从桥流动性到链抽象全栈框架 我们看到了什么创新?

链抽象:改变加密货币游戏规则

在资产管理方面,人类通常不具备专业性,但他们却被迫成为货币管理者。据了解,在美国,平均每人拥有的银行账户数量介于3到4个之间。这个数字揭示了即便是在一个高度发达的银行系统中,美国人平均只管理着约4个账户。尽管资金可以在这些账户之间无缝流动,但这仍然是一个令人惊讶的现象。

在市值排名前25的项目中,有15个被归类为“以消费者为中心的L1”项目。然而,我们不禁要问,普通的非加密货币消费者是否愿意涉足超过3-4个链?他们是否也会将他们的Gas Token视为一种资产?

随着加密市场的迅速扩张,我认为市场已经做好准备,可以自由选择他们最喜欢的三个链(包括Rollups)。但如果技术正在不断进步,那么他们为什么还需要这样做?

链抽象是加密货币领域流动性碎片化的终极解决方案。当不同的去中心化交易所(DEX)存在流动性碎片化时,DEX聚合器将成为赢家;当不同的桥接方案存在于不同的链上时,桥聚合器应运而生(当然,桥聚合器对生态系统的贡献远不止这些);最终,当流动性在不同链上分散时,链抽象的意义将愈发明显。我们早就预言过:“总有一天,用户甚至不会意识到他们正在使用哪个链。”

这正是我对链抽象概念充满信心的原因所在。它有助于大幅提高加密货币的参与度,而用户则无需承担在多个链上管理多个账户的心理负担。本文将深入探讨链抽象概念的实施方式、优缺点、权衡取舍,以及最终可能的赢家。

我将链抽象定义为:用户在选择的链(流动性所在地)上发起的行为,最终在应用程序所在的链(结果所在地)上得以执行。

用户在链A上发起一个行为,然后通过一系列神奇的步骤,在目标链上或者在同一个钱包中获得所需结果。

这种“魔法”可以通过多种不同的方式实现,涉及不同的信任假设、采纳曲线(包括用户和开发者),以及最终应用程序希望解锁的链抽象体验的目标。不同的项目对链抽象有不同的看法,但以下是实现这一目标的关键层面。不同的项目正在解决不同的层面,阅读完本文后,你应该能对所需的关键元素以及最终局面可能是什么样子有一个公正的理解。

链抽象项目新闻稿

NEAR Protocol

NEAR协议旨在简化用户对区块链的抽象化。他们引入了中继器来补贴Gas费,提供了通过电子邮件恢复账户的认证服务(类似Web2的用户体验),最重要的是,NEAR账户可以生成多种签名类型。

应用程序可以在集成NEAR钱包后几乎不需额外开发成本。

多种签名类型有助于用户与多个链进行交互。尽管这看起来简单,但解决流动性和消息传递问题非常重要。NEAR必须能够通过单一或多个消息协议和流动性网络连接到多个链。

由于NEAR最贴近用户,因此必须积极进行市场推广并占据高市场份额。

Particle Network

Particle Network持有与NEAR类似的观点。他们最初作为EVM生态系统中的AA钱包开始,但现在通过在其模块化L1上创建“通用账户”来进行链抽象。该模块化L1是使用Cosmos SDK构建的,使Particle Network能够与任何链间通信的IBC兼容。他们还使用Berachain的Polaris框架成为Cosmos链的EVM兼容。

Particle Network不依赖任何外部协议来提供流动性。由于他们是自己的链,他们将乐观地执行跨链原子交易,并拥有自己的Gas代币。

我们看到NEAR和Particle的方法有很多重叠之处。尽管Particle掌控了大部分技术栈,但除了NEAR面临的类似问题外,他们还必须引导并维护其流动性网络。

