Meme vs 治理代币 万物皆可模因

作者:Yash Agarwal 来源:medium 翻译:善欧巴,金色财经

据A16z的首席技术官称,迷因币被指对“建设者”不具吸引力,甚至可能在外部考量下带来负面影响。

他将迷因币描述为“一系列掩盖赌场本质的虚假诺言”,这改变了公众、监管机构和企业家对加密货币的看法,并指出其在技术上缺乏趣味。

与此同时,Chris Dixon发表了一篇更为冷静的文章,强调了美国证券法制度的荒谬性——强调优质项目因监管而陷入僵局,而迷因币却幸存下来,因为它们“不依赖于任何管理人员”。 这暗示了加密货币领域其他部分的伪装(假装行为)- 各种团队为协议进行管理,同时将其称为治理代币。

我们的目标既不是辩护迷因币(或治理代币),也不是贬低它们;而是主张更公平的代币发行方式。

治理代币是具有额外步骤的模因币

我认为所有治理代币本质上都是模因币,其价值取决于协议的模因起源。换句话说,治理代币是穿着西装的模因币。为什么?

通常,治理代币不提供任何收入分享(由于安全法),并且它们作为面向社区的决策框架的效果也不是特别好(持有往往集中,参与冷漠,或者DAO通常是功能失调)——通过额外的步骤使它们像模因币一样有用。无论是ARB(Arbitrum的治理代币)还是WLD(世界币的代币)——它们本质上都是这些项目的模因币。

这并不是说治理代币没有用。最终,它们的存在不断提醒人们为什么法律需要更新。也就是说,治理代币在许多情况下会造成与模因币一样大的危害:

对于建设者来说:许多知名风投支持的治理代币在产品发布之前就已经推出,造成了巨大的幻灭。这直接损害了多年来一直努力获得采用的创始人的可信度。例如,Zeus Network在发布产品之前就以10亿美元的FDV推出,而许多创始人即使在取得了巨大的吸引力后也很难达到这样的估值。

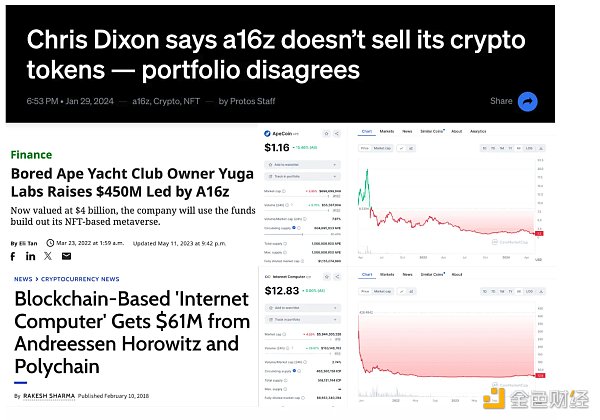

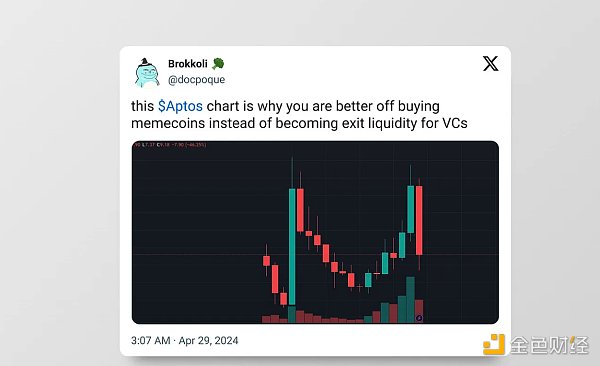

对于社区:大多数治理代币都是由风险投资支持的代币,以高估值发行,并逐渐出售给散户投资者。

研究ICP、XCH、Apecoin、DFINITY等项目,甚至2017年的ICO都比当前风投支持的低流通量代币更可取,因为它们更公平,大部分供应在启动时就解锁了。

