一辆兰博基尼引出的币安与 DWF Labs 罗生门 何一直指做市商暗斗

据2023年10月消息,DWF俄罗斯管理合伙人安德烈·格拉乔夫(Andrei Grachev)在社交媒体上晒出兰博基尼豪车照片,并配文"DWF Lambo"。这一行为引起了加密行业的广泛关注。

安德烈·格拉乔夫现年36岁,曾担任加密货币交易所火币的俄罗斯分部负责人。资料显示,他是DWF Labs的联合创始人之一,目前常驻瑞士。

DWF Labs在加密市场中扮演做市商(MM)的角色。做市商是一种中间人公司,同时买卖资产,对资产价格的涨跌漠不关心。他们的主要任务是提高市场流动性,让参与者更容易地买卖资产,并通过差价获利。

在币安交易平台上,DWF Labs被标记为"VIP 9",这意味着该公司每月的交易额至少达到40亿美元。在这个级别上,币安通常会提供交易费用折扣并提供私人客户经理服务。

币安并不要求做市商签署具体协议,这意味着,很大程度上,币安允许做市商按照自己的意愿进行交易。不过,币安发言人表示,该平台上所有用户都必须遵守禁止市场操纵的一般使用条款。

然而,根据2022年一份向潜在客户发送的提案文件显示,DWF Labs提出利用其活跃的交易头寸来推高代币价格,并在包括币安在内的交易所上创造所谓的"人为交易量",以吸引其他交易者。在当年为一位代币项目客户准备的报告中,DWF甚至直接写道该机构成功地产生了相当于该代币三分之二的人工交易量,并且正在努力创造一种"可信的交易模式",如果与DWF Labs合作,可以为项目代币带来"看涨情绪"。

YGG事件让DWF市场操纵问题浮出水面

2023年8月,币安宣布上市与YGG代币相关的高杠杆衍生品合约。YGG是链游公会Yield Guild Games发行的原生代币,也是DWF Labs投资的一家公司,该公司此前已同意向DWF Labs出售价值1000万美元的代币,约占其当时市值的四分之一。

币安调查揭示市场操纵疑云

社交媒体上一番吹捧后,Andrei Grachev宣称YGG上市将为该代币带来「可持续性和力量」,然而,YGG衍生品合约在币安推出后,价格出现暴跌(如上图所示)。

加密货币行业注意到这种波动,另外两家做市商公司私下向币安表达了对DWF Labs的担忧。其中一位做市商向币安处理VIP客户的部门投诉了DWF Labs的交易,该部门将此事报告给了币安的市场监控团队,很快,2023年9月,币安的市场监控团队开始了对DWF Labs的调查。

调查和解雇

币安公司内部人士透露,调查人员发现,DWF Labs涉嫌操纵YGG和至少六种其他代币的价格,并且在2023年进行了超过3亿美元的洗售交易,最终结论是——这些行为违反了币安的使用条款。

据称调查员还发现了类似洗售交易在币安交易平台已形成一定规模,尤其是币安业务所依赖的VIP客户中,去年头部交易客户(每月交易额超过1亿美元的交易者)已占币安平台总交易量的三分之二,因此调查人员建议在2023年上半年之前关闭数百名违反使用条款的客户。

在DWF Labs这件事上,调查发现,在Andrei Grachev推文宣传YGG后,DWF在YGG价格接近市场峰值时分两批出售了近500万枚代币,导致代币价格暴跌崩盘,而YGG联合创始人Gabby Dizon声称自己并不知道币安的调查结果。

2023年9月下旬,币安市场调查团队提交报告,认为DWF Labs存在涉嫌市场操纵行为,建议币安移除DWF Labs,但事情似乎又发生了变化。

接下来的几天里,币安VIP客户部门负责人及其员工对调查结果提出质疑,并向公司领导层投诉。结果,币安高管表示,市场调查团队没有足够的证据表明DWF Labs参与市场操纵,其发现的洗售交易可能是偶然的所谓自我交易,这可能并不构成操纵行为。币安还认为,市场调查团队负责人与最初提出投诉DWF Labs的竞争对手在此案上合作过于密切,一周后,币安声称为了节约成本解雇了涉及此事的几名调查员。

各方回应

毫无疑问,币安在目前全球数字货币经济中扮演者举足轻重的角色,目前币安平台上已上架约400种加密货币,并且提供了允许用户押注价格方向的衍生产品,币安用户数量更是高达1.9亿,行业数据显示,其三月份处理的现货和衍生品交易价值超过4万亿美元。

根据《华尔街日报》的说法,币安的一位前公司内部人士表示,币安似乎在「包庇」DWF Labs的市场操纵行为,由于DWF Labs交易额巨大,币安不但没有按照市场调查团队的建议阻止DWF Labs,反而将调查该做市商的工作人员给解雇了,这么做的目的很可能是为了从大客户那里赚取高额交易费用。

对此,币安发言人表示不认同任何有关其允许进行市场操纵的说法,而且币安也正在优先考虑改进合规职能,该发言人说道:「我们有一个强大的监控框架,可以识别市场滥用行为并采取行动,币安不会为了平台的安全而偏袒任何个人用户,无论规模有多大。」