Light

Light.so是一个相对较新的项目,采用了账户抽象的方法,但仅限于EVM(以太坊虚拟机)生态系统。通过典型的燃气费抽象化和批量执行的优势,他们改变了钱包用户体验,提供了完整的仪表盘式体验。Light致力于抽象化许多常见操作,并为用户提供类似仪表盘的体验。

未来的发展路径可能包括将多种DeFi操作整合到仪表盘中,如交换(swaps)、借贷(borrow/lend)、结构化收益产品等。然而,为了促进这些操作,后端仍需桥接/消息层。

通讯层:跨链互操作的关键基础设施

Chain abstraction changes the rules of cryptocurrency game. In asset management, human beings are usually not professional, but they are forced to become currency managers. It is understood that the average number of bank accounts owned by each person in the United States is between and. This figure reveals that even in a highly developed banking system, Americans only manage about accounts on average. Although funds can flow seamlessly between these accounts, it is still a surprising phenomenon. Among the top projects in market value, one is classified as Consumer-centered projects, however, we can't help but ask ordinary non-cryptocurrency consumers whether they are willing to set foot in more than one chain, and whether they will also regard theirs as an asset. With the rapid expansion of the cryptocurrency market, I think the market is ready to freely choose their favorite three chains, including, but if the technology is constantly improving, why do they still need to do so? Chain abstraction is the ultimate solution for liquidity fragmentation in the cryptocurrency field. When the existing liquidity is fragmented, the aggregator will become the winner. When different bridging schemes exist on different chains, the bridge aggregator comes into being. Of course, the contribution of the bridge aggregator to the ecosystem is far more than these. Finally, when the liquidity is dispersed on different chains, the significance of chain abstraction will become more and more obvious. We have long predicted that one day users will not even realize which chain they are using, which is why I have full confidence in the concept of chain abstraction. It will greatly increase the participation of cryptocurrency. However, users don't have to bear the psychological burden of managing multiple accounts on multiple chains. This paper will deeply discuss the implementation of the concept of chain abstraction, the advantages and disadvantages, the trade-offs and the final possible winners. I define chain abstraction as the magic that the behavior initiated by users in the selected location of chain liquidity is finally executed in the location of chain result where the application is located, and the user initiates an behavior on the chain and then obtains the required results in the target chain or in the same wallet through a series of magical steps. Law can be realized in many different ways, involving different trust assumptions, adoption curves, including users and developers, and the goal of chain abstraction experience that the final application hopes to unlock. Different projects have different views on chain abstraction, but the following are the key levels to achieve this goal. Different projects are solving different levels. After reading this article, you should be able to have a fair understanding of the key elements needed and what the final situation may be like. The purpose of the press release protocol is to simplify users' abstraction of blockchain. They introduced repeaters to subsidize fees, and provided authentication services to restore accounts through e-mail. The most important thing is that accounts can generate multiple signature types, and applications can be developed at little extra cost after integrating wallets. Although this seems simple, it is very important to solve the problems of liquidity and message delivery. Message protocol and liquidity network are connected to multiple chains. Because they are closest to users, they must actively promote the market and occupy a high market share. They hold similar views. At first, they started as wallets in the ecosystem, but now they abstract the chains by creating universal accounts on their modularity. The modularity is built to make it compatible with any inter-chain communication. The framework they also use becomes the compatibility of chains, and they do not rely on any external agreements to provide liquidity. Because they are their own chains. They will happily carry out cross-chain atomic trading and own their own tokens. We see that there are many overlaps between the methods of and. Although they control most of technology stack, they must guide and maintain their liquidity network in addition to similar problems. It is a relatively new project, which adopts the method of account abstraction but is limited to the Ethereum virtual machine ecosystem. Through the advantages of typical gas fee abstraction and batch execution, they have changed the wallet user experience and provided a complete dashboard experience. Committed to abstracting many common operations and providing users with a dashboard-like experience, the future development path may include integrating various operations into the dashboard, such as exchanging and lending structured income products, etc. However, in order to promote these operations, the back end still needs to bridge the key infrastructure of message layer, press release, communication layer and cross-chain interoperability. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