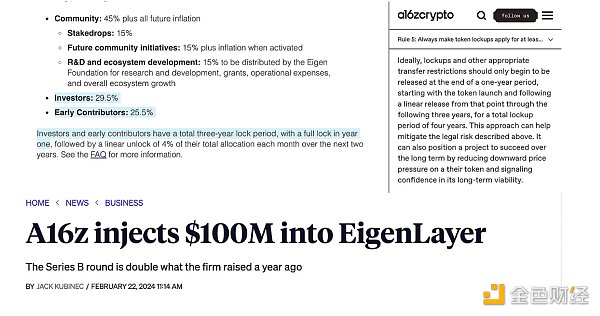

EigenLayer:以太坊协议中的一股新势力

EigenLayer 可谓是本轮周期中最重要的以太坊协议之一,成为一个典型的代表。根据最新数据,内部持有者(包括风险投资者和团队)拥有代币的相当大一部分,占总供应的 55%,而最初的社区空投仅占 5%。这种构成使得代币供应量较低,而完全稀释估值(FDV)较高,同时也凸显了风险投资背后的支持,他们持有的比例为 29.5%。尽管在上一个周期我们曾批评过 FTX/Alameda,但在当前周期并没有出现明显改善。

EIGENDAO 以 EIGEN 代币进行治理,然而,与任何传统的 Web2 治理委员会相比,现在看来没有什么区别,因为内部持有者掌握着绝大部分供应(社区供应最初只有 5%)。更令人担忧的是,EigenLayer 整个构想基于重新抵押(leveraged yield farming),这使其金融工程与迷因币类似,带有庞氏骗局的潜在风险。

如果一群内部持有者掌握了超过一半的代币供应(在本例中为 55%),那么我们将严重阻碍加密货币的再分配效应,使得少数内部持有者通过低流通量、高 FDV 的发布方式迅速积累财富。如果这些内部持有者真的有信心的话,考虑到代币发布的估值已经十分高企,他们最好少分一些配额。

如果一群内部持有者掌握了一半以上的代币供应量(在本例中为 55%),我们将严重阻碍加密货币的再分配效应,并通过低流通量、高 FDV 的发行方式使得少数内部持有者异常富有。如果内部持有者真的有信心,考虑到代币发行的估值已经是天文数字,他们最好减少一些分配。

揭示真相:背后的黑手是谁?

鉴于资本形成过程的荒谬性,导致风投和创作者相互责怪,进而使整个领域陷入监管混乱,严重损害了认真建设者的声誉。

但风投为何如此有害?

风投存在着结构性原因来抬高 FDV。例如,一支大型风投基金以 2000 万美元的价格投资 400 万美元获得 20% 的份额;从逻辑上讲,为了让他们的有限合伙人(LP)受益,他们必须在代币生成事件(TGE)时将 FDV 至少提高到 4 亿美金。为了提高种子/种子投资者代币的价值,协议被推高到尽可能高的 FDV。

在这个过程中,他们不断鼓励项目进行更高估值的融资轮次。基金规模越大,他们越有可能给项目一个荒谬的高私募估值,构建一个强有力的叙事,并最终以更高的公开估值发行代币,迫使散户投资者在代币发行时抛售。以高 FDV 发行只会导致螺旋式下降和零市场认知度。Starkware 的研究已经证明了这一点。

相比之下,较低 FDV 的发行允许散户投资者从重新定价中获利,并有助于形成社区和市场认知度。Celestia 的研究也给出了相关论证。

散户投资者比以往任何时候都更关心代币解锁问题。 仅在本月,Pyth 将解锁价值 12.5 亿美元的代币,而 Avalanche、Aptos、Arbitrum 等项目也将解锁数亿枚代币。欲了解更多即将解锁的代币信息,请访问 tokens.unlock.app。

MemeCoin 是金融体系崩溃的产物

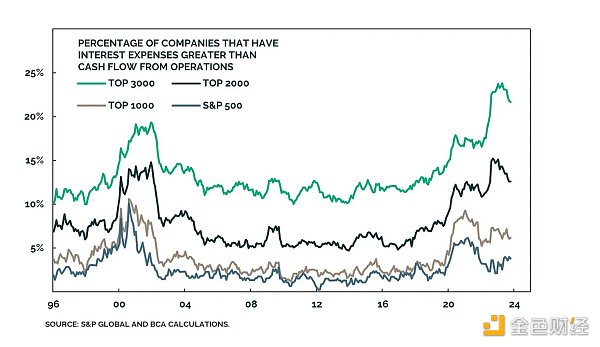

可以说,比特币是最大、最古老的模因币,它诞生于 2008 年金融危机之后。负利率/零利率(利率 - 通货膨胀)迫使每个储蓄者去投机新的热门资产类别(例如,模因币)。零利率环境创造了充斥着依靠源源不断的廉价资本维持生计的僵尸企业的市场。即使像标准普尔 500 指数这样的顶级指数也包含约 5% 的僵尸企业,而随着现在利率上升,这些企业的情况即将恶化,变得和表情包货币没什么区别。更糟糕的是,这些僵尸企业还被基金经理人推荐,散户投资者每个月都在买入它们。

