known as the Vincleworth twins. They were former Olympic rowers and venture capitalists, and created a social networking site, ConectU in early 2002. In 2008, they sued Mark Zuckerberg for stealing their ideas because they had created Facebook only in 2004 and eventually paid $65 million for the reconciliation of twins. Later, the brothers began investing in Bitcoin’s first-ever company, such as BitInstant, a processing company, and many others. In 2014, they launched Gemini, an encrypted currency exchange, which allowed users to purchase, sell and store digital assets.

3. 迈克尔·诺沃格拉茨(Micheal Novogratz)

3. Michael Novogratz

迈克尔·诺沃格拉茨是一位前对冲基金经理,他在2007年和2008年被福布斯(Forbes)列为亿万富翁。从投资公司退休之前,他就开始投资加密货币。后来他成为一家加密货币投资公司Galaxy Investment Partners的首席执行官。早在2012年,他的净资产约为5亿美元。 2017年,他提到自己持有比特币和以太坊财富占比20%至30%,获得了超过2.5亿美元的利润。有争议的是他认为加密货币是一个泡沫,但他会继续投资于不同的加密货币项目。

Michael Novograds, a former hedge fund manager, was classified by Forbes as a billionaire in 2007 and 2008. He began investing in encrypted money before the investment company retired. He became CEO of Galaxy Investment Partners, an encrypt money investment company. As early as 2012, his net assets were about $500 million.

4. 克里斯·拉森(Chris Larsen)

克里斯·拉森是一位商业主管和天使投资人,曾在硅谷与他人共同创立过许多科技初创公司。他是瑞波(Ripple)的联合创始人,瑞波是一家旨在帮助促进使用区块链技术的银行进行国际支付的公司。他的加密货币净资产约为75亿至80亿美元。

Chris Larson, a business executive and an angel investor, was a co-founder of many technology start-ups in Silicon Valley. He was a co-founder of Ripple, a company that helped promote the use of block chain technology for international payments. His net encoded currency assets ranged from $7.5 billion to $8 billion.

5. 约瑟夫·鲁宾(Joseph Lubin)

5. Joseph Lubin

约瑟夫·鲁宾是一位企业家,他和别人共同创立了EthSuisse等公司,EthSuisse旨在扩展区块链数据库的功能。他还创立了ConsenSys,这是一家为以太坊的区块链开发区块链软件的公司。据《福布斯》报道,他的加密货币净资产估值在10亿到50亿美元之间。鲁宾积极参与开发解决方案以解决区块链行业的治理问题。

Joseph Rubin is an entrepreneur who, together with others, created companies such as EthSuisse, which expands the functionality of the block chain database. He also created ConsenSys, a company that develops block chain software for the Etherm block chain. According to Forbes, his net assets in encrypted currencies are valued at between $1 billion and $5 billion. Rubin is actively involved in developing solutions to the governance problems of the block chain industry.

6. 赵长鹏(CZ)

6. CZ

赵长鹏(社区代号CZ)是全球交易量最大的加密货币交易所币安的创始人兼首席执行官。赵长鹏具有计算机科学背景。在开始采用加密货币之前,他曾在东京证券交易所和彭博Tradebook工作,开发与交易相关的软件。他从2013年开始参与各种加密货币项目,包括担任OKcoin的首席技术官。2017年,赵长鹏创立了币安并通过首次代币发行筹集了1500万美元。在2018年《福布斯》“加密货币首富”列表中赵长鹏排名第三,他的净资产在2018年9月估值为14亿美元。

Zhao Chang Peng was the founder and chief executive officer of the currency exchange, the world's largest trade in encrypted currency. Zhao Chang Peng had a computer science background. Prior to the introduction of encrypted currency, he had worked at the Tokyo Stock Exchange and Bloomberg Tradebook to develop trade-related software. He had been involved in various encryption money projects since 2013, including as Chief Technical Officer of OKcoin. In 2017, Zhao Chang Peng created currency and raised $15 million through the first currency release.

7. 马修·罗斯扎克(Matthew Roszak)

7. Matthew Roszak

马修·罗斯扎克是一名投资人和企业家。他声称自己是第一位将比特币授予理查德·布兰森和比尔·克林顿的人。他是一家私人投资公司Tally Capital的创始合伙人。该公司在区块链领域拥有超过20个项目的投资组合,例如Blockstream、Civic和Factom。他的净资产估值为8亿美元。

Matthew Rosszak is an investor and entrepreneur. He claims to be the first person to award Bitcoin to Richard Branson and Bill Clinton. He is a founding partner of a private investment company, Tally Capital. The company has a portfolio of more than 20 projects in the area of block chains, such as Blockstream, Civic and Factom. His net assets are valued at $800 million.

8. 安东尼·迪洛里奥(Anthony Di lorio)

8. Anthony Dilorio

安东尼·迪洛里奥是比特币企业家和早期投资者。他是以太坊的联合创始人,从一开始就活跃于加密货币领域。在Free talk live的播客中了解了比特币之后,他在2012年以9.73美元的价格购买了他人生中第一枚比特币。他还投资了其他加密货币,例如Qtum、唯链和Zcash。福布斯估计他2018年的净资产在7.5亿美元至10亿美元之间。

Anthony Delorio is an entrepreneur and early investor in Bitcoin. He was a co-founder of Etherwood and was active in the area of encryption money from the beginning. After learning about Bitcoin among Free talk live podcasters, he purchased the first bitcoin in his life at $9.73 in 2012. He also invested in other encrypted currencies, such as Qtum, chain-only and Zcash. Forbes estimated his net assets in 2018 to be between $750 million and $1 billion.

9. 布赖恩·阿姆斯特朗(Brian Armstrong)

Brian Armstrong 9

布赖恩·阿姆斯特朗是最大的加密货币Coinbase的联合创始人兼首席执行官。Coinbase于2018年10月首次推出就筹集了3亿美元。Coinbase稳步增长,在2019年获得了800万新用户,自推出以来,该交易所产生了约20亿美元的交易费。据《福布斯》报道,他的净资产约为10亿美元。

Brian Armstrong was a co-founder and CEO of Coinbase, the largest encrypted currency. Coinbase raised $300 million when it was first launched in October 2018. Coinbase grew steadily, gaining 8 million new users in 2019, and since its launch, the exchange has generated approximately $2 billion in transaction fees. According to Forbes, his net assets are about $1 billion.

10. 布罗克·皮尔斯(Brock Pierce)

布罗克·皮尔斯是一位企业家,与他人共同创立了风险投资公司Blockchain Capital。该公司在2017年通过两个风投基金筹集了8500万美元。在2017年ICO繁荣发展期间,皮尔斯推出了EOS并筹集了7亿美元。它是2017年以来最大的ICO项目。该项目通过皮尔斯与他人共同创立的Block.one公司进行营销。《福布斯》杂志将皮尔斯列入2018年2月“加密货币前20位最富有的人”。他的净资产在7亿至11亿美元之间。

Broke Pierce was an entrepreneur who co-founded the venture capital company Blockchain Capital. The company raised $85 million in 2017 through two wind investment funds. During the ICO boom in 2017, Pierce launched EOS and raised $700 million. It was the largest ICO project since 2017. The project was marketed through Block.one, a company that Pierce co-founded with others. Forbes magazine included Pierce among the “20 richest people in the crypto currency” in February 2018. His net assets ranged from $700 million to $1.1 billion.

来源:链得得

Source: chain of rights.

Original title: bitcoin surges and who's decrypting the control plate bitcoin?

最新更新时间:02/26 15:36

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。