在数字资产领域,跨链互操作性一直是一项关键任务。要实现这一目标,交互层需要通过任务执行层,该层可以是桥、代理、验证者或任何可以实现跨链互操作的基础设施。

标准化验证者网络

Across 在跨链聚合器方面取得了领先地位。经常使用以太坊生态系统的现有加密用户可能对 Across 很熟悉。Across 在其 V2 版本中转变为以意图驱动的结构,并将其定位为桥聚合器战争的领导者。这也帮助实现了 V3 版本,开发人员可以在单个交易中方便地组合桥接和协议操作。

举例来说,OpenSea 集成了 Across+。如果我想在 Base 上购买 Base Chads,我只需要使用我选择的钱包在 Arbitrum 上签署一笔交易,然后我就可以在 Base 上的相同地址成功购买一个 Base Chad。

这个例子是我们最容易理解的,因为它看起来像我们一直在寻找的解决方案。

然而,这种方法可能不适用于某些高频活动或者需要较低延迟的交易。在这种情况下,桥接并使用 rollup 可能更容易实现更低的延迟和更好的执行效果。

Anoma 采用了一种独特的以意图驱动的链下方法,他们拥有一个基于验证者的 L1 和共识机制。开发人员可以直接在 Anoma 上构建,也可以将 Anoma 用作中间件(本质上是一个验证者网络)。为了实现网络内的通信标准化,Anoma 有自己的 DSL,开发人员需要学习它才能利用 Anoma 的网络。

验证者网络标准化是链抽象最热门的研究领域之一。验证者中心化、拍卖机制、开放式验证者网络的影响等问题已经争论了很长时间。

以太坊 Swap、UniswapX 和 1inch Fusion等项目展示了基于意图的架构的一流执行力。毫无疑问,基于意图的架构将主导跨链和链抽象领域,但谁将获胜?我们已经看到订单流是王道。能够保证最佳执行的验证者网络将获得最佳订单流,无论订单来自何处。链抽象钱包能给他们提供最佳订单流吗?

验证者对于高频活动有多好?它们对于延迟至关重要的交易有多好(例如,购买流动性较低的 memecoin)?这些可能不是验证者网络或链抽象通常的最佳用例。

成熟的验证者网络可以在链抽象范例中实现的顶级活动是大规模跨链(例如,将 ETH 从所有 L2 移动到单个以太坊主网账户)。任何需要研究开销、集成开销、桥接开销(包括聚合器)、gas 维护等方面的地方,都是验证者基础设施可以提供帮助的地方。在 Injective 上购买 Injective 衍生品应该可以无缝隙地一键完成,即使我没有任何资金也可以进行操作。

```

```html

```

```html

验证者网络的竞争格局

为了确保执行,每个验证者网络都需要与某些合约集成。Across V3 凭借以意图驱动的架构处于领先地位,目前只需要理清与协议的集成问题。协议很可能会与 Across 等经过实战检验的项目集成,并且它们将需要不断创新架构以吸引更多验证者(或他们所说的中继器)参与,同时不影响执行效果。

然而,Across V3 在订单流方面并不是明确的赢家。Stargate 桥在订单流和交易量方面正与 Across 正面竞争,此外还有 Celer Circle 和 cBridge 似乎也正在迎头赶上。

Across 是唯一拥有以意图驱动的架构的项目,并且一直提供卓越的执行效果。长期以来,一种观点认为 Stargate 的交易量是通过激励措施人为增加的,但没有办法证实这一点。然而,尽管 Stargate 的交易量能与 Across 匹敌,但交易数量却翻倍。只有在

LayerZero 空投完成后,我们才能确定哪些交易量是激励性带来的,哪些是非激励性的。

Socket 通过引入模块化订单流拍卖架构 (MOFA) 采用了独特的方法,其中任何上述模块都可以提交订单或参与拍卖。我对底层技术并不熟悉,但凭借该团队以往发布出色产品的记录,这可能会非常有趣。