投机永不消亡是有原因的。对于这个周期,它们是模因币。

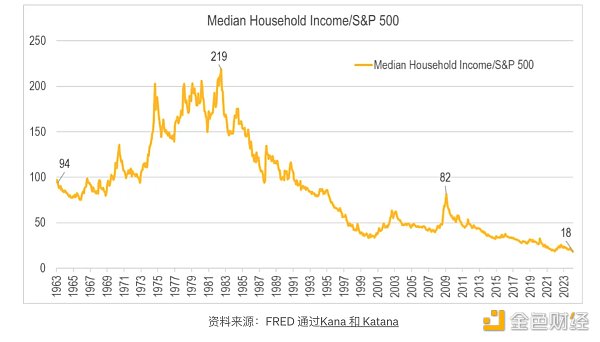

在此背景下,“金融虚无主义”一词最近备受关注。它概括了这样一个想法:生活成本正在扼杀大多数美国人,向上流动机会对越来越多的人来说遥不可及,美国梦在很大程度上已成为过去,房屋中位价与家庭收入中位数的比值处于完全不可持续的水平。金融虚无主义的潜在驱动因素与民粹主义的驱动因素相同,民粹主义是一种迎合厌倦了既定精英阶层的普通民众的政治倾向——“这个体系对我不起作用,所以我想要尝试一些非常不同的东西”(例如,购买 BODEN 代币而不是投票给拜登)。

模因币正在为基础设施进行压力测试:

模因币不仅是吸引新人加入加密货币的绝佳工具,而且还是测试基础设施的绝佳方式。我们认为,与 A16z 的立场相反,模因币对任何生态系统都具有积极的净影响。如果没有模因币,像 Solana 这样的区块链就不会面临网络拥塞问题,也不会发现所有网络/经济漏洞。Solana 上的模因币总体上是积极的:

所有去中心化交易所 (DEX) 不仅处理了历史最高交易量,而且还超过了以太坊上的同行。

货币市场整合模因币以增加总锁仓值 (TVL)。

消费者应用程序整合模因币以引起关注或用于营销目的。

验证者由于优先费用和可提取最大价值 (MEV) 而赚取巨额费用。

由于流动性和活动度的增加,DeFi 领域更广泛的网络效应。

Solana 钱包 Phantom 拥有 700 万月活跃设备(由模因币吸引普通用户加入驱动)是有原因的 - 它可能是目前加密货币领域使用最多的应用程序之一。

对于严肃的去中心化真实世界资产 (RWAs) 在链上交易,我们需要具有足够流动性(请查看顶级模因币;除 L1 代币/稳定币之外,它们拥有最深的流动性)、经过压力测试的 DEX 和更广泛的 DeFi 基础设施。模因币并不是干扰项;它们只是共享账本上存在的另一种资产类别。