与此同时,该发言人还指出,币安并不会轻易做出下架用户的决定,需要有足够的证据证明他们违反了使用条款。在任何情况下,币安都不会以盈利为目的进行交易,也不会操纵市```html

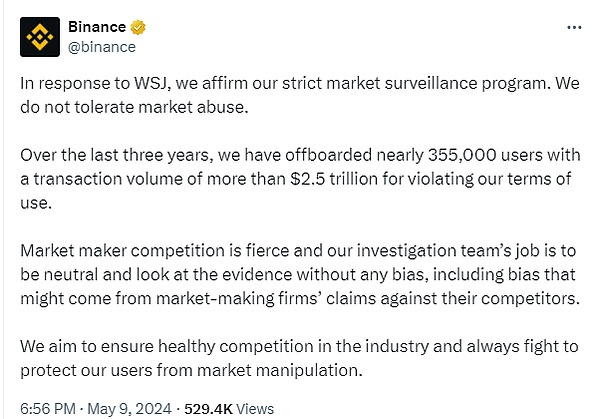

据《华尔街日报》报道,DWF Labs 在币安交易平台上被指存在洗售交易和潜在市场操纵问题。对此,币安于5月9日晚在社交媒体上发布了回应:

“币安坚决驳斥任何关于其市场监控计划允许平台上存在操纵市场的说法。币安拥有一个强大的市场监督框架,用以识别市场滥用行为并采取行动。任何违反使用条款的用户都将被清退,绝不容忍市场滥用行为。在过去三年中,因违反使用条款而被清退的人数接近355,000位用户,其交易量超过2.5兆美元。币安拥有1.9亿用户。他们可以放心,币安将平台的安全置于优先,不会偏袒任何个人,无论其规模有多大。换句话说,这些决定都不是我们轻率做出的。币安将使用多种工具进行深入调查,只有在有足够证据证明用户违反了我们的使用条款时,才会将其清退。此外,Inca Digital最近对币安市场监控实践进行了独立调查,验证了方法的有效性,发现了异常交易活动的最小痕迹。”

作为此次事件的当事方,DWF Labs 也在社交媒体上做出了回应:

“DWF Labs 希望澄清,最近媒体报道的许多指控都是毫无根据的,并且歪曲了事实。DWF Labs 按照最高的诚信、透明度和道德标准运营,仍然致力于为700多个合作伙伴提供支持。”

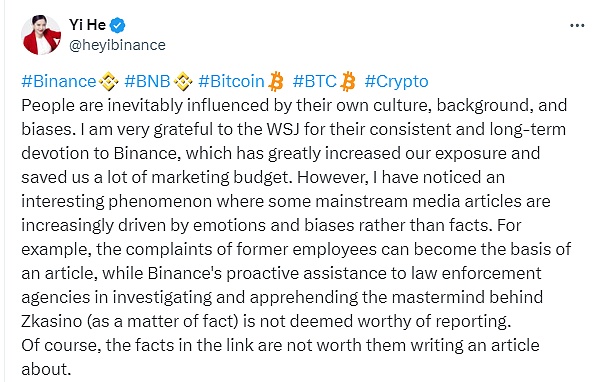

随后,币安联合创始人兼首席客户服务官何一对币安的回应进行了解读,强调币安一直在做MM(做市商)市场监控,而且很严格,但并不针对任何基金。做市商之间存在竞争,手段很阴暗,暗示有些做市商存在公关行为,但不要牵扯到币安。币安会保证自身的公平性,不参与,但也会如实汇报给监管部门。何一还补充称:

“人都会受自己的文化、背景与偏见影响。非常感谢《华尔街日报》对币安持之以恒的长期投入,帮我们增加了很多曝光,节约了很多预算。但我发现一个有趣的现象是,一些主流媒体的文章开始走向情绪与偏见的输出,不再基于事实。例如,离职员工的抱怨(观点)可以成为文章,而币安帮助执法部门,主动侦查举报并抓捕 Zkasino 主犯(事实)却并不值得报道。”