Image Courtesy: Socket

桥和桥聚合器

“跨链桥使用起来很麻烦” - 用户心声

桥聚合器以前是我跨链转移资产的最爱方式。它可以保证以最佳的方式将资产桥接到用户选择的链上。虽然它是目前跨链转账的最佳形式,但它只屏蔽了桥本身,并没有屏蔽区块链。用户仍然需要在目标链上持有最少的 gas 才能完成跨链转账。它们也不能帮助用户在目标链上执行操作,这可能会给刚接触这个领域的用户带来额外的使用体验上的复杂性。

大规模来看,桥的效率比不上验证者网络。为什么?建议您观看 Hart Lambur 在 2024 年 EthDenver 上的演讲,了解为什么批量处理意图可以比传统桥梁便宜 50 倍以上。(参见 9:11 - 13:25)。

尽管我很欣赏那些致力于构建桥梁并让我可以在多链世界中交互的团队和创始人,但我更希望完全消除用户流程中的 3-4 个步骤以及随之而来的轻微焦虑感。

Full-Stack Frameworks

Full-stack frameworks, from the wallet layer to the settlement layer, help establish standards that seem capable of achieving complete chain abstraction for users in terms of technical efficiency (security, communication, etc.). Frameworks like CAKE make protocols easy to adopt and integrate into the entire ecosystem.

For developers, relying entirely on a new framework or chain to build projects will be very challenging. The motivation for developers to choose a specific framework is usually driven by order flow.

I don't know how to convince an entire developer ecosystem that has already chosen their favorite environment for building projects to use a brand new framework. This will be a battle heavily reliant on marketing and partnerships, as challenging as launching a new L1.

Participants in the full-stack framework include: CAKE, DappOS, and Aarc.

Summary

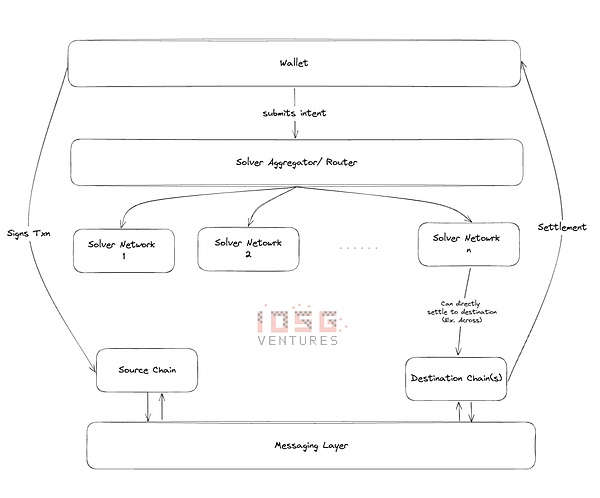

A unified framework is crucial, with leaders in each module determined by the best order flow. The best order flow depends on continually providing optimal execution. The entire chain abstraction framework may look like the following:

If I had to introduce my grandmother to cryptocurrency, I might wait until NEAR or Particle Network releases a product. Because I don't want her to get caught in the loop of learning bridges/aggregators, verifying and maintaining multiple private keys, when all she needs is an EVM wallet and to buy some tokens on Solana.

To achieve all these functionalities, some form of account abstraction, balance abstraction, and possibly gas abstraction will be needed, and many participants are tackling each issue.

Based on current information, leaders of each module will determine the ideal framework. NEAR seems most likely to be the entry point for new order flow, Across seems to be a battle-tested project and also the easiest to integrate (requiring further protocol optimization by the Chaos Labs team, who know how to win in a crowded ecosystem), and finally the cross-chain messaging layer, which will provide a secure environment for auxiliary infrastructure (such as bridges and oracles) and settlement services for assets moving across chains.

```

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。