Chief Technology Officer's Views on Meme Coin Author's Source Translation The chief technology officer of Shanouba Golden Financial Data said that Meme Coin was accused of being unattractive to builders and might even have a negative impact under external considerations. He described Meme Coin as a series of false promises to cover up the essence of casinos, which changed the views of public regulators and entrepreneurs on cryptocurrency and pointed out its lack of technical interest. At the same time, a more calm article was published to emphasize the absurdity of the US securities law system. The high-quality projects are deadlocked due to supervision, but memes survive because they do not depend on any managers. This implies the disguised behavior of other parts of the cryptocurrency field. Various teams manage the agreement and call it governance tokens. Our goal is neither to defend memes or governance tokens, nor to belittle them, but to advocate a fairer token distribution method. Governance tokens are memes with extra steps. I think all governance tokens are memes in essence. The value depends on the meme origin of the agreement. In other words, governance tokens are memes in suits. Why do governance tokens usually not provide any revenue sharing? Because of the security law and their effectiveness as a community-oriented decision-making framework, they often concentrate on participating in indifference or usually dysfunction, and make them as useful as memes through extra steps, whether they are governance tokens or world currency tokens, they are essentially memes of these projects. This is not to say that governance generation. In the end, coins are useless, and their existence constantly reminds people why the law needs to be updated, that is to say, governance tokens will cause as much harm as meme coins in many cases. For builders, many well-known venture capital-supported governance tokens have been launched before the product is released, which has caused great disillusionment, which directly damages the credibility of founders who have been trying to obtain adoption for many years, for example, they were launched at hundreds of millions of dollars before the product was released, and many founders even achieved great attraction. It is also difficult to reach such a valuation after gravity. For the community, most governance tokens are tokens supported by venture capital, which are issued at a high valuation and gradually sold to retail investors. Projects such as research and even years are more desirable than the current low-liquidity tokens supported by venture capital, because they are fairer, and most of the supply is unlocked at the start. A new force in the Ethereum agreement can be said to be one of the most important Ethereum agreements in this cycle, becoming a typical representative according to the latest. The internal holders of data, including venture capitalists and teams, own a considerable part of the total supply of tokens, while the initial community airdrops only account for this composition, which makes the supply of tokens lower and completely diluted, and the valuation higher, and also highlights the support behind venture capital. The proportion they hold is that although we criticized it in the last cycle, there is no obvious improvement in the current cycle. However, compared with any traditional governance Committee, there seems to be no difference now because. At first, the internal holders hold most of the supply to the community. What is even more worrying is that the whole idea is based on re-mortgage, which makes its financial engineering similar to meme money with the potential risk of Ponzi scheme. If a group of internal holders hold more than half of the token supply in this case, then we will seriously hinder the redistribution effect of cryptocurrency, so that a few internal holders can quickly accumulate wealth through low circulation and high distribution, if these internal holders are really confident. Considering that the valuation of token issuance is already very high, they'd better allocate less quotas. If a group of internal holders master more than half of the token supply, in this case, we will seriously hinder the redistribution effect of cryptocurrency and make a few internal holders extremely rich through the issuance method with low liquidity. If internal holders are really confident that the valuation of token issuance is astronomical, they'd better reduce some allocations and reveal who is behind the truth. In view of the capital shape, The absurdity of the process leads venture capitalists and creators to blame each other, which leads to the chaos of supervision in the whole field, which seriously damages the reputation of serious builders. However, there are structural reasons why venture capitalists are so harmful. For example, in order to benefit their limited partners, they must raise the share of a large venture capital fund with a price of $10,000 to at least $100 million. In order to improve the value agreement of seed investors' tokens. Pushed as high as possible, in this process, they constantly encourage the project to carry out higher valuation. The larger the scale of the financing rounds, the more likely they are to give the project an absurdly high private equity valuation, build a strong narrative, and finally issue tokens at a higher public valuation, forcing retail investors to sell at the time of token issuance, which will only lead to a spiral decline and zero market awareness. In contrast, the study of lower issuance allows retail investors to re-price The research that makes profits and helps to form community and market awareness also gives relevant arguments. Retail investors are more concerned about the issue of unlocking tokens than ever before. Only this month, hundreds of millions of tokens will be unlocked, and other projects will unlock hundreds of millions of tokens. For more information about the tokens to be unlocked, please visit the website, which is the product of the collapse of the financial system. It can be said that Bitcoin is the largest and oldest meme. It was born after the financial crisis in 2008 with negative interest rate and zero interest rate. The inflation of goods forces every saver to speculate on new hot asset categories, such as meme currency. The zero interest rate environment has created a market full of zombie enterprises that rely on a steady stream of cheap capital to make a living. Even the top indexes such as the Standard & Poor's Index contain about zombie enterprises, and with the increase of interest rates, the situation of these enterprises is about to deteriorate and become no different from the emoticon currency. What's worse, these zombie enterprises are recommended by fund managers and retail investors buy it every month. Speculation never dies for a reason. For this cycle, they are memes. In this context, the word financial nihilism has recently attracted much attention. It summarizes the idea that the cost of living is killing the upward mobility opportunities of most Americans. For more and more people, it is out of reach. To a large extent, the American dream has become a completely unsustainable level in the past. The potential driving factor of financial nihilism is the same as that of populism, which is a political tendency to cater to ordinary people who are tired of the established elite. This system is not worth me. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