从何一的回应来看,本次事件似乎是做市商之间的竞争引发的,很可能竞争对手为了公关在媒体上发布了一些负面消息,以打击DWF Labs这样的做市机构。

与此同时,就在《华尔街日报》发文当天,币安宣布上线了新一期新币挖矿项目。至少从目前来看,币安并未受到此事太大的影响。

Alleged market manipulation. According to the news of January, Andrei Grachev, the Russian managing partner, exposed photos of Lamborghini luxury cars on social media and wrote articles, which caused widespread concern in the encryption industry. Andrei Grachev was the head of the Russian branch of the cryptocurrency exchange Huobi, and the information shows that he is one of the co-founders. Currently, he lives in Switzerland and plays the role of a market maker, which is a middleman company that buys and sells assets at the same time. Indifferent to ups and downs, their main task is to improve market liquidity, make it easier for participants to buy and sell assets and make profits through price differences. It is marked on the trading platform of Currency Security, which means that the company's monthly transaction volume is at least $100 million. At this level, Currency Security often provides discounts on transaction fees and provides private account manager services. Currency Security does not require market makers to sign specific agreements, which means that to a large extent, Currency Security allows market makers to trade according to their own wishes, but Currency Security spokesman. It means that all users on the platform must abide by the general terms of use prohibiting market manipulation. However, according to a proposal document sent to potential customers in, it is proposed to use its active trading positions to push up the price of tokens and create so-called artificial trading volume on exchanges including Coin Security to attract other traders. In the report prepared for a token project customer that year, it was even directly written that the institution successfully generated artificial trading volume equivalent to two-thirds of the token and was positive. Efforts are being made to create a credible trading model. If cooperation can bring bullish events to the project tokens, the market manipulation problem will surface. In June, Coin Security announced the listing of highly leveraged derivatives contracts related to tokens. The company had previously agreed to sell tokens worth $10,000, accounting for about a quarter of its market value at that time. Coin Security investigation revealed the market manipulation doubt. Social media boasted that listing would bring sustainability and strength to the token. However, the price of derivative contracts plummeted after the launch of Coin 'an. As shown in the above figure, the cryptocurrency industry noticed this fluctuation. Two other market makers privately expressed their concerns to Coin 'an. One of the market makers complained about the transaction to Coin 'an's customer handling department, which reported the matter to Coin's market monitoring team. Soon, Coin's market monitoring team began an investigation and investigation. Dismissal of the insiders of Coin 'an Company revealed that the investigators found that they were suspected of manipulating the price of at least six other tokens and conducted wash sale transactions of more than US$ 100 million in 2008. The final conclusion was that these actions violated the terms of use of Coin 'an. It is said that the investigators also found that transactions similar to wash sale have formed a certain scale on the Coin 'an trading platform, especially among the customers on whom Coin 'an business relies, the monthly transaction volume of head trading customers exceeded US$ 100 million last year, accounting for two-thirds of the total transaction volume of Coin 'an Taiwan. The investigator suggested that hundreds of customers who violated the terms of use should be closed before the first half of 2008. After the investigation, it was found that nearly 10,000 tokens were sold in two batches when the price was close to the peak of the market, which led to the collapse of token prices. The co-founder claimed that he did not know the investigation results of Coin's security. In late March, the market research team of Coin's security submitted a report that there was suspected market manipulation and suggested that Coin's security be removed, but things seemed to change again in the next few days. Department heads and their employees questioned the results of the investigation and complained to the company's leadership. As a result, senior executives of Bi 'an said that the market research team did not have enough evidence to show that the wash sale transaction it discovered might be accidental so-called self-transaction, which might not constitute manipulation. Bi 'an also believed that the head of the market research team cooperated too closely with the competitors who initially complained about this case. After one week, Bi 'an claimed to dismiss several investigators involved in this matter in order to save costs. In response, there is no doubt that Currency Security plays an important role in the current global digital currency economy. At present, about kinds of cryptocurrencies have been put on the platform of Currency Security, and derivatives that allow users to bet on the price direction have been provided. The number of users of Currency Security is as high as 100 million. Industry data show that the value of spot and derivatives transactions it handled in March exceeded one trillion dollars. According to the Wall Street Journal, a former company insider of Currency Security said that the market manipulation behavior that Currency Security seems to be shielding is due to the huge transaction volume. Instead of stopping it as suggested by the market research team, Bian fired the staff who investigated the market maker. The purpose of doing so is probably to earn high transaction costs from big customers. A spokesman for Bian disagreed with any statement that it allowed market manipulation, and Bian is also giving priority to improving its compliance function. The spokesman said that we have a strong monitoring framework to identify market abuse and take action. Bian will not do it for the safety of the platform. At the same time, the spokesman also pointed out that Qian 'an will not easily make a decision to remove users from the market, and there needs to be enough evidence to prove that they have violated the terms of use. Under any circumstances, Qian 'an will not trade for profit or manipulate the market. According to the Wall Street Journal, it is alleged that there are wash sale transactions and potential market manipulation problems on the trading platform of Qian 'an, and Qian 'an issued a response on social media on the evening of May, and resolutely refuted any customs. In its market monitoring plan, there is a saying that there is market manipulation on the platform. Qian 'an has a strong market monitoring framework to identify market abuse and take action. Any user who violates the terms of use will be expelled and will never tolerate market abuse. In the past three years, the number of users who have been expelled for violating the terms of use is close to 100 million, and their transaction volume exceeds trillion US dollars. Qian 'an has hundreds of millions of users. They can rest assured that Qian 'an will give priority to the safety of the platform and will not favor any individual, regardless of its size. In other words, we didn't make these decisions rashly. Money Security will use various tools to conduct in-depth investigation, and only when there is enough evidence to prove that users have violated our terms of use will they be dismissed. In addition, an independent investigation on the monitoring practice of money security market has recently verified the effectiveness of the method and found the smallest trace of abnormal trading activities. As the parties to this incident, they also responded on social media, hoping to clarify that many allegations reported by the media recently are groundless and distort the facts, and they are still committed to mentioning for many partners according to the highest standards of integrity, transparency and ethics. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。