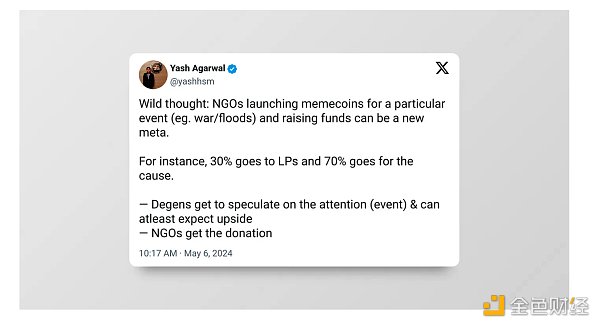

模因币作为融资机制

模因币如今已被证明是一种有效的资本协调手段。Pump.fun的研究表明,该平台促进了近数百万模因币的发行,并为其创造了数十亿美元的价值。这是为何?因为在人类历史上首次,任何人都可以在不到 2 美元和 2 分钟内创建一种金融资产!

模因币也可成为一种doskona(doskona是葡萄牙语,意为“完美”或“极好的”)的筹款机制和上市策略。传统上,项目通过向风险投资(VCs)分配 15-20% 的股权,开发产品,并在通过表情包和营销建立社区的同时发行代币以筹集大量资金。然而,这常常导致社区最终被风投抛弃。

在模因币时代,人们可以通过发行他们的模因币(无需路线图,只是为了好玩)并尽早形成一个部落式的社区来筹集资金。然后,他们可以继续构建应用程序/基础设施,不断为模因币添加实用性,而无需做出虚假承诺或提供路线图。这种方法利用了模因币社区的部落主义(bagholder bias - 指持有大量亏损资产的人倾向于低估其损失并高估其反弹潜力的心理状态),确保了社区成员的高参与度,他们将成为您的业务拓展/营销人员。它还确保了更公平的代币分配,对抗风投采用的低流通量、高完全稀释估值(FDV)的拉高和抛售策略。

这已经在发生了:

1. BONKBot 是源自 BONK 模因币的 Telegram 机器人(峰值日交易量达 2.5 亿美元),利用 10% 的交易费用来购买并销毁 BONK。它仅通过费用累计销毁了约 700 万美元的 BONK,从而使其经济与持有者保持一致。

2. Farcaster 生态系统中的一个模因币 Degen,可以让发布者用 DEGEN 奖励/打赏发布优质内容的人。此外,他们还为去中心化应用(DeFi)构建了一个 L3 链。类似地,上一个周期最流行的模因币之一 Shibatoken 现在正在构建一个 L2。

这种趋势最终将导致模因币和治理代币的融合。需要注意的是,并非所有模因币都是平等的,骗局很普遍,但与风投悄悄实施的欺诈相比,它们更容易被揭露。

未来展望

每个人都想尽早参与下一个大事件,而模因币是少数散户投资者可以比大多数机构更早涉足的领域之一。由于风投(VC)私募交易的门槛限制,模因币为散户资金提供了更好的潜在市场契合度。虽然模因币让权力回归社区,但也确实让加密货币看起来像一个赌场。

那么,解决方案是什么?像 a16z 这样的风投应该联合他们的交易并让任何人都可以参与其中。Echo 等平台非常适合这种情况。

给风投的建议:将你们的交易放到 Echo 上,让社区参与联合投资交易,见证社区从项目早期就开始集结的类似模因币的魔力。

为了澄清,我们并不反对风投/私人融资;我们主张更公平的分配,创造公平的竞争环境,让每个人都有机会获得财务自主权。风投应该因其早期冒险而获得回报。加密货币不仅仅是关于开放和无需许可的技术;它还关乎让早期```html

研究模因币作为筹款和社区建设机制

近期研究指出,模因币作为筹款和社区建设机制的潜力受到了广泛关注。

针对此一现象,专家呼吁项目方应更加重视模因币的合理发行和运用,以促进项目的可持续发展。

3.项目应该倾向于更公平的发行

此外,有关专家还指出,项目的发行应该倾向于更公平,确保更多投资者能够公平参与其中。

是时候让早期融资更加开放了。

综上所述,随着模因币的不断兴起,我们应该意识到早期融资的开放性对于项目的长期发展至关重要。

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。